Changes To Tax Codes: HMRC's New System For Savings Income

Table of Contents

Understanding the New Tax System for Savings Income

Previously, the taxation of savings income involved a relatively straightforward system with clear thresholds. However, HMRC's new system introduces several modifications aimed at streamlining the process and potentially increasing tax revenue. The rationale behind these changes includes improving compliance and simplifying the tax code for savings and investments. Key terms to understand include savings tax, tax code changes, HMRC tax updates, personal savings allowance, and dividend allowance.

Key Changes to Tax Codes:

The core changes within HMRC's new savings income tax system affect several key areas:

- Changes to the Personal Savings Allowance (PSA): The PSA, which allows individuals to earn a certain amount of savings interest tax-free, may have been adjusted. Understanding the new allowance limits is paramount.

- Changes to the Dividend Allowance: Similar to the PSA, the dividend allowance, which offers tax relief on dividend income, might have been altered. Be aware of any reductions or modifications to this allowance.

- Introduction of new thresholds or brackets: The tax bands themselves may have been reshaped, meaning different rates of tax apply to different levels of savings income.

- Impact on higher-rate taxpayers: Higher-rate taxpayers may find the changes particularly impactful, potentially leading to an increased tax liability on their savings income.

- Changes to the reporting requirements for savings income: HMRC may have updated the reporting requirements, so staying informed about how and when to report your savings income is vital.

How the Changes Affect Different Taxpayers

The impact of HMRC's new savings income tax system varies significantly depending on your income bracket.

- Basic-rate taxpayers: While potentially facing some minor adjustments, basic-rate taxpayers generally experience a less dramatic impact compared to higher earners.

- Higher-rate taxpayers: Individuals earning a higher income will likely see a more significant change in their tax liability on savings income.

- Additional-rate taxpayers: These taxpayers, with the highest incomes, face the most substantial changes to their savings income tax calculations.

- Low-income earners: Many low-income earners may still benefit from the personal savings allowance, although the changes bear watching.

Understanding your tax band (tax bands) and how your income tax falls within it is crucial for calculating your tax liability. Proactive tax planning and being aware of the tax implications of your savings income are more important than ever.

Illustrative Examples:

Let's consider a few examples:

- Example 1: A basic-rate taxpayer with £5,000 in savings income might see a small increase in their tax bill due to the changes in the PSA.

- Example 2: A higher-rate taxpayer with £20,000 in savings income could face a substantially higher tax liability under the new system.

- Example 3: A low-income earner with savings below the PSA threshold will likely experience no change in their tax situation.

Navigating the New System: Practical Steps for Taxpayers

Adapting to HMRC's new savings income tax system requires proactive steps.

- Accurate record-keeping: Meticulously track all savings income and related transactions.

- Tax optimization strategies: Explore legitimate avenues for tax optimization within the new framework, perhaps through ISAs or other tax-efficient savings vehicles. Remember, this should always be done within legal and ethical boundaries.

- Understanding your tax code: Familiarize yourself with your specific tax code and how it relates to your savings income.

Resources and Further Support:

- HMRC Website: The official HMRC website provides comprehensive information on the new system. [Insert link to relevant HMRC page here]

- Tax Advisors: Consider seeking professional tax advice if you are uncertain about the implications of the changes.

Conclusion: Staying Informed About HMRC's New Savings Income Tax System

HMRC's new savings income tax system presents significant changes impacting taxpayers across all income levels. Understanding these changes, including adjustments to the PSA and dividend allowance, and their effect on your tax liability is paramount. Accurate record-keeping and potentially seeking professional guidance are crucial to ensure compliance and avoid penalties. Stay informed about future updates on HMRC savings tax changes, and use available resources to understand your tax code fully. To avoid issues with your savings income tax, take the time to review your situation in light of the UK tax system changes. Visit the HMRC website for details and seek professional tax advice if needed. Stay updated on all future changes to HMRC's new savings income tax system.

Featured Posts

-

F1 Kaoset Hamilton Och Leclerc Diskvalificerade

May 20, 2025

F1 Kaoset Hamilton Och Leclerc Diskvalificerade

May 20, 2025 -

Protomagia Sto Oropedio Evdomos Idanikes Drastiriotites And Protaseis

May 20, 2025

Protomagia Sto Oropedio Evdomos Idanikes Drastiriotites And Protaseis

May 20, 2025 -

Us Typhon Missile System In Philippines A Counter To Chinese Aggression

May 20, 2025

Us Typhon Missile System In Philippines A Counter To Chinese Aggression

May 20, 2025 -

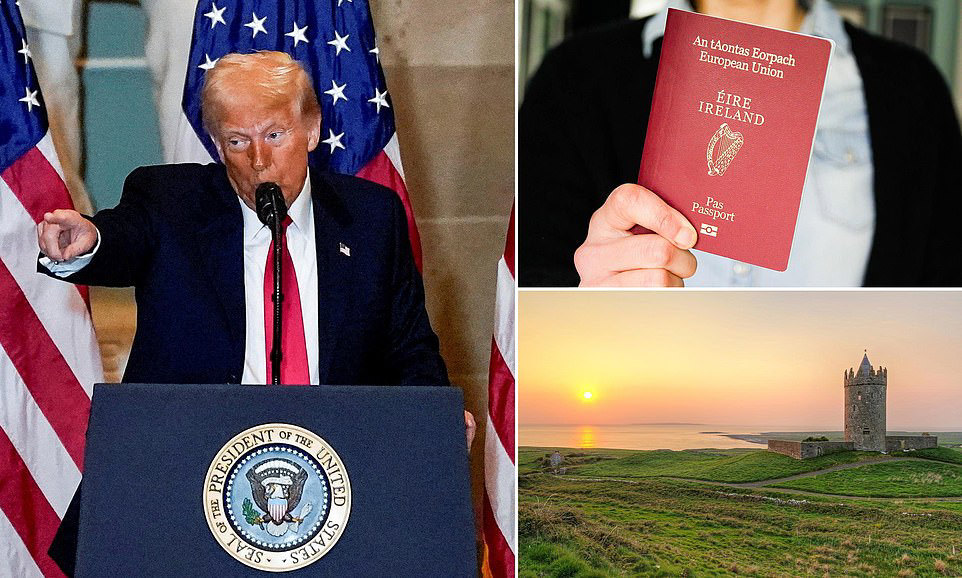

Brexit And Trump A Double Push For Americans Seeking European Citizenship

May 20, 2025

Brexit And Trump A Double Push For Americans Seeking European Citizenship

May 20, 2025 -

Jennifer Lawrences Family Expands Second Child Arrives

May 20, 2025

Jennifer Lawrences Family Expands Second Child Arrives

May 20, 2025