Check Today's Personal Loan Interest Rates - Options Under 6% Available

Table of Contents

Understanding Personal Loan Interest Rates

Personal loan interest rates represent the cost of borrowing money. Lenders charge interest as a percentage of the principal loan amount, reflecting the risk they take in lending you the funds. The higher the risk, the higher the interest rate. This interest is typically calculated annually.

APR (Annual Percentage Rate) is a crucial factor to understand. It represents the total cost of borrowing, including the interest rate and any other fees charged by the lender. Always compare APRs from different lenders, as this provides a more accurate picture of the overall cost than the interest rate alone.

Several factors influence personal loan interest rates:

-

Credit Score: This is arguably the most important factor. A higher credit score demonstrates creditworthiness, leading to lower interest rates. Lenders view individuals with excellent credit as lower risk.

-

Loan Amount: Larger loan amounts often come with higher interest rates because they represent a greater risk for the lender.

-

Loan Term: The length of your loan (the loan term) also impacts the interest rate. Shorter loan terms typically result in lower overall interest paid, but require higher monthly payments.

-

Bullet points:

- Higher credit score = lower interest rates. Aim for a score above 700 for the best rates.

- Larger loan amounts may have higher rates. Consider borrowing only what you truly need.

- Shorter loan terms generally mean lower overall interest paid, but higher monthly payments. Find a balance that fits your budget.

Where to Check Today's Personal Loan Interest Rates

Checking today's personal loan interest rates is easier than ever. Several avenues provide access to current rates and allow for comparisons:

-

Online Lenders: Companies like LendingClub, SoFi, and Upstart offer competitive rates and convenient online applications. Pros include speed and convenience; cons may include higher rates for borrowers with less-than-perfect credit.

-

Banks and Credit Unions: Traditional banks and credit unions often offer personal loans, sometimes with preferential rates for existing members. Pros include potentially lower rates and personalized service; cons might include longer application processes.

-

Loan Comparison Websites: Websites like NerdWallet and Bankrate allow you to compare offers from multiple lenders simultaneously. These sites offer valuable tools and resources to help you find the best deal. Use these tools to streamline your research.

-

Bullet points:

- Use loan calculators to estimate monthly payments and total interest paid before applying.

- Compare rates from multiple lenders before applying. Don't settle for the first offer you see.

- Be wary of hidden fees. Carefully review all loan terms and conditions.

Finding Personal Loan Options Under 6% APR

Securing a personal loan with an APR under 6% requires a strategic approach. While not always achievable, several steps can improve your chances:

-

High Credit Score: A high credit score is paramount. Improving your credit score before applying is the most effective way to qualify for the best rates.

-

Co-signer: A co-signer with excellent credit can significantly strengthen your application, increasing your likelihood of securing a lower interest rate.

-

Shorter Loan Term: Opting for a shorter loan term (e.g., 24 months instead of 60 months) can lead to a lower interest rate. This is because the lender is exposed to less risk over a shorter period.

-

Secured Loan: If your credit score is low, consider a secured loan. This involves pledging collateral (like a car or savings account) to reduce the lender's risk and potentially secure a lower rate.

-

Bullet points:

- Check your credit report for errors and dispute any inaccuracies.

- Pay down existing debts to improve your credit utilization ratio (the amount of credit you're using compared to your total available credit).

- Consider a secured loan if your credit score is low, but be aware of the risk of losing your collateral if you default.

Factors to Consider Beyond Interest Rate

While the interest rate is a crucial factor, don't overlook other important aspects of a personal loan:

-

Loan Fees: Origination fees, prepayment penalties, and late payment fees can significantly impact the overall cost. Compare the total cost, including all fees, not just the interest rate.

-

Customer Service and Reputation: Choose a lender with a positive reputation and responsive customer service. You'll want a lender you can easily contact if you have questions or issues.

-

Repayment Terms and Flexibility: Consider the loan's repayment terms and whether they align with your budget and financial capabilities. Look for flexibility options in case of unexpected circumstances.

-

Bullet points:

- Read the fine print carefully before signing any loan agreement. Don't hesitate to ask questions.

- Choose a lender with transparent and easy-to-understand terms and conditions.

- Consider your budget and repayment capacity. Don't borrow more than you can comfortably repay.

Conclusion

Finding the best personal loan interest rates requires research and careful consideration. Checking today's rates from multiple lenders, understanding the factors influencing interest rates, and comparing APRs across different loan offers are crucial steps. Remember to look beyond the interest rate and consider loan fees, lender reputation, and repayment terms. By using the resources and tips mentioned above, you can significantly improve your chances of securing a personal loan with an interest rate under 6% and take control of your finances. Start your search for the best personal loan interest rates today! Use the resources and tips mentioned above to find the best loan offer with rates under 6%, and secure the financial support you need. Don't wait – check today's personal loan interest rates now and take control of your finances.

Featured Posts

-

Nicolas Anelka All The Latest News And Updates

May 28, 2025

Nicolas Anelka All The Latest News And Updates

May 28, 2025 -

Cannes 2023 Wes Andersons The Phoenician Scheme Reviews And Analysis

May 28, 2025

Cannes 2023 Wes Andersons The Phoenician Scheme Reviews And Analysis

May 28, 2025 -

Stowers Historic Night Leads Marlins To Win Against Cubs

May 28, 2025

Stowers Historic Night Leads Marlins To Win Against Cubs

May 28, 2025 -

Padres Vs Astros Predicting The Winner Of This Crucial Series

May 28, 2025

Padres Vs Astros Predicting The Winner Of This Crucial Series

May 28, 2025 -

Six Figure Euro Millions Wins For Two Lucky Irish Players Where The Winning Tickets Were Sold

May 28, 2025

Six Figure Euro Millions Wins For Two Lucky Irish Players Where The Winning Tickets Were Sold

May 28, 2025

Latest Posts

-

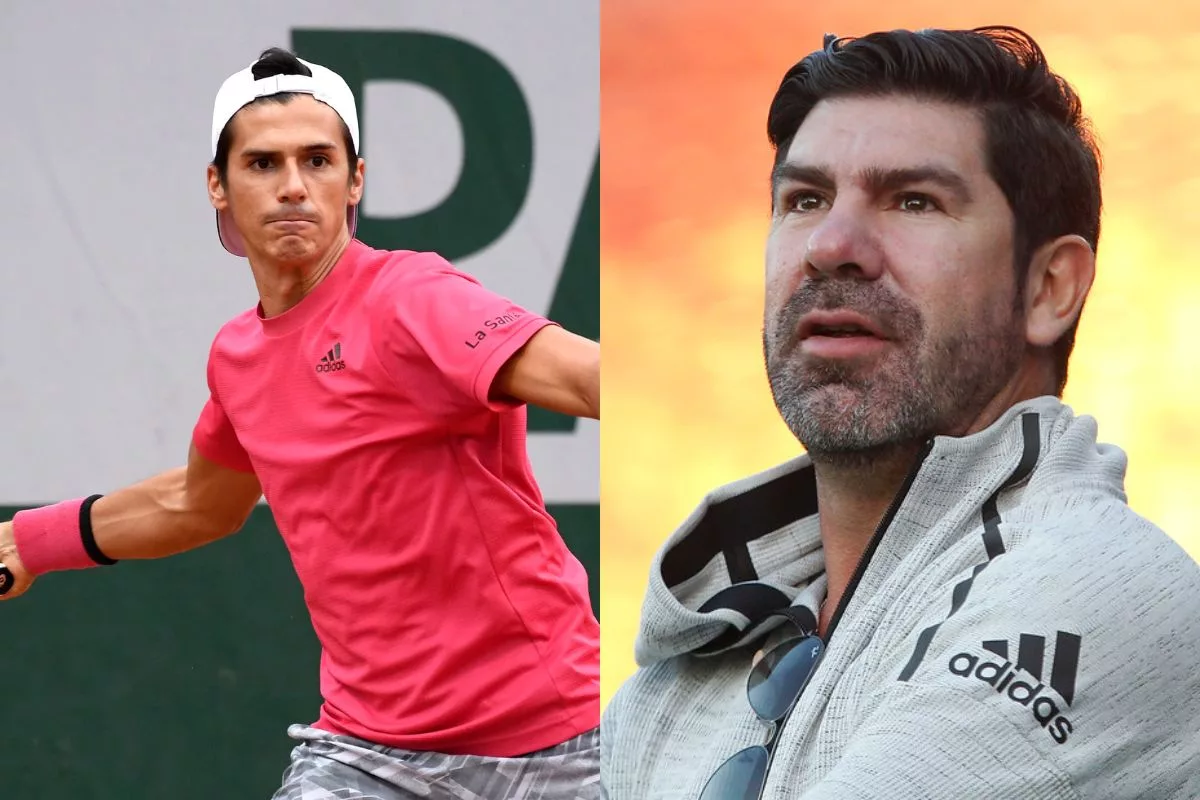

Un Tenista Argentino Revela Su Admiracion Por El Dios Del Tenis Marcelo Rios

May 30, 2025

Un Tenista Argentino Revela Su Admiracion Por El Dios Del Tenis Marcelo Rios

May 30, 2025 -

Marcelo Rios La Opinion De Un Tenista Argentino Que Lo Odiaba

May 30, 2025

Marcelo Rios La Opinion De Un Tenista Argentino Que Lo Odiaba

May 30, 2025 -

Confesion De Un Tenista Argentino Marcelo Rios Una Leyenda

May 30, 2025

Confesion De Un Tenista Argentino Marcelo Rios Una Leyenda

May 30, 2025 -

El Chino Rios Un Dios Del Tenis Segun Un Tenista Argentino

May 30, 2025

El Chino Rios Un Dios Del Tenis Segun Un Tenista Argentino

May 30, 2025 -

Odiado Tenista Argentino Su Impactante Confesion Sobre Marcelo Rios

May 30, 2025

Odiado Tenista Argentino Su Impactante Confesion Sobre Marcelo Rios

May 30, 2025