Chime Launches $500 Instant Loans: Eligibility And Requirements

Table of Contents

Understanding Chime's $500 Instant Loan Program

Chime's $500 instant loan program provides a short-term financial solution designed for existing Chime members. While specific details may vary, the program generally offers a loan of up to $500. This is a significant advantage compared to other Chime products which may not offer such immediate access to funds. This program aims to help members cover unexpected expenses and avoid high-cost options like payday loans. The core features of the program typically include:

- Loan Amount: Up to $500, depending on eligibility and Chime's assessment of your financial situation.

- Repayment Terms: Repayment terms are usually structured to allow for manageable monthly payments over a set period. The exact terms will be clearly outlined in your loan agreement.

- Interest Rates and Fees: Importantly, Chime $500 instant loans often come with lower interest rates and fewer fees than traditional payday loans, offering a more responsible borrowing option. Check the specifics on the Chime app or website. APR (Annual Percentage Rate) information will be provided before you accept the loan.

- Benefits: Beyond the convenience, Chime $500 instant loans can help members manage unexpected expenses without resorting to predatory lending practices.

Eligibility Criteria for Chime $500 Instant Loans

To qualify for a Chime $500 instant loan, you must meet several key requirements. These criteria are designed to ensure responsible lending and protect both Chime and its members. Failing to meet these criteria will result in your application being rejected. Let's break down the essential requirements:

- Minimum Chime Account Age: You'll generally need to have an active Chime account for a minimum period, typically a few months, to demonstrate consistent usage and financial stability.

- Direct Deposit Frequency and Amount: Regular direct deposits into your Chime account are crucial. The required frequency and minimum deposit amount will vary.

- Spending and Savings History: Chime will review your spending and saving patterns within your account to assess your financial responsibility. Consistent, responsible financial habits will strengthen your application.

- Credit Score Considerations: While not always explicitly stated, a good credit history will significantly improve your chances of approval for a Chime $500 instant loan.

- Location Restrictions: Chime's services and loan offerings may have geographical limitations. Ensure your location is covered by the program.

The Application Process for Chime $500 Instant Loans

Applying for a Chime $500 instant loan is typically a straightforward process conducted directly through the Chime mobile app. Here’s a step-by-step guide:

- Accessing the loan application: Open your Chime app and look for the "Loans" or "SpotMe" section (or similar). The exact location may depend on your app version.

- Information required for the application: Be prepared to provide basic personal and financial information, including your Social Security number and banking details (already linked to your Chime account).

- Verification process: Chime will verify your information using its internal systems and potentially external credit bureaus.

- Typical approval timeframe: Depending on verification speed, you may receive an instant decision, or it may take a short time to process your application.

- Loan disbursement method: Upon approval, the funds are usually deposited directly into your Chime spending account within minutes.

Frequently Asked Questions (FAQs) about Chime $500 Instant Loans

Here are answers to some frequently asked questions about Chime's $500 instant loan program:

- What happens if I miss a payment? Missing payments will likely lead to late fees and could negatively impact your credit score. Contact Chime immediately if you anticipate difficulties making a payment.

- How can I contact Chime customer support? Chime offers various customer support channels, including phone, email, and in-app support. Check the Chime app or website for contact details.

- Can I apply for another loan after repaying my current one? This depends on your repayment history and Chime's assessment of your financial situation.

- Are there early repayment options? Chime may allow early repayment; however, check the specific terms and conditions of your loan agreement.

Securing Your Chime $500 Instant Loan

To recap, securing a Chime $500 instant loan requires meeting specific eligibility criteria, including maintaining a good standing Chime account, a history of consistent direct deposits, and responsible spending habits. The application process is generally quick and easy through the Chime app. Remember that a Chime $500 instant loan provides a convenient and potentially less expensive alternative to traditional payday loans. Check your eligibility today and apply for a Chime instant loan, a $500 loan from Chime, or apply for a Chime loan today if you need fast access to funds!

Featured Posts

-

Pokemon Go Dynamax Sobble Winning Strategies For Max Mondays

May 14, 2025

Pokemon Go Dynamax Sobble Winning Strategies For Max Mondays

May 14, 2025 -

Moose Jaw Targeting Us And Canadian Investment Through Tariffs

May 14, 2025

Moose Jaw Targeting Us And Canadian Investment Through Tariffs

May 14, 2025 -

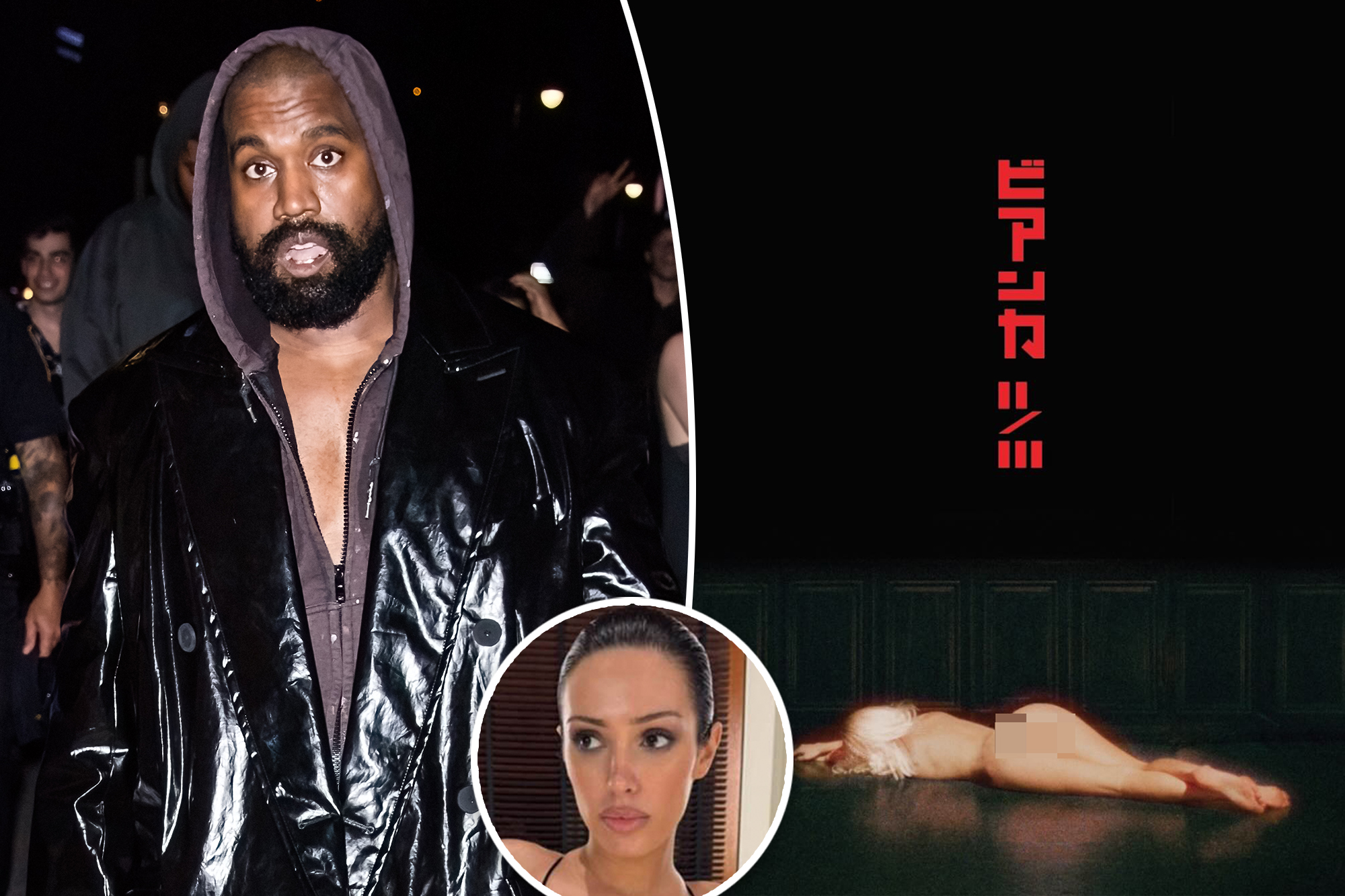

Unclothed Image Of Bianca Censori Sparks Debate Kanye Wests Film Promotion Strategy

May 14, 2025

Unclothed Image Of Bianca Censori Sparks Debate Kanye Wests Film Promotion Strategy

May 14, 2025 -

Mission Impossible Dead Reckoning Streaming Options Before The Next Film

May 14, 2025

Mission Impossible Dead Reckoning Streaming Options Before The Next Film

May 14, 2025 -

E60m Transfer Target Liverpools Determined Bid To Sign Player

May 14, 2025

E60m Transfer Target Liverpools Determined Bid To Sign Player

May 14, 2025