Chime's US IPO Filing: Revenue Growth And Digital Banking Disruption

Table of Contents

Chime's Explosive Revenue Growth and Financial Performance

Chime's success story is built on rapid revenue growth and a compelling financial performance. Understanding this trajectory is crucial to evaluating the Chime IPO's potential.

Year-over-Year Revenue Increases

Chime has demonstrated impressive year-over-year revenue increases in recent years. While precise figures are subject to change pending the IPO filing, reports indicate substantial growth fueled by several key factors:

- Expansion of product offerings: Chime has strategically expanded beyond its core checking and savings accounts, introducing features like credit builder cards and debit cards, broadening its revenue streams. This diversification is key to the Chime IPO valuation.

- Increasing customer base: Chime's user-friendly app and fee-free model have attracted a massive customer base, translating directly into increased transaction volume and revenue. The company's aggressive marketing campaigns have also played a vital role in customer acquisition.

- Successful marketing campaigns: Targeted digital marketing strategies have proven highly effective in reaching and engaging potential customers, particularly younger demographics. This sophisticated marketing approach is a key differentiator.

Data from Chime's official filings (once publicly available) will provide a clearer picture of specific percentage increases and revenue breakdowns. However, available reporting suggests a trajectory indicative of strong growth potential and a solid foundation for the Chime IPO.

Profitability and Path to Sustained Growth

While Chime hasn't yet reached profitability, its strategies for achieving long-term sustainable growth are noteworthy:

- Cost management strategies: Chime's operating model, built on digital infrastructure, minimizes overhead costs compared to traditional banks with extensive brick-and-mortar networks. This efficiency is vital for achieving profitability in the future.

- Focus on specific customer demographics: Targeting underserved and underbanked populations has provided a large and growing market segment. This strategic focus is expected to continue driving customer acquisition.

- Potential for increased monetization of existing services: While currently fee-free for many services, future revenue generation could come from premium features, partnerships, and potentially introducing carefully selected paid services. This measured approach will be key to the Chime IPO’s long-term success.

Challenges remain, however. Increased competition in the digital banking space and navigating regulatory hurdles are significant factors that could impact Chime's path to profitability and influence the Chime IPO's outcome.

Chime's Disruptive Impact on Traditional Banking

Chime's success is largely attributed to its disruptive approach to banking, challenging established norms and leveraging technology for a superior customer experience.

Challenging the Status Quo

Chime's business model directly challenges traditional banks by offering:

- Fee-free services: Eliminating common bank fees like overdraft and monthly maintenance fees has attracted a vast customer base dissatisfied with the costs of traditional banking.

- Mobile-first approach: A user-friendly, feature-rich mobile app provides a seamless banking experience, prioritizing convenience and accessibility.

- Superior customer experience: Chime's focus on customer service and readily available support contrasts sharply with the often impersonal experience offered by large traditional banks.

- Personalized financial management tools: Features such as early direct deposit and budgeting tools provide value-added services, enhancing customer engagement and financial literacy.

These differentiators are crucial to understanding Chime's competitive advantage and the overall impact of the Chime IPO.

Technological Innovation and Customer Acquisition

Chime leverages technology aggressively to acquire and retain customers:

- Targeted marketing: Data analytics and AI-powered targeting ensure marketing campaigns reach the most receptive audiences.

- Streamlined onboarding processes: Quick and easy account setup minimizes friction and maximizes customer acquisition.

- Personalized financial insights: Data-driven insights provide tailored recommendations to help users manage their finances effectively.

- Proactive fraud detection: Sophisticated security measures protect users from fraudulent activities, building trust and loyalty.

AI and machine learning are integral to Chime's growth strategy, powering personalization, risk management, and customer acquisition efforts. These technological strengths are anticipated to significantly influence the Chime IPO's success.

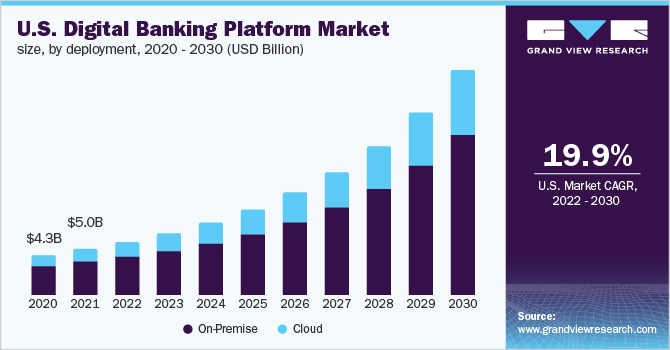

The Chime IPO: Implications for the Future of Digital Banking

The Chime IPO has significant implications for the future of the digital banking landscape.

Market Valuation and Investor Sentiment

Chime's projected market valuation will be a key indicator of investor confidence. Several factors will influence investor sentiment:

- Strengths and weaknesses of the company: Chime’s rapid growth and innovative model are strengths, but challenges in profitability and competition remain weaknesses.

- Potential risks and opportunities: Regulatory changes and macroeconomic conditions pose potential risks, while expansion into new markets and product offerings represent significant opportunities.

- Competitive landscape post-IPO: The IPO will further intensify competition in the digital banking sector, shaping strategic alliances and competitive dynamics.

Financial analysts and news sources will offer varying perspectives on Chime's valuation and the risks associated with the Chime IPO, providing a diverse range of opinions to investors.

Long-Term Growth Prospects and Competitive Landscape

Chime's long-term growth hinges on several factors:

- Potential for expansion into new markets and product offerings: International expansion and diversification into new financial services could fuel future growth.

- Strategies for maintaining a competitive edge: Continuous innovation and strategic partnerships will be critical for staying ahead of competitors.

- Challenges posed by established players and new entrants: Competition from established banks and new fintech startups remains a significant challenge.

Regulatory changes and macroeconomic factors will also significantly impact Chime's long-term trajectory, making the Chime IPO's long-term success subject to external market conditions.

Conclusion

Chime's explosive revenue growth, disruptive business model, and upcoming IPO signal a major shift in the digital banking landscape. The company’s innovative approach and technological prowess have challenged traditional banking, setting a new standard for customer experience and financial accessibility. While challenges remain, Chime's potential for continued growth and innovation is significant. The Chime IPO will undoubtedly reshape the competitive landscape, prompting further innovation and competition within the sector.

Call to Action: Stay informed about the ongoing developments in the digital banking landscape, particularly concerning the Chime IPO and its implications for the future of financial services. Follow industry news and analysis to understand the evolving competitive dynamics of the sector and the future of Chime IPO and other challenger banks.

Featured Posts

-

Netflixs Latest Charming Film A Giant Hearted Weekend Watch

May 14, 2025

Netflixs Latest Charming Film A Giant Hearted Weekend Watch

May 14, 2025 -

The Snow White Movie A Costly Opening Weekend Debacle

May 14, 2025

The Snow White Movie A Costly Opening Weekend Debacle

May 14, 2025 -

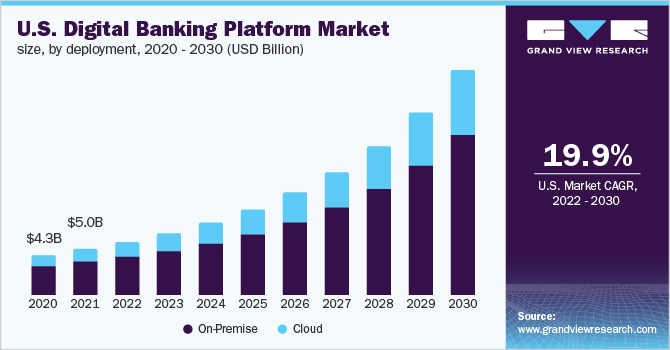

Date E Orari Di Passaggio Della Milano Sanremo 2025 E Sanremo Women Imperia

May 14, 2025

Date E Orari Di Passaggio Della Milano Sanremo 2025 E Sanremo Women Imperia

May 14, 2025 -

Ct Vyloucila Novinare Deniku N A Seznam Zprav Z Brifinku Co Se Stalo

May 14, 2025

Ct Vyloucila Novinare Deniku N A Seznam Zprav Z Brifinku Co Se Stalo

May 14, 2025 -

Alexis Kohler Et Le Senat L Opacite Denoncee Par Transparency International

May 14, 2025

Alexis Kohler Et Le Senat L Opacite Denoncee Par Transparency International

May 14, 2025