China To US Container Shipping: Payden & Rygel's Market Analysis

Table of Contents

Current Market Conditions: Assessing Shipping Rates and Capacity

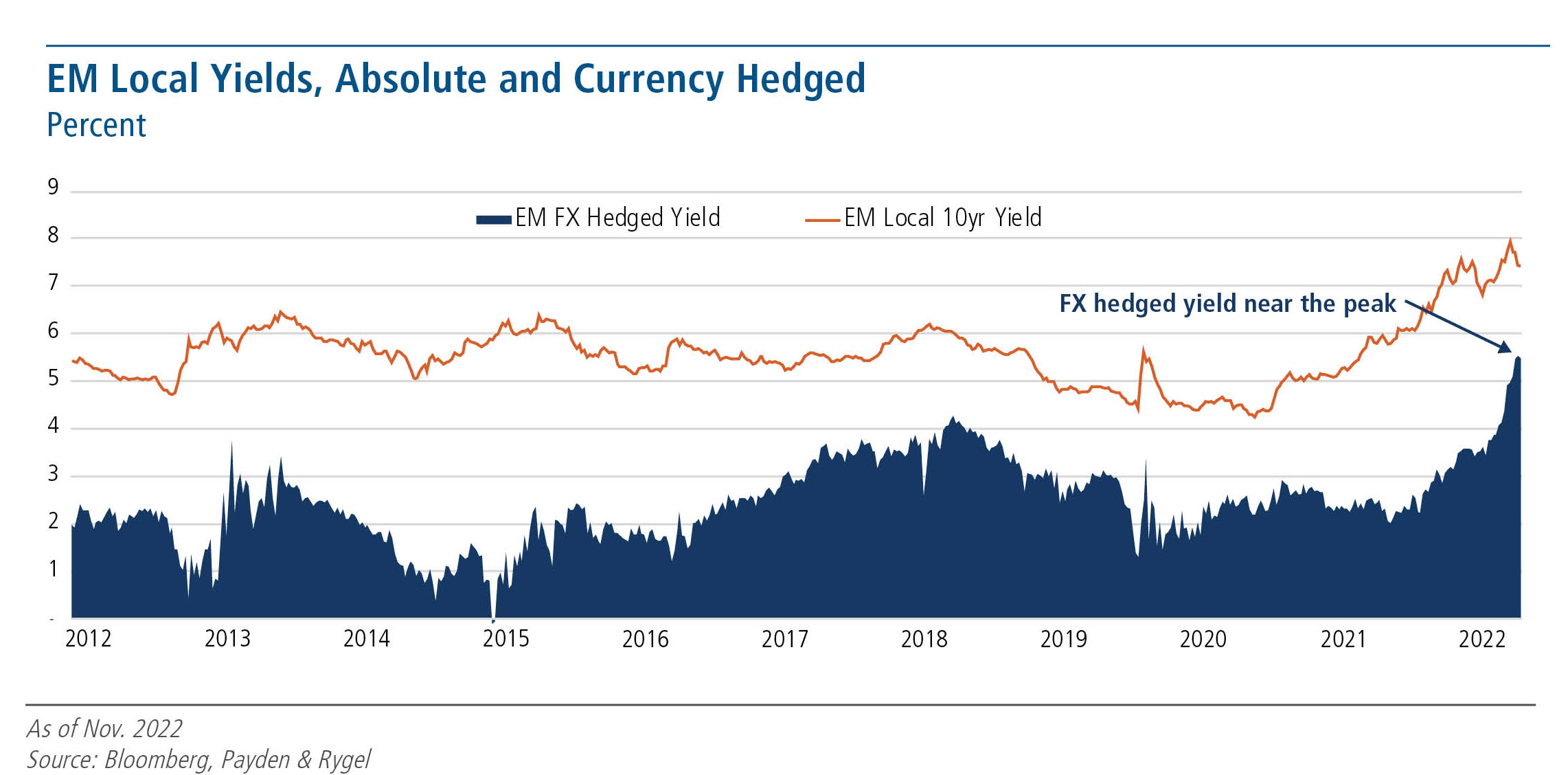

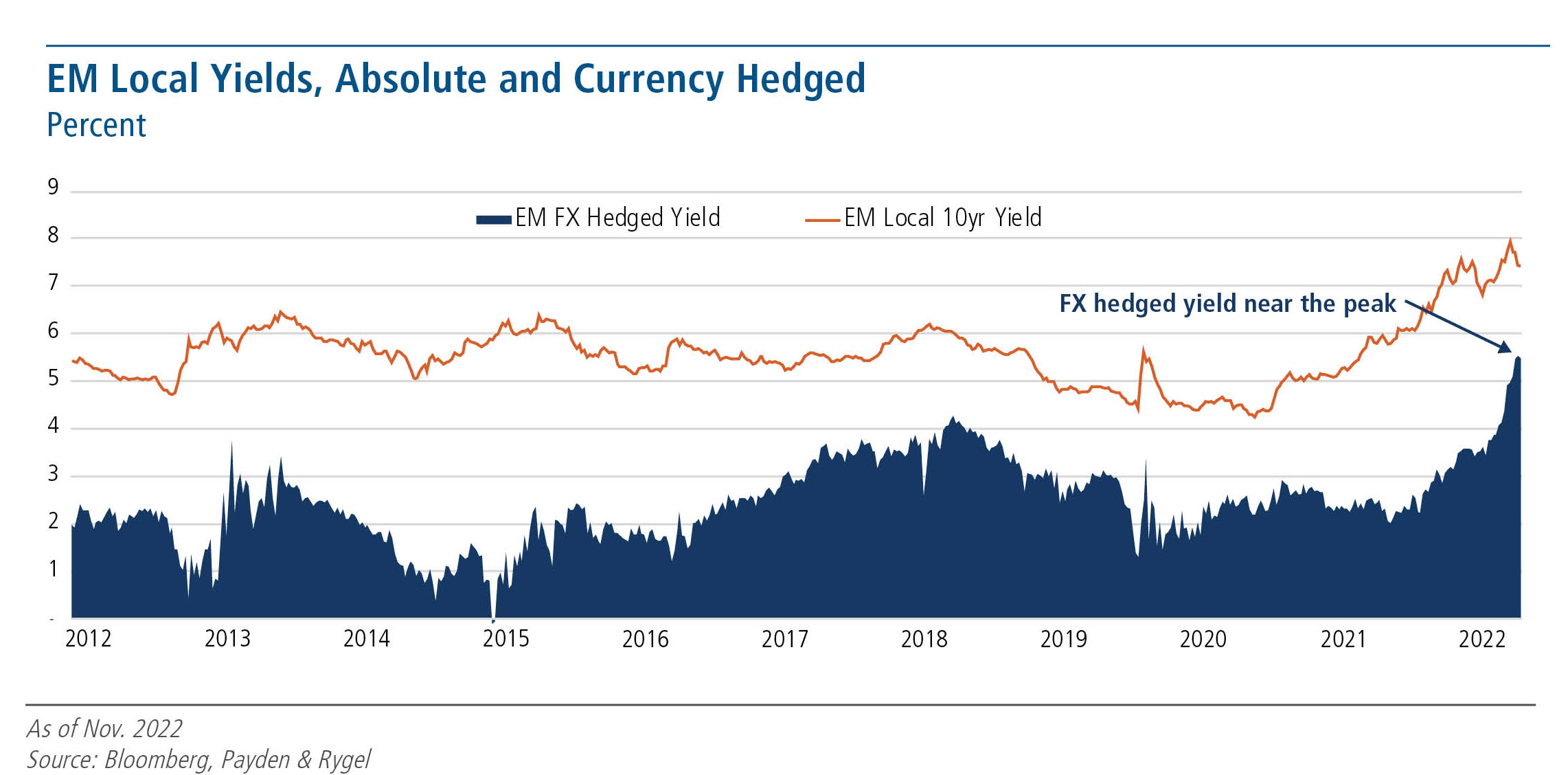

Understanding current market conditions is paramount for anyone involved in China to US container shipping. Key indicators include container shipping rates, freight rates, available shipping capacity, and port congestion. Payden & Rygel's analysis likely reveals fluctuations in these areas, impacting businesses significantly.

-

Shipping Rates: Current rates from China to major US ports like Los Angeles, New York, and Savannah show considerable variability depending on the time of year, commodity type, and overall market demand. (Note: Insert specific data points from Payden & Rygel's analysis here if available. For example: "Payden & Rygel report a 15% increase in rates from Shanghai to Los Angeles in Q3 2024 compared to Q2"). This fluctuation is largely driven by the interplay of supply and demand within the container market.

-

Capacity Constraints: Limited vessel availability and port capacity constraints frequently lead to bottlenecks, driving up shipping rates and extending delivery times. The imbalance between the demand for shipping services and the available capacity significantly impacts the overall cost of ocean freight.

-

Port Congestion: Major US ports often experience significant congestion, causing delays and additional expenses. This congestion stems from factors such as insufficient infrastructure, labor shortages, and increased cargo volume. The resulting backlog adds to overall shipping costs and affects delivery schedules.

-

Vessel Size and Efficiency: The deployment of mega-ships, while offering economies of scale, can also exacerbate port congestion if terminal infrastructure isn't adequately equipped to handle their capacity (measured in TEU - Twenty-foot Equivalent Units). Feeder vessels play a crucial role in connecting smaller ports to major hubs, mitigating the effects of mega-ship limitations to some extent.

-

Geopolitical Impact: Geopolitical events and trade policies significantly influence supply and demand. Trade disputes or unexpected international incidents can disrupt shipping routes and lead to unpredictable rate fluctuations.

Key Factors Influencing China to US Container Shipping

Numerous factors influence the dynamics of China to US container shipping, making it a complex and ever-changing landscape. These factors need careful consideration for effective strategic planning.

-

US-China Trade Relations: The ongoing relationship between the US and China remains a dominant force. Trade disputes, tariffs, and political tensions directly impact shipping volumes and rates, creating uncertainty for businesses.

-

Fuel Costs (Bunker Fuel): Fluctuations in bunker fuel prices, a significant operational cost for shipping lines, directly impact overall freight rates. Rising fuel costs translate to higher shipping costs for importers and exporters.

-

Economic Growth: Economic growth in both China (the source of goods) and the US (the destination market) significantly influences demand for shipping services. Strong economic performance in either country typically leads to increased shipping volumes.

-

Technological Advancements: Technological advancements, such as digitalization and AI-powered logistics solutions, are improving efficiency and transparency within the shipping industry, potentially reducing costs and streamlining processes.

-

Port Infrastructure: The quality and capacity of port infrastructure in both China and the US are crucial. Improvements in infrastructure can increase efficiency and reduce congestion, while limitations can lead to delays and higher costs.

Payden & Rygel's Insights and Predictions for the Future

Payden & Rygel's expertise provides valuable insights into future market trends within China to US container shipping. Their analysis is crucial for informed decision-making.

-

Rate and Capacity Forecasts: Payden & Rygel's forecasts likely provide predictions regarding future shipping rates and available capacity. (Note: Insert specific predictions from Payden & Rygel's analysis here if available). Understanding these predictions allows businesses to anticipate potential price changes and plan their logistics accordingly.

-

Long-Term Market Trends: Their analysis likely identifies long-term market trends, such as shifts in consumer demand, changes in manufacturing patterns, or technological disruptions.

-

Recommendations for Businesses: Payden & Rygel may offer strategic recommendations for companies involved in this trade route. These recommendations might include hedging strategies to mitigate risk associated with volatile shipping rates or guidance on negotiating favorable contracts with shipping lines.

-

Risk and Opportunity Assessment: Their analysis should highlight potential risks and opportunities within the China-US container shipping market, allowing companies to make well-informed decisions and develop proactive risk management strategies.

Conclusion

Understanding the complexities of China to US container shipping is crucial for businesses operating in this vital trade lane. Payden & Rygel's market analysis provides invaluable insights into current market conditions, key influencing factors, and future predictions. By leveraging their expertise, businesses can gain a competitive edge by making informed decisions regarding pricing, capacity planning, and risk management. Gain a competitive edge in the dynamic China to US container shipping market by exploring Payden & Rygel's complete analysis today! [Insert link to Payden & Rygel's website here]

Featured Posts

-

Ufc Vegas 106 Michael Morales Dominance Earns Him Another Bonus

May 19, 2025

Ufc Vegas 106 Michael Morales Dominance Earns Him Another Bonus

May 19, 2025 -

Analyse Passagiersaantallen Maastricht Airport Begin 2025

May 19, 2025

Analyse Passagiersaantallen Maastricht Airport Begin 2025

May 19, 2025 -

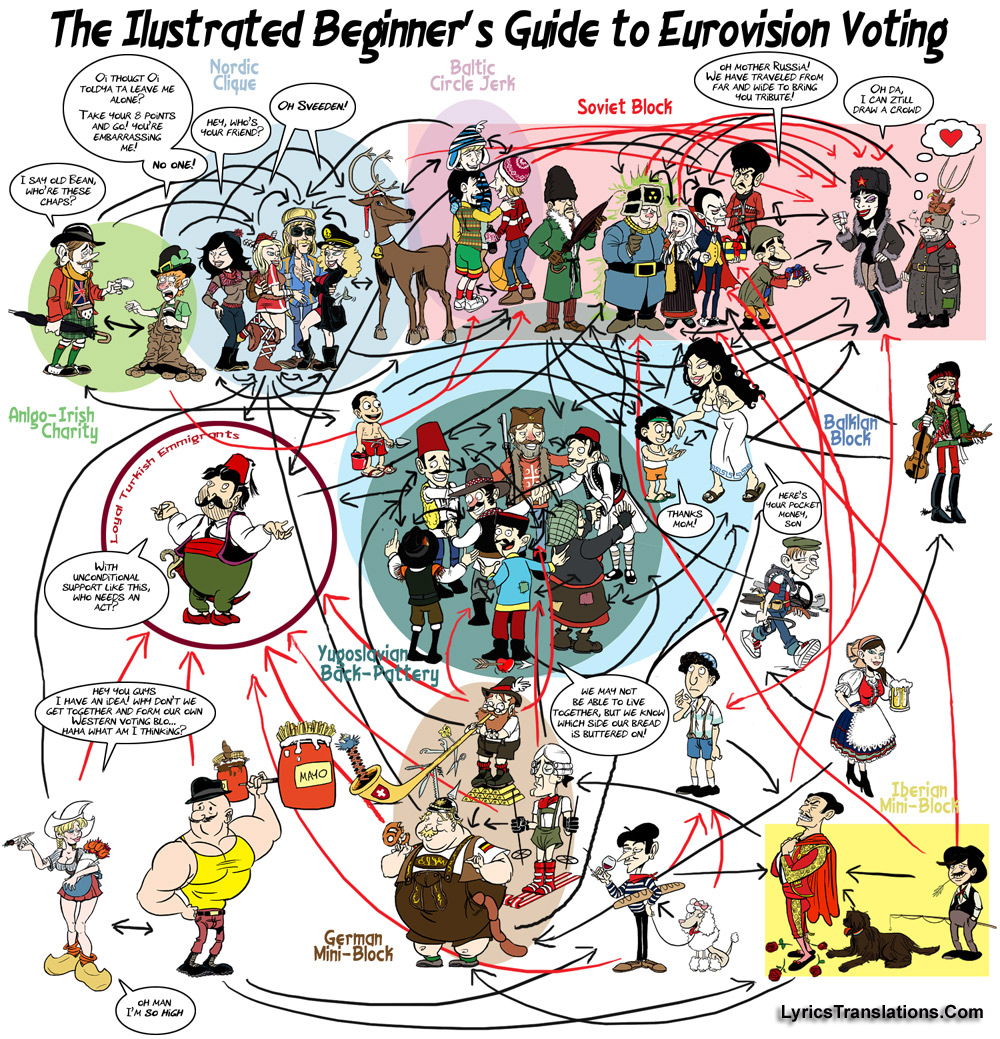

How Eurovision Voting Works A Complete Guide

May 19, 2025

How Eurovision Voting Works A Complete Guide

May 19, 2025 -

Elderly British Drivers Wrong Way Motorway Drive In France

May 19, 2025

Elderly British Drivers Wrong Way Motorway Drive In France

May 19, 2025 -

Announcing Vermonts 2025 Presidential Scholars

May 19, 2025

Announcing Vermonts 2025 Presidential Scholars

May 19, 2025

Latest Posts

-

Iran Three Death Sentences For Deadly Mosque Attacks

May 19, 2025

Iran Three Death Sentences For Deadly Mosque Attacks

May 19, 2025 -

The Crucial Role Of Middle Management In Business Growth And Employee Satisfaction

May 19, 2025

The Crucial Role Of Middle Management In Business Growth And Employee Satisfaction

May 19, 2025 -

Chinese Pakistani Satellite Collaboration An Indian Defense Perspective

May 19, 2025

Chinese Pakistani Satellite Collaboration An Indian Defense Perspective

May 19, 2025 -

Pakistan Receives Chinese Satellite Support Indian Defense Analysis

May 19, 2025

Pakistan Receives Chinese Satellite Support Indian Defense Analysis

May 19, 2025 -

Canadian Government Responds To Criticism Regarding Us Tariffs

May 19, 2025

Canadian Government Responds To Criticism Regarding Us Tariffs

May 19, 2025