China's Auto Market: The Hurdles Faced By BMW, Porsche, And Others

Table of Contents

Intense Competition from Domestic Brands

The rise of powerful and technologically advanced Chinese automakers like BYD, Geely, Nio, and Xpeng poses a significant threat to established luxury brands. These domestic brands are rapidly gaining market share, forcing BMW, Porsche, and other international players to adapt their strategies.

-

Aggressive pricing strategies from domestic brands: Chinese automakers often offer competitive pricing, undercutting the prices of established luxury brands and making their vehicles more accessible to a wider range of consumers. This aggressive pricing strategy is particularly effective in a price-sensitive market like China.

-

Rapid innovation and technological advancements in Chinese-made EVs: Domestic brands are at the forefront of electric vehicle (EV) innovation, frequently introducing cutting-edge technologies and features at competitive prices. This challenges the technological leadership that international brands have traditionally enjoyed. The focus on EVs is a key aspect of the Chinese government's push towards sustainable mobility, further boosting domestic brands.

-

Growing brand loyalty amongst Chinese consumers towards domestic brands: A rising sense of national pride and increasing confidence in domestic brands are leading to stronger brand loyalty among Chinese consumers. This shift in brand preference poses a significant challenge to international luxury brands striving to maintain their market share. Marketing campaigns emphasizing the heritage and prestige of international brands are proving less effective than in the past.

-

Focus on specific market segments and consumer needs: Chinese brands are adept at tailoring their offerings to meet the specific needs and preferences of different consumer segments within the Chinese market. This targeted approach allows them to capture market share more effectively than broader strategies employed by some international brands.

Shifting Consumer Preferences and Demands

Chinese consumers are increasingly demanding environmentally friendly vehicles and advanced technological features. This shift in preferences necessitates a significant adaptation from luxury brands accustomed to focusing on traditional luxury features.

-

High demand for electric vehicles (EVs) and plug-in hybrids: The Chinese government's strong support for new energy vehicles (NEVs), coupled with growing environmental awareness among consumers, has led to a surge in demand for EVs and plug-in hybrid electric vehicles (PHEVs). Luxury brands must invest heavily in their EV portfolios to remain competitive.

-

Preference for connected car features and autonomous driving technology: Chinese consumers highly value advanced technological features, including connected car services, advanced driver-assistance systems (ADAS), and autonomous driving capabilities. Failing to offer these features puts luxury brands at a significant disadvantage.

-

Focus on personalized and customized options: The Chinese consumer market shows a strong preference for customized options and personalized experiences. Luxury brands need to provide flexible options to satisfy this growing demand.

-

Growing awareness of sustainability and eco-friendly practices: Beyond the demand for EVs, there is a growing awareness of sustainability and eco-friendly practices among Chinese consumers. Luxury brands need to demonstrate their commitment to sustainability throughout their supply chains and manufacturing processes to appeal to this segment.

Navigating Regulatory Hurdles and Government Policies

The Chinese government plays a significant role in shaping the automotive market through regulations, tariffs, and policies that impact foreign automakers. Understanding and adapting to these policies is crucial for success.

-

Stringent emission standards and fuel efficiency regulations: China has implemented stringent emission standards and fuel efficiency regulations, pushing automakers to develop more environmentally friendly vehicles. Meeting these regulations adds to the cost of doing business in China.

-

Import tariffs and trade barriers impacting profitability: Import tariffs and other trade barriers can significantly increase the cost of importing vehicles into China, impacting the profitability of luxury brands.

-

Complex regulatory processes for market entry and product approvals: The regulatory processes for market entry and product approvals in China can be complex and time-consuming, adding further challenges for international automakers.

-

Government support for domestic electric vehicle manufacturers: The Chinese government actively supports domestic EV manufacturers through subsidies, tax breaks, and other incentives, creating an uneven playing field for international competitors.

Supply Chain Disruptions and Logistics Challenges

The global pandemic and geopolitical factors have significantly impacted supply chains, making it difficult for automakers to maintain consistent production and delivery in the China auto market.

-

Global chip shortages impacting vehicle production: The global chip shortage has significantly impacted vehicle production worldwide, including in China. This has led to production delays and increased costs for automakers.

-

Disruptions to the supply of raw materials and components: Disruptions to the supply of raw materials and components have further exacerbated the challenges faced by automakers in maintaining consistent production.

-

Increased logistics costs and transportation delays: Logistics costs and transportation delays have also increased, adding to the overall cost of doing business in China.

-

Need for diversified sourcing and resilient supply chain strategies: Automakers need to develop more diversified sourcing strategies and build more resilient supply chains to mitigate the risks associated with supply chain disruptions.

Conclusion

The Chinese auto market presents both immense opportunities and formidable challenges for international luxury brands like BMW and Porsche. Successfully navigating this dynamic environment requires a deep understanding of Chinese consumer preferences, a robust response to the rise of domestic competitors, and the ability to adapt to evolving government regulations and supply chain complexities. By strategically addressing these hurdles, luxury automakers can still tap into the massive potential of the China auto market, securing a strong position in the world's largest automotive market. To learn more about successfully penetrating the China auto market, further research into specific market segments and consumer behavior is crucial. Understanding the nuances of the Chinese automotive market is key to future success.

Featured Posts

-

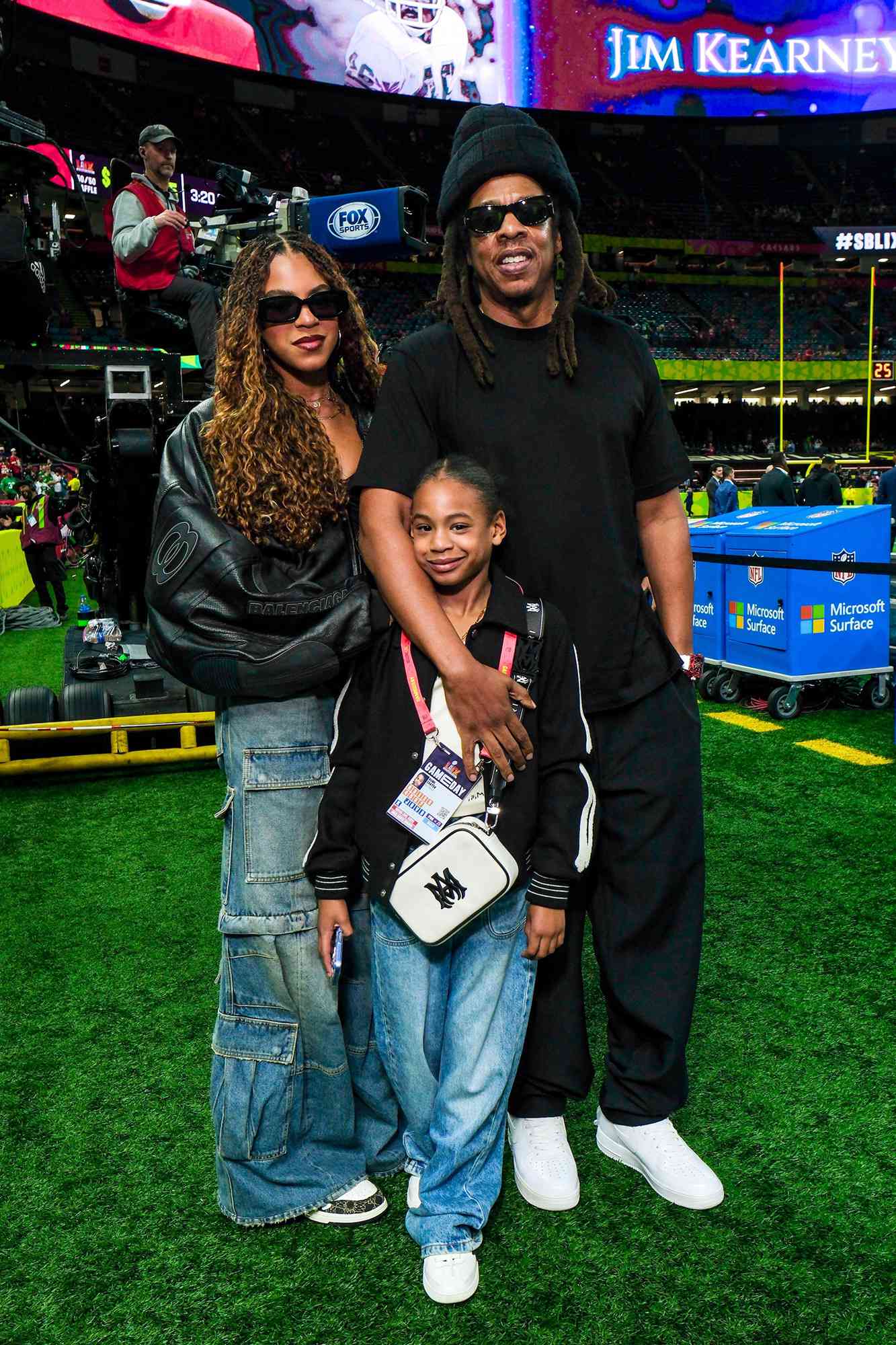

Blue Ivy And Rumi Twin Style At The Super Bowl

Apr 30, 2025

Blue Ivy And Rumi Twin Style At The Super Bowl

Apr 30, 2025 -

Six Year Old Involved Richmond Man Receives Sentence For Gun Possession

Apr 30, 2025

Six Year Old Involved Richmond Man Receives Sentence For Gun Possession

Apr 30, 2025 -

Trumps Plan To Mitigate Automotive Tariff Impact

Apr 30, 2025

Trumps Plan To Mitigate Automotive Tariff Impact

Apr 30, 2025 -

Kiem Tra Ky Cang Truoc Khi Dau Tu Tranh Rui Ro Tu Cac Cong Ty Bi Nghi Van Lua Dao

Apr 30, 2025

Kiem Tra Ky Cang Truoc Khi Dau Tu Tranh Rui Ro Tu Cac Cong Ty Bi Nghi Van Lua Dao

Apr 30, 2025 -

Giai Bong Da Thanh Nien Sinh Vien Quoc Te 2025 Cap Nhat Lich Thi Dau Moi Nhat 10 Tran Hap Dan

Apr 30, 2025

Giai Bong Da Thanh Nien Sinh Vien Quoc Te 2025 Cap Nhat Lich Thi Dau Moi Nhat 10 Tran Hap Dan

Apr 30, 2025

Latest Posts

-

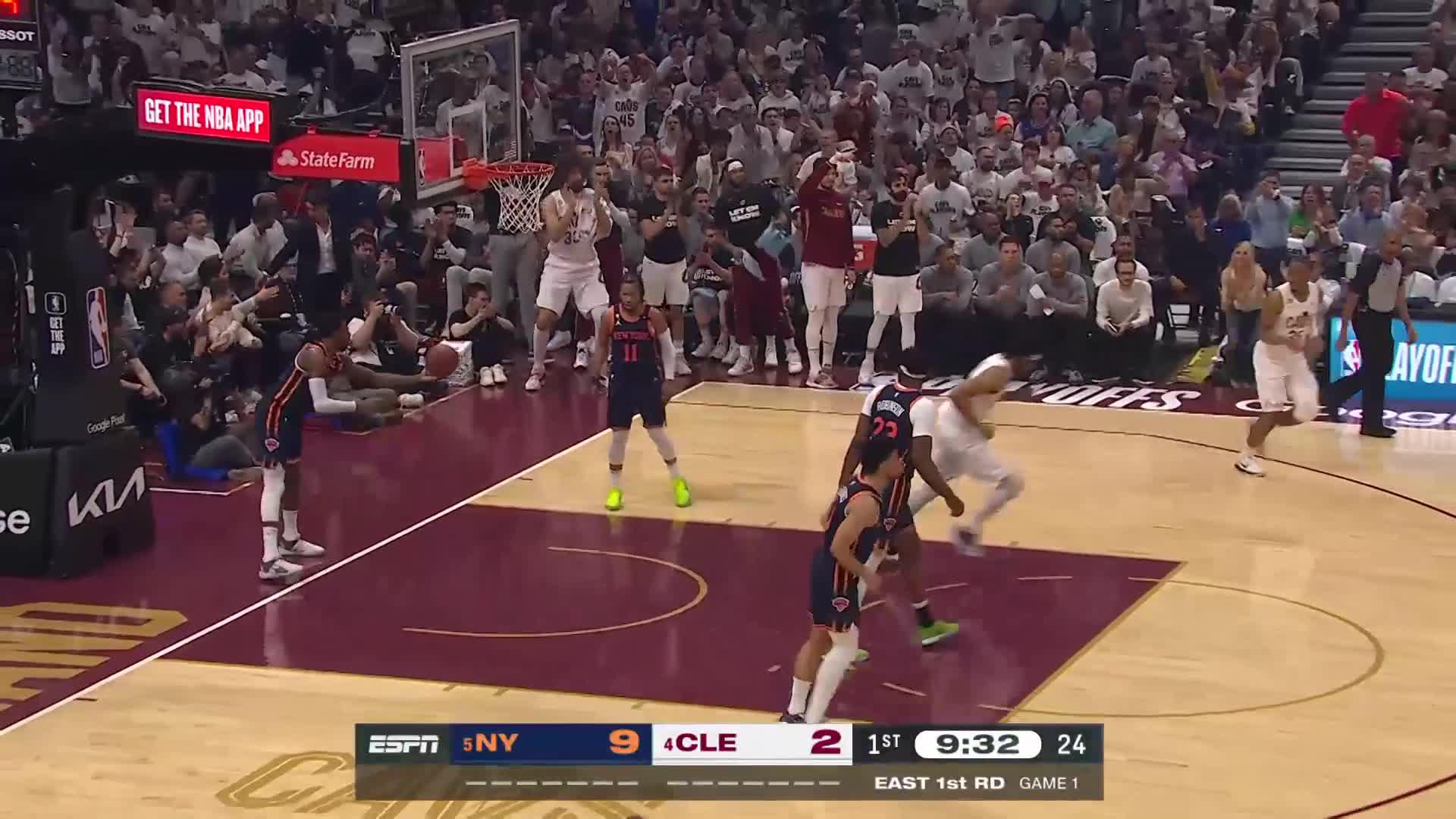

Garland Explodes For 32 As Cavaliers Top Blazers In Overtime Thriller

Apr 30, 2025

Garland Explodes For 32 As Cavaliers Top Blazers In Overtime Thriller

Apr 30, 2025 -

Cavaliers Extend Winning Streak To 10 With De Andre Hunters Strong Performance

Apr 30, 2025

Cavaliers Extend Winning Streak To 10 With De Andre Hunters Strong Performance

Apr 30, 2025 -

133 129 Ot Victory Cavaliers Defeat Blazers Extend Winning Streak

Apr 30, 2025

133 129 Ot Victory Cavaliers Defeat Blazers Extend Winning Streak

Apr 30, 2025 -

De Andre Hunter Leads Cavaliers To 10th Straight Victory Over Trail Blazers

Apr 30, 2025

De Andre Hunter Leads Cavaliers To 10th Straight Victory Over Trail Blazers

Apr 30, 2025 -

Cleveland Cavaliers Extend Winning Streak To 10 With Overtime Thriller Against Portland

Apr 30, 2025

Cleveland Cavaliers Extend Winning Streak To 10 With Overtime Thriller Against Portland

Apr 30, 2025