China's Canola Dependence: A Look At New Supply Chains

Table of Contents

Canada's Dominance and the Recent Trade Disputes

Historically, Canada held a dominant position as the primary supplier of canola to China. For years, Canadian canola met a substantial portion of China's demand, solidifying a strong trade relationship. However, this dominance was disrupted by escalating trade disputes, which significantly impacted both countries' economies. These disputes, often stemming from phytosanitary concerns and other trade barriers, led to restrictions and tariffs on Canadian canola imports.

- Canada's previous market share: Before the trade disputes, Canada supplied over 40% of China's canola imports, making it the single largest source.

- Reasons behind the trade disputes: Allegations of unwanted contaminants in Canadian canola shipments triggered investigations and retaliatory measures from China, creating significant uncertainty in the market.

- Economic repercussions: Canadian canola farmers faced reduced export volumes and lower prices, while China experienced increased costs and potential shortages of this crucial agricultural commodity. The trade disruption caused billions of dollars in losses for both economies.

- Import/export statistics: Data from relevant sources (e.g., Statistics Canada, Chinese customs data) should be included here to quantify the impact of the trade disputes on import/export volumes of canola between Canada and China.

Exploring Alternative Canola Sources for China

Faced with reduced access to Canadian canola, China has actively sought alternative sources. Several countries are emerging as potential replacements, each presenting unique opportunities and challenges.

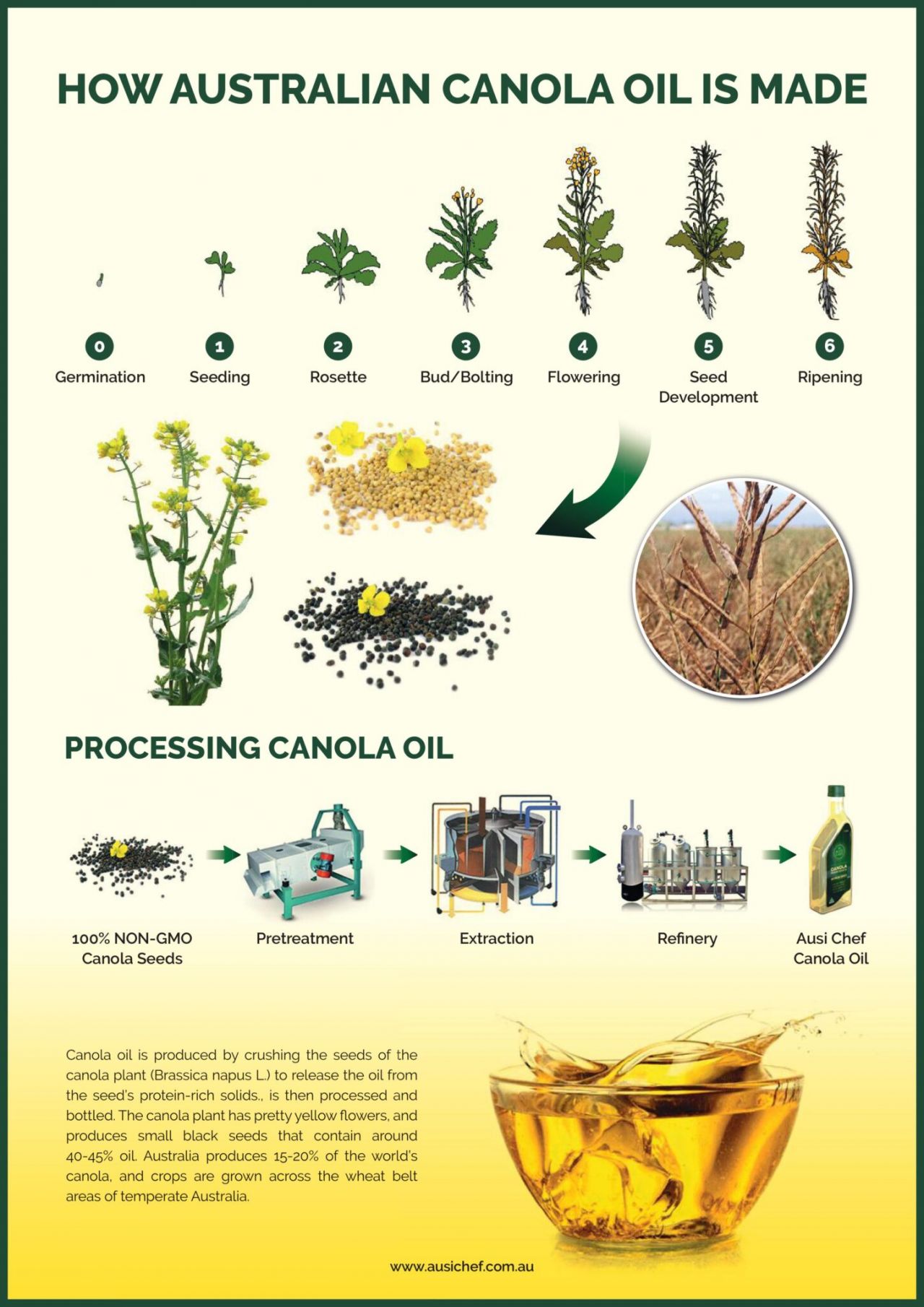

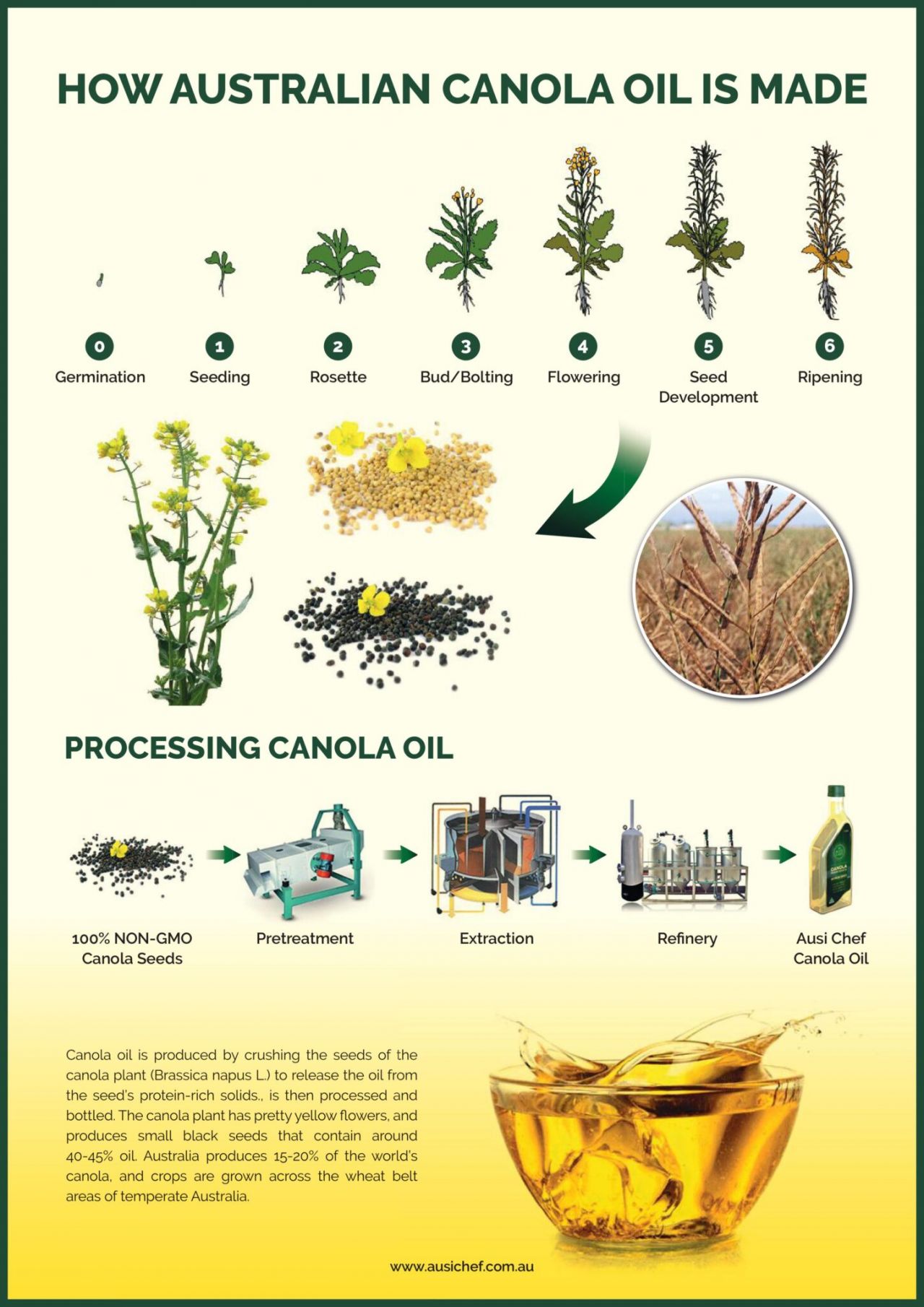

- Australia: Australia's geographical proximity and substantial canola production capacity make it a strong contender. However, increased production to meet China's demand would require significant investments in infrastructure and logistics.

- Ukraine: Pre-war Ukraine was a significant exporter of canola to various global markets, including China. However, the ongoing conflict has drastically curtailed its export capacity and disrupted global canola supplies. The future role of Ukraine as a significant canola supplier remains uncertain.

- Russia: Russia possesses a significant land area suitable for canola cultivation and thus has the potential to become a major supplier. However, geopolitical considerations and existing sanctions could create significant barriers to trade.

- Other countries (e.g., Brazil, Argentina): While Brazil and Argentina are also canola producers, their current export volumes to China are relatively small compared to Canada and Australia. Their potential as major suppliers will depend on expanding production and overcoming logistical hurdles.

The Role of Logistics and Infrastructure

Securing reliable canola supplies for China requires robust and efficient logistics and infrastructure across the entire supply chain. Challenges include:

- Port infrastructure and capacity: Sufficient port capacity in both exporting and importing countries is crucial to handle the large volumes of canola. Investment in port infrastructure improvements is necessary to facilitate smooth and timely shipments.

- Shipping costs: Transportation costs, including shipping, handling, and storage, significantly impact the final price of canola in China. Finding cost-effective shipping routes and optimizing logistics are essential for competitiveness.

- Infrastructure investments: Significant investments in infrastructure are needed across the supply chain – from farms to ports – to ensure reliable and efficient transportation and handling of canola.

The Impact on Global Canola Markets

China's efforts to diversify its canola imports are having a significant ripple effect on global canola markets.

- Canola price fluctuations: Changes in China's import policies and sourcing strategies directly impact global canola prices, creating volatility for producers and consumers alike. Increased demand from China could lead to higher prices globally.

- Implications for other importers and exporters: Other major importers and exporters of canola, such as the European Union and India, are also affected by shifts in the global market dynamics caused by China's actions. Competition for available canola supplies is intensifying.

- Geopolitical factors: Geopolitical instability and trade tensions continue to play a significant role in shaping global canola markets. The uncertainty surrounding global trade relations makes predicting future market trends difficult.

Conclusion

China's canola dependence is shifting dramatically. The country's move away from its reliance on a single supplier, Canada, highlights the growing importance of diversifying supply chains in the face of geopolitical uncertainty and trade disputes. This shift has profound implications for global canola markets, impacting prices, trade relationships, and the strategies of producers and consumers worldwide. Understanding China's canola dependence is crucial for anyone involved in the global agricultural and trade sectors. Further research into the diversification of China's canola supply chains and their global impact is essential for navigating this evolving market landscape. Stay informed on the latest developments in China's canola dependence to adapt to the changing dynamics of global trade.

Featured Posts

-

Ai Driven Podcast Creation Transforming Mundane Scatological Data Into Engaging Content

May 10, 2025

Ai Driven Podcast Creation Transforming Mundane Scatological Data Into Engaging Content

May 10, 2025 -

Bangkok Post Addressing The Urgent Need For Transgender Equality

May 10, 2025

Bangkok Post Addressing The Urgent Need For Transgender Equality

May 10, 2025 -

Planned Elizabeth Line Strikes Impact On February And March Services

May 10, 2025

Planned Elizabeth Line Strikes Impact On February And March Services

May 10, 2025 -

Nhl Playoffs Oilers Vs Kings Game 1 Predictions And Betting Analysis

May 10, 2025

Nhl Playoffs Oilers Vs Kings Game 1 Predictions And Betting Analysis

May 10, 2025 -

Evaluating Palantir Stock 40 Growth Potential And Investment Risks In 2025

May 10, 2025

Evaluating Palantir Stock 40 Growth Potential And Investment Risks In 2025

May 10, 2025