China's Economic Strategy: Combating Tariffs Through Monetary Policy

Table of Contents

The Impact of Tariffs on the Chinese Economy

Tariffs imposed on Chinese goods have had a multifaceted negative impact on the Chinese economy. The increased costs and reduced demand significantly affect various sectors. These effects ripple through the economy, impacting GDP growth, inflation, and employment.

- Decreased demand for Chinese goods in key export markets: Tariffs make Chinese products more expensive for consumers in importing countries, leading to reduced demand and impacting export-oriented industries like manufacturing and textiles.

- Increased production costs for Chinese businesses: Tariffs increase the cost of raw materials and intermediate goods imported for production, squeezing profit margins and potentially leading to reduced investment.

- Potential for job losses in export-oriented sectors: Reduced demand and higher production costs can lead to factory closures and job losses, particularly in sectors heavily reliant on exports. This can cause social and economic instability.

- Strain on the Chinese Yuan: Reduced export demand and capital flight can put downward pressure on the Chinese Yuan, impacting the country's international trade competitiveness and potentially leading to inflation.

Specific industries, such as steel, aluminum, and agricultural products, have been particularly hard hit by tariffs, experiencing significant declines in exports and increased domestic price volatility. The impact varies depending on the industry's dependence on exports and its ability to adapt to changing market conditions.

Monetary Policy Tools Employed by China

The People's Bank of China (PBoC) has employed several monetary policy instruments to counter the negative effects of tariffs. These tools aim to stimulate economic activity, support businesses, and maintain financial stability.

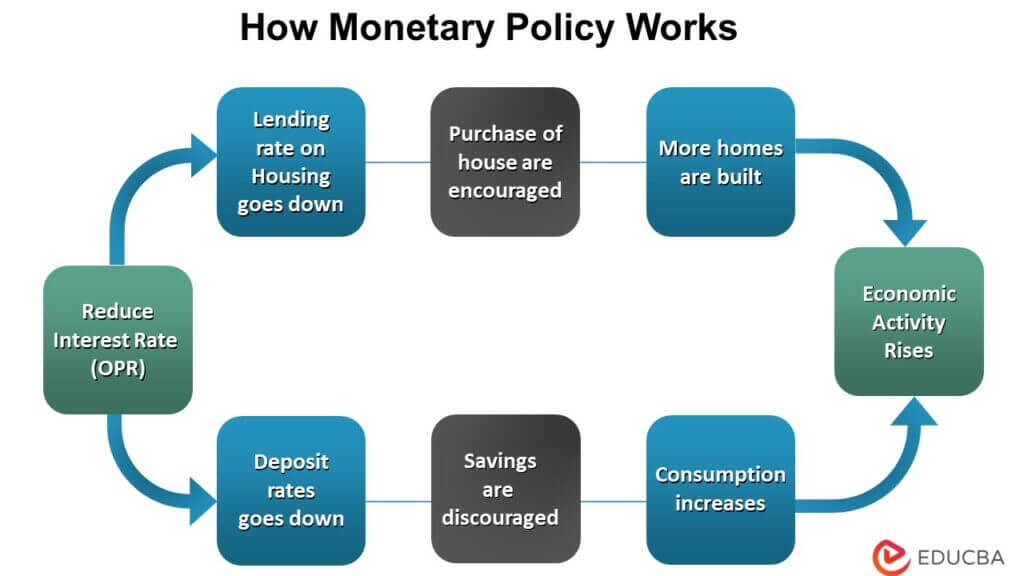

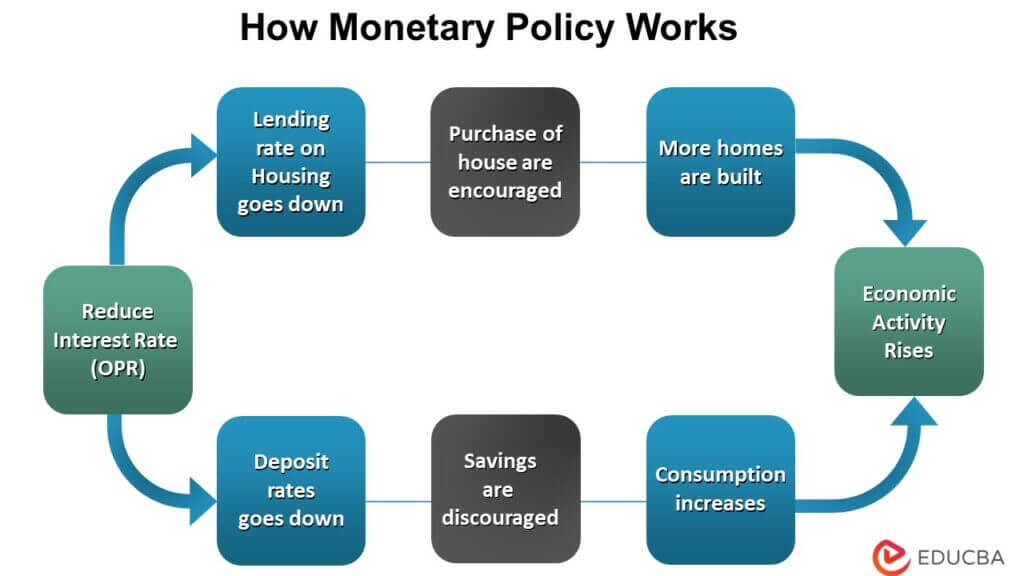

- Interest rate cuts: Lowering interest rates reduces borrowing costs for businesses and consumers, encouraging investment in new projects and stimulating consumption. This boosts aggregate demand and helps offset the decline in exports.

- Reserve requirement ratio (RRR) adjustments: Reducing the RRR, the percentage of deposits banks must hold in reserve, increases liquidity in the banking system. This allows banks to lend more money, fueling economic activity.

- Quantitative easing (QE): While not as extensively used as in other countries, the PBoC has considered and implemented targeted QE measures to inject liquidity into specific sectors of the economy facing significant challenges. This involves purchasing assets to increase money supply.

- Directed lending: The PBoC can guide lending towards specific sectors deemed vital for economic growth, such as infrastructure development or high-tech industries. This ensures that credit flows to where it’s most needed.

Effectiveness of Interest Rate Cuts

The effectiveness of interest rate cuts in boosting economic activity is complex and depends on various factors. While lower rates incentivize borrowing, their impact can be muted by several factors:

- Data on economic growth following interest rate cuts: While some positive effects on GDP growth have been observed, the magnitude has been varied, suggesting the need for a more comprehensive approach.

- Analysis of investment and consumption trends: Increased investment and consumption haven't always followed interest rate cuts directly due to factors like debt levels and investor sentiment.

- Assessment of the effectiveness of transmission mechanisms: The effectiveness of transmitting lower interest rates through the banking system and into the real economy is influenced by factors like bank lending practices and the health of the financial system.

Challenges and Limitations of Monetary Policy

Despite its efforts, the PBoC faces challenges in using monetary policy alone to fully offset the impact of tariffs:

- Concerns about rising debt levels and financial stability: Aggressive monetary easing could exacerbate existing concerns about high corporate and household debt levels, potentially leading to financial instability.

- Effectiveness of monetary policy in addressing structural economic issues: Monetary policy is less effective in addressing structural issues like overcapacity in certain industries or technological backwardness.

- Potential for capital flight and currency depreciation: Loose monetary policy could lead to capital flight and depreciation of the Yuan, further impacting the economy.

- The impact of global economic uncertainty: Global economic slowdowns or geopolitical risks can limit the effectiveness of domestic monetary policy measures.

Alternative Economic Strategies in Conjunction with Monetary Policy

China's response to tariffs isn't solely reliant on monetary policy. Fiscal policy and structural reforms play crucial roles in a multi-pronged approach:

- Increased infrastructure spending: Government investment in infrastructure projects boosts domestic demand, creating jobs and stimulating related industries.

- Tax incentives for businesses: Tax cuts and other incentives encourage businesses to invest, expand, and hire, offsetting the negative impact of tariffs.

- Support for domestic consumption: Government policies aimed at boosting consumer spending help compensate for reduced export demand.

- Structural reforms to improve efficiency and competitiveness: Reforms aimed at improving efficiency, reducing bureaucracy, and fostering innovation enhance the long-term competitiveness of the Chinese economy.

Conclusion

China's response to tariffs relies heavily on a multifaceted economic strategy, with monetary policy playing a key role. While interest rate cuts and RRR adjustments aim to stimulate economic activity and counteract the negative impacts of tariffs, challenges remain. The effectiveness of these tools is contingent on factors such as debt levels and global economic conditions. A holistic approach combining monetary policy with fiscal policy and structural reforms is crucial for China to navigate the complexities of the trade war and maintain sustainable economic growth. Further research into the long-term effects of China's monetary policy and its adaptation to future trade challenges is needed. To stay informed on the latest developments in China's Monetary Policy and its impact on the global economy, continue to follow our updates.

Featured Posts

-

Watch Inter Vs Barcelona Live Uefa Champions League Football

May 08, 2025

Watch Inter Vs Barcelona Live Uefa Champions League Football

May 08, 2025 -

Live Stream Inter Vs Barcelona Uefa Champions League Match

May 08, 2025

Live Stream Inter Vs Barcelona Uefa Champions League Match

May 08, 2025 -

Saturday Night Lives Impact On Counting Crows Career

May 08, 2025

Saturday Night Lives Impact On Counting Crows Career

May 08, 2025 -

Gjranwalh Myn Wlyme Ke Mwqe Pr Dl Ka Dwrh Dlhn Ka Ghm

May 08, 2025

Gjranwalh Myn Wlyme Ke Mwqe Pr Dl Ka Dwrh Dlhn Ka Ghm

May 08, 2025 -

Arsenali Dhe Psg Uefa Heton Dyshimet Per Shkelje Te Rregullave

May 08, 2025

Arsenali Dhe Psg Uefa Heton Dyshimet Per Shkelje Te Rregullave

May 08, 2025