China's Impact On BMW And Porsche Sales: Market Trends And Future Outlook

Table of Contents

H2: Booming Chinese Luxury Car Market and its Effect on BMW Sales

The Chinese luxury car market is a dynamic landscape, presenting both opportunities and challenges for BMW. Understanding the driving forces and potential obstacles is crucial for navigating this competitive environment.

H3: Growth Drivers in the Chinese Market:

- Rising Disposable Incomes: A burgeoning middle class with significantly increased disposable income fuels the demand for luxury goods, including premium vehicles. This translates directly into higher BMW sales in China.

- Status Symbol: Owning a BMW is increasingly viewed as a status symbol in China, enhancing its desirability among aspirational consumers. This perception strengthens brand loyalty and drives sales.

- Government Support: Government policies focusing on infrastructure development and the promotion of domestic car manufacturing indirectly benefit established brands like BMW, ensuring a conducive business environment.

- Successful Models: The BMW 5 Series and X5 SUV have consistently performed well in the Chinese market, demonstrating the brand's understanding of local preferences. Sales figures for these models consistently rank high compared to other regions.

- Localization Strategies: BMW's successful localization strategy, including manufacturing vehicles within China and adapting models to meet specific Chinese consumer needs, has been a key driver of its sales growth.

H3: Challenges for BMW in China:

- Intense Competition: The Chinese market is fiercely competitive, with both domestic brands and other international players vying for market share. This necessitates constant innovation and adaptation.

- Economic Fluctuations: Fluctuations in the Chinese economy can directly impact luxury car sales, creating uncertainty and requiring robust risk management strategies from BMW.

- Shifting Preferences: Consumer preferences are constantly evolving; BMW must continually adapt its offerings to remain relevant and competitive.

- Environmental Regulations: Stringent environmental regulations are driving the need for more sustainable vehicles, impacting the sales of traditional gasoline-powered models and requiring BMW to invest heavily in electric vehicle technology.

H2: Porsche's Performance in China and Future Market Penetration:

Porsche has achieved remarkable success in China, establishing a strong brand presence and cultivating a loyal customer base. However, maintaining this momentum requires strategic planning and adaptation to evolving market dynamics.

H3: Porsche's Success Factors in the Chinese Market:

- Brand Prestige: The Porsche brand carries significant prestige and desirability among Chinese consumers, contributing to its strong sales performance.

- Product Focus: Porsche's focus on high-performance sports cars and SUVs caters to a specific segment of the Chinese luxury car market with a high demand for these types of vehicles.

- Marketing Excellence: Porsche's marketing and brand-building efforts effectively resonate with Chinese consumers, creating a powerful brand image.

- Strong Dealership Network: A robust dealership network and excellent after-sales service ensure customer satisfaction and enhance brand loyalty.

- Sales Growth: Porsche's sales growth in China significantly outpaces its growth in other regions, highlighting the market's importance to the company.

H3: Future Growth Strategies for Porsche in China:

- Expanded Model Range: Porsche plans to expand its model range to meet the diverse needs of the Chinese market, offering a wider selection of vehicles to cater to different consumer preferences.

- EV Investment: Significant investments in electric vehicle (EV) technology and infrastructure are crucial for Porsche to maintain competitiveness in the face of stricter environmental regulations.

- Digital Marketing: Porsche is increasingly leveraging digital marketing and online sales channels to reach a wider audience and enhance customer engagement.

- Sustainability Focus: A commitment to sustainable development and environmental responsibility is becoming increasingly important in China, and Porsche is actively addressing these concerns.

- Strategic Partnerships: Exploring potential partnerships with local Chinese companies could provide access to local expertise and resources.

H2: Comparative Analysis: BMW vs. Porsche in China

Understanding the relative strengths and weaknesses of BMW and Porsche in the Chinese market requires a direct comparison.

H3: Market Share Comparison: While BMW currently holds a larger market share in the overall luxury segment in China than Porsche, Porsche boasts a higher average sales price per vehicle, reflecting its strong brand positioning and high demand for its models. (A chart visually comparing market share would be beneficial here.)

H3: Pricing Strategies and Their Impact: Both brands employ competitive pricing strategies, but Porsche's focus on high-performance vehicles allows for premium pricing, while BMW offers a broader range with different price points to cater to a wider consumer base.

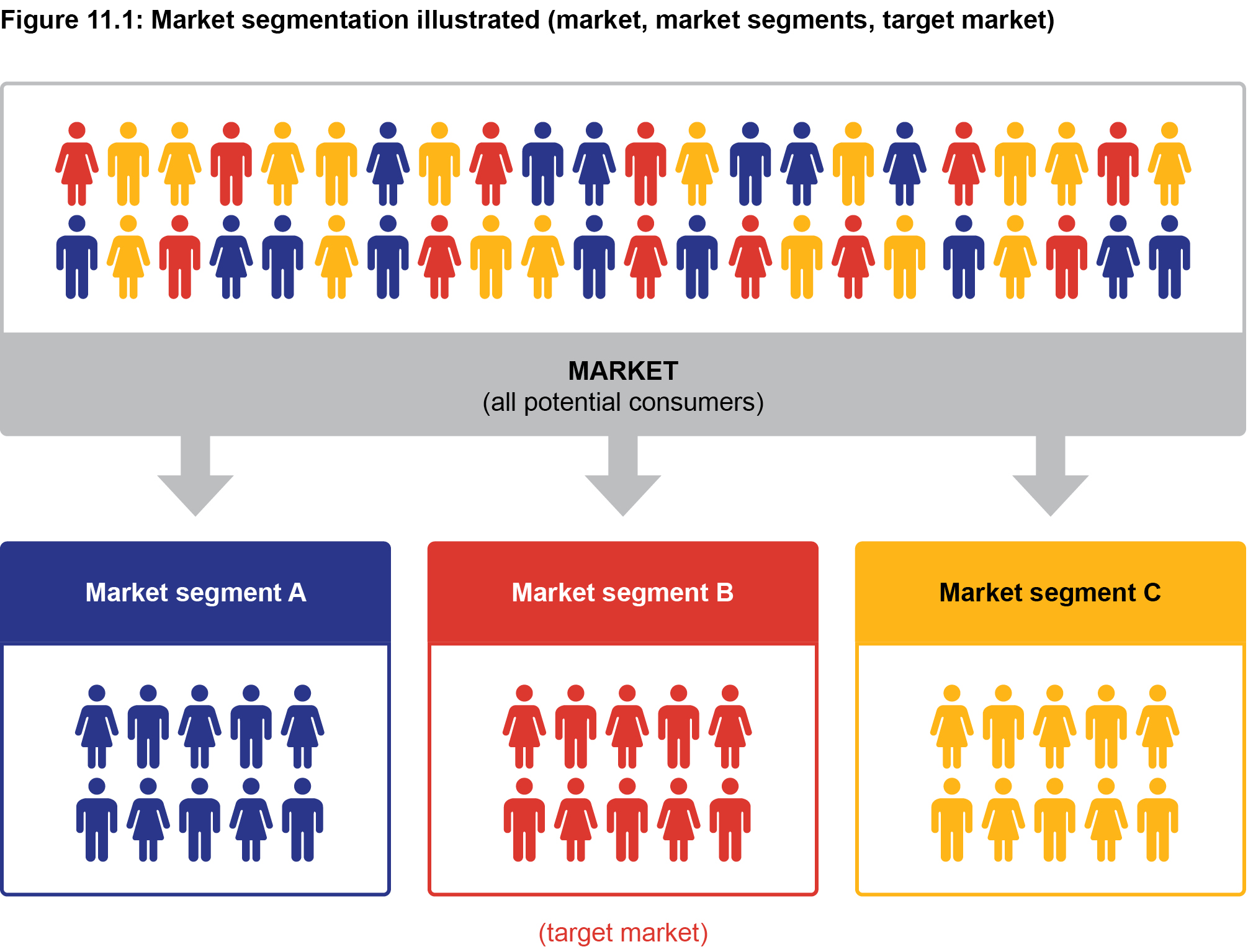

H3: Target Customer Demographics: While both brands target affluent consumers, Porsche’s customer base skews slightly younger and more towards those seeking high-performance vehicles, whereas BMW attracts a broader demographic seeking a combination of luxury, practicality, and prestige.

H2: Future Outlook: Predictions and Trends for the Chinese Automotive Market:

The Chinese automotive market is poised for continued growth, presenting both opportunities and challenges for BMW and Porsche.

- Growth Projections: The luxury car segment in China is projected to experience continued, albeit potentially slower, growth in the coming years, driven by economic factors and evolving consumer preferences.

- Technological Advancements: Technological advancements such as autonomous driving and electric vehicles will significantly impact the market, requiring significant investment from both BMW and Porsche.

- Geopolitical Factors: Geopolitical factors, including trade relations and government policies, will continue to influence the Chinese automotive market and impact the performance of BMW and Porsche.

- Risks and Opportunities: While the market presents significant opportunities, risks such as economic uncertainty and intensifying competition must be carefully managed.

3. Conclusion:

China's automotive market profoundly influences the sales of BMW and Porsche. Both brands have achieved significant success leveraging the country's economic growth and the increasing purchasing power of its consumers. However, intense competition, shifting consumer preferences, and evolving regulations demand continuous adaptation and innovation. The future outlook is promising, but success hinges on strategic investments in electric vehicle technology, effective marketing tailored to the Chinese market, and a commitment to sustainability. Understanding the nuances of "China's automotive future," the dynamics of "luxury car market growth," and the unique positioning of "BMW and Porsche in China" is vital for navigating this complex and lucrative market.

Call to Action: Stay informed about the latest trends affecting BMW and Porsche sales in China by subscribing to our newsletter for in-depth analysis and future forecasts on the evolving landscape of the Chinese luxury car market.

Featured Posts

-

Alex Ovechkins Miami Dolphin Encounter During 4 Nations Tournament

May 07, 2025

Alex Ovechkins Miami Dolphin Encounter During 4 Nations Tournament

May 07, 2025 -

Is John Wick 5 Really Over Keanu Reeves Latest News

May 07, 2025

Is John Wick 5 Really Over Keanu Reeves Latest News

May 07, 2025 -

Xrp Recovery Slowed The Role Of The Derivatives Market

May 07, 2025

Xrp Recovery Slowed The Role Of The Derivatives Market

May 07, 2025 -

Wnba Free Agency Aces Gamble On Parker Tyus And Evans

May 07, 2025

Wnba Free Agency Aces Gamble On Parker Tyus And Evans

May 07, 2025 -

Packers Steelers Trade Could Josh Jacobs Get His Wish

May 07, 2025

Packers Steelers Trade Could Josh Jacobs Get His Wish

May 07, 2025

Latest Posts

-

Get Your Cavs Round 2 Tickets This Tuesday

May 07, 2025

Get Your Cavs Round 2 Tickets This Tuesday

May 07, 2025 -

Ldc Graduation Governments Commitment To Supporting Least Developed Countries

May 07, 2025

Ldc Graduation Governments Commitment To Supporting Least Developed Countries

May 07, 2025 -

Five Top Nie Articles To Read In Q1 2025

May 07, 2025

Five Top Nie Articles To Read In Q1 2025

May 07, 2025 -

Nie Q1 2025 5 Must Read Articles For Target Audience E G Educators

May 07, 2025

Nie Q1 2025 5 Must Read Articles For Target Audience E G Educators

May 07, 2025 -

Govt Committed To Smooth Ldc Graduation Commerce Advisors Assurance

May 07, 2025

Govt Committed To Smooth Ldc Graduation Commerce Advisors Assurance

May 07, 2025