China's Response To Trump Tariffs: Special Bond Issuance

Table of Contents

Understanding the Impact of Trump Tariffs on China's Economy

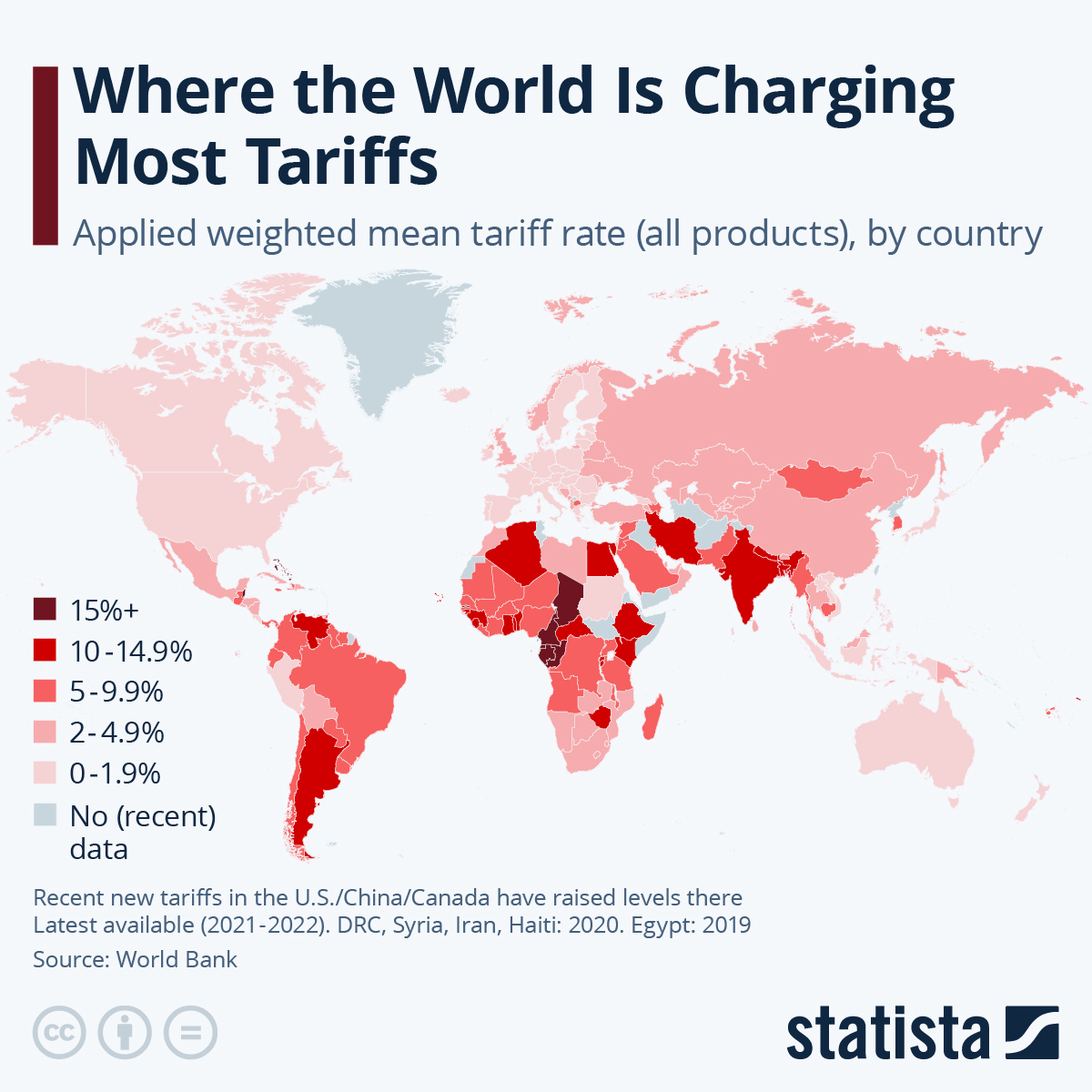

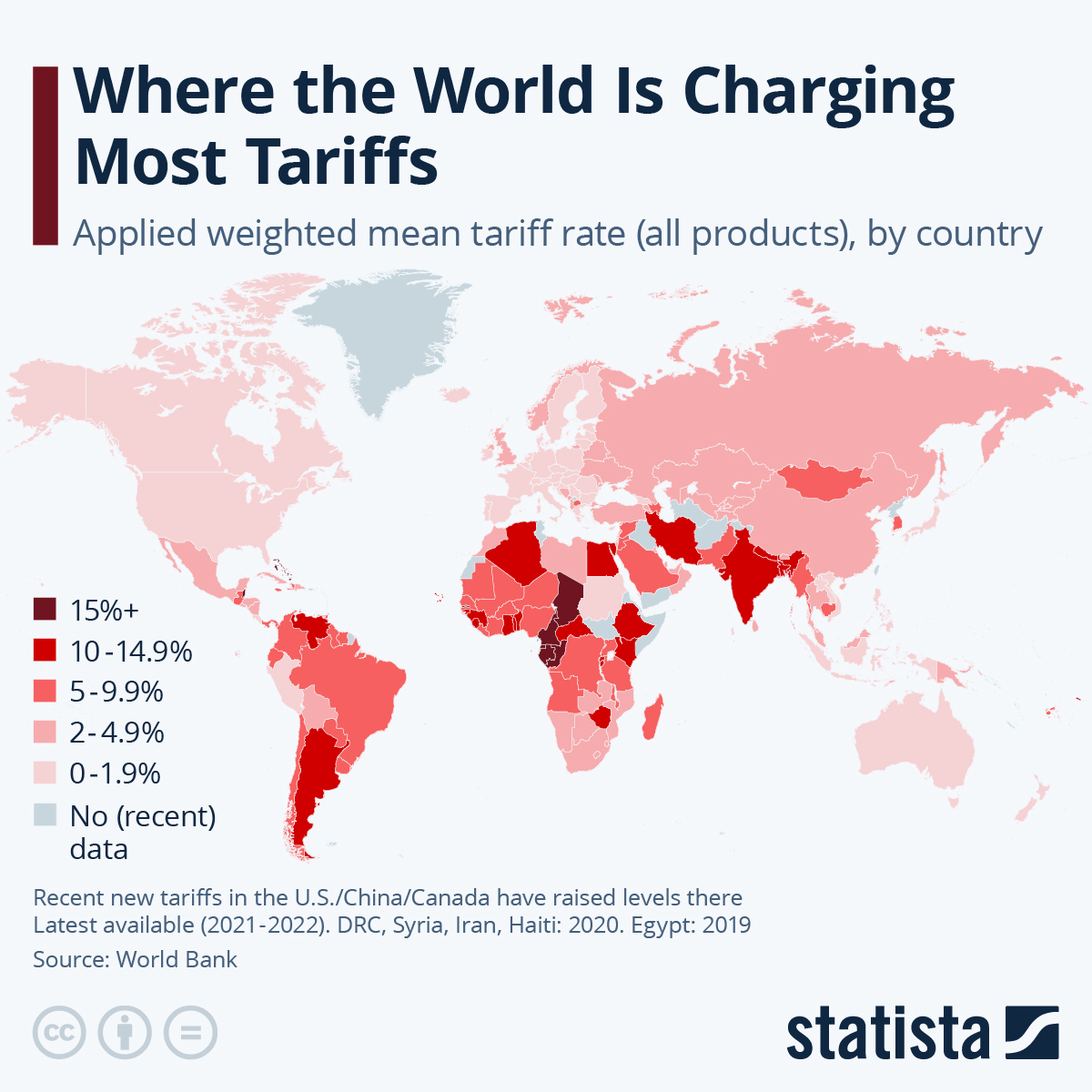

The Trump tariffs inflicted considerable damage on various sectors of the Chinese economy. The immediate consequences were felt across the board:

- Manufacturing: Industries like electronics, textiles, and machinery faced reduced export demand, leading to production cuts and job losses. The tariff impact was particularly severe for export-oriented businesses.

- Agriculture: Chinese agricultural exports, including soybeans and pork, suffered significantly due to increased tariffs, impacting farmers' incomes and agricultural output.

- Technology: The tech sector, a crucial part of China's economic growth, faced challenges due to restrictions on technology imports and the overall slowdown in global trade.

The economic consequences extended beyond immediate losses. The tariff impact resulted in:

- Increased trade deficit: Reduced exports and increased import costs widened China's trade deficit.

- Export decline: Chinese exports to the US, a major trading partner, decreased substantially.

- Weakened consumer confidence: Uncertainty in the market led to decreased consumer spending.

These factors posed a serious threat to China's long-term economic growth trajectory. The potential for a significant slowdown prompted the government to seek effective countermeasures. The resulting trade deficit and export decline highlighted the need for a proactive response to mitigate the damage caused by the Trump tariffs.

The Role of Special Bond Issuance in China's Response

Special bond issuance, a crucial element of China's fiscal policy, involves the government issuing debt securities to finance specific projects and stimulate the economy. Unlike general government bonds, special bonds are earmarked for pre-determined uses.

The mechanism works by:

- Raising funds: The government sells special bonds to investors, raising capital.

- Targeted spending: The raised capital is then allocated to specific sectors or projects outlined in the government's plan.

- Economic stimulus: This targeted investment boosts economic activity and creates jobs.

Special bonds in China were primarily used to:

- Fund infrastructure projects: Building new roads, railways, and other infrastructure boosted employment and stimulated related industries.

- Support technology upgrades: Investment in technology and research & development aimed to enhance China's technological competitiveness and innovation.

- Boost social welfare programs: Funding social welfare projects helped mitigate the social impact of the trade war, supporting vulnerable populations and maintaining social stability.

These targeted investments aimed to counter the negative economic effects of the Trump tariffs and maintain economic growth momentum.

Analyzing the Effectiveness of Special Bond Issuance

Assessing the effectiveness of special bond issuance in offsetting the negative impacts of the tariffs is complex. While the program undoubtedly stimulated the economy and created jobs, several factors need consideration:

- Success in mitigating tariff impact: While special bonds fueled infrastructure development and technological advancements, completely offsetting the tariff-induced slowdown proved challenging.

- Increased government debt: The increased government debt from issuing special bonds poses a risk to long-term fiscal sustainability. Managing this debt burden requires careful planning and efficient resource allocation.

- Long-term sustainability: The long-term sustainability of this strategy depends on the successful implementation of projects funded by the bonds and the overall health of the Chinese economy. The effectiveness of the economic stimulus hinges on the efficient use of funds and their impact on broader economic indicators.

Alternative Strategies Employed by China

Alongside special bond issuance, China employed other strategies to counter the Trump tariffs:

- Internal stimulus packages: Additional monetary and fiscal policies aimed to boost domestic demand and consumption.

- Trade diversification: China actively sought new trading partners to reduce reliance on the US market. This diversification strategy aimed to reduce dependence on a single market and enhance resilience to future trade disputes.

Comparing the effectiveness of these strategies shows that while special bond issuance played a significant role in maintaining infrastructure development, the combination of strategies proved more effective in cushioning the economic blow.

International Implications and Geopolitical Context

China's response to the Trump tariffs had significant international implications:

- Global trade: The trade war and China's response highlighted the interconnectedness of the global economy and the potential disruptions caused by trade disputes.

- US-China relations: The trade war exacerbated tensions between the US and China, impacting bilateral relations and global geopolitical stability. The strategic use of fiscal tools like special bond issuance added another layer of complexity to the existing tensions.

- International finance: China's use of special bonds impacted global financial markets, influencing investor sentiment and capital flows.

The geopolitical implications underscore the wider impact of trade disputes and the importance of international cooperation in managing economic challenges.

Evaluating the Long-Term Impact of China's Special Bond Issuance Strategy

China's special bond issuance strategy, while contributing to economic stability, presented both benefits and challenges. While it stimulated infrastructure development and provided a degree of economic insulation against the negative effects of the Trump tariffs, it also increased government debt. The long-term sustainability depends on the effective management of this debt and the success of the projects funded. The impact on future trade relations remains to be seen, highlighting the need for careful analysis and long-term planning.

To further understand China's economic response to trade disputes and the intricacies of its fiscal policy, we encourage you to research further on China's economic response, Trump tariffs analysis, special bond issuance research, fiscal policy analysis, and trade war strategies. The ongoing evolution of China's economic strategies demands continued scrutiny and analysis.

Featured Posts

-

Michelle Obama And Taraji P Henson Discuss Mental Health And The World In 2025

Apr 25, 2025

Michelle Obama And Taraji P Henson Discuss Mental Health And The World In 2025

Apr 25, 2025 -

Cassidy Hutchinsons Memoir Key Jan 6 Witness To Tell All This Fall

Apr 25, 2025

Cassidy Hutchinsons Memoir Key Jan 6 Witness To Tell All This Fall

Apr 25, 2025 -

Kot Kellog Posetit Ukrainu 20 Fevralya Podrobnosti Ot Smi

Apr 25, 2025

Kot Kellog Posetit Ukrainu 20 Fevralya Podrobnosti Ot Smi

Apr 25, 2025 -

Usha Vances Indian Adventure A Journey To Celebrity Status

Apr 25, 2025

Usha Vances Indian Adventure A Journey To Celebrity Status

Apr 25, 2025 -

Donald Trump Presidency News April 23 2025 Updates

Apr 25, 2025

Donald Trump Presidency News April 23 2025 Updates

Apr 25, 2025

Latest Posts

-

Le Labo Du 8 Une Exposition Photographique De Pierre Terrasson

Apr 26, 2025

Le Labo Du 8 Une Exposition Photographique De Pierre Terrasson

Apr 26, 2025 -

Milan Design Week 2025 Saint Laurent Showcases The Legacy Of Charlotte Perriand

Apr 26, 2025

Milan Design Week 2025 Saint Laurent Showcases The Legacy Of Charlotte Perriand

Apr 26, 2025 -

Exposition De Photos De Pierre Terrasson A La Galerie Le Labo Du 8

Apr 26, 2025

Exposition De Photos De Pierre Terrasson A La Galerie Le Labo Du 8

Apr 26, 2025 -

Saint Laurent And Charlotte Perriand A Milan Design Week 2025 Collaboration

Apr 26, 2025

Saint Laurent And Charlotte Perriand A Milan Design Week 2025 Collaboration

Apr 26, 2025 -

Dong Duong Hotel Joins Fusion Hotel Collection In Hue

Apr 26, 2025

Dong Duong Hotel Joins Fusion Hotel Collection In Hue

Apr 26, 2025