China's Steel Production Cuts: Impact On Iron Ore Prices And Global Markets

Table of Contents

Reasons Behind China's Steel Production Cuts

China's steel production cuts are a multifaceted issue stemming from a confluence of factors impacting the Chinese steel industry and the broader economy. Key drivers include:

-

Stricter Environmental Regulations: The Chinese government has implemented increasingly stringent environmental regulations aimed at curbing carbon emissions and improving air quality. These regulations target the steel industry, a major contributor to air pollution, requiring significant investments in cleaner technologies and leading to production limitations for less efficient mills. This aligns with China's commitment to achieving carbon neutrality.

-

Government Initiatives to Curb Overcapacity: For years, China’s steel industry suffered from significant overcapacity. To foster a more sustainable and efficient industry, the government has initiated programs to reduce excess capacity. This involves consolidating smaller, less efficient steel mills and encouraging the modernization of existing facilities.

-

Slowdown in China's Real Estate Sector: The slowdown in China's once-booming real estate market has significantly decreased demand for steel, a crucial component in construction. This reduced demand has contributed to the decision to curtail steel production.

-

Increased Focus on High-Quality Steel Production: The Chinese government is increasingly focused on producing higher-quality steel to meet the demands of advanced manufacturing and infrastructure projects. This shift involves closing down older, less efficient facilities that cannot meet these higher quality standards.

-

Government Efforts to Consolidate the Steel Industry: The government is actively promoting mergers and acquisitions within the steel industry to create larger, more efficient, and competitive entities. This consolidation process inevitably leads to some production cuts in the short term.

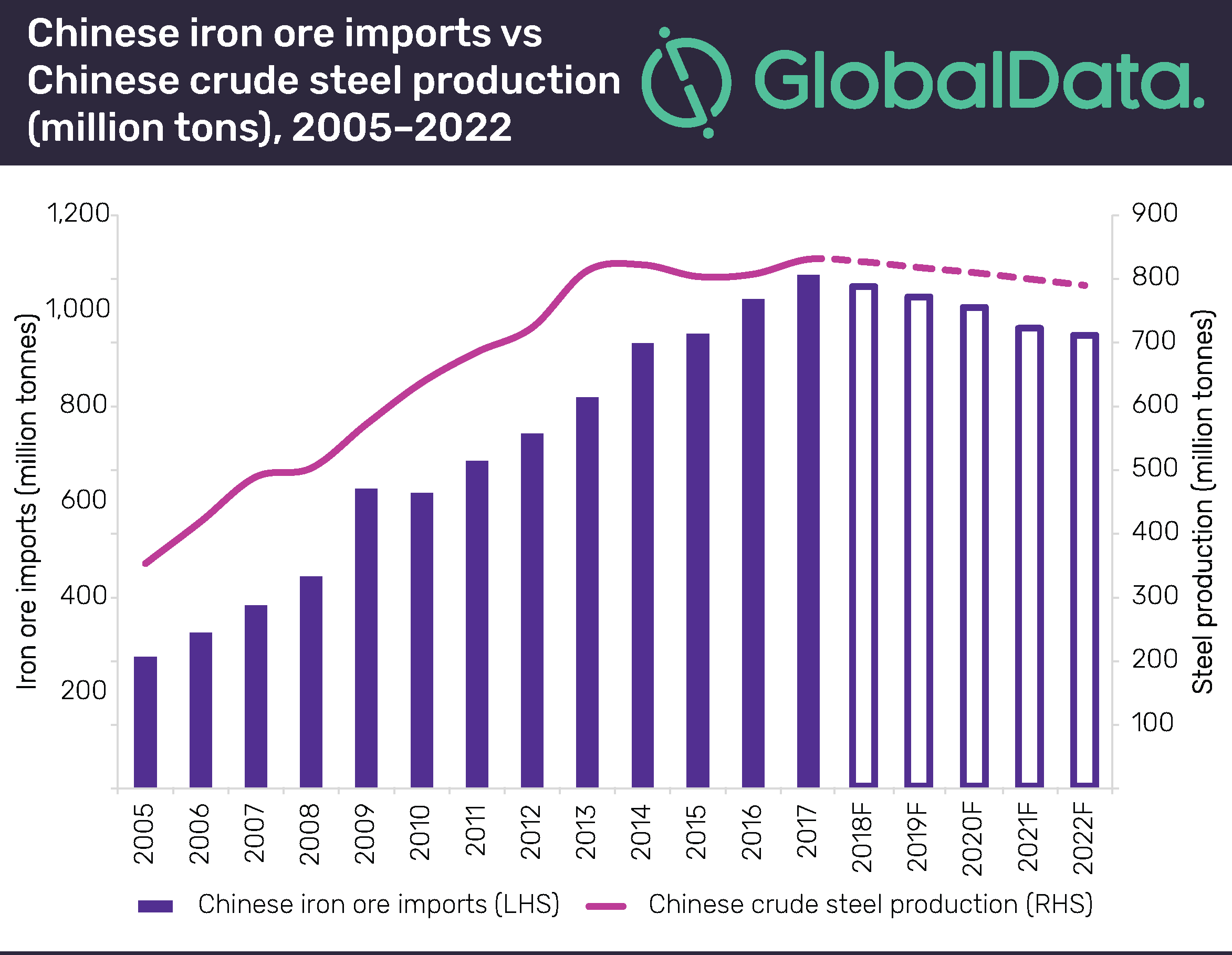

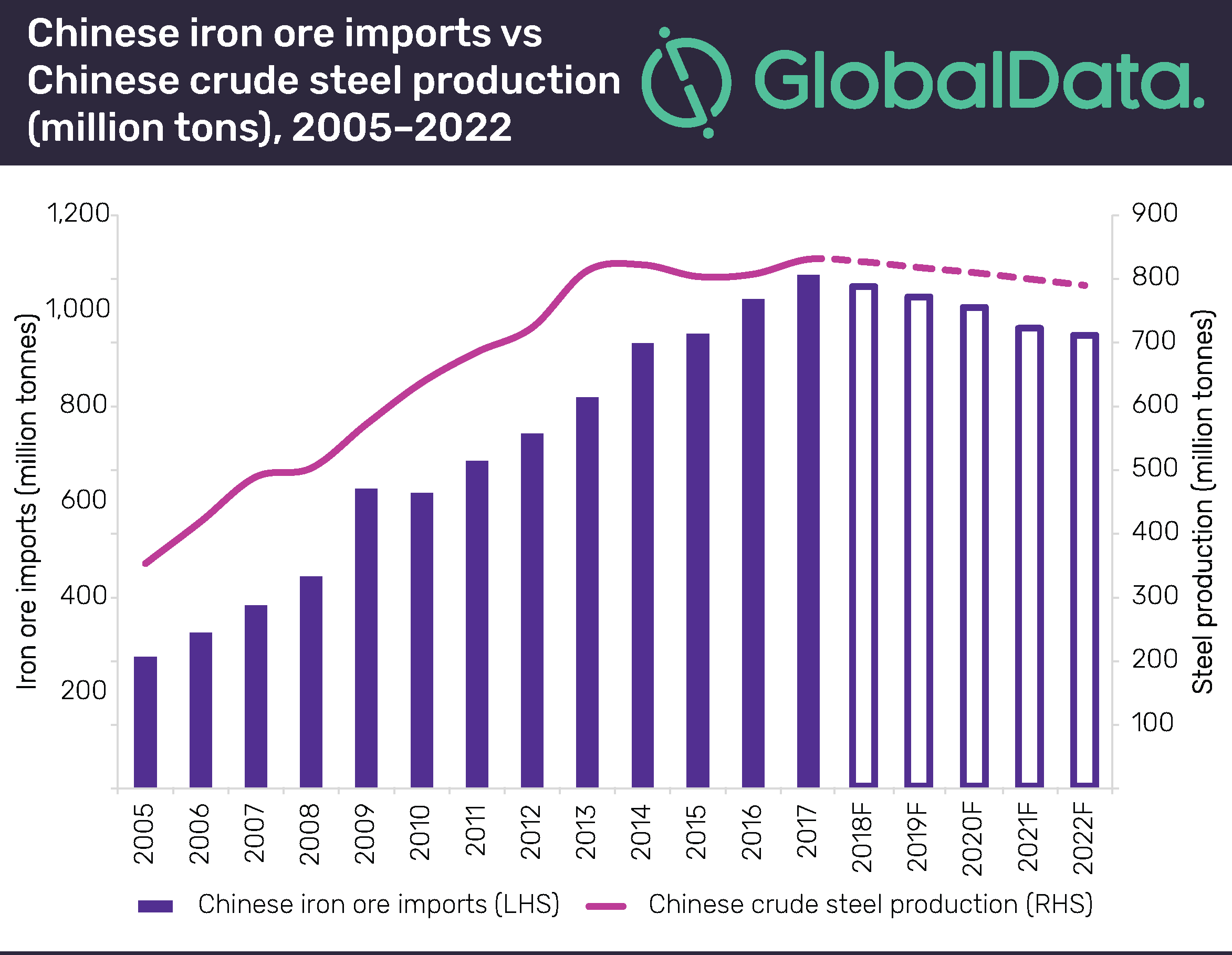

Impact on Iron Ore Prices

The reduction in China's steel production has had a direct and immediate impact on iron ore prices, a key raw material in steelmaking. The effects are multifaceted:

-

Reduced Demand for Iron Ore: The decreased steel production directly translates to lower demand for iron ore from Chinese steel mills. This reduced demand is the primary driver behind the observed price drops.

-

Price Fluctuations in Major Iron Ore Markets: The impact is clearly visible in major iron ore markets like Singapore and Rotterdam, where prices have experienced significant volatility following the announcement of production cuts. This volatility reflects the uncertainty surrounding future demand.

-

Impact on Major Iron Ore Producers: Major iron ore producers, such as Australia and Brazil, are directly affected by the decreased demand from China. This impacts their revenue streams and necessitates adjustments to their production strategies.

-

Potential for Price Volatility and Future Price Predictions: The future trajectory of iron ore prices remains uncertain, dependent on several interacting factors including the pace of China's economic recovery, global steel demand, and the effectiveness of government policies.

-

Hedging Strategies for Iron Ore Traders and Consumers: The increased volatility necessitates the use of hedging strategies by iron ore traders and consumers to mitigate risk and stabilize their operations.

Short-Term vs. Long-Term Effects on Iron Ore Prices

The impact of China's steel production cuts on iron ore prices can be analyzed through both short-term and long-term lenses:

-

Short-term impact: The immediate consequence has been a noticeable drop in iron ore prices, alongside significant market uncertainty. This uncertainty impacts investment decisions and trading strategies.

-

Long-term impact: The long-term impact is less certain. While a sustained reduction in Chinese steel production could lead to price stabilization at a lower level, the global demand for steel, particularly from developing economies, could offset this effect. Factors like technological advancements in steel production and the global shift towards green steel will also play a significant role in shaping long-term price trends.

Global Market Implications

The consequences of China's steel production cuts extend far beyond the iron ore market, influencing the global steel industry and the wider economy:

-

Impact on Global Steel Prices: Reduced Chinese supply has a ripple effect on global steel prices, influencing the competitiveness of steel producers worldwide.

-

Effects on Other Steel-Producing Countries: Other major steel-producing countries, such as India and Japan, may experience increased market share opportunities due to reduced Chinese supply. However, the overall impact depends on their capacity to meet increased demand.

-

Potential Supply Chain Disruptions: Fluctuations in steel prices can cause disruptions throughout various industries reliant on steel, from construction and automotive manufacturing to energy and infrastructure development.

-

Global Economic Implications: Fluctuating steel and iron ore prices have broader implications for global economic growth, particularly impacting countries heavily involved in the production and trade of these commodities.

Conclusion

This article has examined the significant impact of China's steel production cuts on iron ore prices and the global markets. The reduction in steel production, driven by environmental concerns, economic slowdown, and government policies, has created substantial ripple effects throughout the global commodity landscape. The short-term and long-term implications for iron ore prices and the global steel industry require careful monitoring and strategic adaptation.

Call to Action: Stay informed on the latest developments in China's steel production and its effects on iron ore prices by regularly reviewing industry analysis and market forecasts. Understanding the dynamics of China's steel production is crucial for navigating the complexities of the global iron ore market and making informed decisions within this dynamic sector. Learn more about the evolving landscape of China's steel production and its impact on global markets by conducting thorough market research and consulting with industry experts.

Featured Posts

-

Vu Tat Tre O Tien Giang Phai Xu Ly Nghiem Va Ngan Chan Tuong Tu

May 09, 2025

Vu Tat Tre O Tien Giang Phai Xu Ly Nghiem Va Ngan Chan Tuong Tu

May 09, 2025 -

Oilers Vs Sharks Nhl Game Prediction Best Bets And Odds

May 09, 2025

Oilers Vs Sharks Nhl Game Prediction Best Bets And Odds

May 09, 2025 -

Montoyas Revelation Doohans F1 Career Path Confirmed

May 09, 2025

Montoyas Revelation Doohans F1 Career Path Confirmed

May 09, 2025 -

Solve The Nyt Spelling Bee April 4 2025 Hints And Strategies

May 09, 2025

Solve The Nyt Spelling Bee April 4 2025 Hints And Strategies

May 09, 2025 -

The Implications Of A Recent Ruling On Banned Chemicals Sold On E Bay

May 09, 2025

The Implications Of A Recent Ruling On Banned Chemicals Sold On E Bay

May 09, 2025