Chinese Stock Market Rebound: Assessing The Impact Of US Negotiations And Economic Indicators

Table of Contents

The Influence of US-China Trade Negotiations

The ongoing trade relationship between the US and China significantly impacts the Chinese stock market rebound. Positive developments foster investor confidence, while setbacks introduce volatility.

Easing Trade Tensions

Positive developments in US-China trade talks can significantly boost investor confidence, leading to increased investment in Chinese stocks. This increased confidence translates to a more positive outlook for the Chinese stock market.

- Reduced tariffs or tariff removal announcements: The reduction or elimination of tariffs on Chinese goods directly benefits Chinese companies and improves their profitability, leading to higher stock prices.

- Agreements on intellectual property rights: Resolving disputes related to intellectual property rights reduces uncertainty and improves the business environment for Chinese companies, attracting further investment.

- Increased market access for US companies in China: Greater market access for US firms can lead to increased trade and economic activity, positively influencing the overall Chinese economy and stock market.

- Improved communication and diplomatic relations: Improved relations between the US and China reduce geopolitical risks and foster a more stable investment environment, encouraging investors to participate in the Chinese stock market.

Lingering Uncertainty

Conversely, setbacks or stalled negotiations can trigger market volatility and negatively impact the Chinese stock market rebound. Uncertainty about future trade policies keeps investors on edge.

- Escalation of trade disputes: Renewed trade tensions or the imposition of new tariffs can lead to a sharp decline in investor confidence and a sell-off in the Chinese stock market.

- Imposition of new tariffs or sanctions: New trade barriers increase costs for Chinese companies, reducing their profitability and negatively affecting their stock prices.

- Uncertainty regarding future trade policies: Unclear trade policies create uncertainty, making investors hesitant to commit significant capital to the Chinese market. This hesitancy dampens the Chinese stock market rebound.

- Negative media coverage impacting investor sentiment: Negative news coverage surrounding US-China trade relations can quickly impact investor sentiment, leading to market volatility and potentially hindering the Chinese stock market rebound.

Key Economic Indicators Driving the Rebound

Several key economic indicators provide insights into the health of the Chinese economy and its impact on the stock market rebound. Monitoring these indicators is vital for investors.

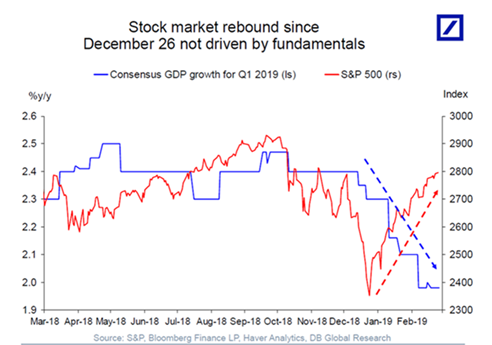

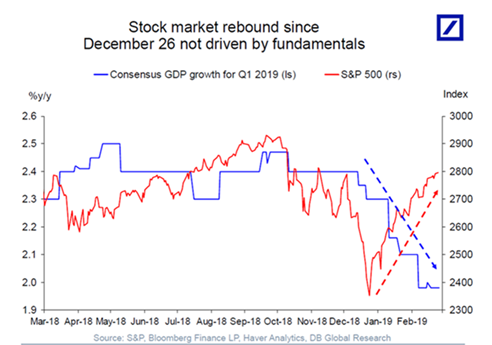

GDP Growth

Stronger-than-expected GDP growth figures often signal a positive outlook for the Chinese economy and its stock market. This growth fuels investor optimism and drives investment.

- Analysis of recent GDP growth rates and projections: Analyzing recent growth rates and future projections provides a clear picture of the overall economic health and prospects.

- Impact of government stimulus measures on GDP: Government initiatives aimed at stimulating economic growth directly impact GDP and investor sentiment.

- Contribution of various sectors to economic growth: Understanding which sectors drive growth helps investors identify promising investment opportunities within the Chinese stock market.

Inflation Rates

Stable inflation rates are crucial for investor confidence. High or unpredictable inflation can negatively affect market performance and hinder a sustained Chinese stock market rebound.

- Analysis of recent inflation data and its impact: Analyzing inflation data helps assess its impact on consumer spending, business investment, and overall economic stability.

- Comparison with historical inflation trends: Comparing current inflation rates with historical trends helps gauge the severity of inflation and its potential impact on the market.

- Government measures to control inflation: Government policies aimed at controlling inflation influence investor confidence and the overall health of the market.

Consumer Spending & Industrial Production

Robust consumer spending and industrial production indicate a healthy economy, supporting a continued Chinese stock market rebound. These factors are essential for sustained economic growth.

- Analysis of consumer confidence indices: Consumer confidence indices reflect the overall sentiment of consumers, providing insights into potential future spending patterns.

- Data on retail sales and industrial output: Data on retail sales and industrial production offers direct insights into economic activity and growth.

- Impact of government policies on consumer spending and production: Government policies targeting consumer spending and industrial production can significantly influence economic growth and market performance.

Sector-Specific Performances within the Rebound

The Chinese stock market rebound is not uniform across all sectors. Some sectors experience greater growth than others, influenced by various factors.

Technology Stocks

The performance of technology companies significantly influences the overall market rebound. This sector is particularly sensitive to government regulations and global competition.

- Analysis of specific tech stock performance: Analyzing individual tech stock performance helps investors identify opportunities and risks within the sector.

- Impact of government regulations on tech companies: Government regulations, particularly those focused on data privacy and antitrust concerns, can have a major impact on the tech sector's performance.

- Global competition and its effects: Global competition from US and other international tech companies affects the profitability and market share of Chinese tech firms.

Real Estate & Infrastructure

These sectors often reflect broader economic trends and contribute substantially to the Chinese stock market rebound. Government policies play a significant role in shaping their performance.

- Analysis of real estate market trends and investment: Analyzing real estate market trends and investment patterns helps investors assess the sector's health and potential for future growth.

- Government policies impacting infrastructure development: Government policies related to infrastructure projects significantly influence investment and growth in the construction and related sectors.

- Impact of construction activity on the economy: Construction activity is a significant contributor to overall economic growth, and its fluctuations directly impact the stock market.

Conclusion

The Chinese stock market rebound is a complex phenomenon influenced by a delicate interplay between US-China negotiations and key economic indicators. While positive trade developments and strong economic data contribute to a bullish market, lingering uncertainties and potential economic headwinds necessitate a cautious approach. Investors should closely monitor developments in both US-China relations and key economic indicators to make informed decisions. Understanding these factors is key to successfully navigating the complexities of the Chinese stock market rebound and capitalizing on potential opportunities. Stay informed about the latest developments affecting the Chinese stock market rebound to maximize your investment strategy.

Featured Posts

-

Descubra 8 Filmes Incrivelmente Bons Com Isabela Merced The Last Of Us

May 07, 2025

Descubra 8 Filmes Incrivelmente Bons Com Isabela Merced The Last Of Us

May 07, 2025 -

Lotto Results For Wednesday 16th April 2025

May 07, 2025

Lotto Results For Wednesday 16th April 2025

May 07, 2025 -

Pei Legislature Reviews 500 000 Bill For Nhl 4 Nations Face Off

May 07, 2025

Pei Legislature Reviews 500 000 Bill For Nhl 4 Nations Face Off

May 07, 2025 -

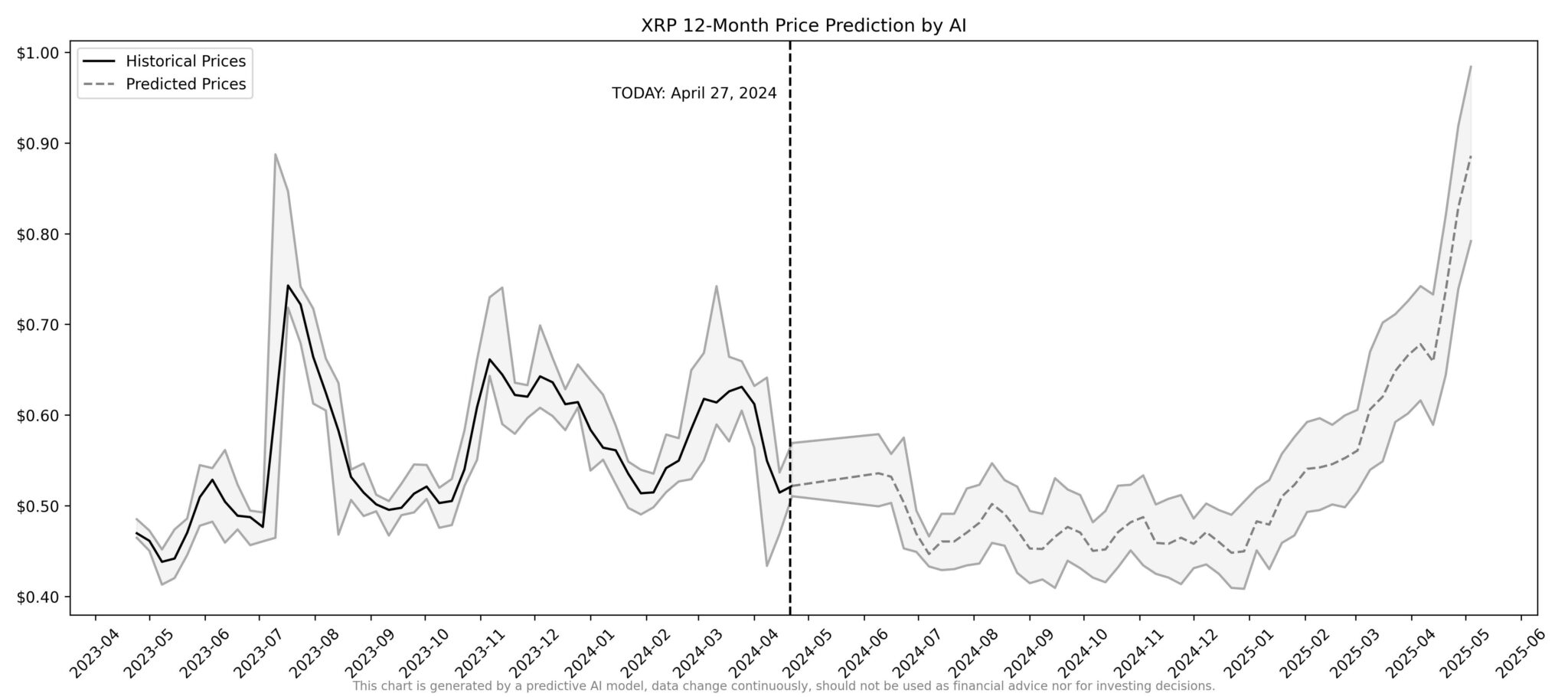

Is Xrps Recent 400 Rally A Sign Of Future Growth

May 07, 2025

Is Xrps Recent 400 Rally A Sign Of Future Growth

May 07, 2025 -

Analyzing The Carney Trump Meeting Key Issues And Resolutions

May 07, 2025

Analyzing The Carney Trump Meeting Key Issues And Resolutions

May 07, 2025

Latest Posts

-

Cleveland Cavaliers Rout Knicks Mitchell And Mobleys Stellar Performance

May 07, 2025

Cleveland Cavaliers Rout Knicks Mitchell And Mobleys Stellar Performance

May 07, 2025 -

Cavaliers Dominant Victory Mitchell And Mobley Power Past Knicks

May 07, 2025

Cavaliers Dominant Victory Mitchell And Mobley Power Past Knicks

May 07, 2025 -

Orlando Magic Upset Cavaliers Ending 16 Game Winning Streak

May 07, 2025

Orlando Magic Upset Cavaliers Ending 16 Game Winning Streak

May 07, 2025 -

Cavaliers Star Reveals Crucial Insights From Celtics Battles

May 07, 2025

Cavaliers Star Reveals Crucial Insights From Celtics Battles

May 07, 2025 -

Boston Celtics Vs Cleveland Cavs 4 Takeaways From A Stunning Upset

May 07, 2025

Boston Celtics Vs Cleveland Cavs 4 Takeaways From A Stunning Upset

May 07, 2025