Client Outflows Drive Schroders Asset Reduction In Q1

Table of Contents

Significant Decline in Assets Under Management (AUM)

Schroders reported a substantial decrease in AUM during the first quarter of the year. The precise figures, while needing official confirmation from Schroders' financial reports, point to a percentage decline in the double digits, representing a significant loss compared to the previous quarter and potentially lagging behind industry averages. This drop represents a considerable blow to the firm's financial performance.

- Specific Figures: While awaiting official confirmation, reports suggest a decline of [Insert Percentage]% in AUM, translating to a loss of approximately [Insert Monetary Value] in assets. (Note: Replace bracketed information with actual figures from Schroders' Q1 report.)

- Comparison to Previous Quarters: This represents a sharper decline than witnessed in previous quarters, indicating a potentially worsening trend. (Further comparative data would strengthen this point, pending official reports.)

- Impact on Profitability: The reduced AUM directly impacts Schroders' profitability, affecting management fees and overall revenue generation. The extent of this impact will be clarified in the detailed Q1 financial statement.

Identifying the Root Causes of Client Outflows

Several factors likely contributed to the significant client outflows experienced by Schroders. A multifaceted analysis is necessary to fully understand the situation.

- Market Volatility and Investor Sentiment: The prevailing market uncertainty and volatility, potentially stemming from [mention specific geopolitical or economic events], likely influenced investor decisions, leading to risk aversion and redemptions.

- Competition from Other Asset Management Firms: Intense competition within the asset management industry means Schroders faces constant pressure from rivals offering similar products and services. The loss of clients could be attributed to competitive pressures and the appeal of alternative investment strategies.

- Performance of Specific Funds: Underperformance of particular funds managed by Schroders might have prompted investors to seek better-performing alternatives. A detailed analysis of individual fund performance is crucial in understanding this aspect.

- Changes in Investor Preferences or Strategies: Evolving investor preferences towards specific asset classes (e.g., a shift away from equities towards fixed income) could also contribute to client outflows.

- Economic Factors: Broader macroeconomic factors, such as rising interest rates or inflation, could impact investor risk appetite and lead to withdrawals from certain investment vehicles.

Schroders' Response to the Asset Reduction

Schroders is likely implementing various strategies to address the decline in AUM and mitigate future client outflows. These measures could include:

- Cost-Cutting Measures: To improve profitability in light of reduced AUM, Schroders may implement cost-cutting measures, potentially affecting operational expenses or staffing.

- New Product Launches or Strategic Initiatives: Launching new investment products or pursuing strategic acquisitions might help attract new clients and diversify the firm's offerings.

- Changes to Investment Strategies: Schroders may adjust its investment strategies to better align with current market conditions and investor preferences.

- Marketing and Outreach Efforts: Increased marketing and client outreach efforts are crucial for retaining existing clients and attracting new ones, showcasing Schroders' expertise and value proposition.

Impact on Schroders' Future Outlook

The Q1 asset reduction presents challenges but doesn't necessarily dictate Schroders' long-term prospects. The future outlook depends on several factors.

- Projections for Future AUM Growth: Schroders' ability to attract new clients and reverse the outflow trend will be critical in determining future AUM growth.

- Potential Changes to the Company's Financial Strategy: The company might adjust its financial strategy to accommodate the reduced AUM, focusing on improved efficiency and profitability.

- Analysis of the Competitive Landscape: Schroders’ ability to compete effectively in a dynamic market will be a significant factor influencing its future performance.

Conclusion: Addressing Client Outflows and the Future of Schroders

The significant drop in Schroders' AUM during Q1, driven by client outflows, underscores the challenges faced by asset managers in volatile markets. The underlying causes are multifaceted, ranging from market conditions and competition to fund performance and evolving investor preferences. Schroders' response, encompassing cost management, product innovation, and strategic adjustments, will be crucial in determining its future trajectory. Understanding these client outflows and Schroders’ approach is key for investors and industry professionals. Stay updated on how Schroders tackles these client outflows and their impact on future AUM. Learn more about the strategies Schroders is employing to reverse the trend of client outflows and ensure long-term growth.

Featured Posts

-

Graeme Souness On Lewis Skelly The Attitude That Impresses

May 03, 2025

Graeme Souness On Lewis Skelly The Attitude That Impresses

May 03, 2025 -

La Matinale Avec Mathieu Spinosi Un Violon A L Ecran

May 03, 2025

La Matinale Avec Mathieu Spinosi Un Violon A L Ecran

May 03, 2025 -

Cowboy Bebop Fortnite Skins How Much Does The Faye Valentine And Spike Spiegel Bundle Cost

May 03, 2025

Cowboy Bebop Fortnite Skins How Much Does The Faye Valentine And Spike Spiegel Bundle Cost

May 03, 2025 -

L Intelligence Artificielle Un Enjeu De Patriotisme Economique Pour Macron

May 03, 2025

L Intelligence Artificielle Un Enjeu De Patriotisme Economique Pour Macron

May 03, 2025 -

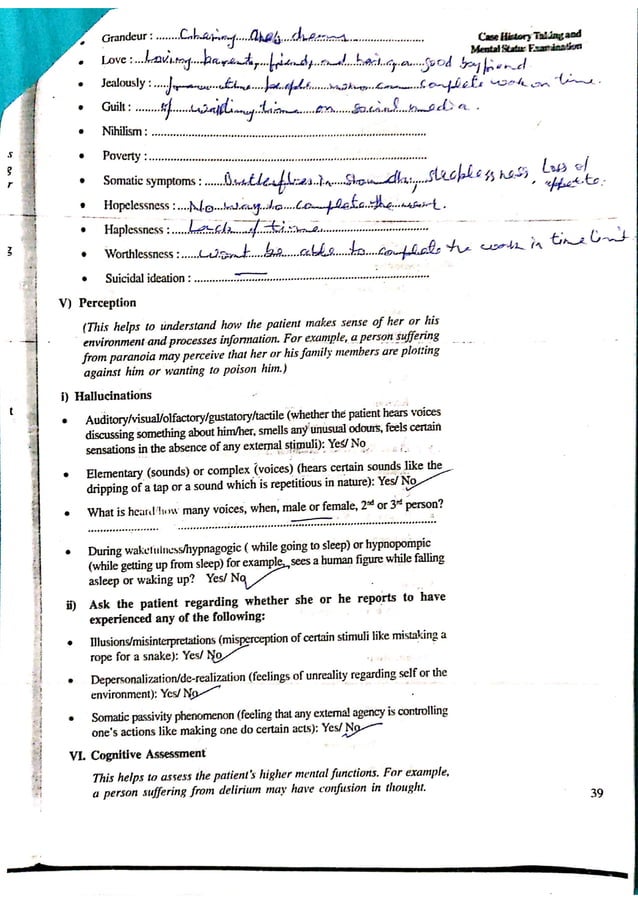

Top Mental Health Courses In India Ignou Tiss Nimhans And Other Government Options

May 03, 2025

Top Mental Health Courses In India Ignou Tiss Nimhans And Other Government Options

May 03, 2025

Latest Posts

-

Obsessive F1 Ceo Stefano Domenicalis Impact On Formula Ones Global Growth

May 04, 2025

Obsessive F1 Ceo Stefano Domenicalis Impact On Formula Ones Global Growth

May 04, 2025 -

Nicolai Tangens Response To Trump Era Tariffs

May 04, 2025

Nicolai Tangens Response To Trump Era Tariffs

May 04, 2025 -

Norways Nicolai Tangen And The Impact Of Trumps Tariffs

May 04, 2025

Norways Nicolai Tangen And The Impact Of Trumps Tariffs

May 04, 2025 -

Grand Theft Auto Vi Revisiting The Official Trailer

May 04, 2025

Grand Theft Auto Vi Revisiting The Official Trailer

May 04, 2025 -

Hate Crime Attack 53 Year Prison Sentence For Assault On Palestinian American Family

May 04, 2025

Hate Crime Attack 53 Year Prison Sentence For Assault On Palestinian American Family

May 04, 2025