Climate Change: A Growing Factor In Your Home Credit Score

Table of Contents

Rising Insurance Premiums Due to Climate Change Risks

The escalating frequency and intensity of extreme weather events – a direct consequence of climate change – are driving up home insurance premiums. This directly impacts your credit score.

Increased Frequency of Extreme Weather Events:

- Hurricanes: The increased intensity and frequency of hurricanes, as seen in recent years along the Gulf Coast and Atlantic seaboard, have led to massive insurance payouts, forcing insurers to raise premiums significantly.

- Wildfires: The devastating wildfires in California and Australia, fueled by prolonged droughts and heatwaves, have resulted in billions of dollars in damage, leading to soaring insurance costs in at-risk areas.

- Flooding: Increased rainfall and rising sea levels are causing more frequent and severe flooding, particularly impacting coastal communities and areas with poor drainage. The resulting damage has drastically increased flood insurance premiums, sometimes making it unaffordable.

Data from the Insurance Information Institute shows a steady upward trend in homeowners' insurance premiums in high-risk areas, reflecting the increasing financial burden of climate-related disasters.

Impact on Credit Scores:

Increased insurance premiums directly impact your debt-to-income ratio (DTI), a crucial factor in determining your credit score. A higher DTI indicates a greater financial burden, making lenders less likely to approve loans or forcing them to offer less favorable terms (higher interest rates).

- Higher Premiums = Higher DTI: The added expense of higher insurance premiums reduces your disposable income, thus increasing your DTI.

- Loan Applications: Lenders view higher insurance costs as a significant risk factor, potentially leading to loan denials or higher interest rates on approved loans.

Property Devaluation from Climate Change Impacts

Climate change significantly impacts property values, particularly in high-risk areas. This devaluation can have a profound impact on your ability to sell, refinance, or even maintain your home, indirectly influencing your credit score.

Decreased Property Value in High-Risk Areas:

- Flood Zones: Properties located in flood zones experience significant devaluation due to the increased risk of damage and the higher cost of flood insurance.

- Wildfire Risk: Homes situated in areas prone to wildfires see a decrease in value, reflecting the increased risk of destruction.

- Coastal Erosion: Coastal properties are losing value as rising sea levels and increased erosion threaten their structural integrity and long-term viability.

Real estate market data consistently demonstrates a decline in property values in areas frequently affected by climate-related disasters. This is particularly true for properties in areas repeatedly impacted by extreme weather events.

Difficulty in Selling or Refinancing:

Diminished property value makes it challenging to sell your home for a fair price or refinance your mortgage.

- Loan Approval: Lenders are less likely to approve loans or offer favorable terms for properties with decreased value, as the collateral is perceived as less secure.

- Mortgage Default: Property damage from climate-related disasters can lead to difficulty in making mortgage payments, potentially resulting in default and a severe negative impact on your credit score.

Accessing Loans and Mortgages in Climate-Vulnerable Areas

Lenders are increasingly incorporating climate change risks into their risk assessments, making it more challenging to secure loans in climate-vulnerable areas.

Stricter Lending Criteria:

- Climate Risk Assessments: Many lenders now conduct detailed climate risk assessments before approving loans, considering factors such as flood risk, wildfire risk, and proximity to rising sea levels.

- Higher Interest Rates: Borrowers in high-risk areas often face higher interest rates to compensate for the increased perceived risk.

Increased Difficulty Securing Loans:

The stricter lending criteria and higher interest rates make it increasingly difficult for homeowners in climate-vulnerable areas to secure loans or refinance their mortgages.

- Homeownership Challenges: This disproportionately affects individuals and families with lower incomes, making homeownership in these areas increasingly challenging.

- Government Initiatives: While some government initiatives aim to support homeowners in vulnerable areas, more comprehensive strategies are needed to address this growing problem.

Conclusion:

Climate change is no longer a distant threat; it's directly impacting homeowners' credit scores through rising insurance premiums, property devaluation, and stricter lending practices. Understanding this connection is crucial. Protecting your credit score from climate risks requires proactive measures. Consider purchasing appropriate insurance (flood, wildfire, etc.), investing in home upgrades to increase resilience to extreme weather, and staying informed about climate-related risks in your area. By acknowledging the link between climate change and your home credit score, you can take steps towards securing your financial future. Taking proactive steps to protect your home from climate change related risks is critical for protecting your credit score and your financial well-being. Don't let climate change negatively impact your "climate change's impact on credit." Learn more about protecting your credit score from climate risks and ensuring climate-resilient homeownership.

Featured Posts

-

Abn Amro Huizenprijzen Omhoog Ondanks Economische Tegenwind

May 21, 2025

Abn Amro Huizenprijzen Omhoog Ondanks Economische Tegenwind

May 21, 2025 -

Slot Admits Liverpool Fortune Enrique Weighs In On Alissons Performance

May 21, 2025

Slot Admits Liverpool Fortune Enrique Weighs In On Alissons Performance

May 21, 2025 -

D Wave Quantum Qbts Stock Price Increase Understanding Todays Gains

May 21, 2025

D Wave Quantum Qbts Stock Price Increase Understanding Todays Gains

May 21, 2025 -

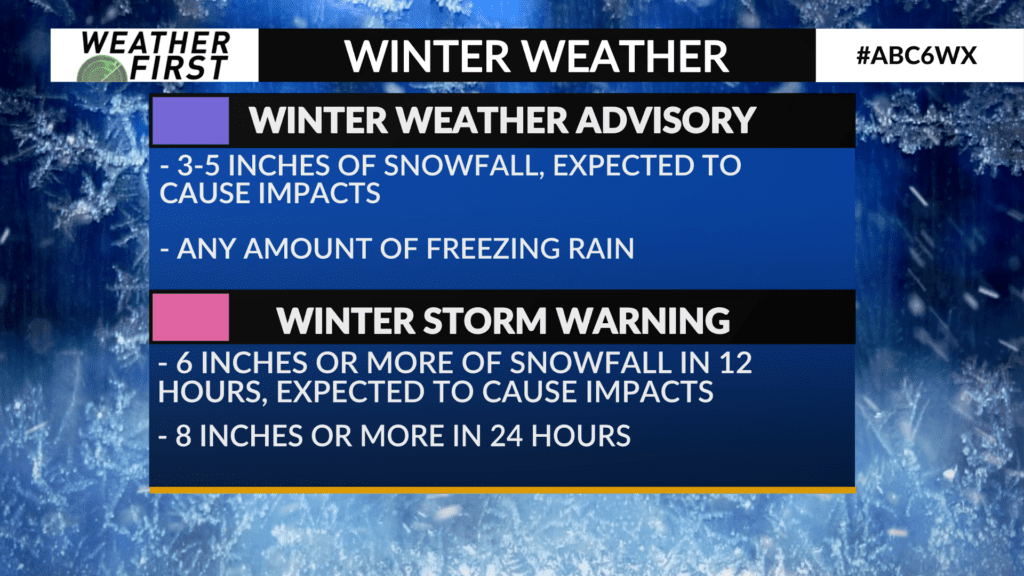

How Winter Weather Advisories Impact School Decisions

May 21, 2025

How Winter Weather Advisories Impact School Decisions

May 21, 2025 -

Beiers Double Propels Borussia Dortmund Past Mainz

May 21, 2025

Beiers Double Propels Borussia Dortmund Past Mainz

May 21, 2025

Latest Posts

-

Huuhkajien Yllaetykset Avauskokoonpanoon Kolme Muutosta

May 21, 2025

Huuhkajien Yllaetykset Avauskokoonpanoon Kolme Muutosta

May 21, 2025 -

Huuhkajien Avauskokoonpano Naein Se Muuttui Kaellman Pois

May 21, 2025

Huuhkajien Avauskokoonpano Naein Se Muuttui Kaellman Pois

May 21, 2025 -

Kolme Muutosta Huuhkajien Avauskokoonpanoon Kaellman Sivussa

May 21, 2025

Kolme Muutosta Huuhkajien Avauskokoonpanoon Kaellman Sivussa

May 21, 2025 -

Huuhkajat Avauskokoonpanoon Kolme Muutosta Kaellman Penkille

May 21, 2025

Huuhkajat Avauskokoonpanoon Kolme Muutosta Kaellman Penkille

May 21, 2025 -

Huuhkajat Kaksikko Kaellman Ja Hoskonen Jaettaevaet Puolan Seuran

May 21, 2025

Huuhkajat Kaksikko Kaellman Ja Hoskonen Jaettaevaet Puolan Seuran

May 21, 2025