CMOC Acquires Lumina Gold For $581 Million

Table of Contents

Details of the CMOC-Lumina Gold Acquisition

Acquisition Price and Structure

The $581 million acquisition price translates to a price per share that needs to be determined based on the final agreement. The payment structure likely involves a combination of cash and potentially stock, though the exact breakdown remains to be officially disclosed. Contingent payments, tied to future performance metrics, might also be part of the deal.

- Total Acquisition Cost: $581 million (USD)

- Price per Share: To be determined upon final agreement disclosure.

- Payment Method: Expected to include a mix of cash and potentially CMOC stock.

- Contingent Payments: Possibility of additional payments based on future performance.

Strategic Rationale Behind the Acquisition

CMOC's motivation for this acquisition is multifaceted. The deal significantly expands CMOC's gold reserves and production capabilities, adding a substantial asset to their existing portfolio. Lumina Gold's projects also offer geographical diversification, reducing CMOC's reliance on specific regions. Furthermore, the acquisition could provide access to advanced technologies or expertise in gold exploration and extraction.

- Expansion of Gold Reserves: Significant increase in CMOC's gold production capacity.

- Geographical Diversification: Reducing reliance on single geographic locations for gold production.

- Technological Advancement: Potential access to new technologies and expertise in gold mining.

- Strengthened Market Position: Enhanced competitive advantage within the global gold market.

Regulatory Approvals and Timeline

The successful completion of this acquisition hinges on securing necessary regulatory approvals from various jurisdictions where Lumina Gold operates. This process might involve navigating complexities related to foreign investment, environmental regulations, and competition laws. The exact timeline for regulatory approvals and final deal closure will depend on the efficiency of these processes.

- Regulatory Bodies Involved: Agencies in the countries where Lumina Gold operates will need to approve the acquisition.

- Expected Completion Date: The official completion date is yet to be announced and will depend on regulatory approvals.

- Potential Delays: Unforeseen hurdles in the regulatory process could cause delays in closing the deal.

Impact of the Acquisition on CMOC and the Gold Market

Impact on CMOC's Portfolio and Financial Performance

The acquisition is expected to positively influence CMOC's overall portfolio and financial standing. This includes a substantial boost in gold production, potentially leading to increased revenue streams and enhanced profitability. However, the integration process will be crucial in realizing these potential gains.

- Projected Increase in Gold Production: A significant expansion of CMOC’s gold output.

- Potential Cost Savings: Opportunities for operational synergies and cost optimization.

- Impact on CMOC's Stock Price: The market's reaction will depend on various factors, including successful integration and gold price fluctuations.

Impact on Lumina Gold Shareholders

Lumina Gold shareholders stand to benefit from the acquisition, receiving a premium on their shares compared to the pre-acquisition market price. The exact return will depend on the final price per share and any contingent payments. The future prospects for former Lumina Gold investors will be linked to CMOC's performance and the success of integrating Lumina Gold's assets.

- Shareholder Returns: Significant returns expected for Lumina Gold shareholders.

- Potential Gains or Losses: The deal's success will influence the actual financial outcome for shareholders.

- Future Prospects: The long-term outlook will be influenced by CMOC’s overall strategic direction.

Implications for the broader Gold Mining Industry

This major gold mining acquisition highlights ongoing consolidation within the gold mining sector. The deal might encourage further mergers and acquisitions as other companies seek to expand their market share and gain access to valuable gold resources. It is likely to increase competition and potentially influence prices in the gold market.

- Industry Consolidation: This deal exemplifies a growing trend of consolidation within the industry.

- Changes in Market Share: CMOC is poised to increase its market share with this acquisition.

- Future M&A Activity: This deal could prompt other major players to consider similar acquisitions.

Future Outlook and Potential Challenges

Integration Challenges

Successfully integrating Lumina Gold's operations into CMOC's existing infrastructure will present significant challenges. This includes harmonizing different operational styles, streamlining processes, and managing potential employee transitions. Careful planning and execution will be crucial to avoid disruptions and maximize synergies.

- Cultural Differences: Addressing differences in corporate culture and work styles between the two companies.

- Operational Streamlining: Efficiently combining operations and eliminating redundancies.

- Employee Transitions: Managing the integration process for employees of both companies.

Market Conditions and Gold Price Volatility

The success of this acquisition is closely tied to the volatility of gold prices. Fluctuations in the gold market could significantly impact CMOC's profitability and the overall return on investment. Effective risk management strategies will be crucial in navigating these uncertainties.

- Gold Price Predictions: Gold price forecasts will influence the long-term success of the acquisition.

- Risk Assessment: CMOC needs to thoroughly assess risks associated with gold price volatility.

- Hedging Strategies: Utilizing hedging mechanisms to mitigate the impact of price fluctuations.

Long-term Growth Strategies

CMOC's long-term plans for Lumina Gold likely involve significant exploration and expansion activities. The acquisition represents a strategic step towards bolstering CMOC's position in the global gold market. Further development and exploration of Lumina Gold's assets will likely be a key focus.

- Expansion Plans: CMOC is likely to pursue expansion projects at Lumina Gold's sites.

- Exploration Activities: Further exploration to identify additional gold reserves.

- Long-term Financial Projections: The acquisition should feature prominently in CMOC’s long-term financial projections.

Conclusion: Analyzing the CMOC Lumina Gold Acquisition – A Key Milestone

The $581 million CMOC acquisition of Lumina Gold represents a major milestone in the gold mining industry. This strategic move significantly expands CMOC's gold reserves, enhances its geographical diversification, and strengthens its competitive position. While integration challenges and gold price volatility pose risks, the potential long-term benefits for CMOC, Lumina Gold shareholders, and the broader market are substantial. Stay tuned for further updates on this significant CMOC gold acquisition and other key developments in the gold mining sector.

Featured Posts

-

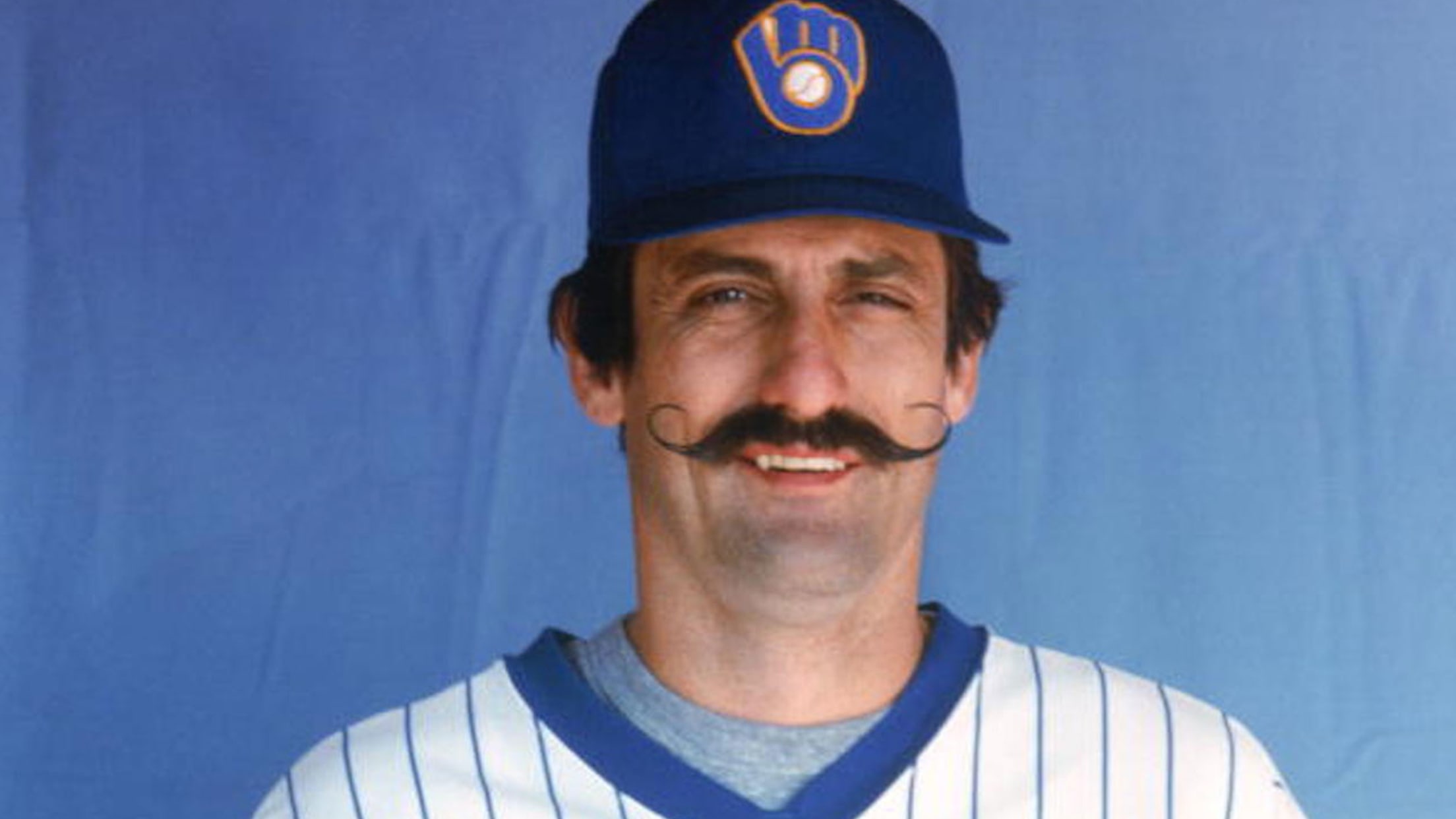

Brewers Break 33 Year Old Record With Nine Stolen Bases

Apr 23, 2025

Brewers Break 33 Year Old Record With Nine Stolen Bases

Apr 23, 2025 -

Sf Giants Defeat Brewers Flores And Lees Stellar Performances

Apr 23, 2025

Sf Giants Defeat Brewers Flores And Lees Stellar Performances

Apr 23, 2025 -

Siap Siap Inilah Daftar Program Tv Spesial Ramadan 2025 Untuk Menemani Buka Dan Sahur

Apr 23, 2025

Siap Siap Inilah Daftar Program Tv Spesial Ramadan 2025 Untuk Menemani Buka Dan Sahur

Apr 23, 2025 -

Aaron Judges Historic Home Run Show Yankees Smash Record With 9 Blast Game

Apr 23, 2025

Aaron Judges Historic Home Run Show Yankees Smash Record With 9 Blast Game

Apr 23, 2025 -

Der Dortmunder Weg Adeyemi Und Sein Stylisher Auftritt

Apr 23, 2025

Der Dortmunder Weg Adeyemi Und Sein Stylisher Auftritt

Apr 23, 2025