Colgate Stock (CL) Takes Hit As Tariffs Slash Profits By $200 Million

Table of Contents

The Impact of Tariffs on Colgate's Profitability

The imposition of tariffs has significantly impacted Colgate's financial performance, resulting in a substantial reduction in profitability. This impact is felt both directly and indirectly, affecting various aspects of the company's operations.

Direct Costs of Tariffs

Increased import and export tariffs have directly raised Colgate's production costs. This is primarily due to:

- Higher raw material prices: Tariffs on imported ingredients like essential oils, packaging materials, and certain chemical components have escalated their cost.

- Increased transportation costs: Tariffs on shipping and logistics have added to the overall expense of getting products to market.

- Impact on global supply chain: Specific regions like Southeast Asia, where Colgate sources various materials, have seen an amplified cost due to existing and newly imposed tariffs, greatly increasing the cost of goods sold.

These increased costs directly contribute to the reported $200 million profit loss, impacting the company's bottom line significantly. The geographical regions most affected include those with significant trade relationships with the United States and other countries imposing tariffs. Precise figures on the breakdown of costs per region are not publicly available, but internal company analyses likely point towards specific areas of substantial tariff-related financial burdens.

Indirect Costs and Supply Chain Disruptions

Beyond the direct costs, tariffs have created indirect challenges for Colgate. The ripple effect on its supply chain has resulted in:

- Delays in shipments: Navigating increased customs procedures and bureaucratic hurdles has slowed down the delivery of raw materials and finished goods.

- Increased supplier costs: Colgate's suppliers are also facing higher costs due to tariffs, which they often pass on to Colgate.

- Potential shortages of raw materials: The complexity of global supply chains makes it challenging to easily find alternative sources for raw materials, potentially leading to shortages.

These indirect costs exacerbate the financial strain on Colgate, further contributing to the overall decline in profit. The company's ability to manage these supply chain disruptions will be crucial to its future recovery.

Consumer Impact and Price Increases

The impact of tariffs extends beyond Colgate's internal operations. The rising costs are likely to lead to:

- Increased prices for Colgate products: To maintain profit margins, Colgate may be forced to increase prices for its products.

- Potential consumer backlash: Higher prices could lead to reduced consumer demand, negatively affecting sales volume.

- Impact on market share: Competitors who are less affected by tariffs might gain a competitive advantage.

Colgate has not yet publicly announced widespread price increases, but the pressure to do so is evident given the significant cost increases. This potential price increase could create a ripple effect, affecting not only Colgate's profit margins but also its brand perception among consumers.

Colgate's Response to the Tariff Situation

Facing these challenges, Colgate is actively implementing strategies to mitigate the negative impact of tariffs.

Strategic Adjustments and Mitigation Efforts

Colgate has already begun exploring several avenues to lessen the tariff burden:

- Sourcing raw materials from different regions: Diversifying its supply chain by sourcing materials from countries with fewer or no tariffs will help reduce reliance on affected regions.

- Cost-cutting measures: The company is likely implementing various cost-cutting measures across different departments to offset increased expenses. These measures could potentially involve streamlining operations and reducing non-essential expenditure.

- Negotiation with Suppliers: The company may be in ongoing negotiations with its suppliers to find ways to share the burden of increased tariff-related costs.

The effectiveness of these strategies remains to be seen, and their full impact on Colgate's profitability will only become clear in the coming quarters.

Future Outlook and Company Guidance

Colgate's official statements regarding future performance in light of the tariff situation remain limited. However, the company's actions suggest that it is actively working towards mitigating the negative effects of these tariffs.

- Revised financial forecasts: It's likely Colgate will issue revised financial forecasts in upcoming reports, reflecting the impact of tariffs. This will provide investors with a clearer picture of the company's short- and long-term prospects.

- Projected impact on earnings: The $200 million loss is only a snapshot of the current impact, and the extent of future losses or recovery remains uncertain. Close monitoring of future earnings reports is crucial.

Investors should look towards official company statements and earnings calls for the most accurate and up-to-date outlook on Colgate's performance and expectations.

Investor Reaction and Market Analysis

The news of Colgate's substantial profit loss due to tariffs has significantly impacted investor sentiment and the stock's performance.

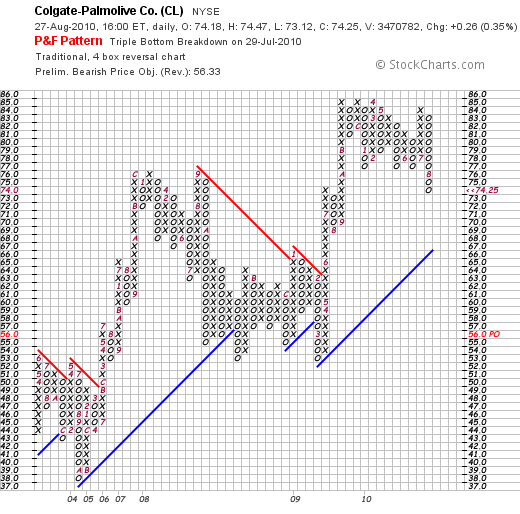

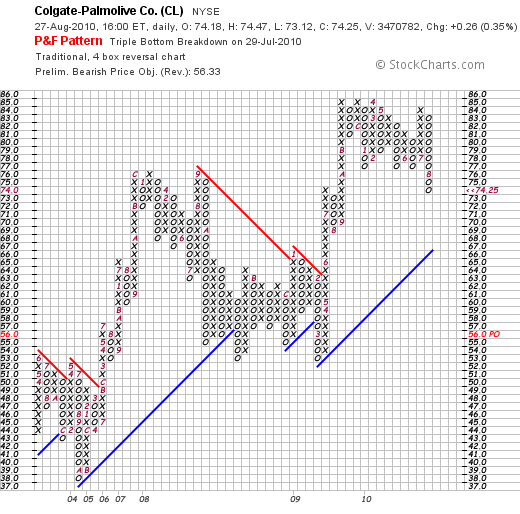

Stock Price Performance and Volatility

The announcement led to immediate volatility in Colgate Stock (CL).

- Stock price fluctuations: The stock price likely experienced a significant drop following the announcement, reflecting investor concerns about the company's future profitability. The extent of the drop depends on overall market conditions and investor reaction.

- Increased trading volume: Trading volume for Colgate stock likely increased significantly as investors reacted to the news. This indicates heightened investor interest and uncertainty.

- Analyst ratings: Financial analysts will adjust their ratings and target prices for Colgate stock based on the updated financial information and the company's response to the challenges.

Charts and graphs illustrating the stock price movement would enhance this analysis for a complete picture.

Expert Opinions and Market Sentiment

Market experts and financial analysts offer diverse perspectives on the long-term implications.

- Recovery potential: Analysts will assess Colgate's ability to mitigate the effects of tariffs and recover its profitability. Factors considered include the company's response, market conditions, and consumer behavior.

- Further stock price fluctuations: The stock price is expected to remain volatile until there is more clarity regarding the company's long-term prospects. Significant uncertainty remains, and volatility is likely to continue until market confidence is restored.

Monitoring financial news and analyst reports will provide insight into changing market sentiment and expert opinions on Colgate stock.

Conclusion

The $200 million profit loss suffered by Colgate-Palmolive (CL) due to tariffs underscores the significant impact of trade policies on even large, established corporations. The company's response, encompassing strategic adjustments and cost-cutting measures, will be critical in its recovery. The impact on the stock price and investor sentiment highlights the importance of monitoring such developments closely.

To stay informed about the evolving situation surrounding Colgate Stock (CL) and make well-informed investment decisions, continuous monitoring of company reports, financial news, and expert analysis is recommended. Understanding the impact of tariffs on Colgate's profitability, and similar situations in the broader market, is key for responsible investment strategies. Thorough research before investing in Colgate Stock (CL) or similar companies susceptible to tariff impacts is crucial.

Featured Posts

-

Governor Newsoms Controversial Decision Fallout Within The Democratic Party

Apr 26, 2025

Governor Newsoms Controversial Decision Fallout Within The Democratic Party

Apr 26, 2025 -

Tom Cruises Biplane Stunt In Mission Impossible 8 A Detailed Look

Apr 26, 2025

Tom Cruises Biplane Stunt In Mission Impossible 8 A Detailed Look

Apr 26, 2025 -

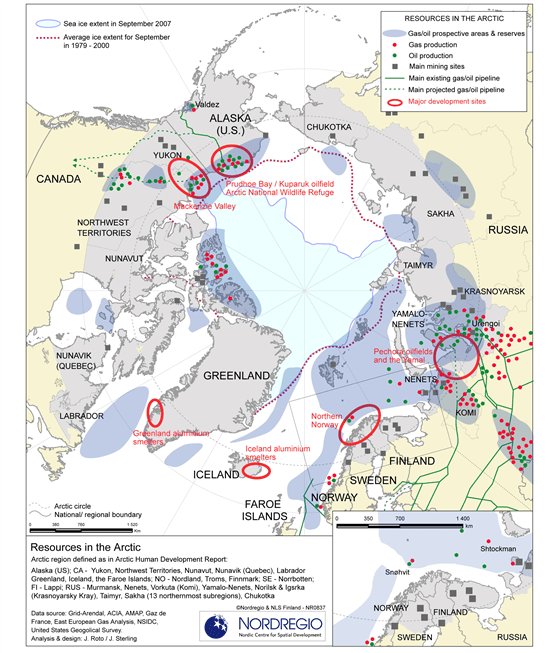

Russias Arctic Gas Exports The Role Of European Shipyards

Apr 26, 2025

Russias Arctic Gas Exports The Role Of European Shipyards

Apr 26, 2025 -

Brian Brobbey Physical Prowess Poses Europa League Threat

Apr 26, 2025

Brian Brobbey Physical Prowess Poses Europa League Threat

Apr 26, 2025 -

Trumps Ukraine Strategy Russias Role And The Challenges Ahead

Apr 26, 2025

Trumps Ukraine Strategy Russias Role And The Challenges Ahead

Apr 26, 2025