Compare No Credit Check Loans: Guaranteed Approval Direct Lender Options

Table of Contents

Understanding No Credit Check Loans and Guaranteed Approval

What are No Credit Check Loans?

No credit check loans are short-term loans designed for borrowers with poor credit or no credit history. Unlike traditional loans, these loans don't require a comprehensive credit check. This makes them accessible to a wider range of applicants who might otherwise be rejected. However, it's crucial to understand that this accessibility often comes with a trade-off: significantly higher interest rates than traditional loans. Responsible borrowing is paramount when considering this type of financing. Remember, borrowing more than you can comfortably repay can lead to serious financial difficulties.

- Definition: Loans provided without a thorough review of a borrower's credit report.

- Difference from Traditional Loans: Traditional loans heavily rely on credit scores to assess risk. No credit check loans focus more on other factors like income verification.

- Higher Interest Rates: Expect substantially higher interest rates compared to loans requiring a credit check.

- Responsible Borrowing: Always borrow only what you can comfortably repay within the loan term.

The "Guaranteed Approval" Claim: Reality Check

While many lenders advertise "guaranteed approval" for no credit check loans, this doesn't mean automatic approval. "Guaranteed approval" typically indicates a higher likelihood of approval compared to traditional loans, not a 100% guarantee. Several factors can still influence your approval, even without a credit check. These include your income, employment stability, and the lender's internal risk assessment. Choosing a lender with a strong reputation for transparency is essential.

- Higher Likelihood, Not Guarantee: Don't mistake "guaranteed approval" for absolute certainty.

- Factors Affecting Approval: Income, employment history, and debt-to-income ratio still matter.

- Lender Reputation: Research the lender's reputation thoroughly before applying. Look for reviews and complaints.

Finding Reputable Direct Lenders for No Credit Check Loans

Benefits of Using Direct Lenders

Applying for a no credit check loan directly with a lender offers several advantages. By avoiding intermediaries, you can often secure better terms and lower fees. The application process is typically simpler and more straightforward, and communication with the lender is direct and efficient.

- Lower Fees: Fewer intermediaries mean potentially lower fees overall.

- Simpler Application: The process is streamlined when dealing directly with the lender.

- Direct Communication: Clearer and faster communication helps resolve any issues promptly.

How to Identify Legitimate Direct Lenders

Identifying trustworthy direct lenders requires diligence. Thoroughly investigate potential lenders before submitting any personal information.

- Online Reviews: Check online reviews and ratings on sites like Trustpilot or the Better Business Bureau.

- Licensing and Registration: Verify if the lender is licensed and registered with the appropriate authorities in your state.

- Transparent Fees: Look for clear and detailed information on all fees and interest rates. Avoid lenders who are vague or misleading.

- Avoid Aggressive Marketing: Be wary of lenders using high-pressure tactics or making unrealistic promises.

Key Factors to Consider When Comparing No Credit Check Loans

Interest Rates and Fees

Interest rates and fees are crucial considerations when comparing no credit check loans. Always compare the Annual Percentage Rate (APR), which represents the total cost of borrowing, including interest and fees. No credit check loans typically have much higher APRs than traditional loans due to the higher risk involved for lenders. Understanding the total cost of borrowing is essential before committing to a loan.

- Compare APRs: The APR reflects the total cost of borrowing, so compare this across different offers.

- High Interest Rates: Expect significantly higher rates than traditional loans.

- Total Cost: Calculate the total repayment amount to understand the full financial burden.

Loan Amounts and Repayment Terms

No credit check loans usually offer smaller loan amounts compared to traditional loans. Repayment terms vary, ranging from short-term loans (a few weeks) to slightly longer terms (several months). Choose a repayment plan that aligns with your budget and financial capabilities; ensure you can comfortably make all payments on time.

- Loan Amounts: Generally smaller loan amounts are available.

- Repayment Options: Short-term or slightly longer-term options are typical.

- Affordable Repayment: Choose a repayment plan you can realistically manage.

Potential Risks and Consequences

While convenient, no credit check loans carry risks. Failing to make timely repayments can lead to debt traps and negatively affect your creditworthiness, even though these loans don't directly impact your credit score initially. Late payments or defaults can still harm your credit standing indirectly and can negatively impact future loan applications. Responsible borrowing is critical to avoid these pitfalls.

- Debt Traps: Missed payments can quickly escalate into a difficult-to-manage debt situation.

- Credit Score Impact (Indirect): While not directly reported, defaulting can lead to negative consequences for future credit applications.

- Responsible Borrowing Habits: Always borrow responsibly and only what you can confidently repay.

The Application Process for No Credit Check Loans

Online Application Procedures

Applying for a no credit check loan is typically done online. The process is generally straightforward, but remember each lender has its specific requirements.

- Step-by-Step Application: Most lenders offer clear online application forms.

- Required Documents: Expect to provide proof of income and identity.

- Information Needed: You'll typically need details about your income, employment, and banking information.

Speed of Approval and Funding

The speed of approval and funding varies depending on the lender. Some lenders offer instant approval and same-day funding, while others may take a few days. The funding method may also vary, with options like direct deposit or check.

- Processing Time: Approval and funding times can differ significantly between lenders.

- Funding Methods: Direct deposit or check are common funding methods.

Conclusion

Choosing the right no credit check loan requires careful consideration. While guaranteed approval direct lender loans offer convenience, it's crucial to understand the associated risks, compare offers thoroughly, and choose a reputable lender. Remember, even with no credit check, responsible borrowing is paramount.

Call to Action: Start comparing your options for no credit check loans today! Find a direct lender that fits your needs and finances, and take control of your financial situation. Use our resources to find the best guaranteed approval direct lender loan for your circumstances.

Featured Posts

-

Info Cuaca Jawa Tengah 23 April 2024 Waspada Hujan Lebat

May 28, 2025

Info Cuaca Jawa Tengah 23 April 2024 Waspada Hujan Lebat

May 28, 2025 -

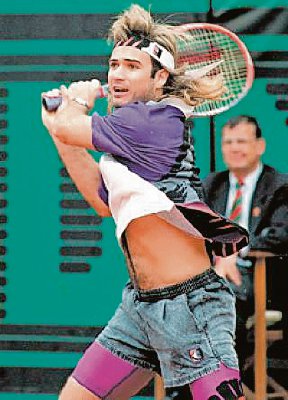

French Open 2025 Top Seed Sinners Dominant Performance Against Rinderknech

May 28, 2025

French Open 2025 Top Seed Sinners Dominant Performance Against Rinderknech

May 28, 2025 -

Analyzing Nintendos Safe Bets And Their Impact On The Gaming Industry

May 28, 2025

Analyzing Nintendos Safe Bets And Their Impact On The Gaming Industry

May 28, 2025 -

Cherki Transfer Speculation A German Perspective

May 28, 2025

Cherki Transfer Speculation A German Perspective

May 28, 2025 -

March 8th Pacers Vs Hawks Latest Injury News And Starting Lineups

May 28, 2025

March 8th Pacers Vs Hawks Latest Injury News And Starting Lineups

May 28, 2025

Latest Posts

-

Confesion De Un Tenista Argentino Marcelo Rios Una Leyenda

May 30, 2025

Confesion De Un Tenista Argentino Marcelo Rios Una Leyenda

May 30, 2025 -

El Chino Rios Un Dios Del Tenis Segun Un Tenista Argentino

May 30, 2025

El Chino Rios Un Dios Del Tenis Segun Un Tenista Argentino

May 30, 2025 -

Odiado Tenista Argentino Su Impactante Confesion Sobre Marcelo Rios

May 30, 2025

Odiado Tenista Argentino Su Impactante Confesion Sobre Marcelo Rios

May 30, 2025 -

Mas Alla Del Tenis El Sorprendente Regreso Al Deporte De Andre Agassi

May 30, 2025

Mas Alla Del Tenis El Sorprendente Regreso Al Deporte De Andre Agassi

May 30, 2025 -

Pickleball Die Erfolgsformel Von Steffi Graf Und Andre Agassi

May 30, 2025

Pickleball Die Erfolgsformel Von Steffi Graf Und Andre Agassi

May 30, 2025