Compare Personal Loan Interest Rates & Apply Now

Table of Contents

Understanding Personal Loan Interest Rates

Understanding personal loan interest is crucial for securing a favorable loan. A key term to understand is APR, or Annual Percentage Rate. The APR represents the annual cost of borrowing, including interest and any associated fees. When comparing personal loan interest, always focus on the APR, as it gives a complete picture of the loan's cost. This differs from simply looking at the stated interest rate.

You'll also encounter two types of interest rates: fixed and variable. A fixed interest rate personal loan means your monthly payments remain consistent throughout the loan term, providing predictable budgeting. A variable interest rate, on the other hand, fluctuates based on market conditions. This can lead to unpredictable monthly payments. Finally, the length of your loan term (e.g., 12 months, 36 months, 60 months) significantly impacts the total interest paid. Shorter terms mean higher monthly payments but lower overall interest charges.

- APR includes all fees associated with the loan.

- Fixed interest rates remain constant throughout the loan term.

- Variable interest rates fluctuate based on market conditions.

- Shorter loan terms mean higher monthly payments but lower overall interest.

Factors Affecting Your Personal Loan Interest Rate

Several factors influence the personal loan interest rate you'll receive. Lenders use a complex algorithm to assess risk and determine the appropriate rate. Your credit score is the most significant factor. A higher credit score, reflecting responsible borrowing behavior, typically translates to lower interest rates. Your debt-to-income ratio (DTI), which compares your monthly debt payments to your gross monthly income, also plays a vital role. A lower DTI indicates a greater ability to manage debt, leading to better rates.

The loan amount itself can also impact interest rates. Larger loan amounts often come with higher interest rates due to the increased risk for the lender. The type of lender matters as well. Banks, credit unions, and online lenders often offer different interest rates, reflecting their individual risk assessments and business models. Finally, thorough income verification is crucial for loan approval and helps lenders determine the appropriate interest rate, ensuring responsible lending.

- A higher credit score usually results in lower interest rates.

- A low debt-to-income ratio improves your chances of securing a favorable rate.

- Larger loan amounts may come with higher interest rates.

- Different lenders (banks, credit unions, online lenders) offer varying rates.

- Income verification is crucial for loan approval and rate determination.

How to Compare Personal Loan Interest Rates Effectively

Effectively comparing personal loan interest rates requires a strategic approach. Start by using online loan comparison tools and personal loan calculators. These resources allow you to input your desired loan amount, term, and credit score to quickly compare offers from various lenders. This helps you see the total cost of each loan and find the lowest APR.

Pre-qualification is a valuable tool. This process allows you to obtain personalized rate quotes from multiple lenders without impacting your credit score significantly. It provides a realistic view of your potential interest rates before formally applying. Remember to shop around! Don't settle for the first offer you receive. Compare multiple offers from various banks, credit unions, and online lenders to ensure you're getting the best possible deal. Carefully review each loan offer, paying close attention to the APR, loan terms, and any associated fees.

- Use online comparison websites to view multiple offers simultaneously.

- Utilize personal loan calculators to estimate monthly payments and total interest.

- Pre-qualify with multiple lenders to get personalized rate quotes without a hard credit inquiry.

- Carefully compare APR, loan terms, and fees before applying.

- Read the fine print of each loan offer.

Applying for a Personal Loan with the Best Interest Rate

Once you've found a loan with competitive personal loan interest rates, the application process is straightforward. Begin by gathering the required documents, typically including proof of income, identification, and potentially bank statements. Most lenders offer online applications, simplifying the process and offering faster turnaround times. Complete the application form accurately and thoroughly.

Before signing any loan agreement, carefully review all the terms and conditions. Ensure you understand the repayment schedule, interest rate, fees, and any other stipulations. Choose a reputable lender with a secure online application process to protect your personal information. After submitting your application, monitor its status and contact the lender if you have any questions or concerns.

- Gather required documents (income proof, ID, etc.).

- Complete the online application form accurately.

- Carefully review the loan terms and conditions before signing.

- Choose a reputable lender with a secure online application process.

- Monitor your application status and contact the lender if needed.

Conclusion

Securing the best personal loan interest rates requires careful comparison and understanding of the factors influencing your rate. By understanding your credit score, debt-to-income ratio, and shopping around for the best offers, you can significantly reduce the overall cost of your loan. Remember to utilize online comparison tools and pre-qualification to streamline the process. Start comparing personal loan interest rates today! Use our resources and tools to find the perfect loan to meet your financial needs. Apply now for the best personal loan rates and secure your financial future. Don't delay—compare personal loans and apply now!

Featured Posts

-

Jennifer Lopez Set To Emcee American Music Awards In Las Vegas

May 28, 2025

Jennifer Lopez Set To Emcee American Music Awards In Las Vegas

May 28, 2025 -

Ronaldo Ya Danimarka Dan Fenerbahce Daveti Tuerk Taraftarin Cagrisi

May 28, 2025

Ronaldo Ya Danimarka Dan Fenerbahce Daveti Tuerk Taraftarin Cagrisi

May 28, 2025 -

Official Ice Cube Returns For A New Last Friday Movie

May 28, 2025

Official Ice Cube Returns For A New Last Friday Movie

May 28, 2025 -

Prakiraan Cuaca Bandung Besok 26 Maret Antisipasi Hujan Di Jawa Barat

May 28, 2025

Prakiraan Cuaca Bandung Besok 26 Maret Antisipasi Hujan Di Jawa Barat

May 28, 2025 -

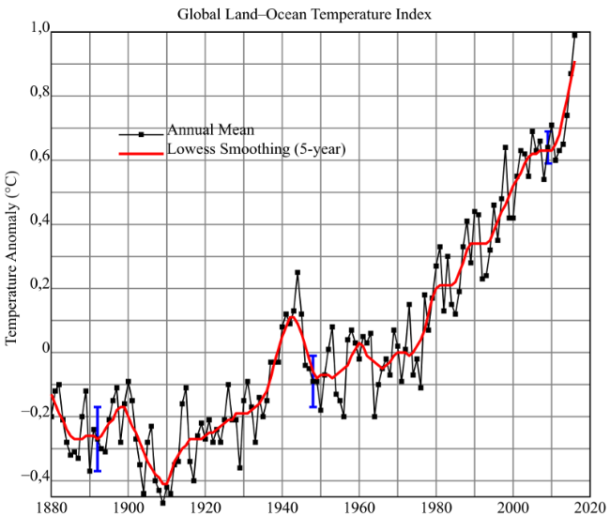

More Rain In Western Massachusetts A Climate Change Consequence

May 28, 2025

More Rain In Western Massachusetts A Climate Change Consequence

May 28, 2025

Latest Posts

-

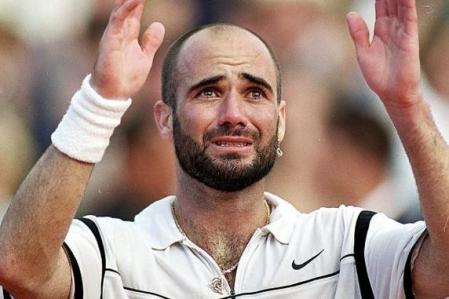

Andre Agassi Nueva Etapa Nueva Cancha Mismo Espiritu Competitivo

May 30, 2025

Andre Agassi Nueva Etapa Nueva Cancha Mismo Espiritu Competitivo

May 30, 2025 -

Andre Agassi Un Regreso Inesperado Lejos De Las Canchas De Tenis

May 30, 2025

Andre Agassi Un Regreso Inesperado Lejos De Las Canchas De Tenis

May 30, 2025 -

Steffi Graf Und Andre Agassi Ihr Pickleball Erfolg Tipps Und Tricks

May 30, 2025

Steffi Graf Und Andre Agassi Ihr Pickleball Erfolg Tipps Und Tricks

May 30, 2025 -

Marturia Lui Andre Agassi Stresul Si Presiunea In Tenisul De Elita

May 30, 2025

Marturia Lui Andre Agassi Stresul Si Presiunea In Tenisul De Elita

May 30, 2025 -

Agassi Dezvaluie Anxietatea Inainte De Competitii O Confesiune Surprinzatoare

May 30, 2025

Agassi Dezvaluie Anxietatea Inainte De Competitii O Confesiune Surprinzatoare

May 30, 2025