Congressional Stock Trading Ban: Trump's Position Revealed In Time Interview

Table of Contents

Trump's Stated Position on a Congressional Stock Trading Ban in the Time Interview

In his Time interview, Donald Trump's position on a Congressional Stock Trading Ban was notably nuanced. While he didn't explicitly endorse a complete ban, his comments revealed a complex understanding of the issue. He expressed concerns about potential conflicts of interest and the appearance of impropriety. However, he also voiced concerns about the practicality and potential unintended consequences of a blanket ban.

- Ambiguity in Stance: Trump didn't offer a clear "yes" or "no" to the question of a ban. His response leaned toward skepticism regarding the feasibility and effectiveness of such legislation.

- Key Arguments: Trump hinted at concerns about the ability to enforce such a ban effectively and the possibility it could unduly restrict the financial freedom of lawmakers. He seemed to favor alternative solutions that addressed perceived conflicts of interest without completely prohibiting stock trading.

- Contextual Clues: The interview revealed Trump's perspective to be informed by his business background, emphasizing a pragmatic approach focused on potential drawbacks and limitations of a complete ban.

Ultimately, his statement avoided a definitive declaration, leaving his true position open to interpretation and adding complexity to the ongoing debate surrounding the Congressional Stock Trading Ban.

Comparing Trump's Stance to Other Key Figures and Political Parties

Trump's ambiguous position contrasts sharply with the more definitive stances of other prominent political figures and parties. President Biden, for example, has openly supported a ban on Congressional stock trading, aligning with a growing number of Democrats.

- Biden's Support: President Biden has actively advocated for stricter ethics regulations and transparency in government, including measures to curb Congressional stock trading.

- Democratic Stance: The Democratic Party generally favors stricter regulations, often proposing comprehensive legislation to prevent conflicts of interest.

- Republican Divergence: While some Republicans support greater transparency, the party's stance on a complete ban is less unified, with some expressing concerns about government overreach. Trump's cautious approach seems to reflect this internal division.

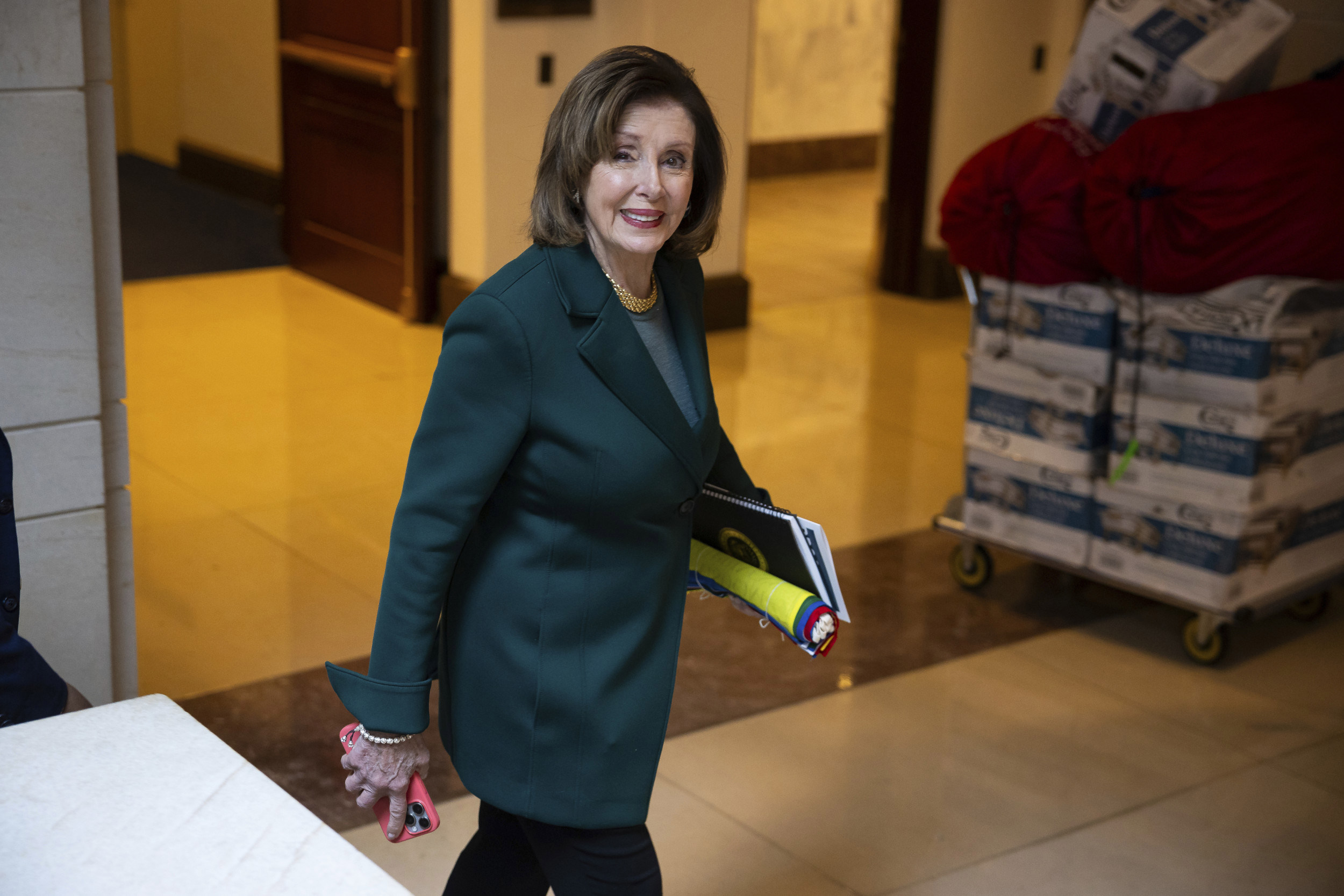

- Pelosi's Involvement: Nancy Pelosi’s past actions and statements regarding this topic have also fueled the debate and added complexity to the contrasting stances within the political landscape.

This divergence in opinions highlights the significant partisan divide surrounding this issue, with the debate extending beyond simply the merits of a ban, delving into larger questions about government regulation and individual liberties.

Public Opinion and the Momentum Behind a Congressional Stock Trading Ban

The push for a Congressional Stock Trading Ban enjoys significant public support. Numerous polls consistently show overwhelming public disapproval of lawmakers trading stocks. This sentiment is largely driven by a growing distrust of politicians and a belief that they should prioritize public service over personal financial gain.

- Public Distrust: Recent scandals involving alleged insider trading by members of Congress have exacerbated public distrust and fueled the demand for reform.

- Media Influence: Extensive media coverage of these scandals has played a crucial role in shaping public opinion, amplifying concerns about ethics and transparency in government.

- Arguments for a Ban: Proponents argue a ban is necessary to restore public trust, eliminate conflicts of interest, and prevent the appearance of impropriety.

- Arguments Against a Ban: Opponents argue that such a ban would be overly restrictive, potentially violating lawmakers' constitutional rights.

The strong public sentiment, coupled with increasing media attention to these concerns, is creating significant momentum toward legislative action on a ban on Congressional stock trading.

Potential Legal and Practical Challenges to Implementing a Ban

Implementing a Congressional Stock Trading Ban faces significant legal and practical hurdles. Challenges include potential legal challenges based on First Amendment rights and the practical difficulties of enforcement.

- Constitutional Challenges: Opponents might argue that a complete ban infringes on lawmakers' First Amendment rights, restricting their freedom of association and economic activity.

- Enforcement Difficulties: Monitoring and enforcing a ban across hundreds of lawmakers would be complex and resource-intensive. Defining what constitutes insider trading or a conflict of interest could be ambiguous, leading to difficulties in prosecution.

- Alternative Solutions: Some propose alternative solutions such as stricter disclosure requirements, blind trusts, or independent oversight bodies to mitigate conflicts of interest without a complete ban on stock trading. These options offer more nuanced and potentially more effective means of addressing public concerns while navigating legal complexities.

Overcoming these obstacles requires careful consideration of legal implications and the development of robust and effective enforcement mechanisms.

Conclusion: The Future of Congressional Stock Trading and Trump's Legacy

Trump's position, as presented in the Time interview, remains ambiguous. This ambiguity highlights the multifaceted nature of the debate surrounding a Congressional Stock Trading Ban, reflecting not only legal and practical considerations but also deep-seated political divisions. The strong public support for reform, alongside the ongoing scrutiny of lawmaker activities, suggests that this issue will continue to be a central focus in the ongoing dialogue about ethics in government. His stance, while not explicitly supportive of a ban, implicitly acknowledges the need for addressing concerns about the appearance of conflicts of interest. The long-term impact of Trump’s stance, and its influence on future legislation regarding a Congressional Stock Trading Ban, remains to be seen.

To stay informed on this crucial issue and contribute to the conversation, learn more about the ongoing debate surrounding the Congressional Stock Trading Ban. Research the proposed legislation, explore the arguments from various perspectives, and engage in informed discussions about the future of ethics and transparency in government. [Link to relevant resource 1] [Link to relevant resource 2]

Featured Posts

-

Lente Is Here Your Guide To Springtime Vocabulary

Apr 26, 2025

Lente Is Here Your Guide To Springtime Vocabulary

Apr 26, 2025 -

The Newsom Democrat Rift Analyzing The Governors Recent Actions

Apr 26, 2025

The Newsom Democrat Rift Analyzing The Governors Recent Actions

Apr 26, 2025 -

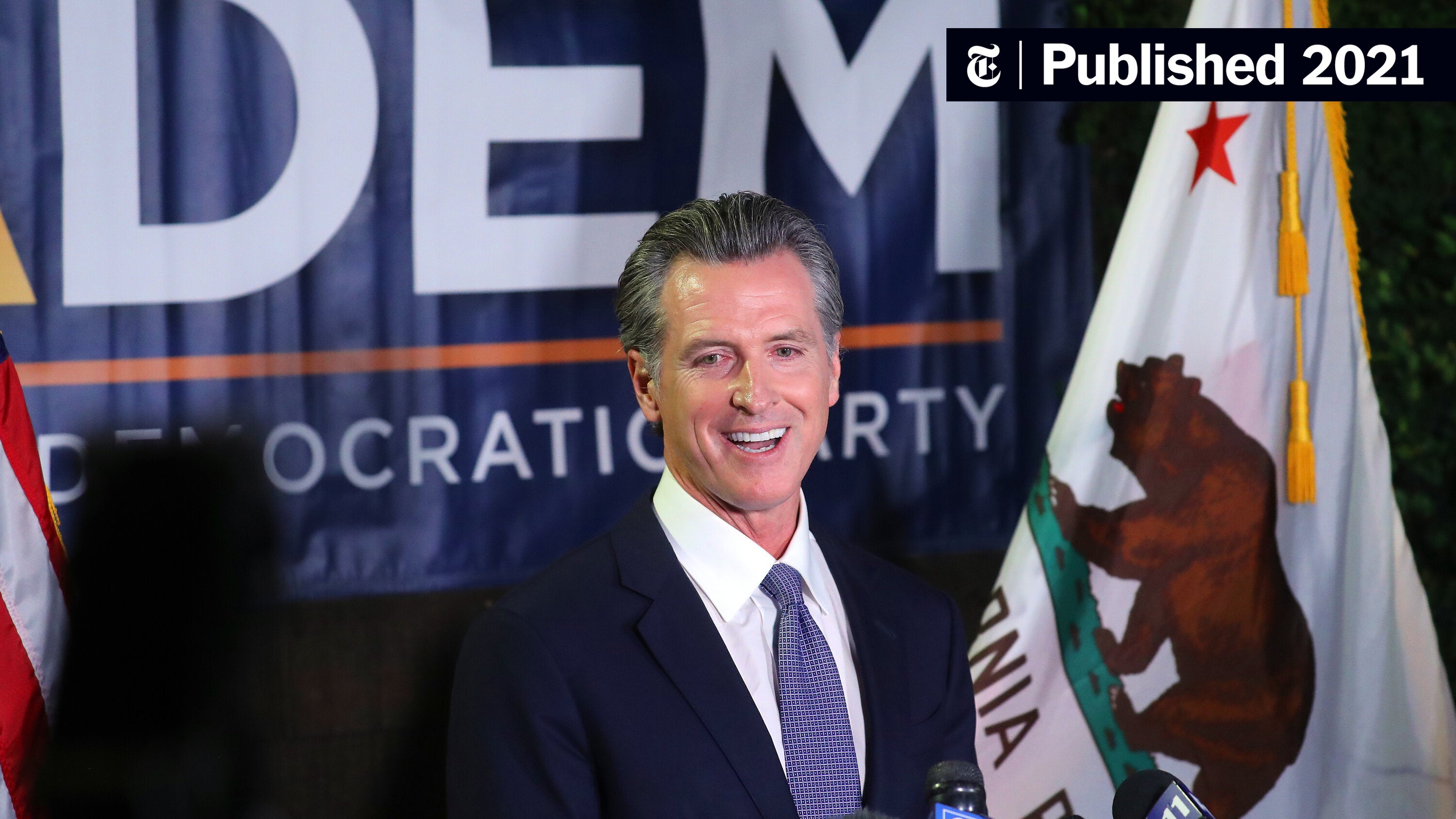

Are High Stock Market Valuations A Cause For Concern Bof A Says No

Apr 26, 2025

Are High Stock Market Valuations A Cause For Concern Bof A Says No

Apr 26, 2025 -

Analyzing Trumps Influence Unifying Factors In The Canadian Election

Apr 26, 2025

Analyzing Trumps Influence Unifying Factors In The Canadian Election

Apr 26, 2025 -

Why Current Stock Market Valuations Are Not A Reason To Panic According To Bof A

Apr 26, 2025

Why Current Stock Market Valuations Are Not A Reason To Panic According To Bof A

Apr 26, 2025