Consistent Dividend Income: The Power Of Simplicity

Table of Contents

Identifying Reliable Dividend-Paying Stocks

Building a successful dividend investing strategy starts with carefully selecting stocks known for their consistent dividend payouts. This involves understanding key metrics and employing effective diversification strategies.

Understanding Dividend Payout Ratios

A crucial aspect of dividend investing is understanding the dividend payout ratio. This ratio indicates the percentage of a company's earnings that are paid out as dividends. A sustainable dividend payer typically has a payout ratio below 70%, leaving enough room for reinvestment and future growth. A high payout ratio, on the other hand, could signal financial instability and potential future dividend cuts.

- Dividend Yield: This represents the annual dividend payment relative to the stock's price. A higher yield doesn't always mean a better investment; consider it alongside the payout ratio.

- Payout Ratio: As discussed above, a lower payout ratio (generally below 70%) suggests a more sustainable dividend.

- Dividend Growth History: Examine the company's track record of increasing its dividend payments over time. A consistent history of dividend increases is a positive sign.

Researching a company's financials and overall stability is vital. Look into factors such as revenue growth, debt levels, and future prospects to ensure the company is financially sound and capable of maintaining its dividend payments. This due diligence is crucial for building a robust consistent dividend income portfolio.

Diversification Strategies for Dividend Income

Diversifying your dividend portfolio across different sectors and industries is key to mitigating risk and maximizing returns. Don't put all your eggs in one basket!

- Sector Diversification: Consider investing in diverse sectors known for consistent dividend payments, such as:

- Utilities: Companies providing essential services like electricity and water often have stable dividend payouts.

- Consumer Staples: Companies producing everyday goods like food and beverages tend to have consistent demand and stable dividends.

- Real Estate Investment Trusts (REITs): REITs invest in income-producing real estate and are often required to distribute a significant portion of their income as dividends.

- Geographic Diversification: Spreading your investments across different countries can further reduce risk and potentially increase returns.

Building a Consistent Dividend Income Portfolio

Building a portfolio that generates consistent dividend income is a marathon, not a sprint. It’s achievable even with limited capital.

Starting Small and Growing Gradually

You don't need a vast sum to begin your dividend investing journey. Starting small and growing gradually is a perfectly viable and effective approach.

- Dollar-Cost Averaging (DCA): Invest a fixed amount of money at regular intervals (e.g., monthly). This strategy helps mitigate the risk of investing a lump sum at a market peak.

- Dividend Reinvestment: Reinvest your dividend payments to buy more shares. This powerful strategy accelerates compounding growth over time, significantly increasing your consistent dividend income stream.

The Importance of Long-Term Investing

Patience and a long-term perspective are essential for maximizing dividend income. Market fluctuations are inevitable; however, consistent dividend income strategies are designed to weather these storms.

- Long-Term Holding: Holding dividend stocks for extended periods allows you to benefit from both dividend payments and potential capital appreciation.

- Power of Compounding: Over time, the compounding effect of dividend reinvestment can dramatically increase your overall returns and consistent dividend income.

Managing and Optimizing Your Dividend Income Portfolio

Once you've built your portfolio, ongoing management is crucial to maintain and optimize its performance.

Regularly Reviewing and Rebalancing

Regularly reviewing your portfolio's performance and rebalancing it to maintain your desired asset allocation is essential for long-term success.

- Monitoring Dividend Payments: Track your dividend income to ensure payments are consistent and meet your expectations.

- Tracking Portfolio Performance: Monitor the overall performance of your portfolio, comparing it to your benchmarks and adjusting your strategy as needed.

- Handling Dividend Cuts: Be prepared for the possibility of dividend cuts. Research the reasons behind any cuts and assess whether to hold or sell the affected stocks.

Tax Implications of Dividend Income

Dividend income is taxable. Understanding the tax implications is important for maximizing your after-tax returns.

- Qualified vs. Non-Qualified Dividends: Qualified dividends are taxed at lower rates than ordinary income. Understanding this distinction is crucial for tax planning.

- Seek Professional Advice: Consult a tax professional or financial advisor for personalized advice tailored to your specific situation and tax bracket.

Reap the Rewards of Consistent Dividend Income

Building a consistent dividend income portfolio is surprisingly simple, requiring careful stock selection, diversification, and a long-term investing approach. This strategy provides financial security, supplemental income, and significant long-term wealth-building potential. Remember, the benefits of consistent dividend income extend beyond mere financial returns; it offers peace of mind and a path towards greater financial freedom.

Start building your path to financial freedom today. Begin your journey towards consistent dividend income by researching reliable dividend-paying stocks and creating a diversified portfolio. For further resources and personalized guidance on building a consistent dividend income strategy, consider exploring reputable financial websites and consulting with a qualified financial advisor.

Featured Posts

-

Grand Slam Track Revolutionizing The World Of Athletics

May 11, 2025

Grand Slam Track Revolutionizing The World Of Athletics

May 11, 2025 -

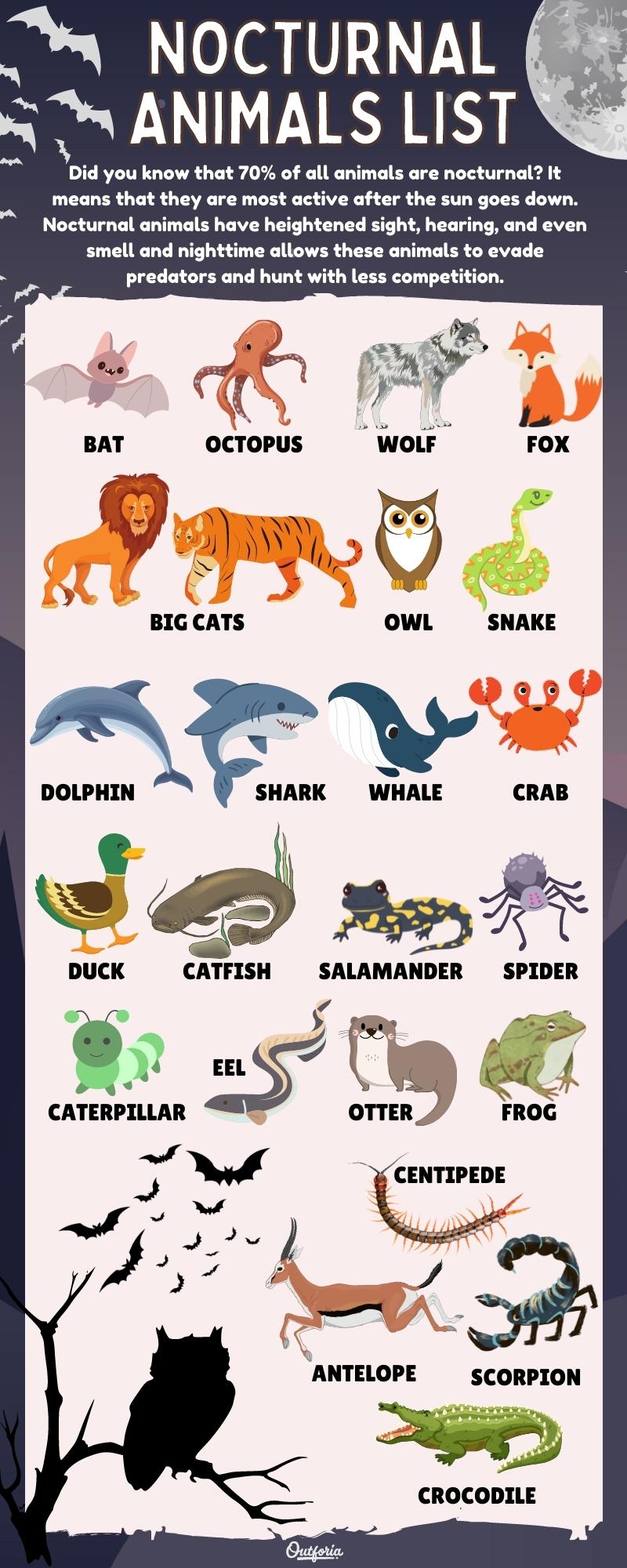

Night Hunter Tracking And Identifying Nocturnal Animals

May 11, 2025

Night Hunter Tracking And Identifying Nocturnal Animals

May 11, 2025 -

Understanding Debbie Elliotts Contributions

May 11, 2025

Understanding Debbie Elliotts Contributions

May 11, 2025 -

Why Henry Cavill Left The Witcher Exploring The Reasons Behind His Exit

May 11, 2025

Why Henry Cavill Left The Witcher Exploring The Reasons Behind His Exit

May 11, 2025 -

Averea Lui Sylvester Stallone Cat A Adus Rocky

May 11, 2025

Averea Lui Sylvester Stallone Cat A Adus Rocky

May 11, 2025