Copper Market Volatility: Impact Of China-US Trade Discussions

Table of Contents

China's Role as a Dominant Copper Consumer

China's massive infrastructure projects and robust manufacturing sector consume a significant portion of the world's copper production. Any disruption to its import capabilities directly impacts global copper demand, creating copper market volatility.

Raw Material Demand and Import Reliance

China's voracious appetite for copper stems from its booming economy.

- High demand for copper in construction (buildings, infrastructure): Massive urbanization and infrastructure development initiatives fuel immense copper consumption.

- Significant use in electronics and electrical equipment manufacturing: The global electronics industry relies heavily on copper for wiring and components. China's manufacturing prowess translates to significant copper demand.

- Reliance on imported copper due to domestic production limitations: While China is a major copper producer, it still relies heavily on imports to meet its massive demand.

- Tariffs and trade restrictions directly impacting import costs: Trade tensions and tariffs directly influence the cost of imported copper, creating price fluctuations and copper market volatility.

Government Policies and Economic Growth

Chinese government policies significantly influence copper consumption. Changes in these policies can cause dramatic shifts in copper demand, further contributing to copper market volatility.

- "Belt and Road Initiative" and its impact on copper demand: This ambitious infrastructure project fuels immense demand for copper in participating countries.

- Stimulus packages and their effect on infrastructure projects: Government stimulus packages often prioritize infrastructure development, leading to increased copper demand.

- Environmental regulations influencing copper mining and processing: Stringent environmental regulations can impact copper production, potentially leading to supply shortages and price increases.

- The impact of government subsidies on domestic copper production: Government subsidies can influence domestic copper production, affecting the balance between imports and domestic supply.

US Tariffs and Countermeasures

The imposition of US tariffs on Chinese goods, and subsequent retaliatory tariffs from China, creates uncertainty and copper market volatility in the global copper market. These tariffs increase the cost of copper and related products, impacting supply chains and investment decisions.

Impact of Tariffs on Copper Prices

Tariffs directly affect copper prices and the wider market.

- Increased costs for US importers of copper and copper products: Tariffs increase the cost of copper for US businesses, potentially reducing demand.

- Potential for reduced demand due to higher prices: Higher prices resulting from tariffs can lead to decreased demand, affecting copper producers.

- Disruption of global supply chains: Trade disputes disrupt established supply chains, causing delays and uncertainty.

- Impact on copper futures markets and investor sentiment: Uncertainty surrounding trade policies leads to volatility in copper futures markets.

Geopolitical Implications and Market Sentiment

The ongoing trade tensions between the US and China create uncertainty affecting investor confidence and market sentiment, impacting copper prices and increasing copper market volatility.

- Increased market volatility due to unpredictable trade policies: Unpredictable trade policies create a climate of uncertainty, leading to price fluctuations.

- Impact on investment decisions in the copper mining and processing sector: Uncertainty deters investment in the copper industry, potentially impacting future supply.

- Speculation and hedging activities influencing copper prices: Market participants engage in speculation and hedging to mitigate risks, further influencing prices.

- The role of financial markets in amplifying market fluctuations: Financial markets can amplify price swings, exacerbating copper market volatility.

Alternative Supply Sources and Market Adjustments

The volatility caused by US-China trade discussions incentivizes diversification of copper supply sources. Countries like Chile, Peru, and the Democratic Republic of Congo are becoming increasingly important copper producers.

Diversification of Copper Supply

Diversification is key to mitigating risks and stabilizing the market.

- Exploring new copper mines and expanding existing operations: Companies are investing in new mines and expanding existing ones to meet growing demand.

- The role of technology in improving copper extraction efficiency: Technological advancements are improving extraction efficiency and reducing costs.

- The influence of political and economic stability in copper producing countries: Political and economic stability in producing countries is crucial for reliable supply.

- Transportation costs and logistics affecting supply chain efficiency: Efficient transportation and logistics are essential for a stable supply chain.

Long-Term Outlook and Market Stabilization

While short-term volatility persists, the long-term demand for copper remains strong, driven by global infrastructure development and the growth of renewable energy technologies.

- Growing demand for copper in electric vehicles and renewable energy infrastructure: The transition to electric vehicles and renewable energy requires vast amounts of copper.

- Technological advancements that improve copper recycling and utilization: Technological advancements are improving copper recycling and reuse.

- The potential for sustainable copper mining practices: Sustainable mining practices are becoming increasingly important for environmental reasons.

- Government initiatives promoting responsible sourcing and ethical trade: Government initiatives are promoting responsible sourcing and ethical trade in copper.

Conclusion

The volatility in the copper market is inextricably linked to the evolving dynamics of China-US trade discussions. Understanding the interplay between these trade negotiations, global demand, and supply chain adjustments is crucial for navigating the complexities of the copper market. The future of the copper market depends on the resolution of trade disputes, the diversification of supply chains, and the continued growth in global demand. By staying informed about developments in the China-US trade relationship and understanding the broader macroeconomic landscape, businesses and investors can better mitigate the risks and capitalize on the opportunities presented by copper market volatility. Stay updated on the latest developments in copper market volatility to make informed decisions.

Featured Posts

-

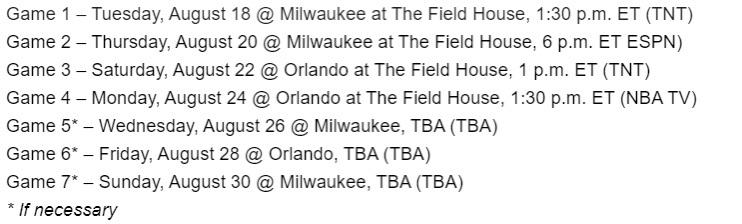

Celtics Vs Magic Playoff Schedule Full Dates And Times

May 06, 2025

Celtics Vs Magic Playoff Schedule Full Dates And Times

May 06, 2025 -

Trotyl Polski Nitro Chem Wiodacy Producent W Europie

May 06, 2025

Trotyl Polski Nitro Chem Wiodacy Producent W Europie

May 06, 2025 -

Celtics Vs Suns Game On April 4th Where To Watch And Stream

May 06, 2025

Celtics Vs Suns Game On April 4th Where To Watch And Stream

May 06, 2025 -

Independence Day A Comprehensive Guide To Celebrations And History

May 06, 2025

Independence Day A Comprehensive Guide To Celebrations And History

May 06, 2025 -

The Sinking City Of Venice Innovative Solutions For Its Survival

May 06, 2025

The Sinking City Of Venice Innovative Solutions For Its Survival

May 06, 2025

Latest Posts

-

Maintaining Extra Long Nails Advice From Beauty School

May 06, 2025

Maintaining Extra Long Nails Advice From Beauty School

May 06, 2025 -

Predicting The Met Gala 2025 Guest List Celebrities We Expect To See

May 06, 2025

Predicting The Met Gala 2025 Guest List Celebrities We Expect To See

May 06, 2025 -

Expert Tips On Extra Long Nails From Beauty School

May 06, 2025

Expert Tips On Extra Long Nails From Beauty School

May 06, 2025 -

Beauty Schools Guide To Extra Long Nails

May 06, 2025

Beauty Schools Guide To Extra Long Nails

May 06, 2025 -

Met Gala 2025 A Look At The Potential Celebrity Guest List

May 06, 2025

Met Gala 2025 A Look At The Potential Celebrity Guest List

May 06, 2025