Core Inflation Surge Forces Bank Of Canada Into Difficult Policy Decision

Table of Contents

The Unexpected Rise in Core Inflation

Recent data from Statistics Canada reveals an unsettling increase in core inflation. For example, the core inflation rate for [insert month and year] reached [insert percentage], exceeding the Bank of Canada's target range of 1-3%. This unexpected rise is significantly impacting the Canadian economy and necessitates a thorough understanding of its underlying causes.

Several factors are contributing to this concerning trend:

Supply Chain Disruptions

Persistent supply chain bottlenecks continue to plague the global economy, significantly impacting prices in Canada.

- Microchip shortages: The ongoing semiconductor shortage continues to constrain production across various industries, from automobiles to electronics, leading to higher prices for consumers.

- Port congestion: Delays at major Canadian ports exacerbate supply chain issues, increasing transportation costs and delaying the delivery of goods.

- Increased shipping costs: Global freight rates remain elevated, adding to the overall cost of imported goods and contributing to inflationary pressures.

These disruptions limit the availability of goods, driving up prices and adding to the core inflation rate.

Strong Consumer Demand

Robust consumer spending is fueling inflationary pressures. Canadians are spending more, driving up demand and putting upward pressure on prices.

- Increased disposable income: Government support measures and strong employment have boosted disposable income, enabling consumers to spend more.

- Pent-up demand: Following the pandemic lockdowns, consumers are eager to spend, further increasing demand for goods and services.

- High savings rates: Many Canadians accumulated significant savings during the pandemic, providing them with additional capacity for spending.

This strong consumer demand, combined with supply chain constraints, creates a perfect storm for rising prices.

Wage Growth

Increased wage growth, while positive for workers, also contributes to higher production costs, pushing prices upward.

- Tight labor market: A tight labor market is leading to increased competition for workers, pushing wages higher.

- Union negotiations: Successful union negotiations are resulting in higher wages for many workers, which gets passed on to consumers in the form of higher prices.

- Minimum wage increases: Increases in minimum wage across various provinces also contribute to higher labor costs for businesses.

This upward pressure on wages is a significant factor in the current inflationary environment and is contributing to the core inflation surge. The implications of this core inflation surge extend beyond headline inflation, impacting purchasing power, interest rates, and overall economic stability.

The Bank of Canada's Policy Dilemma

The Bank of Canada faces a significant challenge in responding to the rising core inflation without triggering a recession. The central bank must carefully balance the need to control inflation with the desire to support sustainable economic growth and employment. This necessitates a strategic approach considering multiple policy options:

Interest Rate Hikes

The most common tool used by central banks to combat inflation is raising interest rates. Increasing interest rates makes borrowing more expensive, cooling down consumer spending and investment, and subsequently reducing inflationary pressures. However, aggressive interest rate hikes risk slowing economic growth and increasing unemployment.

Quantitative Tightening

Quantitative tightening (QT) involves reducing the Bank of Canada's balance sheet by allowing government bonds to mature without reinvestment. This reduces the money supply, helping to curb inflation. The potential downside is that QT can tighten financial conditions significantly, potentially leading to a sharper economic slowdown.

Forward Guidance

Clear communication and forward guidance from the Bank of Canada are crucial in managing market expectations. Transparent communication about the central bank's intentions helps to stabilize markets and avoid unnecessary volatility. The Bank's ability to credibly communicate its strategy is vital in effectively navigating this complex situation.

The trade-offs between controlling inflation and supporting economic growth are substantial. The Bank of Canada must carefully weigh the risks and benefits of each policy option.

Potential Economic Consequences

The Bank of Canada's policy response will significantly impact the Canadian economy. Several scenarios are possible:

Soft Landing

A soft landing is the ideal outcome – successfully controlling inflation without triggering a recession. This requires a carefully calibrated approach that effectively manages inflation while minimizing negative impacts on economic growth and employment.

Recessionary Risk

Aggressive monetary policy, aimed at quickly reducing inflation, carries the risk of inducing a recession. Higher interest rates can significantly curb investment and consumer spending, leading to a contraction in economic activity and increased unemployment.

Impact on the Housing Market

Changes in interest rates profoundly affect the housing market. Higher interest rates make mortgages more expensive, potentially cooling down the housing market and reducing house prices. This can have significant consequences for household wealth and overall economic stability.

Conclusion

The recent surge in core inflation presents a serious challenge for the Bank of Canada. The interplay between supply chain disruptions, strong consumer demand, and wage growth is driving up prices. The Bank faces a difficult policy decision, needing to balance the need to control inflation with the risks of triggering a recession. The Bank of Canada's response to this core inflation surge will be crucial in shaping the Canadian economy's future. Stay informed about the Bank of Canada's decisions regarding interest rates and monetary policy to better understand the potential impact on your finances and investments. Closely follow updates on core inflation and the Bank of Canada's actions to prepare for potential economic shifts. Further research into the Bank of Canada's monetary policy and its impact on core inflation is recommended for a deeper understanding.

Featured Posts

-

Javier Baez Y Su Lucha Por La Salud Y La Productividad En El Beisbol

May 22, 2025

Javier Baez Y Su Lucha Por La Salud Y La Productividad En El Beisbol

May 22, 2025 -

Investigating The Reasons Behind Core Weave Crwv S Thursday Stock Dip

May 22, 2025

Investigating The Reasons Behind Core Weave Crwv S Thursday Stock Dip

May 22, 2025 -

Australian Crossing New Speed Record Set By Foot

May 22, 2025

Australian Crossing New Speed Record Set By Foot

May 22, 2025 -

The 3 Billion Question Sses Spending Cuts And The Future Of Energy

May 22, 2025

The 3 Billion Question Sses Spending Cuts And The Future Of Energy

May 22, 2025 -

Testing Googles New Ai Smart Glasses Prototype

May 22, 2025

Testing Googles New Ai Smart Glasses Prototype

May 22, 2025

Latest Posts

-

Large Fire Engulfs Used Car Dealership Crews Respond

May 22, 2025

Large Fire Engulfs Used Car Dealership Crews Respond

May 22, 2025 -

Used Car Dealership Fire Crews On Scene

May 22, 2025

Used Car Dealership Fire Crews On Scene

May 22, 2025 -

Susquehanna Valley Storm Damage A Comprehensive Guide To Repair And Restoration

May 22, 2025

Susquehanna Valley Storm Damage A Comprehensive Guide To Repair And Restoration

May 22, 2025 -

Susquehanna Valley Storm Damage Assessing The Impact And Recovery

May 22, 2025

Susquehanna Valley Storm Damage Assessing The Impact And Recovery

May 22, 2025 -

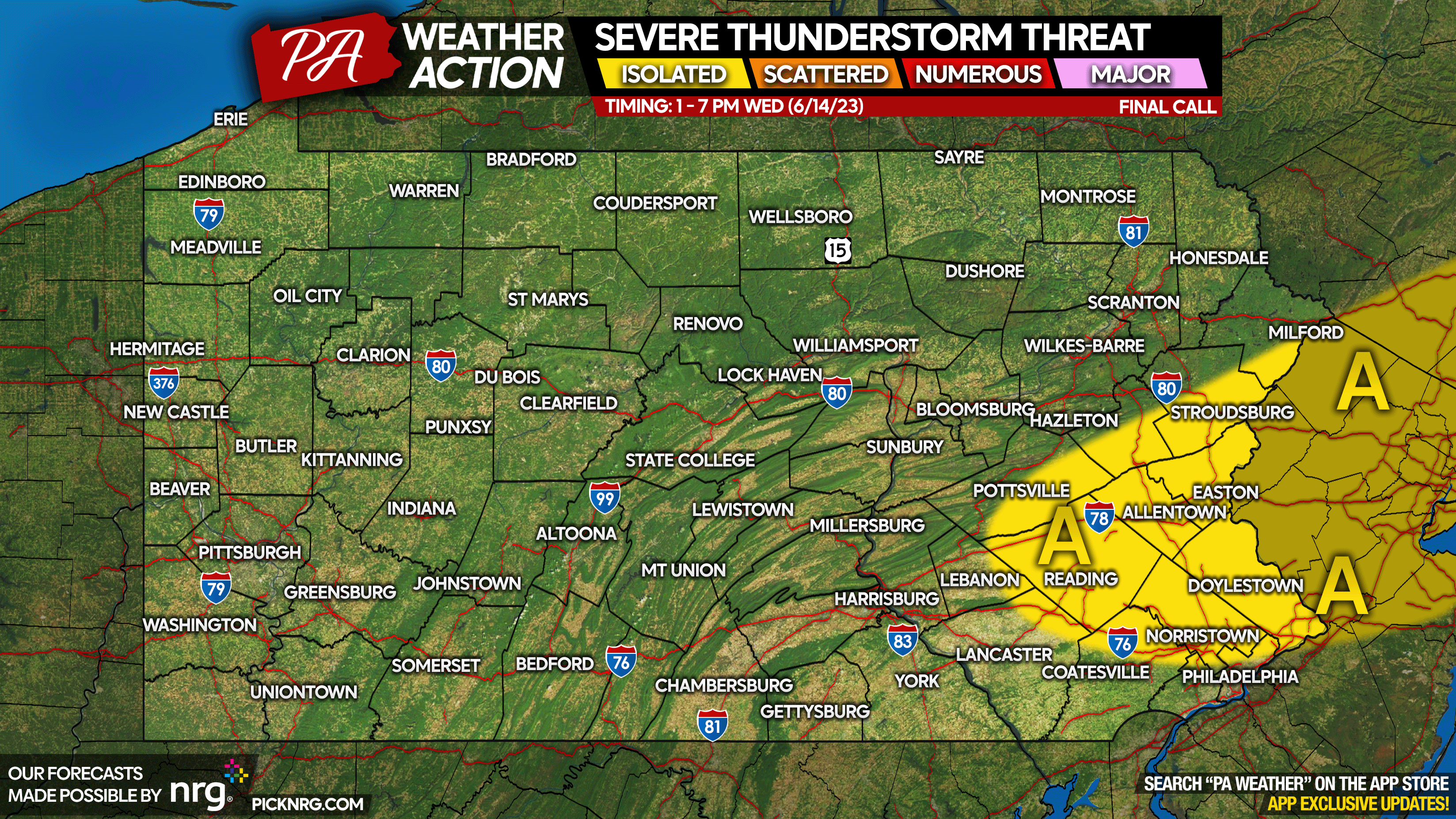

Pennsylvania Thunderstorm Warning Urgent Action Needed In South Central Region

May 22, 2025

Pennsylvania Thunderstorm Warning Urgent Action Needed In South Central Region

May 22, 2025