CoreWeave (CRWV): Deconstructing The Significant Price Increase On Thursday

Table of Contents

Market Sentiment and Investor Speculation

Thursday's market saw a generally positive trend, but CoreWeave's jump was particularly noteworthy. Several factors likely contributed to this heightened investor enthusiasm. The overall positive market sentiment undoubtedly played a role, creating a fertile ground for speculative trading. But the surge likely stemmed from more specific factors related to CoreWeave itself.

Investor speculation and hype, fueled by social media discussions and online forums, were clearly significant contributors. The speed and magnitude of the price increase suggest a strong element of speculative buying. This suggests that positive sentiment, perhaps amplified by online communities, drove significant buying pressure. Possible triggers for this speculative frenzy include:

- Positive press coverage: Favorable articles or news reports highlighting CoreWeave's innovative technology or market position could have ignited investor interest.

- Analyst upgrades: Positive ratings or price target increases from influential financial analysts may have triggered a buying spree.

- New partnerships or contracts: Rumors or announcements of significant new partnerships with major technology companies or the securing of large contracts could have fueled the price increase.

- Speculation about potential acquisitions: Market speculation about a potential acquisition of CoreWeave by a larger player in the cloud computing or AI infrastructure sector could have significantly impacted the stock price.

CoreWeave's Business Fundamentals and Recent Developments

Beyond the market noise, CoreWeave's strong business fundamentals and recent developments likely contributed to the increased investor confidence. While specifics regarding the recent surge may not be publicly available immediately, considering CoreWeave's overall trajectory is crucial.

Analyzing CoreWeave's recent financial performance, including revenue growth and profitability, provides valuable context. Any key business milestones achieved, such as exceeding targets or successfully launching new products, would further support the price increase. Furthermore, strategic decisions and partnerships play a key role:

- New product launches or updates: The release of cutting-edge technology or significant updates to existing products could have boosted investor confidence in CoreWeave's long-term growth potential.

- Expansion into new markets: Successful expansion into new geographic regions or market segments could have signaled to investors a growing market share and increased revenue streams.

- Improved operational efficiency: Improvements in operational efficiency, leading to cost reductions and increased profitability, would attract investors seeking stable growth and profitability.

CoreWeave operates in a highly competitive landscape. Its ability to differentiate itself through innovation and strategic partnerships within the AI and cloud computing industry is crucial for continued growth and investor confidence. The company's focus on GPU computing and AI infrastructure positions it favorably in a rapidly expanding market.

Technical Analysis of CoreWeave (CRWV) Stock

Analyzing the technical aspects of CRWV's stock chart reveals valuable insights into the price surge. Examining trading volume, price patterns, and key indicators helps to understand the dynamics behind the price movement. A significant increase in trading volume accompanying the price jump confirms strong buying pressure. Identifying support and resistance levels reveals price points where buying or selling pressure is likely to intensify.

Chart patterns, such as breakouts from established ranges or the formation of flags or pennants, can provide valuable signals about future price movements. A thorough technical analysis would involve studying these patterns and identifying potential future support and resistance levels. (Note: This section would ideally include relevant charts and graphs illustrating these technical indicators.)

Potential Short-Term and Long-Term Implications

The Thursday price surge presents both opportunities and risks for investors. In the short term, the price may experience volatility as the market digests the news and investors react. This could lead to further price increases or a correction. In the long term, CoreWeave's future performance will depend on its ability to execute its business strategy, maintain its competitive edge, and capitalize on the growing demand for cloud computing and AI infrastructure. The risks include the inherent volatility of the stock market and the possibility that the price increase was driven primarily by speculation, with limited basis in fundamental business performance. The potential rewards, however, include significant returns if CoreWeave continues its growth trajectory.

Conclusion: Evaluating the Future of CoreWeave (CRWV) After the Thursday Spike

CoreWeave's significant price increase on Thursday resulted from a confluence of factors, including positive market sentiment, investor speculation, and potentially positive underlying business developments. While the short-term outlook remains uncertain and dependent on further market reactions, understanding CoreWeave’s fundamentals and the broader context is critical. The sustainability of this price increase will depend on the company’s ability to deliver on its promises and maintain its competitive advantage in a rapidly evolving market.

Before making any investment decisions related to CoreWeave (CRWV) stock, it is crucial to conduct thorough research, carefully assess your risk tolerance, and consider both the bullish and bearish scenarios. Understand the risks and rewards before investing in CoreWeave, and learn more about CoreWeave's future prospects by reviewing their financial reports and industry analyses. Investing in volatile stocks like CRWV requires a well-informed approach and a clear understanding of the potential consequences. Remember, careful consideration is essential when navigating the complexities of the stock market.

Featured Posts

-

Rising Gas Prices In Philadelphia Current Average And Future Outlook

May 22, 2025

Rising Gas Prices In Philadelphia Current Average And Future Outlook

May 22, 2025 -

Alles Over De Kamerbrief Certificaten Van Abn Amro Een Praktische Handleiding

May 22, 2025

Alles Over De Kamerbrief Certificaten Van Abn Amro Een Praktische Handleiding

May 22, 2025 -

Accenture Announces 50 000 Promotions Following Delay

May 22, 2025

Accenture Announces 50 000 Promotions Following Delay

May 22, 2025 -

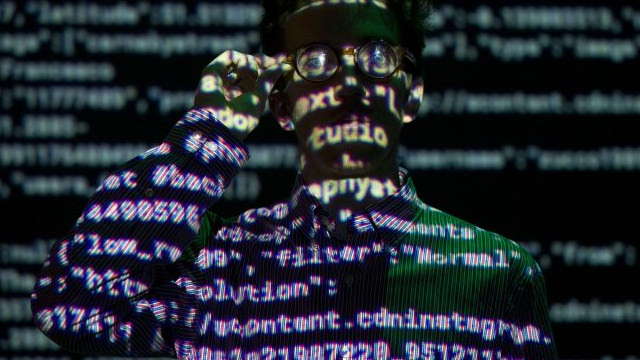

Du An Ha Tang Tp Hcm Binh Duong Thuc Day Ket Noi Giao Thong Vung

May 22, 2025

Du An Ha Tang Tp Hcm Binh Duong Thuc Day Ket Noi Giao Thong Vung

May 22, 2025 -

1 050 V Mware Price Hike At And T Highlights Broadcoms Extreme Cost Increase

May 22, 2025

1 050 V Mware Price Hike At And T Highlights Broadcoms Extreme Cost Increase

May 22, 2025

Latest Posts

-

Columbus Gas Price Survey 2 83 To 3 31 Per Gallon

May 22, 2025

Columbus Gas Price Survey 2 83 To 3 31 Per Gallon

May 22, 2025 -

Significant Gas Price Variation Across Columbus Stations

May 22, 2025

Significant Gas Price Variation Across Columbus Stations

May 22, 2025 -

Wordle 1358 March 8th Hints And Solution

May 22, 2025

Wordle 1358 March 8th Hints And Solution

May 22, 2025 -

Wordle Today 1358 Hints Clues And The Answer For Saturday March 8th

May 22, 2025

Wordle Today 1358 Hints Clues And The Answer For Saturday March 8th

May 22, 2025 -

Todays Wordle Answer Nyt March 18 1368 With Hints

May 22, 2025

Todays Wordle Answer Nyt March 18 1368 With Hints

May 22, 2025