CoreWeave (CRWV) Stock Decline Tuesday: Understanding The Market Reaction

Table of Contents

Tuesday witnessed a significant decline in CoreWeave (CRWV) stock, leaving investors scrambling to understand the underlying causes. This article delves into the factors contributing to this market reaction, examining the potential reasons behind the drop and offering insights into future implications for CRWV investors. We'll analyze the day's events and explore what this means for the long-term prospects of this cloud computing company.

Analyzing the CRWV Stock Decline

Several interconnected factors likely contributed to the CoreWeave stock price drop on Tuesday. Let's examine the key elements that influenced this market reaction.

Impact of Overall Market Sentiment

Tuesday's broader market conditions played a significant role in CRWV's decline. A general downturn in the tech sector, reflected in the performance of indices like the Nasdaq and S&P 500, likely contributed to the negative sentiment surrounding CoreWeave stock.

- Correlation between CRWV's performance and broader tech sector movements: CoreWeave, as a technology company, is highly susceptible to overall tech sector performance. A negative trend in the broader market often drags down individual tech stocks, including CRWV.

- Influence of investor risk aversion: In times of uncertainty, investors tend to become more risk-averse, leading them to sell off shares of potentially volatile stocks like CoreWeave.

- Significant economic news impacting the market: Any negative economic news released on Tuesday, such as disappointing inflation data or concerns about interest rate hikes, could have further exacerbated the market's negative sentiment and impacted CRWV stock price.

Lack of Positive Catalysts

The absence of positive catalysts also contributed to the decline in CoreWeave stock. Without any significant positive news or announcements to bolster investor confidence, the stock became vulnerable to selling pressure.

- Analysis of recent company news and its impact on investor confidence: A review of recent CoreWeave news reveals no major announcements or positive developments that could have counteracted the negative market sentiment.

- Absence of significant product launches or partnerships: The lack of significant new product launches or strategic partnerships could have disappointed investors anticipating growth catalysts.

- Comparison to competitor performance: A comparison of CoreWeave's performance to that of its competitors in the cloud computing space could also reveal relative underperformance, contributing to the stock's decline.

Potential Short-Selling Activity

Increased short-selling pressure could have significantly amplified the downward pressure on CRWV stock. Short sellers bet against a stock's price, and their actions can create a self-fulfilling prophecy, driving the price down further.

- Data on short interest in CRWV stock: Analyzing data on short interest in CRWV stock can provide insights into the extent of short-selling activity. A high short interest percentage suggests significant bearish sentiment.

- Analysis of potential short-selling triggers: Specific events or announcements, such as disappointing earnings reports or concerns about the company's future prospects, could trigger increased short-selling activity.

- Impact of short squeezes (if applicable): While unlikely given the overall negative trend, the possibility of a short squeeze (a rapid price increase due to short sellers covering their positions) should also be considered, though less probable in this scenario.

Technical Analysis of CRWV Stock Chart

A technical analysis of the CRWV stock chart on Tuesday reveals key indicators that support the observed decline.

- Chart patterns observed on Tuesday: Identifying chart patterns such as bearish engulfing candles or breakdowns from support levels could offer insights into the price movement.

- Key price levels broken: The breach of key support levels (significant price points where the stock previously found support) often signifies a shift in market sentiment and can trigger further selling pressure.

- Volume analysis to identify significant buying or selling pressure: Analyzing trading volume on Tuesday can help determine whether the price drop was driven by high selling volume, indicating strong bearish sentiment.

Conclusion

This analysis of CoreWeave (CRWV) stock's decline on Tuesday highlighted several potential contributing factors, including broader market sentiment, a lack of positive catalysts, potential short-selling activity, and negative technical indicators. The interplay of these factors resulted in the observed price drop.

Call to Action: Understanding these market dynamics is crucial for informed investment decisions regarding CoreWeave stock. Stay informed about future developments, such as upcoming earnings reports and strategic announcements, and conduct thorough due diligence before making any investment choices related to CRWV Stock. Continue to monitor CoreWeave Stock and its performance – including the CRWV stock price – to make the most informed decisions. Analyzing factors like short interest, market sentiment, and technical indicators will help you navigate the volatility of the CoreWeave stock market.

Featured Posts

-

20 Cent Gas Price Hike Impact On Consumers And The Economy

May 22, 2025

20 Cent Gas Price Hike Impact On Consumers And The Economy

May 22, 2025 -

New Challenger Targets Trans Australia Run World Record

May 22, 2025

New Challenger Targets Trans Australia Run World Record

May 22, 2025 -

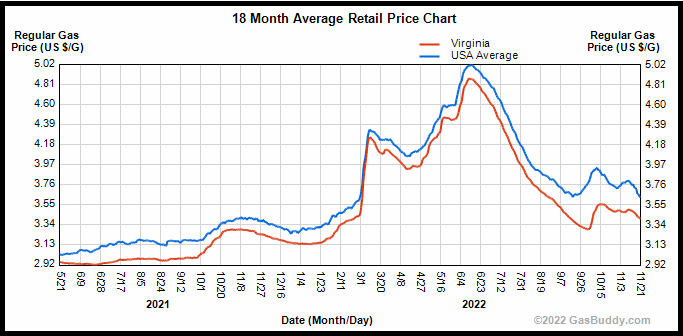

Significant Drop In Virginia Gas Prices 50 Cents Less Per Gallon

May 22, 2025

Significant Drop In Virginia Gas Prices 50 Cents Less Per Gallon

May 22, 2025 -

French Skies Illuminated Analyzing The Mysterious Red Light Flashes

May 22, 2025

French Skies Illuminated Analyzing The Mysterious Red Light Flashes

May 22, 2025 -

Record Breaking Run Man Completes Fastest Foot Crossing Of Australia

May 22, 2025

Record Breaking Run Man Completes Fastest Foot Crossing Of Australia

May 22, 2025

Latest Posts

-

March 26 Nyt Wordle Solution And Strategies For Todays Puzzle

May 22, 2025

March 26 Nyt Wordle Solution And Strategies For Todays Puzzle

May 22, 2025 -

Wordle Answer And Hints Today April 26 2025 Puzzle 1407

May 22, 2025

Wordle Answer And Hints Today April 26 2025 Puzzle 1407

May 22, 2025 -

Tough Wordle Today March 26 Nyt Wordle Answer And Clues

May 22, 2025

Tough Wordle Today March 26 Nyt Wordle Answer And Clues

May 22, 2025 -

Wordle Help Solving Todays March 26 Nyt Wordle Puzzle

May 22, 2025

Wordle Help Solving Todays March 26 Nyt Wordle Puzzle

May 22, 2025 -

Nyt Wordle March 26 Solution And Hints For Todays Puzzle

May 22, 2025

Nyt Wordle March 26 Solution And Hints For Todays Puzzle

May 22, 2025