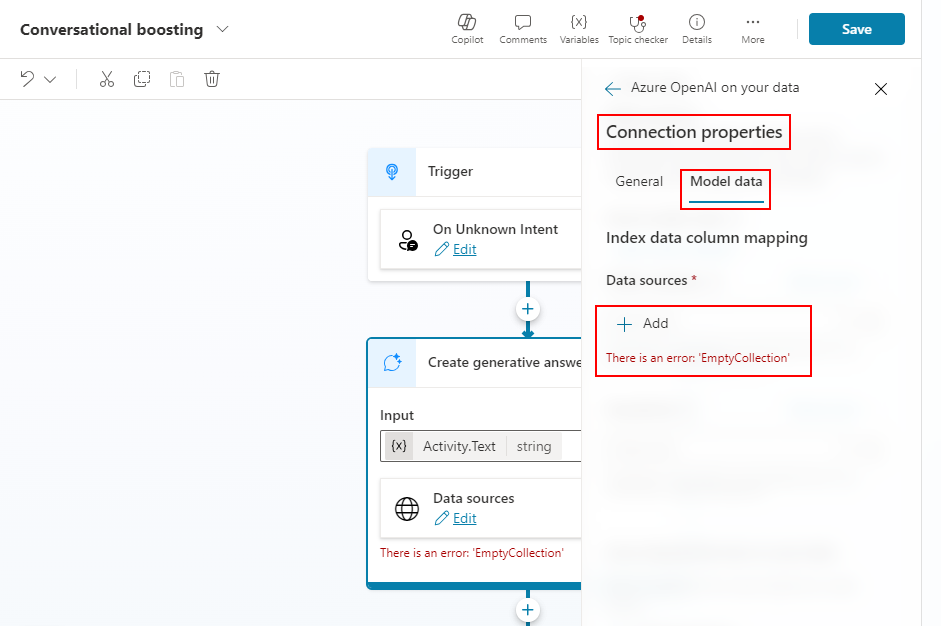

CoreWeave (CRWV) Stock Performance: Analyzing The Nvidia Effect

Table of Contents

CoreWeave's Business Model and Dependence on Nvidia

CoreWeave's business model hinges on providing cloud computing services leveraging the power of Nvidia's graphics processing units (GPUs). These GPUs are crucial for accelerating computationally intensive tasks, particularly in the booming fields of artificial intelligence and machine learning. This dependence presents both significant opportunities and considerable risks.

- High performance computing (HPC) market dependence: CoreWeave's success is directly tied to the growth of the HPC market, which relies heavily on Nvidia's technology. Any slowdown in this market could negatively impact CoreWeave's revenue.

- Potential for supply chain disruptions: CoreWeave's reliance on Nvidia GPUs exposes it to potential supply chain disruptions. Any shortage of Nvidia GPUs could limit CoreWeave's ability to deliver services and meet customer demand.

- Opportunities from Nvidia's advancements in AI: Nvidia's continuous innovation in AI and its related hardware significantly benefits CoreWeave. Advancements in GPU technology directly translate into enhanced performance for CoreWeave's cloud services, attracting more clients and boosting revenue.

- Impact of Nvidia's pricing strategies on CoreWeave's profitability: Nvidia's pricing decisions for its GPUs directly influence CoreWeave's operational costs and profitability. Increased GPU prices could squeeze CoreWeave's margins.

Nvidia's Impact on CRWV Stock Price Fluctuations

The correlation between Nvidia's performance and CRWV's stock price is undeniable. Positive news for Nvidia often translates into immediate gains for CRWV, and vice-versa.

- Examples of Nvidia's positive announcements boosting CRWV: Strong quarterly earnings reports from Nvidia, groundbreaking advancements in AI technology, or successful product launches often lead to a surge in both Nvidia and CRWV stock prices. Investors see this as a positive indicator for the entire GPU computing ecosystem.

- Examples of Nvidia's challenges affecting CRWV negatively: Conversely, any negative news concerning Nvidia, such as weaker-than-expected sales figures, production issues, or regulatory hurdles, typically leads to a decline in CRWV's stock price. Investor sentiment towards Nvidia directly impacts the perception of its closely tied partners.

- Correlation analysis: While a detailed quantitative analysis requires extensive data and statistical tools, anecdotal evidence and market observation strongly suggest a high positive correlation between Nvidia's and CRWV's stock price movements. Further research using statistical methods like regression analysis could provide a more precise quantification of this relationship.

- Investor sentiment: Investor sentiment plays a pivotal role. Positive investor sentiment towards Nvidia often spills over to CRWV, driving investment in the latter. Conversely, negative sentiment can trigger significant sell-offs in CRWV stock.

Analyzing CRWV's Financial Performance and Future Projections

Analyzing CoreWeave's financial performance provides crucial insights into its growth potential. While detailed financial data might be limited as a relatively new public company, key indicators like revenue growth, customer acquisition, and operating margins are important factors to consider.

- Key financial ratios and their interpretation: Monitoring key financial metrics such as revenue growth rate, gross margin, and net income will offer a clearer understanding of CoreWeave's financial health and profitability.

- Market share and competitive landscape: Assessing CoreWeave's market share within the cloud computing and GPU-accelerated services sector is crucial to understanding its competitive positioning and future growth prospects. Analyzing competitors' strategies and market trends provides a broader context.

- Future projections and growth estimates: Industry analysts' future projections and growth estimates for the broader cloud computing market, specifically the AI-driven segment, are essential to predicting CoreWeave's potential for future growth.

- Potential risks and challenges facing CRWV: The competitive landscape, technological advancements, regulatory changes, and economic downturns all pose potential risks and challenges that could affect CoreWeave's future performance.

Investment Strategies for CoreWeave Stock

Investing in CoreWeave (CRWV) requires a careful assessment of risk and a clear investment strategy.

- Buy-and-hold strategy for long-term growth: A long-term investment strategy focuses on the potential for sustained growth in the cloud computing and AI sectors. This approach requires patience and a tolerance for short-term volatility.

- Short-term trading strategies based on news and market trends: Short-term trading strategies exploit the strong correlation between CRWV and Nvidia's stock price movements. This approach demands close market monitoring and a higher risk tolerance.

- Risk mitigation strategies – diversification and stop-loss orders: Diversifying your portfolio to mitigate risk and employing stop-loss orders to limit potential losses are crucial aspects of any responsible investment strategy.

- Importance of thorough due diligence before investing: Before investing in CRWV, conducting thorough due diligence, including researching the company's financials, business model, and competitive landscape, is crucial for informed decision-making.

Conclusion: Navigating the CoreWeave (CRWV) Investment Landscape

CoreWeave's strong tie to Nvidia significantly influences its stock performance. Understanding this complex relationship, analyzing CRWV's financial health, and assessing market trends are critical steps for potential investors. While the Nvidia effect significantly influences CoreWeave's trajectory, thorough due diligence and understanding of the market dynamics are critical before investing in CoreWeave (CRWV) stock. Remember to conduct further research and consult with a financial advisor before making any investment decisions. Stay updated on the latest news and developments in the cloud computing and AI sectors to inform your investment strategy.

Featured Posts

-

Southeast Wisconsin Gas Prices Causes Of The Recent Surge

May 22, 2025

Southeast Wisconsin Gas Prices Causes Of The Recent Surge

May 22, 2025 -

Jim Cramers Take On Core Weave Crwv Its Open Ai Connection

May 22, 2025

Jim Cramers Take On Core Weave Crwv Its Open Ai Connection

May 22, 2025 -

Higher Gasoline Prices Hit Mid Hudson Valley Communities

May 22, 2025

Higher Gasoline Prices Hit Mid Hudson Valley Communities

May 22, 2025 -

Significant Drop In Bp Chief Executives Salary Down 31

May 22, 2025

Significant Drop In Bp Chief Executives Salary Down 31

May 22, 2025 -

Espn Uncovers The Key To The Bruins Transformative Offseason

May 22, 2025

Espn Uncovers The Key To The Bruins Transformative Offseason

May 22, 2025

Latest Posts

-

Lower Gas Prices In Toledo Current Cost Per Gallon

May 22, 2025

Lower Gas Prices In Toledo Current Cost Per Gallon

May 22, 2025 -

Toledo Gas Prices Drop Per Gallon Cost Decreases

May 22, 2025

Toledo Gas Prices Drop Per Gallon Cost Decreases

May 22, 2025 -

Gas Buddy Reports On Falling Gas Prices In Virginia This Week

May 22, 2025

Gas Buddy Reports On Falling Gas Prices In Virginia This Week

May 22, 2025 -

Gas Prices Down In Virginia Gas Buddys Week Over Week Analysis

May 22, 2025

Gas Prices Down In Virginia Gas Buddys Week Over Week Analysis

May 22, 2025 -

Weekly Virginia Gas Price Report Significant Drop Reported By Gas Buddy

May 22, 2025

Weekly Virginia Gas Price Report Significant Drop Reported By Gas Buddy

May 22, 2025