CoreWeave (CRWV) Stock Plunge: Understanding Thursday's Decline

Table of Contents

Market Sentiment and the Broader Tech Sell-off

The CoreWeave (CRWV) stock plunge wasn't an isolated incident. Thursday witnessed a broader sell-off in the technology sector, reflecting a prevailing negative market sentiment. Major tech indices, such as the Nasdaq Composite and the S&P 500 technology sector, also experienced significant declines, indicating a correlation with CRWV's performance. This widespread negativity likely amplified the impact on CoreWeave's stock price.

- Market Events: The sell-off could be attributed to several factors, including renewed concerns about inflation and the potential for further interest rate hikes by the Federal Reserve. Negative earnings reports from other tech giants might have also contributed to the overall bearish sentiment.

- Economic Indicators: Weakening economic indicators, such as a slowdown in consumer spending or a contraction in manufacturing, could have fueled investor anxieties, leading to a risk-off sentiment and impacting growth stocks like CRWV.

- Interest Rate Concerns: Rising interest rates increase borrowing costs for companies, potentially impacting future growth and profitability. Investors often reduce their holdings in growth stocks during periods of rising interest rates, contributing to the CoreWeave (CRWV) stock plunge.

Analysis of CoreWeave's Specific Financial Performance (if applicable)

While no specific financial news regarding CoreWeave was released on the day of the plunge, it's crucial to monitor any future earnings reports or financial guidance. Any deviation from analyst expectations or a significant change in revenue forecasts could heavily influence CRWV’s stock price. If such news were released concurrently with the plunge, we would analyze it in detail here, examining:

- Specific Data Points: We would compare key financial metrics such as revenue, earnings per share (EPS), and operating margins to previous quarters and years. Any significant year-over-year or quarter-over-quarter decreases would be highlighted.

- Performance Comparison: A detailed comparison to competitor performance within the cloud computing sector would provide context and help determine if CoreWeave's underperformance was industry-wide or specific to the company.

- Analyst Predictions: We would incorporate expert opinions and analyst predictions on CoreWeave’s future financial outlook to assess the long-term implications of the recent stock decline.

Impact of Competitor Activities or Industry Trends

The competitive landscape within the cloud computing sector is fiercely competitive. Any actions by competitors, or broader industry trends, could impact CoreWeave’s stock price.

- Competitor Analysis: We would assess whether any announcements from major players like AWS, Microsoft Azure, or Google Cloud had a ripple effect on investor sentiment towards CoreWeave. A significant new product launch or strategic partnership by a competitor could lead to investors shifting their focus and capital.

- Emerging Technologies: Advancements in artificial intelligence (AI), machine learning, or other disruptive technologies could affect CoreWeave’s market position and investor confidence. The adoption rate of these technologies and their impact on cloud computing demand would need to be considered.

- Market Share Analysis: Changes in market share within the cloud computing industry would offer further context for the CoreWeave (CRWV) stock plunge, highlighting whether the decline reflects broader industry trends or a specific issue with CoreWeave's strategy.

Speculation and Trading Activity

Analyzing the trading volume and patterns surrounding the CoreWeave (CRWV) stock plunge is vital. High trading volume on Thursday, compared to previous days, suggests increased market activity.

- Trading Volume Data: We would examine trading volume data to determine if the decline was fueled by a large sell-off or other unusual trading activity. High volume coupled with a significant price drop can indicate a strong bearish sentiment.

- Short Selling Activity: Increased short-selling activity, where investors bet against the stock's future performance, could contribute to the downward pressure on CRWV's stock price.

- Market Rumors and News: Any circulating rumors (whether substantiated or not) about CoreWeave or the broader tech sector should be analyzed for their potential impact on investor psychology and trading decisions.

Conclusion: Understanding the CoreWeave (CRWV) Stock Plunge and Looking Ahead

The CoreWeave (CRWV) stock plunge on Thursday was likely a confluence of factors. The broader tech sell-off, driven by negative market sentiment and concerns about interest rates, created a challenging environment. While no specific CoreWeave financial news coincided with the drop, future performance and competitor actions remain key factors to monitor. Unusual trading activity might have further amplified the decline. Ultimately, understanding the interplay of these factors is crucial for navigating the volatility surrounding CoreWeave (CRWV) stock.

To stay informed about future CoreWeave (CRWV) stock price movements and the broader tech market, bookmark this page and check back regularly for updates. We will continue to monitor the situation and provide further analysis as new information becomes available.

Featured Posts

-

Lancaster County Pa Police Investigating Fatal Shooting Incident

May 22, 2025

Lancaster County Pa Police Investigating Fatal Shooting Incident

May 22, 2025 -

Half Dome Secures Abn Group Victoria Account

May 22, 2025

Half Dome Secures Abn Group Victoria Account

May 22, 2025 -

Juergen Klopp Nereye Gidecek Transfer Spekuelasyonlari Ve Analiz

May 22, 2025

Juergen Klopp Nereye Gidecek Transfer Spekuelasyonlari Ve Analiz

May 22, 2025 -

Peppa Pigs Baby Sisters Name A Touching Family Story

May 22, 2025

Peppa Pigs Baby Sisters Name A Touching Family Story

May 22, 2025 -

Zebra Mussel Problem Casper Residents Boat Lift Infestation

May 22, 2025

Zebra Mussel Problem Casper Residents Boat Lift Infestation

May 22, 2025

Latest Posts

-

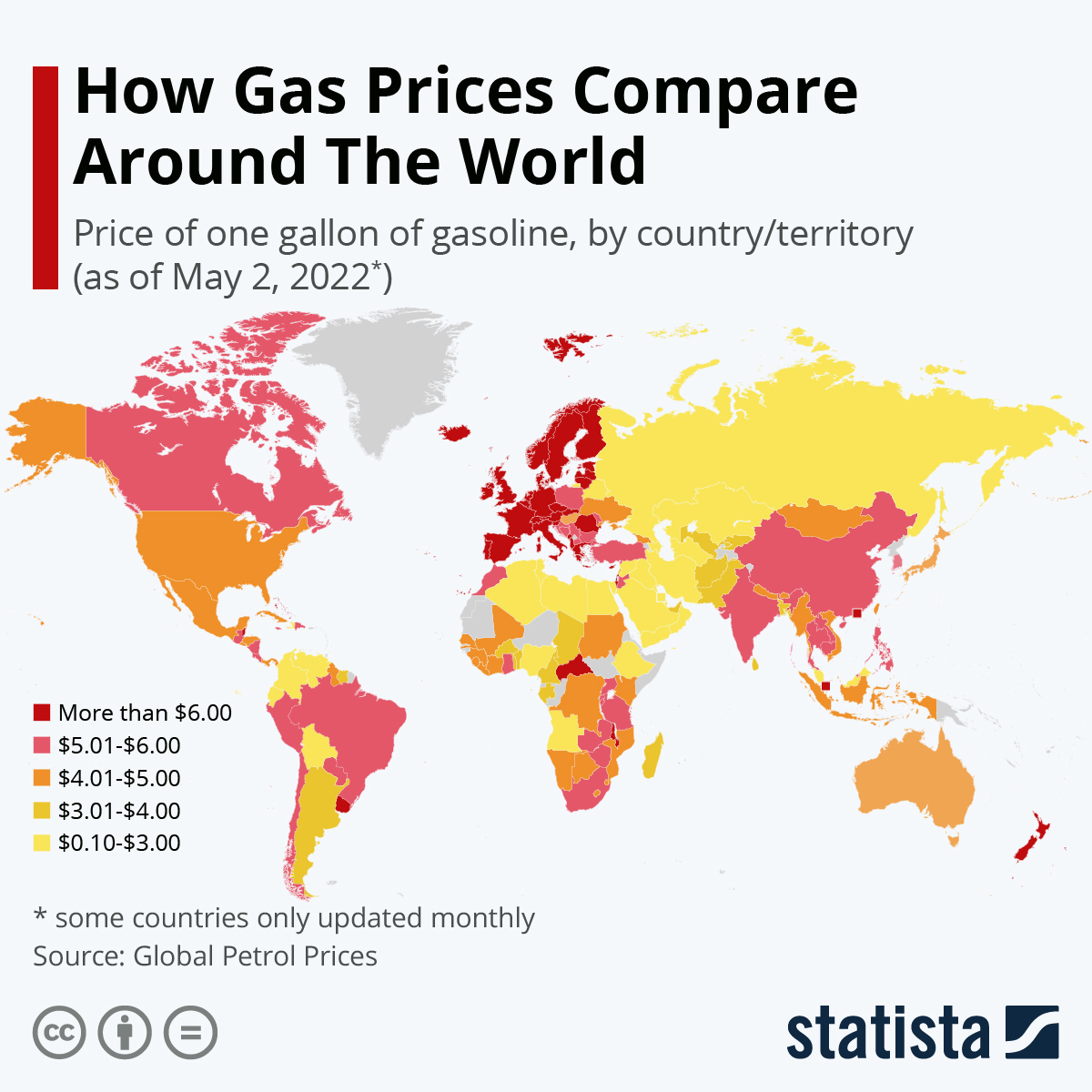

Current Gas Prices In Columbus Ohio A Price Comparison

May 22, 2025

Current Gas Prices In Columbus Ohio A Price Comparison

May 22, 2025 -

Wordle 1358 Answer And Hints For Saturday March 8th

May 22, 2025

Wordle 1358 Answer And Hints For Saturday March 8th

May 22, 2025 -

Columbus Gas Price Survey 2 83 To 3 31 Per Gallon

May 22, 2025

Columbus Gas Price Survey 2 83 To 3 31 Per Gallon

May 22, 2025 -

Significant Gas Price Variation Across Columbus Stations

May 22, 2025

Significant Gas Price Variation Across Columbus Stations

May 22, 2025 -

Wordle 1358 March 8th Hints And Solution

May 22, 2025

Wordle 1358 March 8th Hints And Solution

May 22, 2025