CoreWeave (CRWV) Stock Price Increase: Factors Contributing To Today's Movement

Table of Contents

Increased Demand for AI-Powered Cloud Computing

The meteoric rise of artificial intelligence (AI) is undeniably fueling the demand for powerful cloud computing infrastructure. AI applications across healthcare, finance, research, and countless other sectors are insatiable consumers of processing power. This insatiable appetite is precisely where CoreWeave, with its specialized GPU-powered data centers, finds itself perfectly positioned. CoreWeave's services are directly benefiting from this surge in demand, making them a key player in the burgeoning AI landscape.

- Growth in AI applications across various sectors: The expansion of AI into new industries is driving unprecedented demand for high-performance computing resources.

- CoreWeave's strategic positioning to capitalize on the AI boom: CoreWeave's infrastructure is specifically designed to meet the unique computational demands of AI workloads.

- Increased client acquisition in the AI sector: The company is actively attracting clients seeking reliable and scalable GPU-based cloud solutions.

- Expansion of CoreWeave's data center capacity to meet growing demand: CoreWeave's investments in expanding its infrastructure show their commitment to supporting the ever-increasing needs of the AI industry. This forward-thinking approach is attracting investor confidence.

Strong Financial Performance and Positive Earnings Reports

CoreWeave's recent financial performance has been nothing short of impressive, contributing significantly to the surge in its stock price. [Insert details of recent earnings report, including revenue figures, profitability, and any positive surprises]. These strong financial results showcase CoreWeave's robust growth trajectory and solidify investor confidence in the company's long-term potential. The positive financial performance has also led to several analyst upgrades, further bolstering investor sentiment.

- Recent quarterly or annual earnings report details: [Insert specific data points from the most recent earnings report, such as revenue growth percentage, net income, and EPS.]

- Positive revenue growth compared to previous periods: Highlight the percentage increase in revenue year-over-year and quarter-over-quarter.

- Improved profit margins and overall financial health: Emphasize the company's improving financial stability.

- Analyst upgrades and positive ratings following earnings releases: Mention any upgrades from financial analysts and the reasons behind their positive assessments.

Strategic Partnerships and Technological Advancements

CoreWeave's strategic partnerships and continuous technological innovation further contribute to its success. [Insert details about any new partnerships or technological advancements. For example, mention any collaborations with leading AI companies or improvements to its GPU technology and data center infrastructure]. These initiatives solidify CoreWeave's competitive advantage within the market. The company's focus on cutting-edge technology and collaborative relationships positions it for continued growth.

- Details on recent strategic partnerships and their impact: Explain the nature of these partnerships and how they benefit CoreWeave.

- Description of technological advancements in CoreWeave's infrastructure: Highlight any upgrades to their data centers or cloud services.

- Mention of any new service offerings: Describe any new products or services launched by CoreWeave.

- Competitive analysis highlighting CoreWeave's advantages: Explain what sets CoreWeave apart from its competitors.

Overall Market Sentiment and Investor Confidence

The overall positive market sentiment towards the technology sector and the growing investor confidence in the future of AI and cloud computing have also played a crucial role in the increase of the CRWV stock price. A bullish market generally benefits growth stocks like CoreWeave. The current risk appetite among investors also suggests a willingness to invest in companies with high growth potential, making CoreWeave an attractive investment option.

- Overall market trends (bullish or bearish): Explain the current state of the stock market.

- Investor sentiment towards the technology sector: Describe the general feeling among investors about tech stocks.

- Impact of macroeconomic factors on investor decisions: Discuss any broad economic influences.

- Analysis of short-term and long-term investment perspectives on CRWV: Offer insights into potential future stock performance.

Conclusion

The remarkable increase in CoreWeave (CRWV) stock price is a result of a confluence of factors: the escalating demand for AI-powered cloud computing, the company's strong financial performance, strategic partnerships and technological advancements, and the overall positive market sentiment. CoreWeave's strategic positioning within the rapidly growing AI and cloud computing sectors makes it a compelling investment opportunity.

Stay tuned for updates on the CoreWeave (CRWV) stock price and consider including this promising growth stock in your portfolio. Learn more about CoreWeave's services and future prospects.

Featured Posts

-

Vanja Mijatovic Ime Koje Je Promenila I Zasto

May 22, 2025

Vanja Mijatovic Ime Koje Je Promenila I Zasto

May 22, 2025 -

Shifting Strategies A Turning Point In Wyomings Otter Management

May 22, 2025

Shifting Strategies A Turning Point In Wyomings Otter Management

May 22, 2025 -

Sejarah Kemenangan Liverpool Di Liga Inggris Analisis Peran Pelatih

May 22, 2025

Sejarah Kemenangan Liverpool Di Liga Inggris Analisis Peran Pelatih

May 22, 2025 -

Testing Googles New Ai Smart Glasses Prototype

May 22, 2025

Testing Googles New Ai Smart Glasses Prototype

May 22, 2025 -

Is This The End David Walliams And Simon Cowells Britains Got Talent Conflict

May 22, 2025

Is This The End David Walliams And Simon Cowells Britains Got Talent Conflict

May 22, 2025

Latest Posts

-

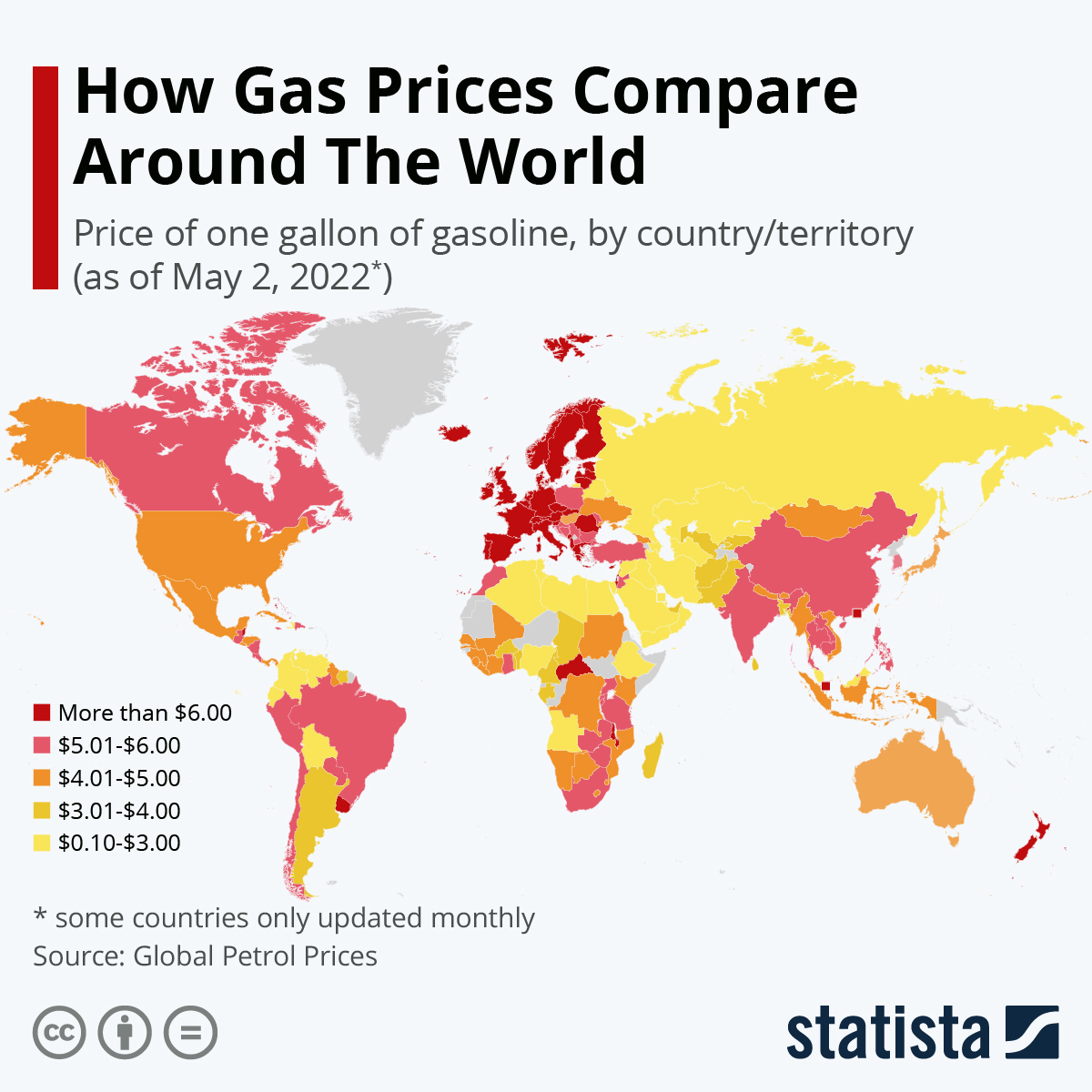

Current Gas Prices In Columbus Ohio A Price Comparison

May 22, 2025

Current Gas Prices In Columbus Ohio A Price Comparison

May 22, 2025 -

Wordle 1358 Answer And Hints For Saturday March 8th

May 22, 2025

Wordle 1358 Answer And Hints For Saturday March 8th

May 22, 2025 -

Columbus Gas Price Survey 2 83 To 3 31 Per Gallon

May 22, 2025

Columbus Gas Price Survey 2 83 To 3 31 Per Gallon

May 22, 2025 -

Significant Gas Price Variation Across Columbus Stations

May 22, 2025

Significant Gas Price Variation Across Columbus Stations

May 22, 2025 -

Wordle 1358 March 8th Hints And Solution

May 22, 2025

Wordle 1358 March 8th Hints And Solution

May 22, 2025