CoreWeave (CRWV) Stock Price Jump: Analyzing Wednesday's Increase

Table of Contents

Market Sentiment and Investor Confidence in CoreWeave (CRWV)

The overall market sentiment on Wednesday played a significant role in CoreWeave's stock price increase. While the broader market experienced some positive momentum, CRWV's surge suggests a specific boost in investor confidence directed at the company itself. This positive sentiment could be attributed to several factors:

- Positive Analyst Reports and Upgrades: Any positive analyst reports released prior to or on Wednesday offering increased price targets or upgraded ratings would have significantly influenced investor confidence. Such reports often carry considerable weight in the market.

- Strategic Partnerships and Contract Wins: The announcement of a major partnership or a substantial contract win, even if not publicly disclosed until after the stock price increase, could easily trigger a surge in buying activity. Investors often respond positively to news reflecting strong growth potential.

- Social Media Sentiment: The buzz on social media platforms dedicated to investing and stock market discussions can act as a powerful indicator of prevailing sentiment. A sudden increase in positive commentary and discussions about CRWV on platforms like Twitter or Stocktwits could indicate a growing optimism driving the stock price higher. Analyzing this social media sentiment is crucial for understanding market dynamics. Increased mentions and positive narratives regarding CoreWeave investor sentiment and CRWV investor confidence could help provide clarity.

Analyzing CoreWeave's (CRWV) Recent Financial Performance

Examining CoreWeave's recent financial performance is crucial to understanding the Wednesday stock surge. A strong earnings report, exceeding expectations, or the release of positive financial forecasts could significantly impact stock valuation. Let's look at potential contributing factors:

- Strong Revenue Growth: Impressive growth in revenue, perhaps exceeding analyst projections, would indicate healthy demand for CoreWeave's cloud computing and AI infrastructure services. Significant revenue growth is a potent driver of stock price increases.

- Improved Profitability: Improvements in profitability, as measured by metrics such as gross margin and net income, demonstrate the company's efficiency and financial health. Increased profitability usually translates to a more positive investor outlook.

- Positive Financial Trends: Overall trends in financial performance—such as accelerating revenue growth or improved operating margins—could point towards a sustained period of positive momentum, making CRWV stock appear increasingly attractive to investors. Analyzing CoreWeave financial performance, CRWV earnings, and revenue growth are key aspects of understanding the surge.

The Role of AI and Cloud Computing in CoreWeave's (CRWV) Stock Performance

CoreWeave operates within the rapidly expanding sectors of AI and cloud computing. The overall growth trajectory of these sectors significantly impacts the company's stock price.

- Strong Industry Tailwinds: The explosive growth of AI and cloud computing creates significant tailwinds for companies like CoreWeave. Increased demand for AI infrastructure and cloud services translates directly into higher revenue and profitability.

- Competitive Advantage: CoreWeave's unique selling propositions (USPs), such as specialized hardware or proprietary software, could provide a competitive advantage in this intensely competitive market. Identifying and assessing these CoreWeave competitors and their performance is crucial.

- Market Domination Potential: CoreWeave's strategic positioning within the AI infrastructure market and its ability to capture market share contribute to its overall stock valuation. Understanding its growth potential within the broader AI stock market and cloud computing stocks is critical.

Potential Risks and Future Outlook for CoreWeave (CRWV)

While the recent stock price increase is positive, it's important to acknowledge potential risks and challenges:

- Economic Downturn: A broader economic downturn could negatively impact spending on cloud computing and AI infrastructure, affecting CoreWeave's revenue growth.

- Competitive Landscape: The intense competition in the AI and cloud computing sectors presents a constant challenge. New entrants or aggressive strategies from established players can put pressure on CoreWeave.

- Regulatory Landscape: Changes in regulatory environments could create compliance costs and affect business operations. Understanding the regulatory landscape is crucial for risk assessment. Analyzing these factors is important for the CoreWeave risk analysis and understanding the CRWV future outlook.

Conclusion: Understanding the CoreWeave (CRWV) Stock Price Jump and What's Next

Wednesday's significant increase in CoreWeave's stock price is likely a result of a combination of factors, including positive market sentiment, strong financial performance, and the overall growth potential of the AI and cloud computing sectors. Analyzing CoreWeave stock price movements requires a comprehensive understanding of market dynamics, financial health, and the competitive landscape. While the outlook for CoreWeave seems promising, investors should remain aware of potential risks. Stay informed about CoreWeave stock price fluctuations, keep track of CoreWeave's financial reports, and analyze the future of CoreWeave in the AI and cloud computing sector to make informed investment decisions. Conduct your own thorough research before making any investment decisions related to CRWV stock.

Featured Posts

-

Kenny Pickett Silences Critics Pittsburgh Homecoming Triumph

May 22, 2025

Kenny Pickett Silences Critics Pittsburgh Homecoming Triumph

May 22, 2025 -

Irish Actor Barry Ward An Interview On His Career And Perceptions

May 22, 2025

Irish Actor Barry Ward An Interview On His Career And Perceptions

May 22, 2025 -

Increased Security At London Israeli Embassy After Us Attacks

May 22, 2025

Increased Security At London Israeli Embassy After Us Attacks

May 22, 2025 -

Gas Price Relief Toledo Sees Decrease In Fuel Costs

May 22, 2025

Gas Price Relief Toledo Sees Decrease In Fuel Costs

May 22, 2025 -

Witness History Vybz Kartel Performs Live In New York

May 22, 2025

Witness History Vybz Kartel Performs Live In New York

May 22, 2025

Latest Posts

-

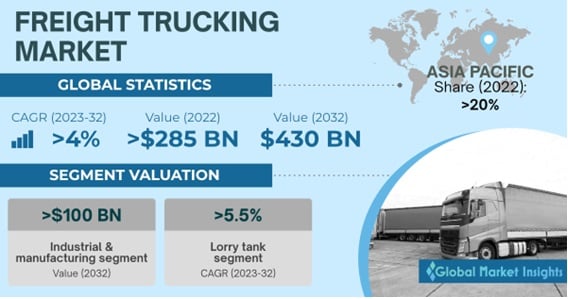

Trucking News And Music Big Rig Rock Report 3 12 From 99 5 The Fox

May 23, 2025

Trucking News And Music Big Rig Rock Report 3 12 From 99 5 The Fox

May 23, 2025 -

Big Rig Rock Report 3 12 On 99 5 The Fox Essential Trucking Information

May 23, 2025

Big Rig Rock Report 3 12 On 99 5 The Fox Essential Trucking Information

May 23, 2025 -

5 The Fox Presents Big Rig Rock Report 3 12 Trucking And Music News

May 23, 2025

5 The Fox Presents Big Rig Rock Report 3 12 Trucking And Music News

May 23, 2025 -

Ralph Macchio On My Cousin Vinny Reboot Latest News And Joe Pescis Status

May 23, 2025

Ralph Macchio On My Cousin Vinny Reboot Latest News And Joe Pescis Status

May 23, 2025 -

Big Rig Rock Report 3 12 Analysis Of The Big 100 Trucking Companies

May 23, 2025

Big Rig Rock Report 3 12 Analysis Of The Big 100 Trucking Companies

May 23, 2025