CoreWeave (CRWV) Stock Soars: Analyzing The Factors Driving Growth

Table of Contents

CoreWeave's Competitive Advantage in the Cloud Computing Market

CoreWeave's success stems from its unique approach to cloud computing, offering a compelling alternative to established giants like AWS, Azure, and GCP. Its competitive advantage is built on several key pillars:

- Specialized infrastructure optimized for AI workloads: Unlike general-purpose cloud providers, CoreWeave has built its infrastructure specifically for the demanding needs of AI and machine learning applications. This includes a massive network of GPUs, allowing for faster training and deployment of AI models.

- Leveraging cutting-edge GPU technology for superior performance: CoreWeave utilizes the latest generation of NVIDIA GPUs, providing clients with unparalleled computing power and performance for their AI and high-performance computing (HPC) needs. This translates to significantly faster processing times and improved efficiency.

- Scalable and flexible cloud solutions tailored to diverse customer needs: The company offers scalable solutions, allowing clients to easily adjust their computing resources based on their specific requirements. This flexibility is particularly crucial for AI workloads, which can fluctuate significantly in demand.

- Competitive pricing models compared to traditional cloud providers: CoreWeave often presents more competitive pricing models, particularly for large-scale AI projects, making its services attractive to businesses of all sizes.

- Focus on sustainability and environmentally friendly data center operations: CoreWeave is committed to sustainable practices, employing energy-efficient technologies and actively reducing its environmental impact, a factor increasingly important to environmentally conscious corporations.

CoreWeave's focus on high-performance computing (HPC) and its tailored solutions for AI development and deployment sets it apart. This specialized approach allows them to cater to the specific needs of demanding AI applications, offering superior performance and efficiency compared to more general-purpose cloud platforms.

The Booming AI Market and its Impact on CRWV Stock

The explosive growth of the AI market is undeniably a major driver of CoreWeave's success. The increasing demand for powerful computing resources to fuel machine learning, deep learning, and other AI applications has created a perfect storm for companies like CoreWeave:

- Explosive growth in the AI market creating significant demand for computing power: The AI boom is fueling an unprecedented demand for computing power, particularly GPUs, the core of CoreWeave's infrastructure.

- CoreWeave's strategic positioning to capitalize on this demand through its GPU-focused infrastructure: CoreWeave is perfectly positioned to capitalize on this increased demand, offering a scalable and efficient solution for businesses needing massive GPU compute power.

- Increased investment in AI by major corporations driving adoption of CoreWeave's services: Major corporations are increasingly investing heavily in AI, driving the adoption of powerful cloud computing solutions like those provided by CoreWeave.

- Potential for future partnerships and collaborations in the rapidly evolving AI landscape: The rapidly evolving AI landscape presents significant opportunities for strategic partnerships and collaborations, further strengthening CoreWeave's position in the market.

The symbiotic relationship between the burgeoning AI market and CoreWeave's specialized services is clear. As AI continues its rapid expansion, the demand for CoreWeave's GPU-powered cloud computing resources is expected to grow proportionally, fueling further stock appreciation.

Financial Performance and Investor Sentiment

CoreWeave's strong financial performance has significantly boosted investor confidence. While detailed financial reports may vary, several key indicators point towards positive growth:

- Review of CoreWeave's recent financial reports, including revenue growth and profitability: Reports indicate substantial revenue growth, reflecting the increasing demand for CoreWeave's services. While profitability may still be in its early stages for a rapidly growing company, positive trends are crucial for investor confidence.

- Analysis of investor sentiment towards the company and its future prospects: Investor sentiment is overwhelmingly positive, reflecting confidence in CoreWeave's future prospects and its ability to capitalize on the growth of the AI market.

- Discussion of the company's valuation and potential for future appreciation: The company's valuation reflects the market's recognition of its significant growth potential. Continued strong performance is likely to drive further valuation increases.

- Comparison of CRWV's performance with competitors in the cloud computing market: While direct comparisons require a thorough market analysis, CoreWeave's specialized focus allows it to carve out a niche where its growth rate may surpass that of more diversified competitors.

The combination of strong revenue growth, positive investor sentiment, and a compelling valuation makes CoreWeave an attractive investment for those focused on the growth of the cloud computing and AI sectors.

Risks and Challenges Facing CoreWeave

While CoreWeave's prospects appear bright, it's crucial to acknowledge potential risks:

- Competition from established cloud providers like AWS, Azure, and GCP: Competition from established giants remains a significant challenge. CoreWeave must continue to innovate and differentiate its services to maintain its competitive edge.

- Potential for technological disruptions affecting the demand for GPU computing: Technological advancements could potentially disrupt the demand for GPU computing, impacting CoreWeave's business model.

- Financial risks associated with rapid expansion and investment in infrastructure: The company's rapid expansion requires significant investments in infrastructure, carrying inherent financial risks.

- Regulatory compliance challenges in the data center and cloud computing industry: Navigating the complex regulatory landscape of the data center and cloud computing industry presents ongoing challenges.

A balanced perspective requires acknowledging these risks, but CoreWeave's strategic focus, technological leadership, and strong financial performance provide a robust foundation for navigating these challenges.

Conclusion

CoreWeave (CRWV) stock's recent surge is a testament to its strategic positioning at the heart of the booming AI and cloud computing revolutions. Its specialized infrastructure, strong financial performance, and significant growth potential have attracted substantial investor interest. While challenges exist, the future outlook for CoreWeave appears promising, making it a compelling prospect within the rapidly evolving landscape of AI infrastructure.

Call to Action: Learn more about investing in CoreWeave (CRWV) and the factors driving its impressive growth. However, remember to conduct your own thorough research and consider consulting with a financial advisor before making any investment decisions related to CoreWeave stock or other similar cloud computing companies. Understanding the nuances of CRWV and the broader cloud computing market is crucial for informed investing in this dynamic sector.

Featured Posts

-

Delayed Ruling Ex Tory Councillors Wifes Racial Hatred Tweet Appeal

May 22, 2025

Delayed Ruling Ex Tory Councillors Wifes Racial Hatred Tweet Appeal

May 22, 2025 -

Aims Group And World Trading Tournament Announce Official Partnership

May 22, 2025

Aims Group And World Trading Tournament Announce Official Partnership

May 22, 2025 -

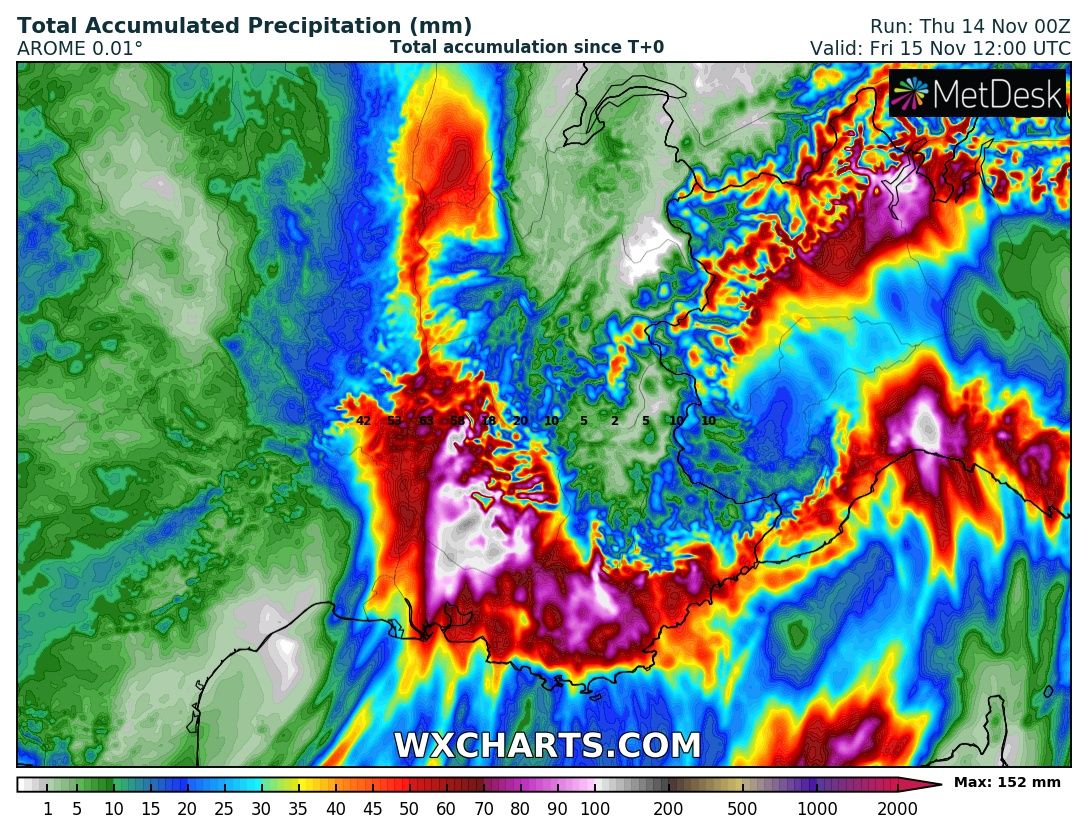

Stormy Weather And Late Snow Hit Southern French Alps

May 22, 2025

Stormy Weather And Late Snow Hit Southern French Alps

May 22, 2025 -

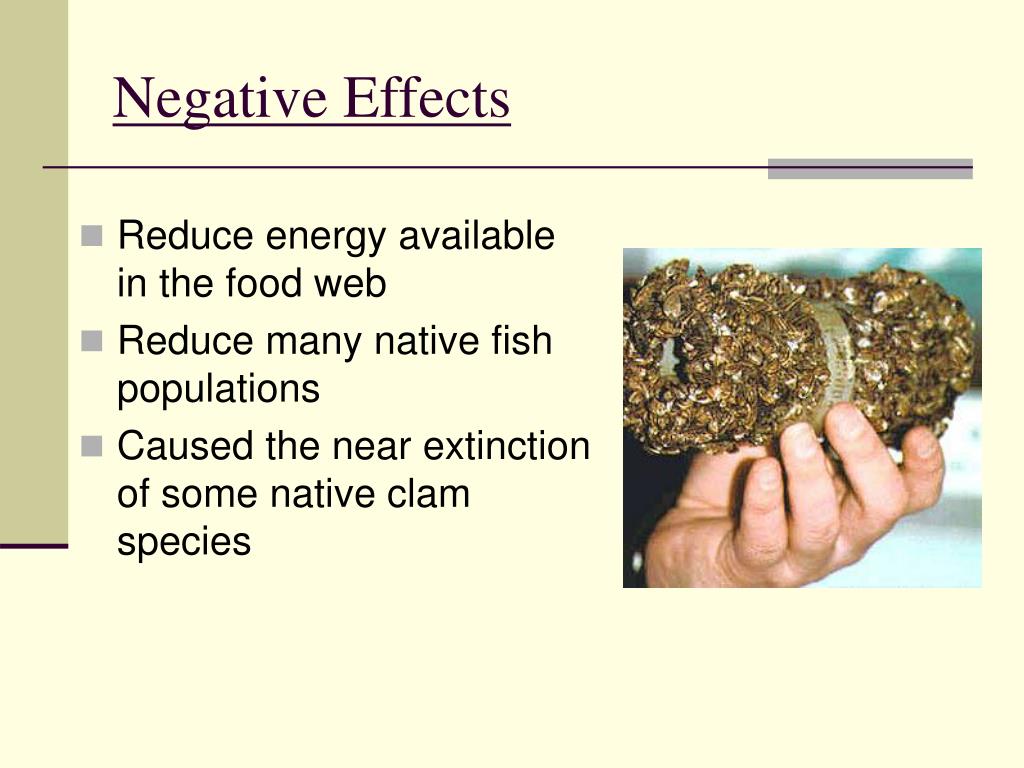

Dealing With A Zebra Mussel Invasion A Casper Residents Story

May 22, 2025

Dealing With A Zebra Mussel Invasion A Casper Residents Story

May 22, 2025 -

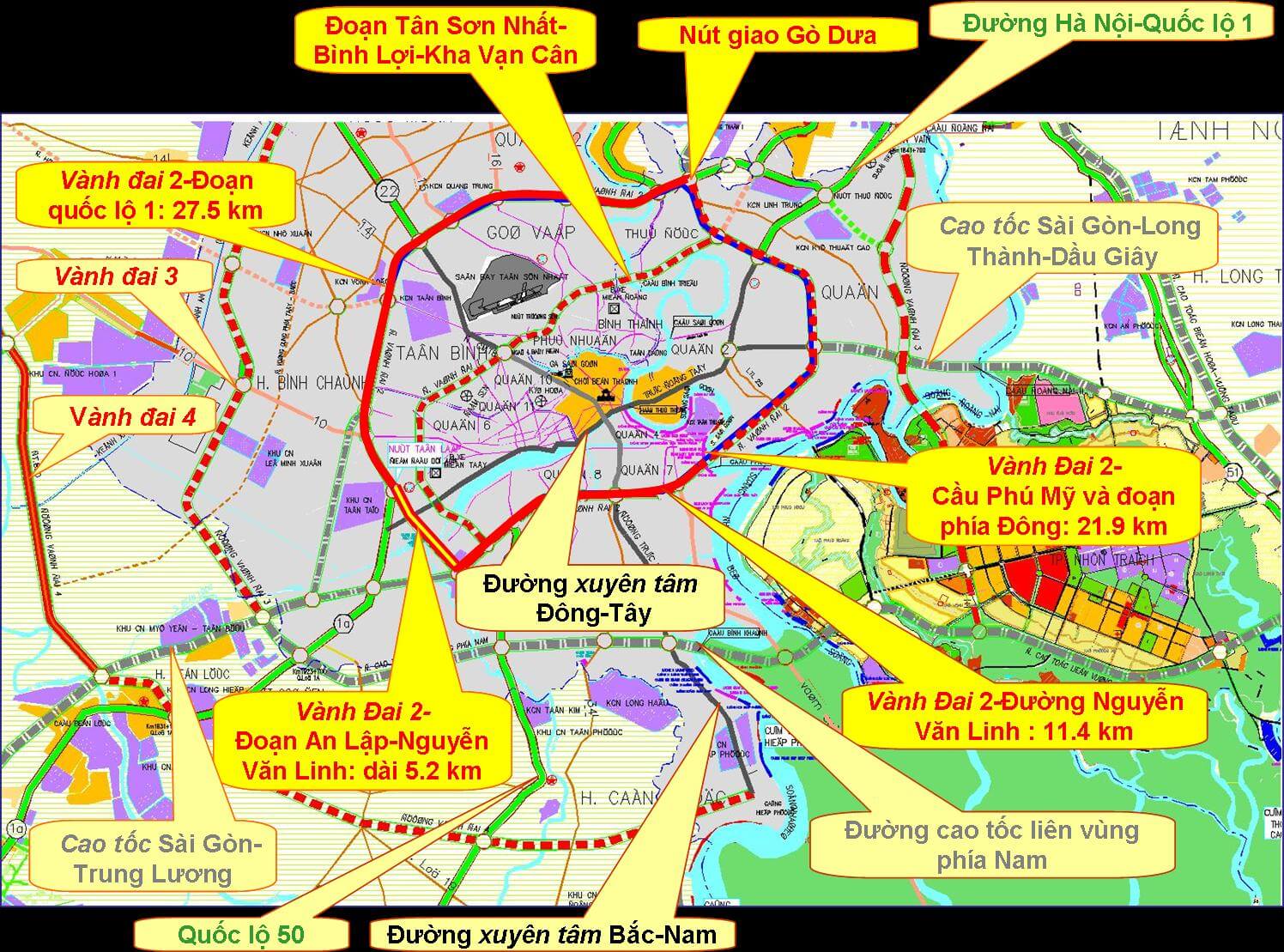

Cau Va Duong Noi Binh Duong Tay Ninh Ten Goi Va Thong Tin Chi Tiet

May 22, 2025

Cau Va Duong Noi Binh Duong Tay Ninh Ten Goi Va Thong Tin Chi Tiet

May 22, 2025

Latest Posts

-

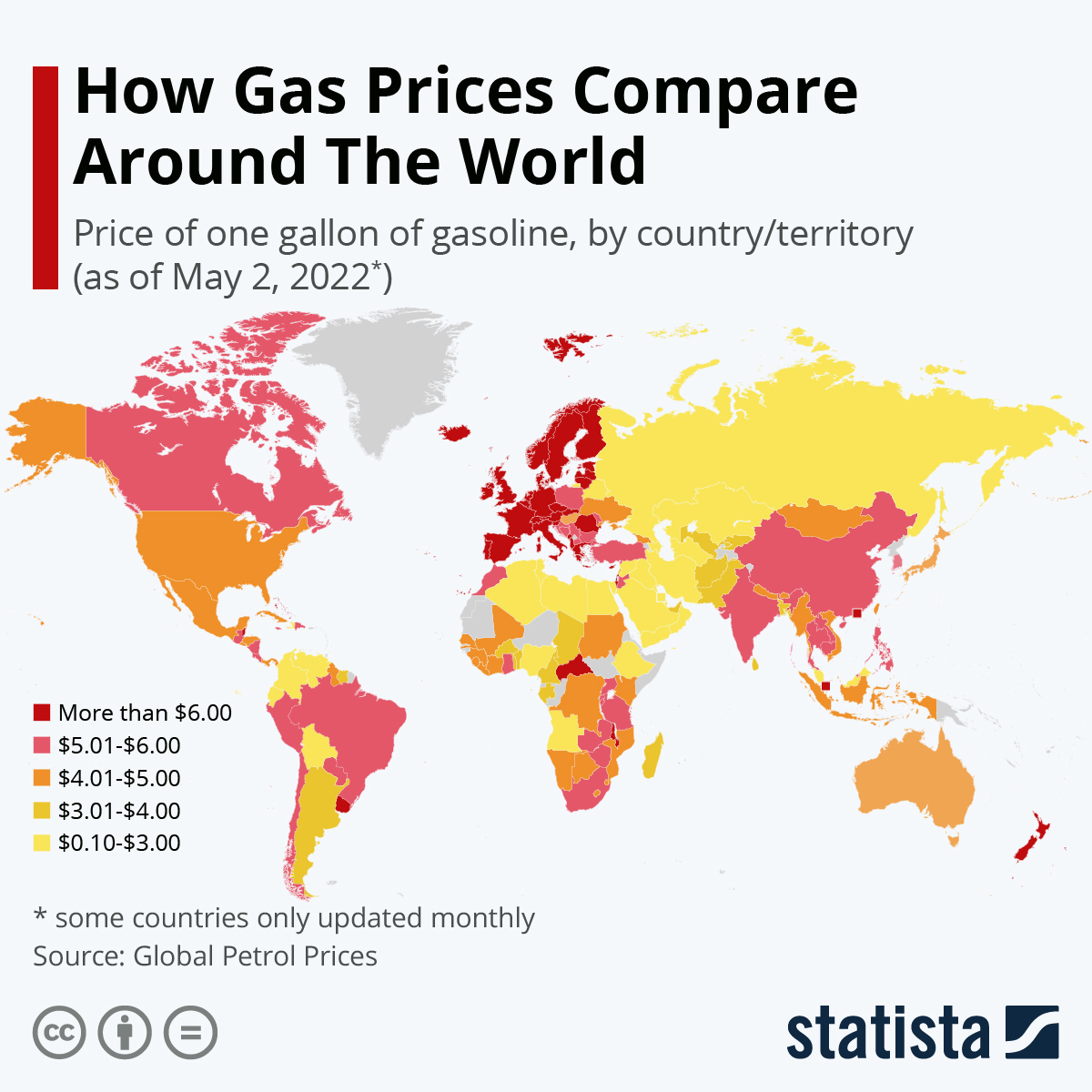

Current Gas Prices In Columbus Ohio A Price Comparison

May 22, 2025

Current Gas Prices In Columbus Ohio A Price Comparison

May 22, 2025 -

Wordle 1358 Answer And Hints For Saturday March 8th

May 22, 2025

Wordle 1358 Answer And Hints For Saturday March 8th

May 22, 2025 -

Columbus Gas Price Survey 2 83 To 3 31 Per Gallon

May 22, 2025

Columbus Gas Price Survey 2 83 To 3 31 Per Gallon

May 22, 2025 -

Significant Gas Price Variation Across Columbus Stations

May 22, 2025

Significant Gas Price Variation Across Columbus Stations

May 22, 2025 -

Wordle 1358 March 8th Hints And Solution

May 22, 2025

Wordle 1358 March 8th Hints And Solution

May 22, 2025