CoreWeave (CRWV) Stock Surge: Nvidia Investment Fuels Growth

Table of Contents

Nvidia's Strategic Investment and its Implications

Nvidia's investment in CoreWeave represents a significant strategic move in the rapidly evolving landscape of AI infrastructure. While the exact amount remains undisclosed publicly, the partnership's implications are substantial.

-

Strategic Rationale: Nvidia's investment isn't just about financial returns; it's about securing access to CoreWeave's vast and scalable GPU computing infrastructure. This access is crucial for Nvidia to expand its reach in the cloud computing market, supporting the growing demands of AI and machine learning applications. By partnering with CoreWeave, Nvidia gains access to a ready-made, powerful infrastructure to support its own AI initiatives and offer its customers seamless access to high-performance computing.

-

Strengthening CoreWeave: The Nvidia investment significantly strengthens CoreWeave's financial position, providing the capital needed for further expansion, research and development, and aggressive market penetration. This injection of capital allows CoreWeave to scale its data center operations, acquire more cutting-edge GPUs, and expand its customer base.

-

Market Standing and Competitive Advantage: The partnership instantly elevates CoreWeave's market standing, establishing it as a trusted provider of cloud-based GPU computing resources with the backing of a leading technology giant. This provides a significant competitive advantage, enabling CoreWeave to attract larger clients and secure lucrative contracts.

-

Joint Initiatives: While specifics remain limited, the partnership likely involves joint projects and initiatives focused on developing and deploying advanced AI solutions. This collaboration can lead to innovation in both hardware and software, driving further growth for both companies.

CoreWeave's Position in the Booming AI Market

CoreWeave's core business model centers around providing cloud-based GPU computing resources, perfectly positioned to capitalize on the explosive growth of the AI market.

-

Meeting AI Demand: The demand for high-performance computing (HPC) resources is skyrocketing, driven by the increasing adoption of AI, machine learning, and deep learning technologies across various industries. CoreWeave's infrastructure is specifically designed to meet this demand.

-

Competitive Advantages: CoreWeave benefits from several key competitive advantages. Its infrastructure boasts exceptional scalability, allowing it to quickly adapt to changing demand. It also offers cost-effectiveness compared to building and maintaining in-house HPC infrastructure, making it an attractive option for businesses of all sizes. The company’s specialized infrastructure, optimized for GPU-intensive workloads, provides a further edge.

-

Leveraging AI Advancements: CoreWeave actively leverages AI advancements to improve its own services, including predictive maintenance for its data centers and optimized resource allocation for enhanced efficiency. This commitment to innovation attracts customers seeking cutting-edge technology.

-

Beyond Nvidia: While the Nvidia partnership is significant, CoreWeave is also forging relationships with other prominent AI companies. These partnerships further diversify its revenue streams and solidify its position within the ecosystem.

Analyzing CoreWeave's Financial Performance and Future Outlook

While detailed financial information may be limited publicly, CoreWeave’s growth trajectory is promising.

-

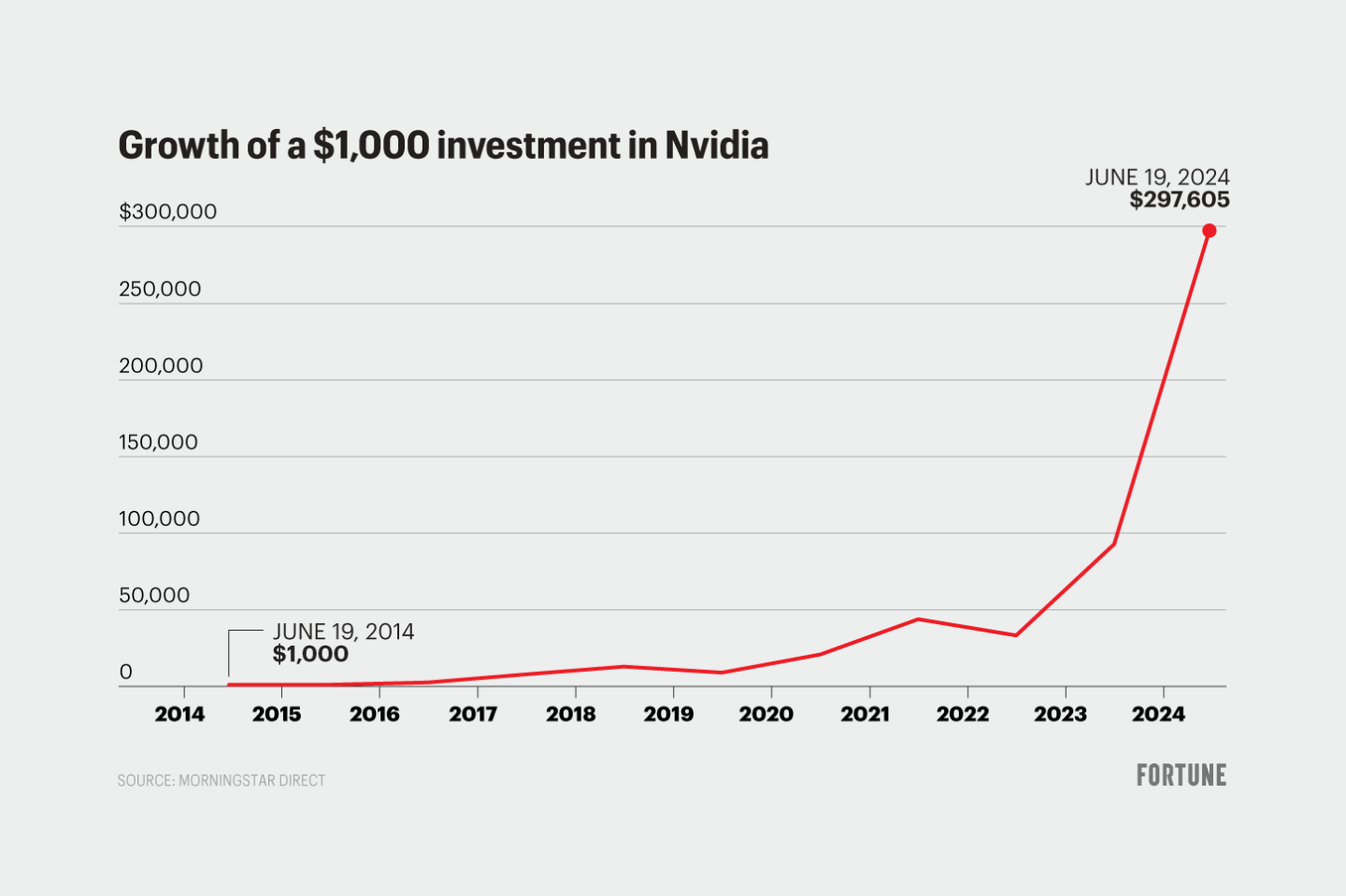

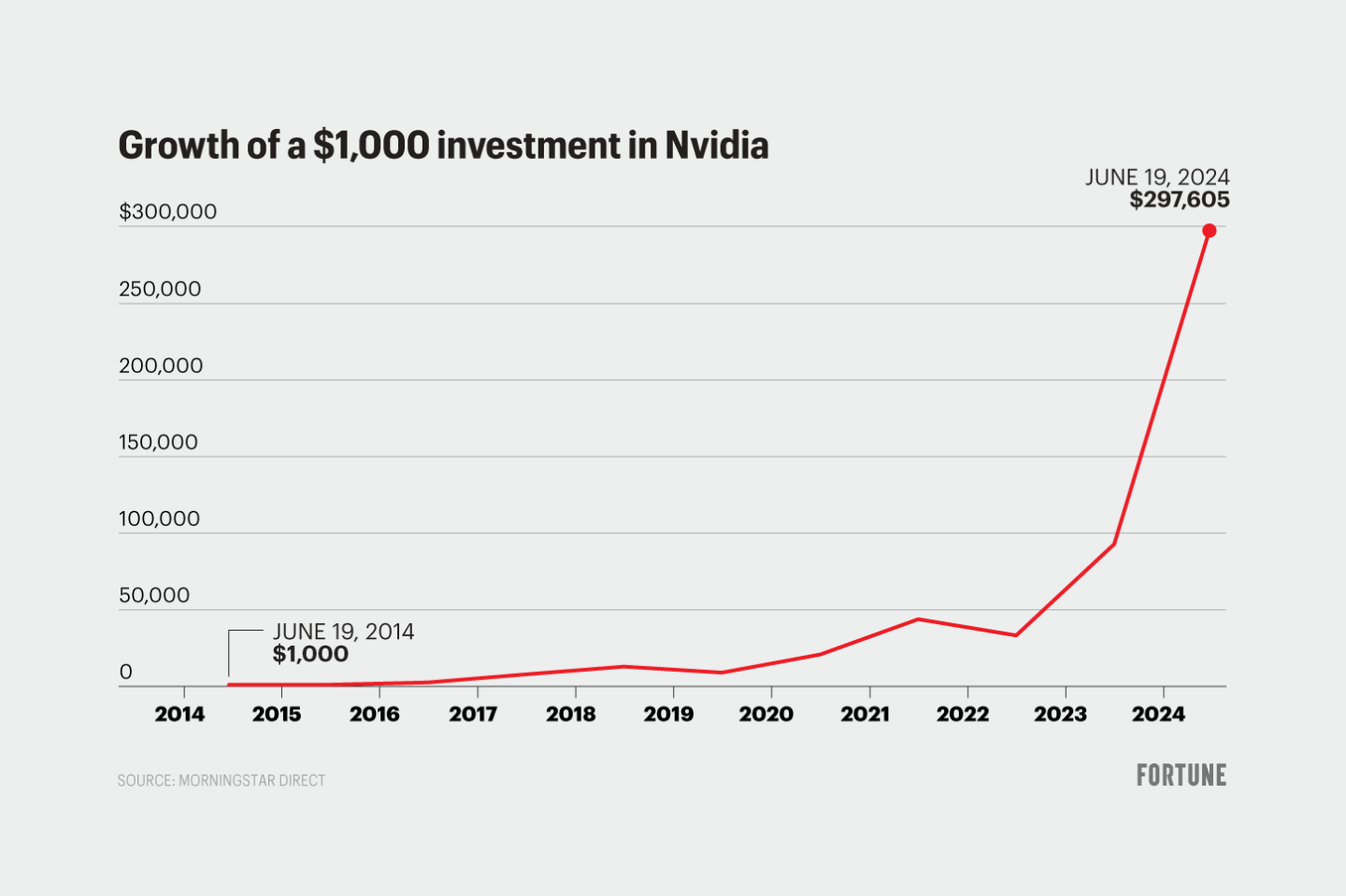

Financial Metrics: Analyzing available revenue figures and growth rates provides a glimpse into CoreWeave's financial strength. The Nvidia investment and strategic partnerships suggest a healthy upward trend in revenue and profitability.

-

Future Revenue Growth: The burgeoning AI market presents immense opportunities for CoreWeave. As AI adoption continues to accelerate across various sectors, the demand for CoreWeave's services is expected to increase significantly.

-

Stock Valuation and Potential: The current stock valuation reflects the market's perception of CoreWeave's growth potential. However, it’s essential to remember that stock prices are subject to market volatility.

-

Risks and Challenges: While the outlook is positive, CoreWeave faces potential risks. Increased competition, rapid technological advancements, and market fluctuations pose challenges. Careful consideration of these risks is crucial for potential investors.

-

Future Outlook: The future outlook for CRWV stock is promising, given its strong positioning in a high-growth market. However, investors should proceed with caution, carefully weighing the potential rewards against the inherent risks associated with any investment in a relatively new company in a rapidly evolving technology sector.

Conclusion

The Nvidia investment has significantly propelled CoreWeave (CRWV) into the spotlight, positioning it as a major player in the rapidly expanding AI and cloud computing markets. Its robust business model, strategic partnerships, and the increasing demand for high-performance computing make it a compelling investment opportunity. However, investors should carefully consider the associated risks before making any investment decisions. Learn more about CoreWeave (CRWV) stock and its potential for continued growth. Conduct thorough research and consult with a financial advisor before making any investment decisions related to CRWV or similar cloud computing and AI-focused companies. Understanding the CoreWeave investment landscape is crucial for navigating this dynamic sector.

Featured Posts

-

Tikkie En Uw Bankrekening Een Complete Handleiding

May 22, 2025

Tikkie En Uw Bankrekening Een Complete Handleiding

May 22, 2025 -

Google Ai Smart Glasses Prototype A User Perspective

May 22, 2025

Google Ai Smart Glasses Prototype A User Perspective

May 22, 2025 -

Port Du Crucifix A Clisson Un College Au C Ur D Une Polemique

May 22, 2025

Port Du Crucifix A Clisson Un College Au C Ur D Une Polemique

May 22, 2025 -

Mas Alla Del Arandano El Superalimento Clave Para Prevenir Enfermedades Cronicas

May 22, 2025

Mas Alla Del Arandano El Superalimento Clave Para Prevenir Enfermedades Cronicas

May 22, 2025 -

Abn Amro Aex Prestaties Na Publicatie Kwartaalcijfers

May 22, 2025

Abn Amro Aex Prestaties Na Publicatie Kwartaalcijfers

May 22, 2025

Latest Posts

-

Dropout Kings Singer Adam Ramey Dies At 31

May 22, 2025

Dropout Kings Singer Adam Ramey Dies At 31

May 22, 2025 -

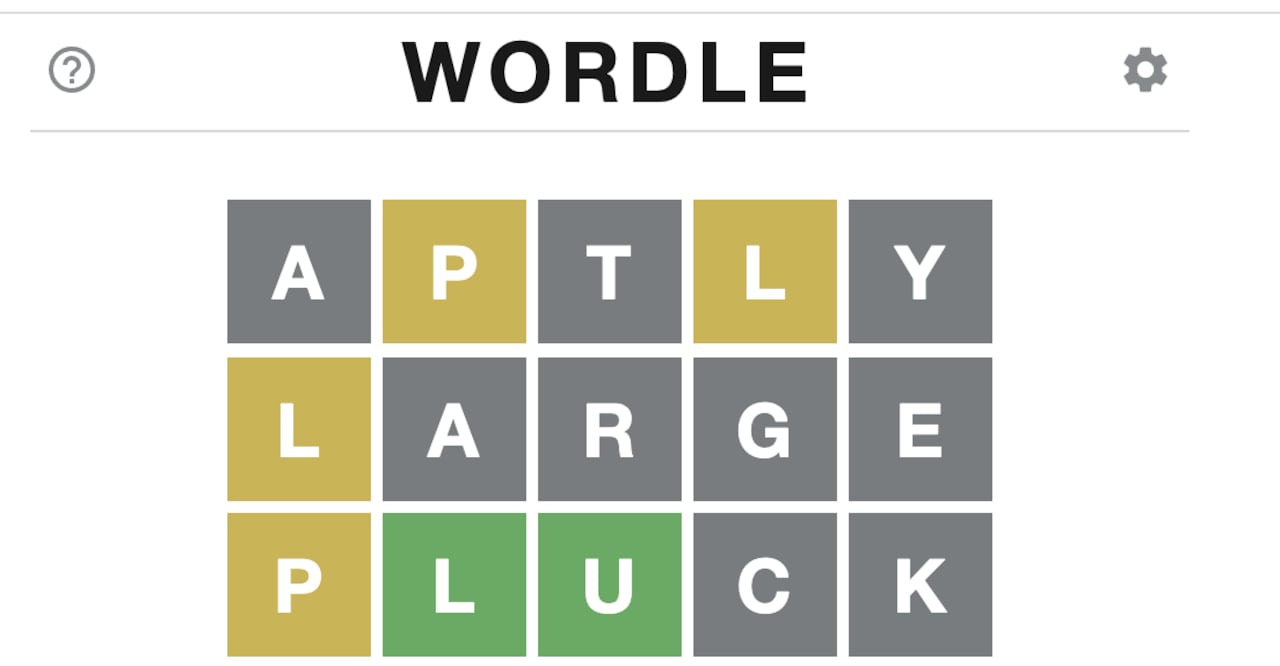

Solve Wordle 363 Hints Clues And Answer For March 13th

May 22, 2025

Solve Wordle 363 Hints Clues And Answer For March 13th

May 22, 2025 -

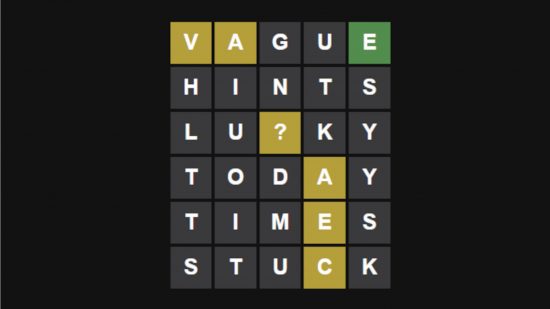

Wordle 1356 Solution Hints For March 6th Game

May 22, 2025

Wordle 1356 Solution Hints For March 6th Game

May 22, 2025 -

Wordle 363 Hints And Answer For March 13th Thursday

May 22, 2025

Wordle 363 Hints And Answer For March 13th Thursday

May 22, 2025 -

Dropout Kings Lose Singer Adam Ramey To Suicide At 31

May 22, 2025

Dropout Kings Lose Singer Adam Ramey To Suicide At 31

May 22, 2025