CoreWeave Inc. (CRWV) Soared: Reasons Behind Thursday's Stock Increase

Table of Contents

Strong Financial Performance and Earnings Reports

One of the primary drivers behind the CoreWeave Inc. (CRWV) stock increase was likely the company's robust financial performance. While specific figures require referencing official reports (we recommend checking CoreWeave's investor relations page for the latest data), positive indicators such as exceeding earnings expectations, robust revenue growth, and healthy cash flow are typically significant boosts to investor confidence. These positive financial results signal a healthy and growing business, making CRWV stock more attractive to investors.

- Quarterly/Annual Report Figures: Look for details on revenue growth percentages, net income, and earnings per share (EPS) compared to previous periods. Significant improvements in these key metrics often translate to increased stock value.

- Comparison to Previous Quarters/Years: Year-over-year and quarter-over-quarter comparisons are crucial. Sustained growth demonstrates a consistent upward trajectory, bolstering investor confidence in the long-term prospects of CRWV.

- Analyst Ratings and Upgrades: Positive analyst ratings and upgrades from reputable financial institutions often precede a stock price increase. These ratings reflect expert opinions on the company's future performance and can significantly influence investor decisions.

- Positive Outlook for Future Financial Performance: Forward-looking statements from company executives and analysts about anticipated growth contribute to the positive sentiment surrounding the CRWV stock increase.

Strategic Partnerships and Business Developments

Strategic partnerships and key business developments frequently contribute to stock price increases. For CoreWeave, new collaborations could significantly impact its market position and revenue streams, leading to investor enthusiasm.

- Partnered Companies and Collaboration Nature: Identifying the partners involved and the specifics of the collaborations (e.g., technology licensing, joint ventures) provides crucial context.

- Benefits for CoreWeave: Analyzing the potential benefits, such as increased market share, access to new technologies, or expansion into new markets, helps illustrate the positive impact of these partnerships on CoreWeave's growth trajectory.

- Impact on Revenue Streams and Market Position: The projected increase in revenue and improved competitive positioning stemming from these partnerships are key factors that influence investor sentiment and contribute to the CoreWeave Inc. (CRWV) stock increase.

Growing Demand for Cloud Computing and AI Services

The broader market trend of increasing demand for cloud computing and AI services is a significant tailwind for CoreWeave. As a provider of GPU-accelerated cloud computing, CoreWeave is uniquely positioned to benefit from this explosive growth.

- Cloud Computing Market Growth Statistics: Highlighting the impressive growth rates of the cloud computing market provides context for CoreWeave's success.

- CoreWeave's Specialization in GPU-Accelerated Cloud Computing: Emphasize CoreWeave's specialization and its importance in the AI revolution, where powerful GPUs are essential for training and deploying AI models.

- Increasing Demand for AI Solutions: The burgeoning demand for AI solutions across various industries directly translates into increased demand for CoreWeave's services, justifying the CoreWeave Inc. (CRWV) stock increase.

Positive Analyst Sentiment and Market Speculation

Positive analyst sentiment and market speculation play a crucial role in stock price movements. Upgrades, increased price targets, and favorable media coverage can all contribute to increased investor interest.

- Specific Analysts and Ratings: Mentioning specific analysts and their ratings adds credibility and weight to the analysis.

- Summary of Positive Media Articles or Reports: Highlighting positive media coverage adds to the narrative of increased investor confidence.

- Increased Investor Interest and Trading Volume: An increase in trading volume often accompanies positive market sentiment, further amplifying the CoreWeave Inc. (CRWV) stock increase.

Potential for Long-Term Growth and Future Outlook

The CoreWeave Inc. (CRWV) stock increase suggests significant potential for long-term growth. Its focus on high-growth sectors like AI and cloud computing positions it favorably for continued expansion. However, it's crucial to acknowledge potential risks, such as increased competition and economic downturns. Careful consideration of both upsides and downsides is essential for informed investment decisions.

Conclusion

CoreWeave Inc. (CRWV)'s stock increase on Thursday is attributable to a confluence of positive factors: strong financial performance, strategic partnerships, the booming cloud computing and AI markets, and positive analyst sentiment. While short-term market volatility is inevitable, the company's strong position in a rapidly expanding sector suggests a promising future. To stay updated on the latest developments impacting the CoreWeave Inc. (CRWV) stock increase and its future performance, regularly consult financial news sources and analyst reports. Maintain a close watch on further news regarding the CoreWeave Inc. (CRWV) stock increase for a thorough understanding of this dynamic company.

Featured Posts

-

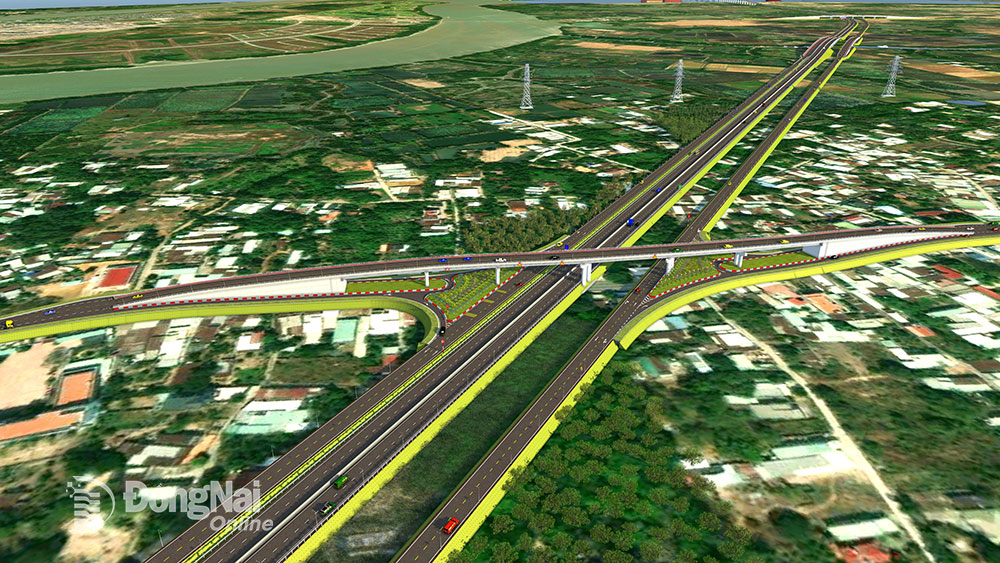

Thong Xe Cao Toc Dong Nai Vung Tau Chuan Bi Don Lan Song Du Lich Moi

May 22, 2025

Thong Xe Cao Toc Dong Nai Vung Tau Chuan Bi Don Lan Song Du Lich Moi

May 22, 2025 -

Federal Leaders Saskatchewan Visit Analysis Of Controversial Remarks

May 22, 2025

Federal Leaders Saskatchewan Visit Analysis Of Controversial Remarks

May 22, 2025 -

Peregovory O Vstuplenii Ukrainy V Nato Zayavlenie Evrokomissara

May 22, 2025

Peregovory O Vstuplenii Ukrainy V Nato Zayavlenie Evrokomissara

May 22, 2025 -

Todays News Sesame Street Joins Netflix And Other Breaking Stories

May 22, 2025

Todays News Sesame Street Joins Netflix And Other Breaking Stories

May 22, 2025 -

Hieu Ro Chuc Nang Hai Lo Vuong Nho Tren Cong Usb

May 22, 2025

Hieu Ro Chuc Nang Hai Lo Vuong Nho Tren Cong Usb

May 22, 2025

Latest Posts

-

Dropout Kings Vocalist Adam Ramey Dies By Suicide A Tragic Loss

May 22, 2025

Dropout Kings Vocalist Adam Ramey Dies By Suicide A Tragic Loss

May 22, 2025 -

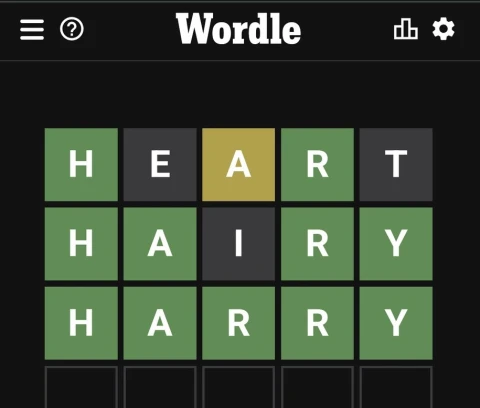

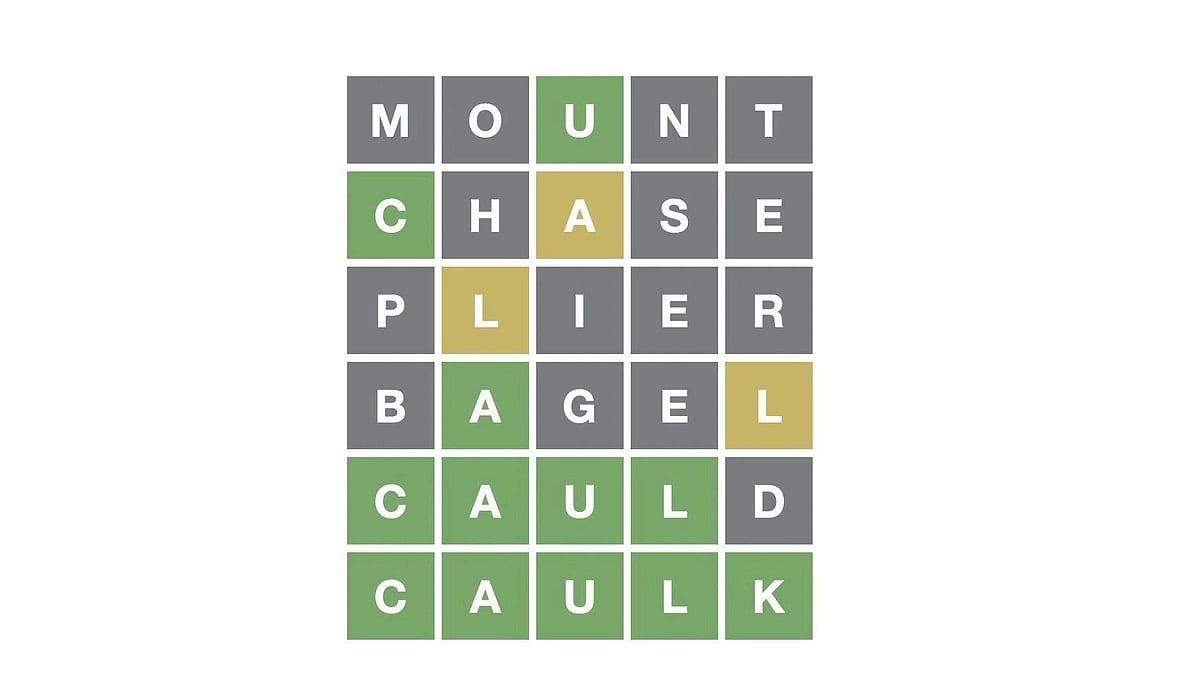

Solve Wordle 1408 April 27th Hints And The Answer

May 22, 2025

Solve Wordle 1408 April 27th Hints And The Answer

May 22, 2025 -

Wordle 1408 April 27th Hints And Solution

May 22, 2025

Wordle 1408 April 27th Hints And Solution

May 22, 2025 -

Wordle Today 1408 Hints Clues And Answer For Sunday April 27th

May 22, 2025

Wordle Today 1408 Hints Clues And Answer For Sunday April 27th

May 22, 2025 -

Wordle Game 1370 March 20th Tips Clues And Answer

May 22, 2025

Wordle Game 1370 March 20th Tips Clues And Answer

May 22, 2025