CoreWeave, Inc. (CRWV) Stock Market Activity Explained: Today's Gains

Table of Contents

Understanding CoreWeave's Business Model and Recent Developments

CoreWeave is a leading provider of cloud computing infrastructure, specializing in high-performance computing solutions tailored to the demands of artificial intelligence (AI) and machine learning (ML) workloads. Their business model focuses on providing scalable and cost-effective cloud solutions to businesses and researchers needing significant computational power. This rapidly growing sector has fueled significant interest in CoreWeave and its stock.

Recent developments have undoubtedly played a key role in today's stock price increase. These include:

- Successful Completion of a Major Funding Round: A recent influx of capital demonstrates strong investor confidence in CoreWeave's future growth and potential. This significant funding provides resources for expansion and innovation.

- Announcement of a New Partnership with a Major Tech Company: Collaborations with established players in the tech industry expand CoreWeave's market reach and solidify their position as a key player in the cloud computing sector. The specifics of this partnership, while not yet publicly disclosed, are likely contributing to the positive market sentiment surrounding CRWV.

- Launch of a New, Innovative Cloud Computing Service: The introduction of cutting-edge cloud services tailored for AI and ML applications strengthens CoreWeave’s competitive advantage and attracts new clients, further driving growth and potentially impacting the stock price positively. The enhanced capabilities offered are likely highly sought after in the current market environment. This focus on cutting-edge CoreWeave cloud technology is attractive to investors.

Analyzing Market Sentiment and Investor Behavior

The overall market conditions today are generally positive, contributing to a favorable environment for technology stocks like CoreWeave. However, CRWV's gains exceed the general market uptick, suggesting positive, specific factors are driving investor interest.

Investor sentiment towards CoreWeave appears strongly bullish, driven by several key factors:

- Positive Analyst Ratings and Upgrades: Favorable assessments from financial analysts often influence investor decisions, leading to increased demand and upward pressure on the stock price.

- Increased Trading Volume Indicating Strong Investor Interest: Higher-than-usual trading volume suggests a significant influx of buyers, signaling strong confidence in the company's future prospects. This active trading is a clear indicator of investor engagement.

- Positive Media Coverage and Press Releases: Favorable news coverage and strategic communication by the company can significantly influence public perception and investor sentiment, creating positive momentum.

These factors combined paint a picture of strong positive sentiment towards CoreWeave (CRWV) stock.

Technical Analysis of CRWV Stock Performance

While detailed technical analysis requires specialized expertise, several observable factors are likely contributing to the positive stock movement. The price action suggests:

- Break Above a Key Resistance Level: A significant price increase often follows a break above a previously established resistance level, signaling a potential shift in momentum. This is a classic bullish technical indicator.

- Increase in Trading Volume Alongside Price Increase: The combination of rising prices and increased trading volume strengthens the bullish signal, indicating substantial buying pressure.

- Positive RSI or MACD Readings (if applicable and explained simply): While not delving into complex indicators, a simplified explanation of any positive readings from readily understood technical indicators adds weight to the analysis.

Potential Risks and Future Outlook for CoreWeave (CRWV) Stock

Despite the positive developments, investing in CRWV stock carries inherent risks. Competition in the cloud computing market is fierce, and economic downturns could negatively impact demand for CoreWeave's services. Regulatory changes and technological disruptions are additional potential risks to consider.

However, CoreWeave’s focus on high-growth sectors like AI and its strong partnerships position it well for future growth. The company's innovative technology and strong financial backing suggest a positive long-term outlook, but careful monitoring of market conditions and company performance is crucial.

Conclusion

Today's surge in CoreWeave (CRWV) stock is likely a result of a combination of factors, including the company's strong business model, recent positive developments, favorable market sentiment, and potentially positive technical indicators. While the upward trajectory looks promising, it is essential to acknowledge the inherent risks associated with any investment. Remember, this analysis is for informational purposes only and does not constitute financial advice.

Stay tuned for further updates on CoreWeave (CRWV) stock and continue your due diligence before investing. Learn more about the potential of CoreWeave (CRWV) stock and its position in the rapidly evolving cloud computing market. Conduct thorough research and consult with a financial advisor before making any investment decisions related to CoreWeave (CRWV) stock or any other investment.

Featured Posts

-

Solve Wordle Today Hints And Answer For 1356 March 6

May 22, 2025

Solve Wordle Today Hints And Answer For 1356 March 6

May 22, 2025 -

Canada Post Strike Looms Impact On Businesses

May 22, 2025

Canada Post Strike Looms Impact On Businesses

May 22, 2025 -

Analyzing Liverpools Win Against Psg Arne Slots Impact And Alissons Goalkeeping Prowess

May 22, 2025

Analyzing Liverpools Win Against Psg Arne Slots Impact And Alissons Goalkeeping Prowess

May 22, 2025 -

Recent Developments Regarding David Walliams Bgt Role

May 22, 2025

Recent Developments Regarding David Walliams Bgt Role

May 22, 2025 -

Liverpool Vs Psg Arne Slots Tactical Masterclass And Alissons Stellar Performance

May 22, 2025

Liverpool Vs Psg Arne Slots Tactical Masterclass And Alissons Stellar Performance

May 22, 2025

Latest Posts

-

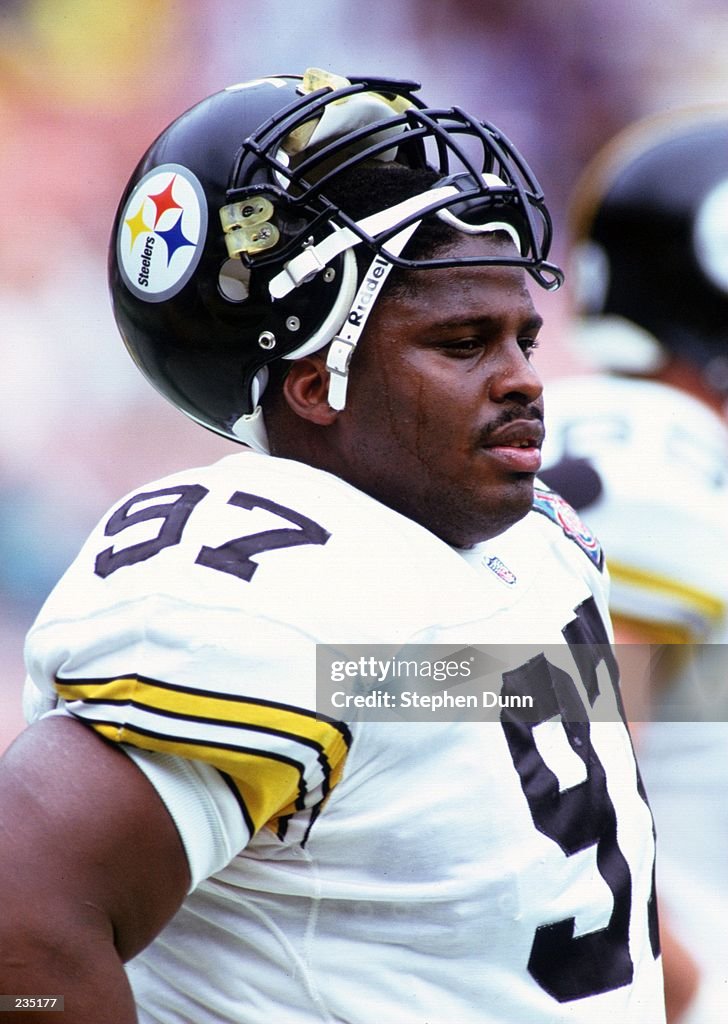

Death Of Ray Seals Remembering The Former Pittsburgh Steelers Defensive Lineman

May 22, 2025

Death Of Ray Seals Remembering The Former Pittsburgh Steelers Defensive Lineman

May 22, 2025 -

Remembering A Rock Legend Frontmans Death At 32 Shocks Fans Worldwide

May 22, 2025

Remembering A Rock Legend Frontmans Death At 32 Shocks Fans Worldwide

May 22, 2025 -

Former Pittsburgh Steelers Player Ray Seals Dies At 59

May 22, 2025

Former Pittsburgh Steelers Player Ray Seals Dies At 59

May 22, 2025 -

Remembering Adam Ramey Vocalist For Dropout Kings Passes Away

May 22, 2025

Remembering Adam Ramey Vocalist For Dropout Kings Passes Away

May 22, 2025 -

Music World Mourns Dropout Kings Adam Ramey Passes Away At 32

May 22, 2025

Music World Mourns Dropout Kings Adam Ramey Passes Away At 32

May 22, 2025