CoreWeave, Inc. (CRWV) Stock Market Performance: Analysis Of Recent Gains

Table of Contents

Strong Financial Performance and Growth Prospects

CoreWeave's recent success is strongly linked to its robust financial performance and promising growth trajectory. Let's break down the key elements:

Revenue Growth and Profitability

CRWV's financial reports reveal impressive revenue growth, fueled by the burgeoning demand for AI-powered cloud computing. While specific numbers require referencing the latest quarterly and annual reports, key metrics such as year-over-year revenue increase, net income growth, and improving operating margins should be analyzed. Visual aids like charts and graphs can effectively demonstrate this positive trend.

- Increased demand for AI-powered cloud computing: The explosive growth of artificial intelligence and machine learning is directly translating into higher demand for CRWV's specialized infrastructure, a key driver of its financial success.

- Cost structure and efficiency improvements: CRWV's ability to maintain or improve its operating margins amidst revenue growth showcases operational efficiency and cost management. Analyzing these improvements provides insights into the company's long-term profitability.

- Competitive performance: Comparing CRWV's key financial metrics (like revenue growth and profit margins) against competitors like AWS, Google Cloud, and Microsoft Azure provides valuable context and highlights its competitive standing in the market.

Strategic Partnerships and Acquisitions

Strategic partnerships and acquisitions play a significant role in CRWV's expansion and stock performance. Analyzing these collaborations reveals potential synergies and growth opportunities.

- Nature and impact of key partnerships: Identifying and analyzing CRWV's strategic partnerships with major technology companies or research institutions is crucial. These partnerships can provide access to new markets, technologies, or customer bases.

- Synergies and benefits of acquisitions: Any recent acquisitions should be examined for their potential to enhance CRWV's service offerings, expand its market reach, or improve its technological capabilities.

- Contribution to long-term growth: The long-term implications of these strategic moves should be considered, assessing their potential to drive sustained revenue growth and enhance CRWV's competitive advantage.

Market Sentiment and Investor Confidence

The positive market sentiment surrounding CRWV is driven by several factors, reflecting investor confidence in the company's future.

Increased Demand for AI Infrastructure

The world is witnessing an unprecedented surge in demand for AI infrastructure, a trend perfectly aligned with CRWV's core business.

- CRWV's role in supporting AI workloads: CRWV's specialized infrastructure is uniquely positioned to support the computationally intensive workloads required for advanced AI applications, making it a key beneficiary of this market expansion.

- Industry reports and analyst predictions: Citing industry reports and analyst forecasts that project strong growth in the AI infrastructure market further strengthens the bullish sentiment surrounding CRWV.

- Competitive landscape and market share: Analyzing CRWV's market share and competitive positioning within the AI infrastructure sector provides valuable context for understanding its growth potential and the factors influencing investor confidence.

Positive Analyst Ratings and Price Targets

Favorable analyst ratings and upward revisions of price targets are further indicators of positive market sentiment.

- Specific analyst ratings: Mentioning specific analysts and their ratings (buy, hold, sell) along with their rationale, adds credibility and transparency to the analysis.

- Rationale behind positive ratings: Understanding the reasons behind positive analyst ratings – such as strong revenue growth, improving profitability, or positive future outlook – helps investors assess the validity of these predictions.

- Range of price targets: Analyzing the range of price targets offered by various analysts provides a clearer picture of the potential upside for CRWV stock.

Potential Risks and Challenges

Despite the positive outlook, investors must acknowledge potential risks and challenges.

Competition and Market Saturation

The cloud computing and AI infrastructure market is highly competitive.

- Key competitors and their strengths/weaknesses: Identifying key competitors like AWS, Google Cloud, and Microsoft Azure and analyzing their strengths and weaknesses helps assess CRWV's competitive positioning.

- Market saturation and price wars: The potential for market saturation and the risk of price wars, which could negatively impact profitability, must be considered.

- CRWV's competitive advantage: Understanding CRWV's unique competitive advantages – such as specialized technology, strategic partnerships, or a strong focus on a particular niche – is crucial for evaluating its ability to sustain its market share.

Economic Uncertainty and Market Volatility

Macroeconomic factors significantly influence investor sentiment and stock performance.

- Impact of economic conditions: Factors like inflation, interest rates, and overall economic uncertainty can affect investor confidence and demand for cloud computing services.

- Financial resilience during economic downturns: Analyzing CRWV's financial health and its ability to withstand potential economic downturns is essential for evaluating its risk profile.

- Mitigation strategies: Understanding the strategies CRWV employs to mitigate risks associated with economic downturns – such as cost-cutting measures or diversification – adds another layer of analysis.

Conclusion

CoreWeave, Inc. (CRWV) stock's recent surge is primarily attributed to its strong financial performance, positive market sentiment fueled by the growing AI infrastructure market, and strategic partnerships. However, potential risks, such as intense competition and economic uncertainty, should not be overlooked. This analysis provides valuable insights, but conducting thorough due diligence and potentially seeking advice from a financial advisor are crucial steps before investing in CRWV stock. Stay informed about CoreWeave, Inc. (CRWV) stock and market trends for a well-rounded investment strategy.

Featured Posts

-

A Traverso Family Legacy Cannes Film Festival Photography

May 22, 2025

A Traverso Family Legacy Cannes Film Festival Photography

May 22, 2025 -

Restauration Du Patrimoine Breton Plouzane Et Clisson Beneficient De La Mission Patrimoine 2025

May 22, 2025

Restauration Du Patrimoine Breton Plouzane Et Clisson Beneficient De La Mission Patrimoine 2025

May 22, 2025 -

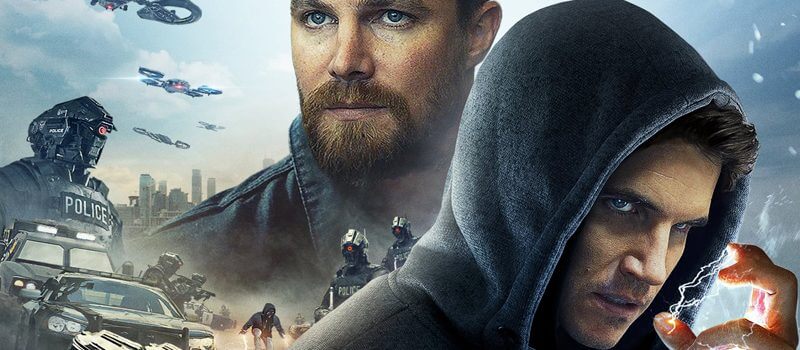

Distributie De Vis Pe Netflix Un Nou Serial Care Promite Mult

May 22, 2025

Distributie De Vis Pe Netflix Un Nou Serial Care Promite Mult

May 22, 2025 -

Five Escapees Remain At Large New Orleans Sheriff Withdraws From Reelection

May 22, 2025

Five Escapees Remain At Large New Orleans Sheriff Withdraws From Reelection

May 22, 2025 -

New Challenger Targets Trans Australia Run World Record

May 22, 2025

New Challenger Targets Trans Australia Run World Record

May 22, 2025

Latest Posts

-

Sibiga Rubio Ta Grem Rezultati Vazhlivoyi Zustrichi

May 22, 2025

Sibiga Rubio Ta Grem Rezultati Vazhlivoyi Zustrichi

May 22, 2025 -

Suspect Arrested In Murder Of Embassy Employees Lischinsky And Milgram

May 22, 2025

Suspect Arrested In Murder Of Embassy Employees Lischinsky And Milgram

May 22, 2025 -

May 2025 Netflix Releases Movies And Tv Shows

May 22, 2025

May 2025 Netflix Releases Movies And Tv Shows

May 22, 2025 -

Sibiga Zustrivsya Z Rubio Ta Gremom Detali Zustrichi Senatoriv S Sh A

May 22, 2025

Sibiga Zustrivsya Z Rubio Ta Gremom Detali Zustrichi Senatoriv S Sh A

May 22, 2025 -

New On Netflix Complete May 2025 Release List

May 22, 2025

New On Netflix Complete May 2025 Release List

May 22, 2025