CoreWeave IPO: Lower Than Expected Listing Price At $40

Table of Contents

Initial Public Offering (IPO) Pricing and Market Conditions

The CoreWeave IPO's $40 price tag fell short of expectations, raising questions about investor sentiment and the overall health of the tech market. Several factors contributed to this lower-than-anticipated valuation.

-

Lower-than-expected pricing: The pricing reflects a cautious approach by investors, potentially influenced by prevailing market uncertainty. This contrasts with earlier estimations that suggested a higher valuation. The discrepancy needs further investigation to understand the market's perception of CoreWeave's risk profile.

-

Market volatility: The current macroeconomic environment, marked by high inflation and subsequent interest rate hikes, has injected considerable volatility into the stock market. This uncertainty has negatively impacted the valuations of many tech companies, including CoreWeave, creating a challenging climate for IPOs. This general market downturn has undoubtedly influenced the final pricing.

-

Investor skepticism: Some investors expressed reservations about CoreWeave's long-term profitability and its reliance on specific technologies. Concerns about the sustainability of its business model in a rapidly evolving market may have contributed to the lower-than-expected IPO price. A detailed analysis of the company's financials and future projections is crucial in addressing these concerns.

-

Comparison to competitors: Comparing CoreWeave's IPO valuation to established players like AWS, Azure, and Google Cloud provides valuable context. A comparative analysis reveals CoreWeave's position within the competitive landscape and helps explain the pricing strategy adopted. This comparison highlights the challenges of competing in a market dominated by large, established players.

CoreWeave's Business Model and Financial Performance

CoreWeave's business model and financial performance played a significant role in determining its IPO price. Understanding these aspects is essential for assessing its investment potential.

-

Focus on GPU computing: CoreWeave's specialization in GPU-accelerated cloud computing positions it within a rapidly growing niche. However, the market's maturity and the presence of established competitors need careful consideration. The demand for GPU computing is increasing, but competition is fierce.

-

Revenue growth and profitability: Analyzing CoreWeave's historical revenue growth and its projected path to profitability is critical. Sustained revenue growth is a key indicator of a company's long-term health and potential for return on investment. Profitability, or the lack thereof, significantly impacts investor confidence.

-

Customer acquisition and retention: CoreWeave's ability to attract and retain high-value customers is a crucial factor. A strong customer base translates to stable revenue streams and a more resilient business. Customer churn and acquisition costs are important metrics to consider.

-

Technological advancements and innovation: CoreWeave's commitment to innovation and technological leadership is crucial for maintaining a competitive advantage. Its ability to adapt to changing market demands and introduce cutting-edge technologies will directly impact its future success and valuation. Investment in R&D is a positive indicator of future growth.

Implications for Investors and the Future of CoreWeave

The lower-than-expected IPO price has significant implications for both short-term and long-term investors.

-

Short-term outlook: The $40 price might present a buying opportunity for some investors who believe the market has undervalued CoreWeave. However, others may adopt a wait-and-see approach, monitoring the company's performance before making any investment decisions.

-

Long-term potential: CoreWeave's long-term success depends on its execution of its business plan and its ability to navigate the competitive cloud computing market. Its potential for growth hinges on technological innovation, market expansion, and consistent financial performance.

-

Risk assessment: Investing in CoreWeave entails inherent risks, considering the current market conditions and the company's relatively early stage of development. A thorough risk assessment is essential before committing capital.

-

Growth prospects: CoreWeave's future growth hinges on factors such as market demand for GPU computing, its ability to secure and retain key clients, and its capacity to innovate and adapt to technological advancements. A comprehensive analysis of these factors is crucial for assessing the investment opportunity.

Conclusion

The CoreWeave IPO, priced at $40 per share, presents a complex scenario reflecting the interplay between market conditions, investor sentiment, and the company's financial performance. While the lower-than-expected price might appear attractive to some, a thorough understanding of CoreWeave's business model, its financial health, and its potential for growth is crucial for any potential investor. Careful consideration of the competitive landscape and market volatility is essential before making any investment decisions related to the CoreWeave IPO. Continue monitoring the CoreWeave IPO and its impact on the broader cloud computing sector for informed decision-making.

Featured Posts

-

Puede Javier Baez Recuperar Su Productividad Analisis De Su Salud Y Futuro

May 22, 2025

Puede Javier Baez Recuperar Su Productividad Analisis De Su Salud Y Futuro

May 22, 2025 -

Thames Waters Executive Bonuses Performance Vs Reward

May 22, 2025

Thames Waters Executive Bonuses Performance Vs Reward

May 22, 2025 -

Significant Drop In Bp Chief Executives Salary Down 31

May 22, 2025

Significant Drop In Bp Chief Executives Salary Down 31

May 22, 2025 -

Exclusive Ford And Nissan Collaborate On Battery Plant Amidst Ev Slowdown

May 22, 2025

Exclusive Ford And Nissan Collaborate On Battery Plant Amidst Ev Slowdown

May 22, 2025 -

Record Breaking Run Man Fastest To Cross Australia On Foot

May 22, 2025

Record Breaking Run Man Fastest To Cross Australia On Foot

May 22, 2025

Latest Posts

-

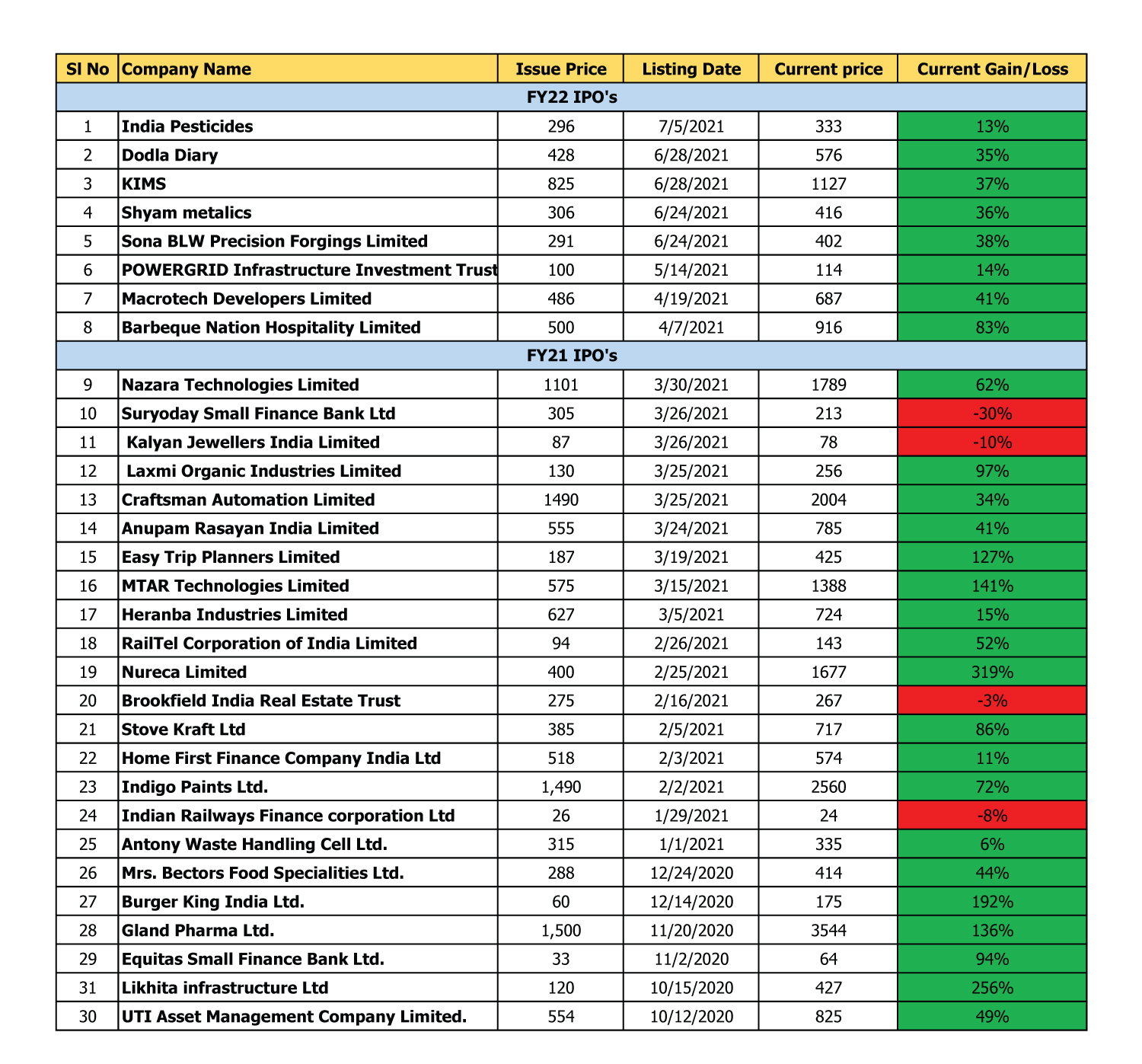

Significant Drop In Virginia Gas Prices 50 Cents Less Per Gallon

May 22, 2025

Significant Drop In Virginia Gas Prices 50 Cents Less Per Gallon

May 22, 2025 -

Analysis Gas Prices Soar By Almost 20 Cents

May 22, 2025

Analysis Gas Prices Soar By Almost 20 Cents

May 22, 2025 -

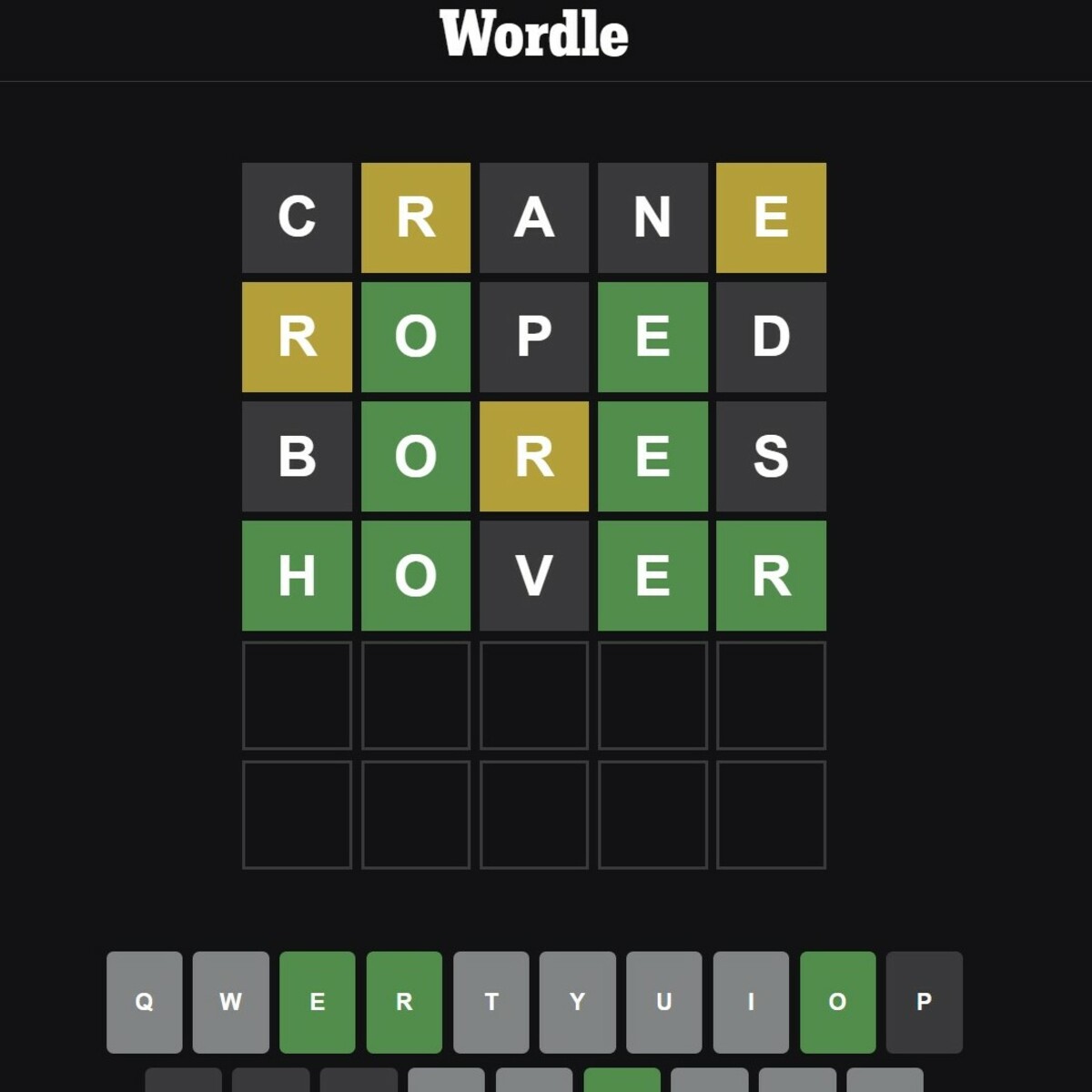

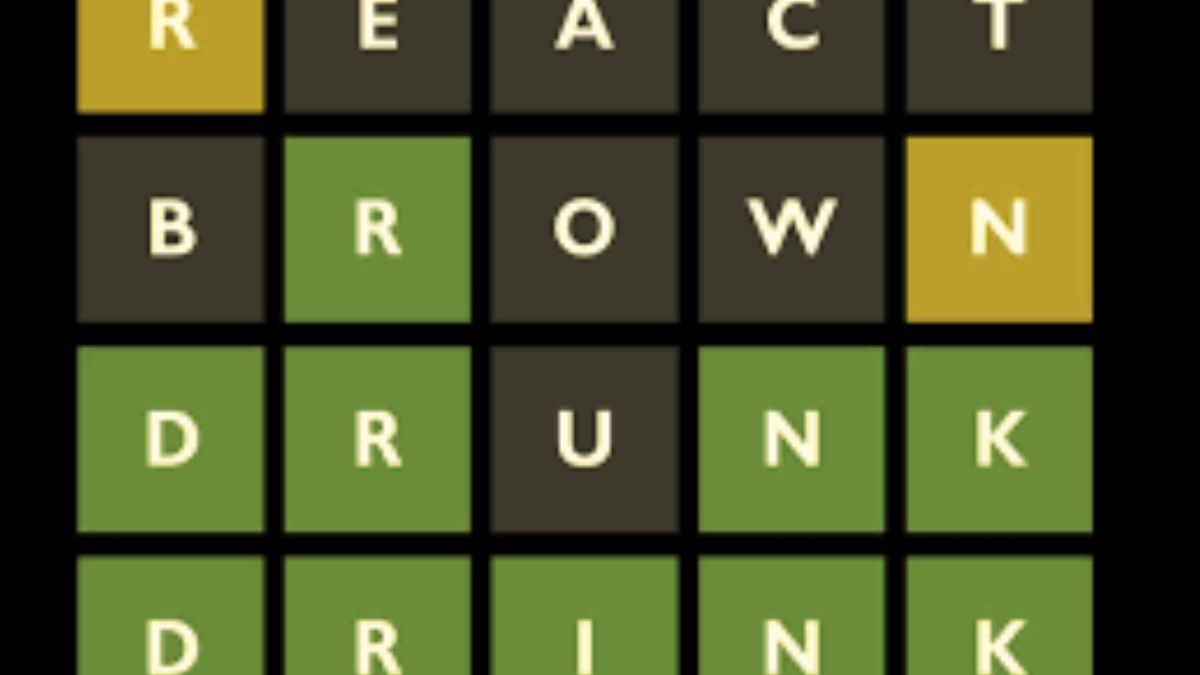

Wordle Help Hints And Answer For April 8th 1389

May 22, 2025

Wordle Help Hints And Answer For April 8th 1389

May 22, 2025 -

Wordle 367 March 17 Clues And Solution

May 22, 2025

Wordle 367 March 17 Clues And Solution

May 22, 2025 -

Significant Increase In Gas Prices Nearly 20 Cents Per Gallon

May 22, 2025

Significant Increase In Gas Prices Nearly 20 Cents Per Gallon

May 22, 2025