Corporate Earnings: The Solid Present And Uncertain Future

Table of Contents

Current State of Corporate Earnings: A Strong Performance?

Recent corporate earnings reports paint a mixed picture. While some sectors are thriving, others are facing significant headwinds. Companies in the technology and consumer staples sectors, for instance, have generally shown strong performance, fueled by robust consumer spending and supply chain improvements. However, sectors heavily reliant on discretionary spending, such as travel and hospitality, are still recovering from the pandemic's impact and are facing inflationary pressures.

Key factors contributing to the current state of corporate earnings include:

- Strong Consumer Spending: Despite rising inflation, consumer spending remains relatively resilient in many regions, boosting revenue for numerous companies.

- Supply Chain Improvements: While not fully resolved, supply chain disruptions have eased significantly in many sectors, leading to improved production and reduced costs.

- Government Policies: Government policies, including infrastructure spending and tax incentives, have had varying impacts on different sectors, affecting profitability accordingly.

- Inflation and its Effect on Profitability: Inflation has squeezed profit margins for many companies, forcing them to implement pricing strategies to offset increased input costs. This has impacted earnings per share (EPS) for some.

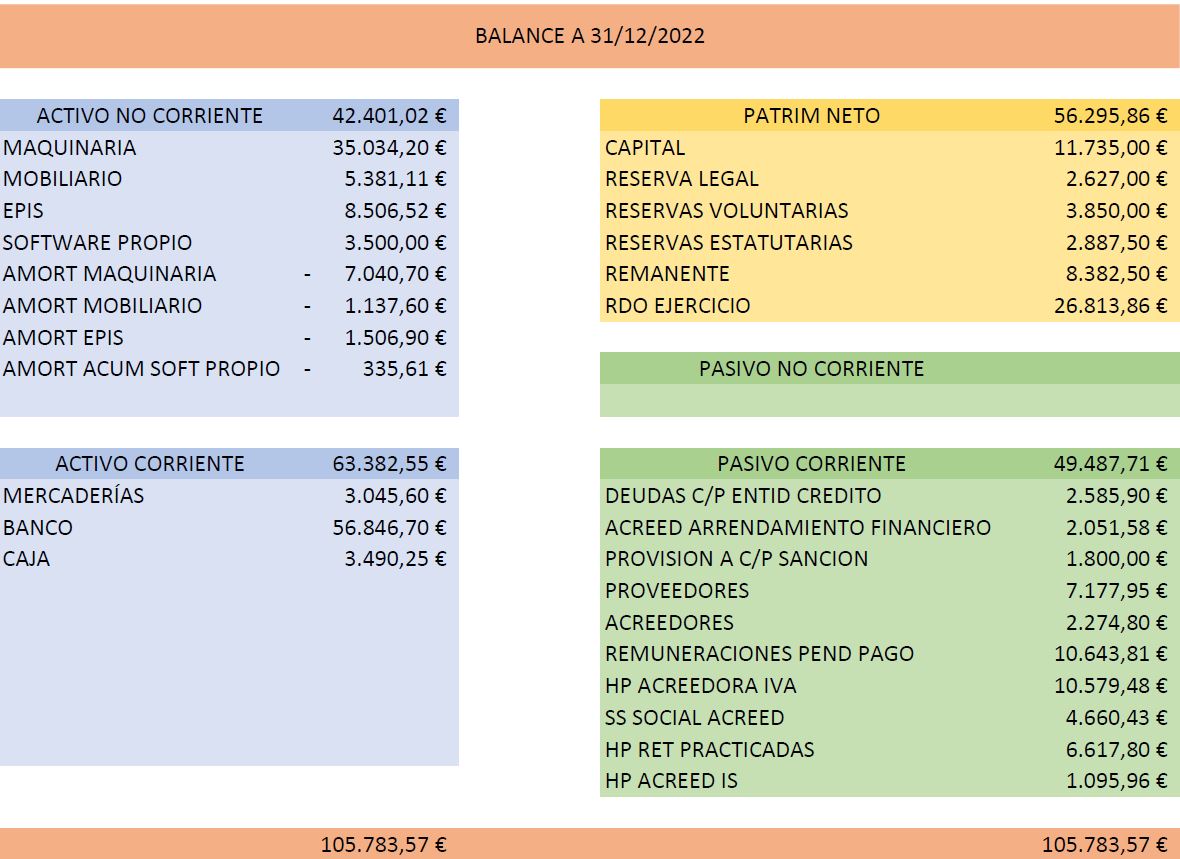

The following chart illustrates the trend in overall corporate earnings growth over the past year, highlighting the variation in sector performance:

[Insert a chart or graph here showing corporate earnings growth across various sectors. The chart should clearly label axes and data sources.]

Analyzing revenue growth and profit margins across various sectors reveals a nuanced picture of corporate earnings. While some companies have exhibited impressive EPS growth, others are grappling with reduced profitability due to macroeconomic headwinds.

Factors Shaping the Future of Corporate Earnings: Navigating Uncertainty

Predicting the future of corporate earnings requires considering a multitude of macroeconomic factors:

- Global Economic Slowdown: The possibility of a global recession continues to loom, posing a significant risk to corporate earnings growth. Economic forecasts vary widely, creating significant market volatility.

- Interest Rate Hikes: Central banks globally are raising interest rates to combat inflation. This increases borrowing costs for businesses, potentially impacting investment and expansion plans.

- Geopolitical Risks: Geopolitical instability, such as the war in Ukraine, creates significant uncertainty, affecting supply chains, energy prices, and market sentiment.

- Technological Disruptions: Rapid technological advancements create both opportunities and challenges. Companies that fail to adapt risk losing market share and profitability.

The Role of Technology in Reshaping Corporate Earnings

Technological advancements are profoundly reshaping corporate earnings. Artificial intelligence (AI), automation, and digital transformation are driving increased efficiency and productivity for some, leading to higher profit margins. However, companies struggling to adapt to these changes may face declining profitability and even obsolescence. The automotive industry, for instance, is undergoing a significant transformation with the rise of electric vehicles, impacting traditional automakers differently than tech-focused companies.

Strategies for Navigating Uncertain Corporate Earnings

Companies need robust strategies to mitigate risks and enhance future earnings in this uncertain environment:

- Diversification of Revenue Streams: Reducing reliance on single products or markets makes companies more resilient to economic shocks.

- Investment in Innovation and R&D: Investing in research and development is crucial for developing new products and services and staying ahead of the competition.

- Efficient Cost Management and Operational Excellence: Streamlining operations and improving efficiency are essential for maximizing profitability.

- Talent Acquisition and Retention Strategies: Attracting and retaining skilled employees is crucial for maintaining a competitive edge. This includes robust risk management strategies, strategic planning, and accurate financial forecasting.

Conclusion: Understanding and Preparing for the Future of Corporate Earnings

While current corporate earnings show relative strength in certain sectors, the future is far from certain. Macroeconomic factors, technological disruptions, and geopolitical risks all present significant challenges. Understanding these factors and implementing proactive strategies are critical for success. Companies must embrace innovation, optimize operations, and diversify their revenue streams to navigate the evolving landscape.

Stay ahead of the curve by regularly monitoring corporate earnings reports and adapting your investment or business strategies accordingly. Understanding corporate earnings is crucial for success in today’s dynamic market. Analyzing key performance indicators like revenue growth, profit margins, and earnings per share (EPS) will be essential to navigating the complexities of the future corporate earnings landscape.

Featured Posts

-

Kyriaki 16 Martioy Odigos Tileoptikon Metadoseon

May 30, 2025

Kyriaki 16 Martioy Odigos Tileoptikon Metadoseon

May 30, 2025 -

Ticketmaster Vista Previa Del Asiento Con Su Nuevo Venue Virtual

May 30, 2025

Ticketmaster Vista Previa Del Asiento Con Su Nuevo Venue Virtual

May 30, 2025 -

Alexander Gustafsson Jon Jones Isnt Scared But Aware Of Aspinalls Danger

May 30, 2025

Alexander Gustafsson Jon Jones Isnt Scared But Aware Of Aspinalls Danger

May 30, 2025 -

Vil Kasper Dolberg Na 35 Mal En Dybdegaende Diskussion

May 30, 2025

Vil Kasper Dolberg Na 35 Mal En Dybdegaende Diskussion

May 30, 2025 -

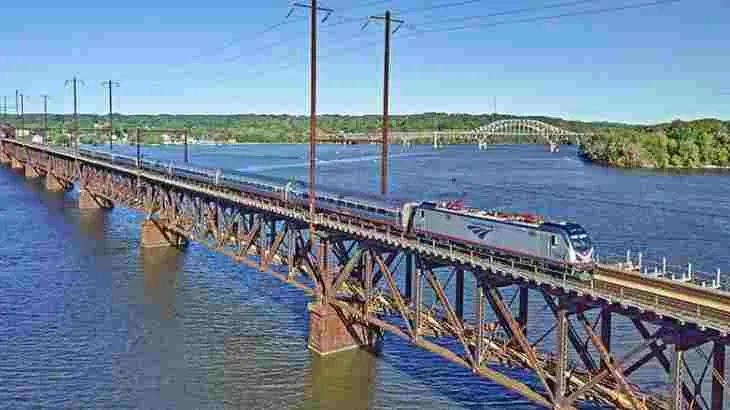

Susquehanna River Assault Case Advances To Trial

May 30, 2025

Susquehanna River Assault Case Advances To Trial

May 30, 2025