Could You Be Due An HMRC Refund? A Payslip Check Could Reveal Thousands

Table of Contents

Common Reasons for HMRC Underpayments and Missed Refunds

Several factors can lead to unintentional overpayment of tax and missed opportunities for an HMRC refund. Understanding these common reasons is the first step in identifying potential discrepancies on your payslips.

Tax Code Errors

Incorrect tax codes are a frequent cause of overpaid tax. Your tax code determines how much income tax is deducted from your salary. An incorrect code can result in too much tax being taken, leading to a significant HMRC refund.

- Examples of common tax code errors: Incorrect digits, missing letters, codes not updated after life changes (marriage, children).

- How to identify them on payslips: Look for your tax code clearly stated on each payslip. Compare it to the code HMRC issued to you. If you're unsure, contact HMRC directly for clarification.

- Further information:

National Insurance Contributions (NIC) Overpayments

Overpaying National Insurance Contributions is another common scenario resulting in a potential HMRC refund. Various circumstances can lead to this.

- Scenarios leading to NIC overpayment: Errors in your employment details, incorrect calculation of NICs based on your earnings, changes in employment status not properly reflected.

- Ways to verify on payslips: Check the amount deducted for NICs on each payslip and compare it to your earnings. Look for any inconsistencies over time.

- Relevant legislation/HMRC guidance:

Salary Sacrifice Schemes

Salary sacrifice schemes, where you exchange part of your salary for a non-cash benefit (e.g., pension contributions), can sometimes lead to errors in tax and NIC calculations.

- Examples of potential errors: Incorrect application of tax relief, discrepancies between the sacrificed amount and the benefit received.

- How to check payslips for discrepancies: Carefully compare your gross pay, net pay, and the deductions for the salary sacrifice scheme on your payslips. Look for any inconsistencies.

- External resources:

Marriage Allowance and Other Tax Reliefs

Many taxpayers are unaware of or don't claim tax reliefs they're entitled to, including the marriage allowance. This can lead to unnecessary tax payments.

- Eligibility criteria for marriage allowance and other relevant reliefs: Check HMRC's website for detailed eligibility criteria for various tax reliefs.

- Where to find this information on payslips: Your payslip may not directly show if you’re receiving these reliefs, but you can use your payslip data to check if you’re eligible.

- Links to HMRC's official pages: and other relevant tax relief pages.

How to Check Your Payslips for Potential HMRC Refunds

Checking your payslips systematically is crucial for identifying potential HMRC underpayments. This section provides a step-by-step approach.

Understanding Your Payslip Components

Familiarize yourself with the key components of your payslip.

- Step-by-step guide on interpreting payslip data: Look for your gross pay (total earnings before deductions), income tax deducted, and NICs deducted. Compare these figures with your contract of employment.

- Visual aid: [Insert a sample payslip image with key areas highlighted].

Comparing Payslips Over Time

Inconsistencies across your payslips might indicate errors.

- Tips on comparing data across different payslips: Check for sudden changes in tax or NIC deductions. Look for patterns or inconsistencies in the amounts deducted over time.

Using Online Payslip Access

Online payslip access provides convenient comparison and storage.

- Advantages of using online systems: Easier access, ability to download and store payslips electronically, better organization.

- How to access and download payslips digitally: Follow your employer's instructions for accessing your online payslip portal.

Claiming Your HMRC Refund: A Step-by-Step Guide

Once you've identified a potential HMRC underpayment, follow these steps to claim your refund.

Gathering Necessary Documentation

Prepare the necessary documents for a smooth claim process.

- Detailed checklist of what to prepare: Payslips for the relevant tax year(s), P60s, proof of any relevant tax reliefs (e.g., marriage allowance certificate).

Submitting Your Claim Online

HMRC provides an online portal for claiming refunds.

- Step-by-step instructions with screenshots (if possible): . Guide the user through the process, step by step.

Contacting HMRC Directly

If you encounter any issues, contact HMRC for assistance.

- Different contact methods: Phone, email, post. Include details of your query, relevant dates, and payslip references.

Secure Your HMRC Refund Today

This article has highlighted common reasons for HMRC underpayments, including tax code errors, NIC overpayments, salary sacrifice scheme discrepancies, and overlooked tax reliefs. Checking your payslips thoroughly is crucial for identifying potential HMRC refunds. Many people are owed thousands of pounds that they could easily reclaim! Don't miss out on your potential HMRC refund! Check your payslips now and claim what’s rightfully yours. Start your HMRC refund claim today!

Featured Posts

-

Schumachers Cadillac Future A World Champion Weighs In

May 20, 2025

Schumachers Cadillac Future A World Champion Weighs In

May 20, 2025 -

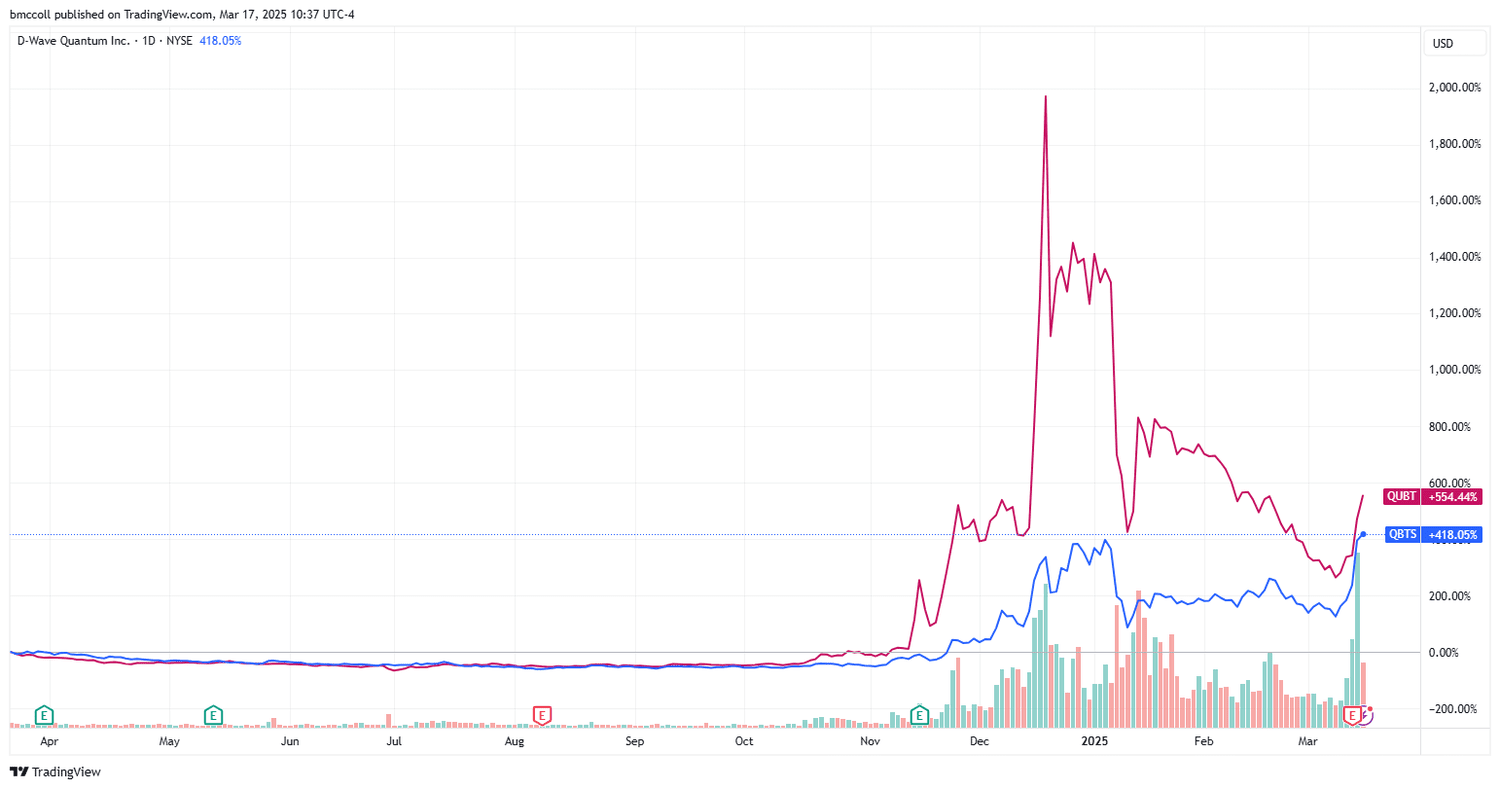

D Wave Quantum Qbts Stock Soars Understanding The Market Rally

May 20, 2025

D Wave Quantum Qbts Stock Soars Understanding The Market Rally

May 20, 2025 -

Investigating The Increase In Femicide Cases

May 20, 2025

Investigating The Increase In Femicide Cases

May 20, 2025 -

I Kakodaimonia Ton Sidirodromon Istoriki Anadromi Kai Prooptikes

May 20, 2025

I Kakodaimonia Ton Sidirodromon Istoriki Anadromi Kai Prooptikes

May 20, 2025 -

D Wave Quantum Qbts Stock Mondays Market Movement Explained

May 20, 2025

D Wave Quantum Qbts Stock Mondays Market Movement Explained

May 20, 2025