Court Case: Trump's Tariffs Immune To Judicial Scrutiny

Table of Contents

The Basis of the Tariffs and the Legal Challenges

The Trump administration implemented sweeping tariffs, primarily under Section 301 of the Trade Act of 1974, citing national security concerns and unfair trade practices by China and other countries. This section grants the President broad authority to take action against foreign countries engaging in practices deemed harmful to US interests. However, these tariffs immediately faced numerous legal challenges.

-

Challenges based on exceeding presidential authority: Several lawsuits argued that the Trump administration exceeded its authority under Section 301, claiming the tariffs were not justified by legitimate national security or trade concerns, but rather were motivated by protectionist aims.

-

Arguments concerning violation of international trade agreements (WTO): The tariffs triggered complaints from other countries, leading to disputes within the World Trade Organization (WTO). Challengers argued that the tariffs violated WTO rules and principles of fair trade.

-

Claims of economic harm to specific industries: Many US businesses, particularly those reliant on imported goods affected by the tariffs, filed lawsuits claiming significant economic harm due to increased costs and reduced competitiveness.

-

Constitutional challenges to the tariff imposition process: Some legal challenges questioned the constitutionality of the process used to impose the tariffs, arguing a lack of sufficient due process or transparency.

The "Political Question" Doctrine and its Application

A significant hurdle in challenging the Trump tariffs has been the "political question" doctrine. This legal principle holds that certain issues, particularly those involving foreign policy and national security, are best left to the political branches of government (the executive and legislative branches) rather than the courts.

-

Definition and historical application of the political question doctrine: The doctrine prevents courts from interfering in matters deemed inherently political, often involving complex policy judgments best made by elected officials. Its application in past tariff disputes has varied, with courts sometimes deferring to executive branch decisions.

-

Arguments for and against applying the doctrine to Trump's tariffs: Supporters of applying the doctrine argue that trade policy is inherently political and complex, involving considerations of national security and international relations. Opponents argue that the tariffs cause significant economic harm and violate established laws, necessitating judicial intervention.

-

Analysis of relevant Supreme Court precedents: Supreme Court precedents on the political question doctrine provide little clear guidance on the specific context of trade policy. The Court's interpretation often hinges on the specific facts of each case.

-

Potential implications of court decisions: If courts consistently apply the political question doctrine, it could significantly limit the ability of businesses and other stakeholders to challenge future trade policies through the courts.

The Impact of Court Decisions on Future Trade Policy

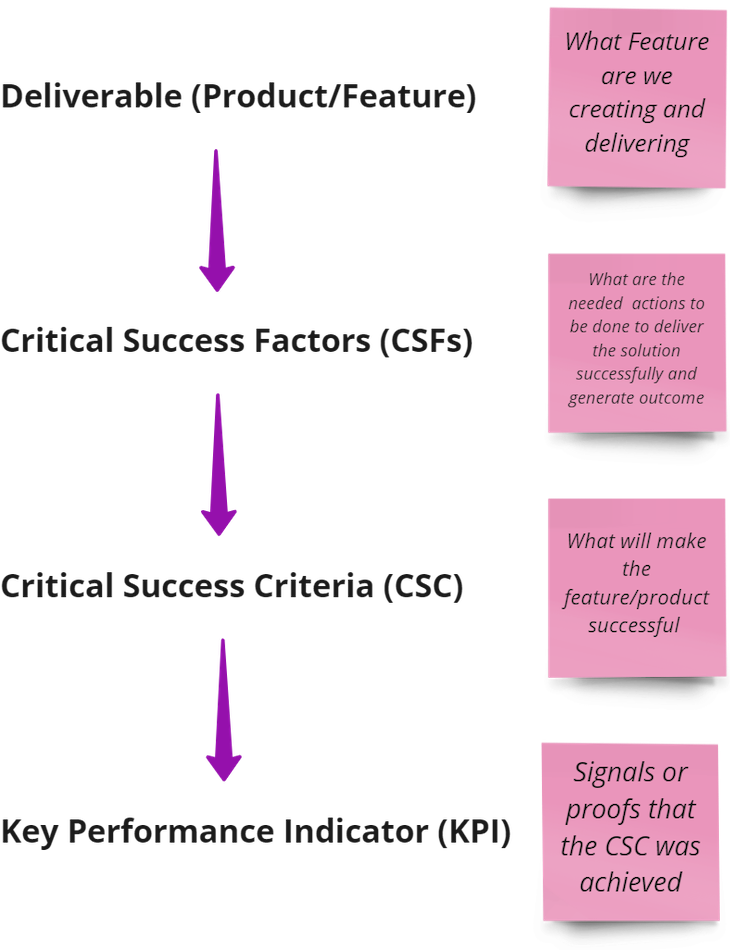

The outcome of legal challenges to Trump's tariffs will have far-reaching implications for future trade policy and presidential authority.

-

Uncertainty for businesses regarding long-term trade strategies: The uncertainty created by the legal battles makes it difficult for businesses to formulate long-term trade strategies, impacting investment decisions and supply chain management.

-

Impact on investment decisions and international trade relations: The potential for legal challenges casts a shadow over international trade relations, potentially deterring foreign investment and creating uncertainty in global markets.

-

Potential for increased protectionist policies or retaliatory tariffs: If the tariffs are upheld, it could embolden protectionist policies, leading to further trade restrictions and potentially retaliatory tariffs from other countries.

-

The role of international trade organizations (WTO) in resolving disputes: The WTO plays a crucial role in settling trade disputes, but its effectiveness is limited by the willingness of countries to comply with its rulings.

The Role of Congressional Oversight in Tariff Disputes

Congress plays a significant role in trade policy, even with the President's broad authority under Section 301.

-

Congressional authority in trade policy: Congress can influence trade policy through legislation, appropriations, and oversight hearings. It can limit the President's power to impose tariffs through specific legislation or by withholding funding.

-

Legislative checks and balances on executive power: Congressional oversight serves as a check on the executive branch's power, ensuring accountability and transparency in trade policy decisions.

-

Potential for future legislation to clarify presidential authority on tariffs: Congress could pass legislation to clarify the scope of presidential authority under Section 301, potentially limiting the President's power to impose tariffs without specific congressional authorization.

-

The interaction between executive and legislative branches on trade issues: Effective trade policy requires cooperation between the executive and legislative branches. Clear communication and a shared understanding of national interests are critical to navigating complex trade issues.

Conclusion

The legal challenges to Trump's tariffs highlight the complexities of balancing presidential power with legal constraints in trade matters. The application of the political question doctrine remains a central point of contention, with significant implications for future trade disputes and the ability of courts to review executive actions in this area. The uncertainty surrounding the legal status of these tariffs underscores the need for a nuanced understanding of US trade law and the interplay between executive and legislative branches in shaping trade policy.

Call to Action: Understanding the legal intricacies of Trump's tariffs and their potential immunity to judicial scrutiny is crucial for businesses and policymakers alike. Stay informed on the latest developments in this ongoing legal battle regarding Trump tariffs, and learn how these decisions may impact future trade negotiations and your business. Further research into challenges to Trump tariffs and the application of the political question doctrine is recommended for a comprehensive understanding.

Featured Posts

-

London Fashion Week Kate And Lila Moss Twin In Stunning Lbds

May 03, 2025

London Fashion Week Kate And Lila Moss Twin In Stunning Lbds

May 03, 2025 -

Fortnites Chapter 6 Season 2 Launch Delayed Due To Unexpected Server Issues

May 03, 2025

Fortnites Chapter 6 Season 2 Launch Delayed Due To Unexpected Server Issues

May 03, 2025 -

The Five Biggest Threats To Reform Uks Success

May 03, 2025

The Five Biggest Threats To Reform Uks Success

May 03, 2025 -

Federal Agents Hacker Made Millions Targeting Executive Office365 Accounts

May 03, 2025

Federal Agents Hacker Made Millions Targeting Executive Office365 Accounts

May 03, 2025 -

Australian Government Responds To Rise In Chinese Ship Activity Near Sydney

May 03, 2025

Australian Government Responds To Rise In Chinese Ship Activity Near Sydney

May 03, 2025

Latest Posts

-

Effective Middle Management Key To Employee Engagement And Business Growth

May 04, 2025

Effective Middle Management Key To Employee Engagement And Business Growth

May 04, 2025 -

The China Factor Assessing Risks And Opportunities For Automakers Like Bmw And Porsche

May 04, 2025

The China Factor Assessing Risks And Opportunities For Automakers Like Bmw And Porsche

May 04, 2025 -

The Power Of Middle Management Fostering Collaboration And Driving Results

May 04, 2025

The Power Of Middle Management Fostering Collaboration And Driving Results

May 04, 2025 -

Investing In Middle Management A Strategic Approach To Business Growth

May 04, 2025

Investing In Middle Management A Strategic Approach To Business Growth

May 04, 2025 -

Middle Management A Critical Link In The Chain Of Success

May 04, 2025

Middle Management A Critical Link In The Chain Of Success

May 04, 2025