Court Rejects Bid To Halt Paramount-Skydance Merger; Shareholder Case Accelerated

Table of Contents

The Court's Decision to Reject the Halt of the Paramount-Skydance Merger

A judge in [Court Name], [Judge's Name], ruled against the motion to temporarily restrain the Paramount-Skydance merger. The plaintiffs, [mention plaintiff group if known, e.g., a group of concerned investors], argued that the merger was detrimental to shareholders and violated certain undisclosed clauses, potentially harming competition within the entertainment sector. They presented evidence suggesting [briefly summarize the key arguments against the merger].

However, the court found the plaintiffs' arguments insufficient to warrant a halt. The judge's reasoning centered on [explain the key legal arguments the judge used, e.g., lack of demonstrable harm, insufficient evidence to support claims of antitrust violations]. The court emphasized the lack of substantial evidence to prove irreparable harm would occur if the merger proceeded.

- Key legal points supporting the court's decision: The court highlighted the lack of demonstrable harm to the plaintiffs, insufficient evidence of antitrust violations, and the plaintiffs’ failure to meet the necessary legal threshold for injunction.

- Impact of the ruling on the merger timeline: This decision significantly accelerates the merger process, paving the way for its swift completion.

- Potential legal avenues remaining for opponents: While this decision is a setback, the plaintiffs could potentially appeal the ruling or pursue other legal avenues.

Accelerated Shareholder Lawsuit Against the Paramount-Skydance Merger

Concurrently, a shareholder lawsuit alleging [briefly summarize the shareholder allegations, e.g., breach of fiduciary duty, undervaluation of company assets] has been fast-tracked following the court's decision to allow the merger to proceed. The acceleration of the lawsuit suggests the court believes there is merit to at least some of the shareholder claims, and wants a timely resolution. This lawsuit involves [mention key shareholders involved if known]. The speed of the proceedings indicates a sense of urgency to address the concerns raised before the merger's completion.

- Specific claims made by the shareholders: Shareholders claim [list specific accusations; e.g., the merger price undervalues the company, directors acted in their own self-interest, crucial information was withheld from shareholders].

- Potential outcomes of the lawsuit: Possible outcomes range from a dismissal of the lawsuit to significant financial penalties for Paramount and Skydance or restructuring of the merger terms.

- Impact on the stock prices of Paramount and Skydance: The ongoing lawsuit and its uncertain outcome have created market volatility, impacting the stock prices of both companies.

Implications of the Court Ruling on the Future of Media Mergers and Acquisitions

This court ruling has significant implications for the future of media mergers and acquisitions. It sets a precedent, clarifying the legal standards for challenging such deals, specifically regarding the burden of proof for plaintiffs seeking to halt mergers. This case may lead to:

- Potential changes in regulatory scrutiny of media mergers: Regulatory bodies may review their processes and increase scrutiny of future mergers, demanding more detailed financial disclosures and impact assessments.

- Impact on the valuation of media companies: The valuation of media companies involved in potential merger negotiations could be influenced by this case, potentially requiring more robust due diligence and risk assessment.

- Effects on future merger negotiations: This ruling might shift negotiation strategies, with companies potentially anticipating stricter legal challenges and incorporating stronger safeguards.

Expert Analysis of the Paramount-Skydance Merger and Shareholder Case (Optional)

[If available, insert quotes from legal experts or industry analysts offering their insights on the court's decision and the shareholder lawsuit. Maintain objectivity and include diverse perspectives.]

Conclusion: The Paramount-Skydance Merger Moves Forward; What's Next?

The court's rejection of the bid to halt the Paramount-Skydance merger, coupled with the accelerated shareholder lawsuit, marks a pivotal moment for the entertainment industry. While the merger proceeds, the legal battle is far from over. The outcome of the shareholder lawsuit remains uncertain, potentially influencing the long-term success of the combined entity. The case also establishes a significant precedent for future media mergers.

To stay updated on further developments regarding the Paramount-Skydance merger and related legal proceedings, including updates on the shareholder lawsuit and any appeals, be sure to subscribe to our newsletter or follow reputable news sources for the latest information on the Paramount Skydance merger update and the Paramount Skydance legal case.

Featured Posts

-

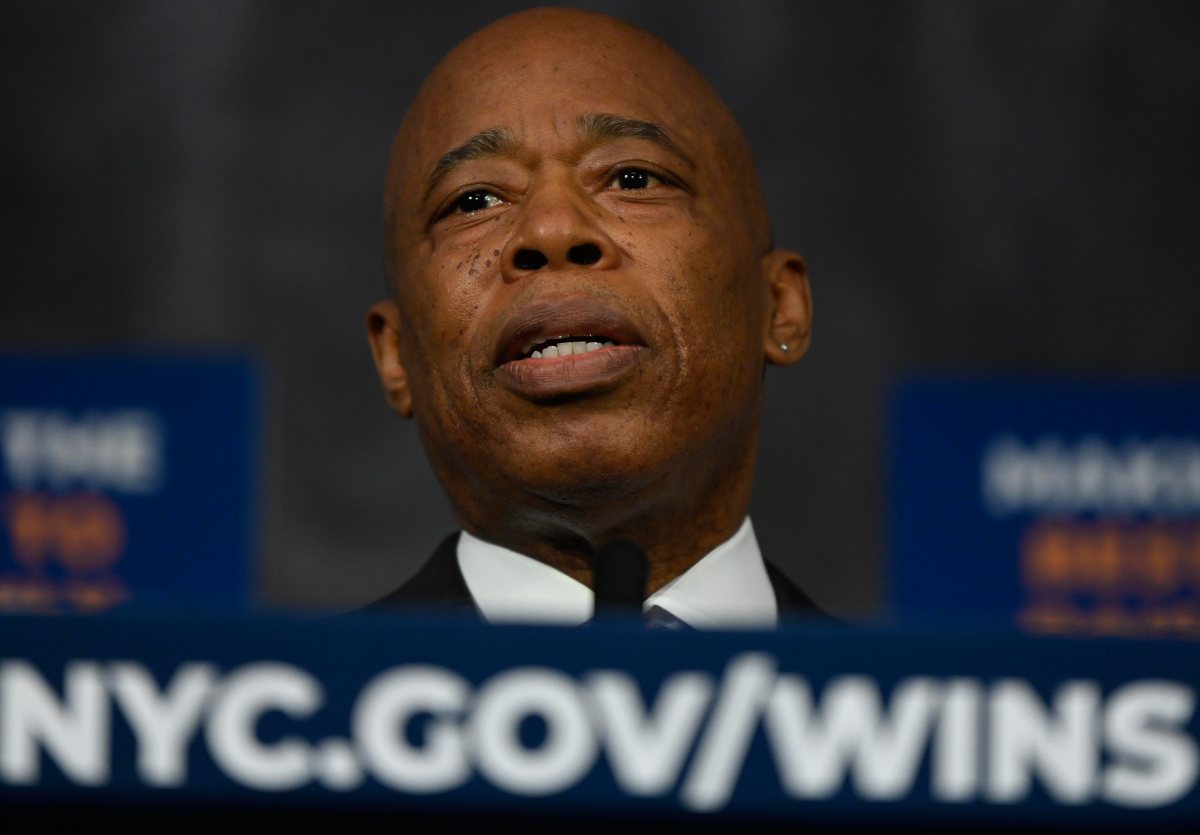

American Jewish Congress Weighs In Cuomo Endorsed Lander And Mamdani Criticized In Nyc Mayoral Race

May 27, 2025

American Jewish Congress Weighs In Cuomo Endorsed Lander And Mamdani Criticized In Nyc Mayoral Race

May 27, 2025 -

Alkhtwt Aljwyt Aljzayryt Khttha Llwswl Ila Alryadt Fy Afryqya

May 27, 2025

Alkhtwt Aljwyt Aljzayryt Khttha Llwswl Ila Alryadt Fy Afryqya

May 27, 2025 -

Tracker Season 2 Episode 12 Monster Preview And Episode 13 Neptune Early Look

May 27, 2025

Tracker Season 2 Episode 12 Monster Preview And Episode 13 Neptune Early Look

May 27, 2025 -

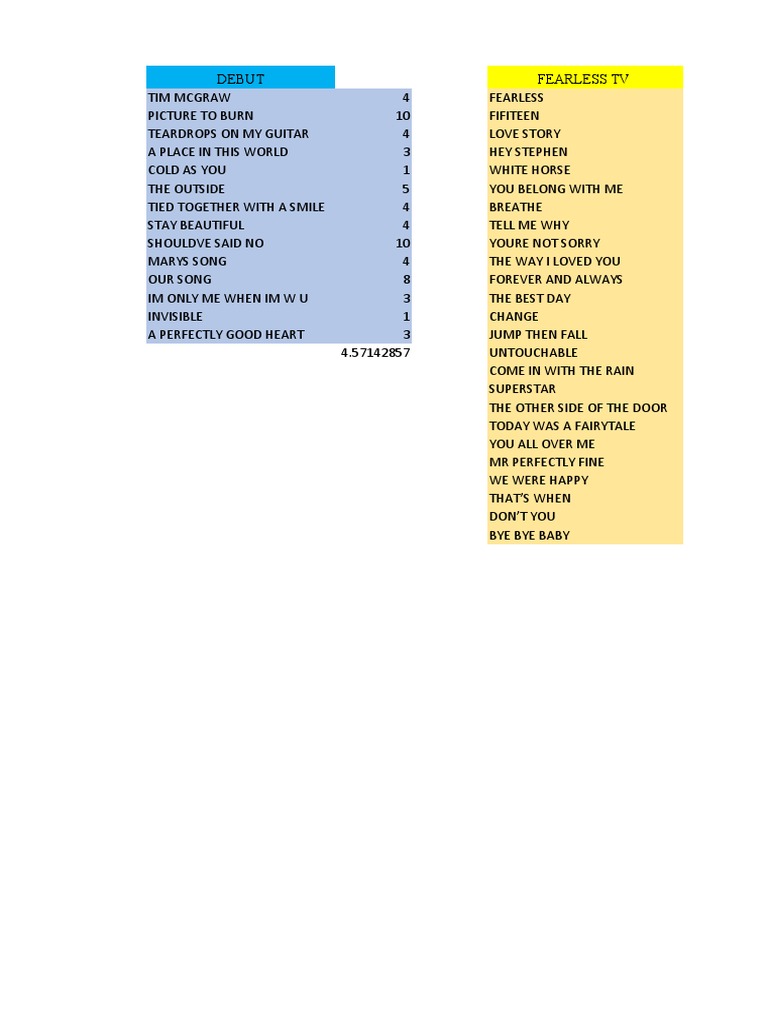

The Ultimate Ranking Of All 11 Taylor Swift Albums

May 27, 2025

The Ultimate Ranking Of All 11 Taylor Swift Albums

May 27, 2025 -

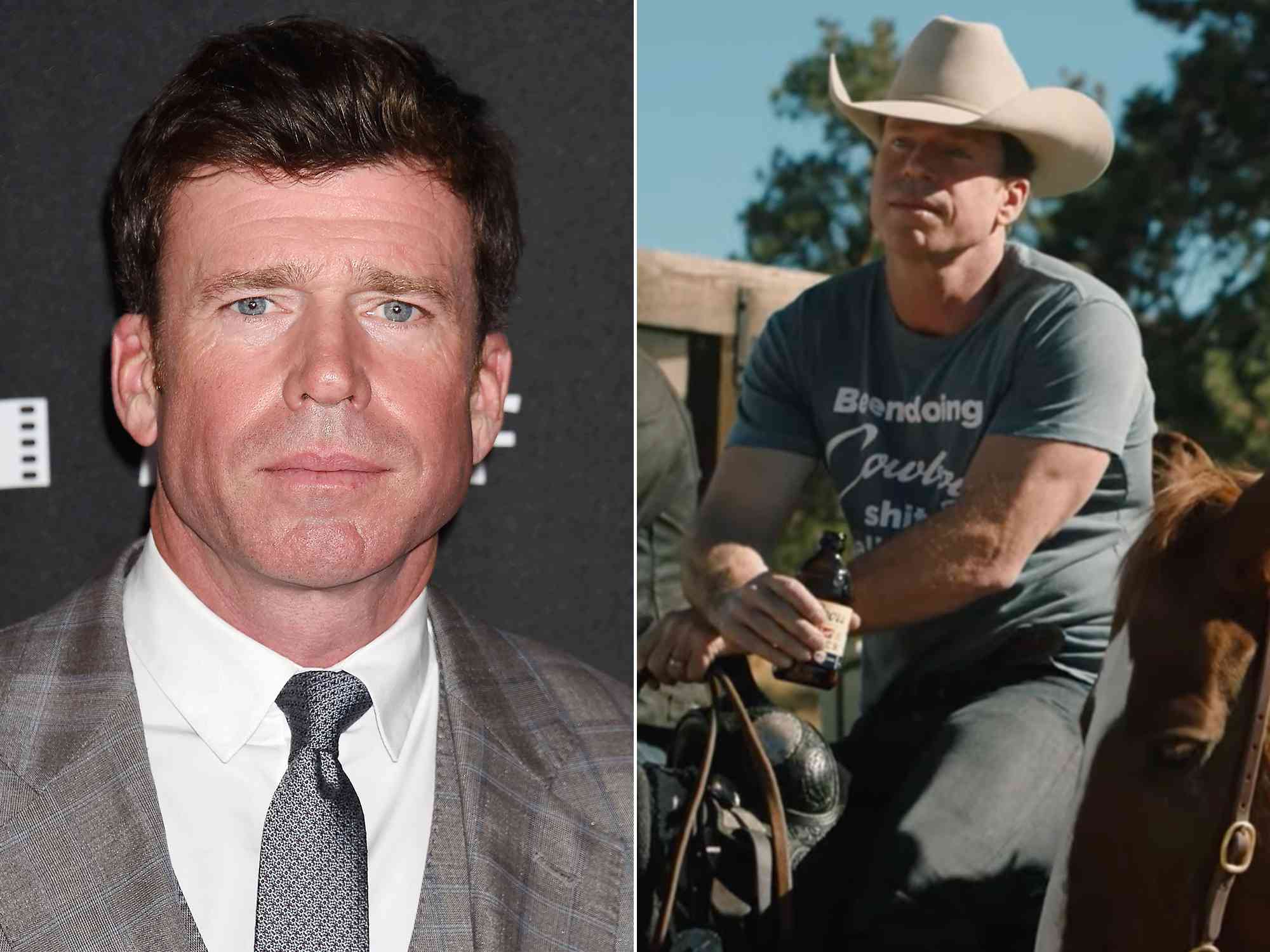

Taylor Sheridans Yellowstone Future Retirement On The Horizon

May 27, 2025

Taylor Sheridans Yellowstone Future Retirement On The Horizon

May 27, 2025

Latest Posts

-

Banksys Broken Heart A Walls Journey To Auction

May 31, 2025

Banksys Broken Heart A Walls Journey To Auction

May 31, 2025 -

The Westcliff Bournemouth Banksy Genuine Or Imitation

May 31, 2025

The Westcliff Bournemouth Banksy Genuine Or Imitation

May 31, 2025 -

Bernard Kerik A Look Back At The Life Of The Former Nyc Police Commissioner

May 31, 2025

Bernard Kerik A Look Back At The Life Of The Former Nyc Police Commissioner

May 31, 2025 -

Bernard Kerik A Look At His Family Life With Hala Matli And Their Children

May 31, 2025

Bernard Kerik A Look At His Family Life With Hala Matli And Their Children

May 31, 2025 -

Unattributed Banksy The Paintings Provenance And Upcoming Auction

May 31, 2025

Unattributed Banksy The Paintings Provenance And Upcoming Auction

May 31, 2025