Crack The Code: 5 Do's And Don'ts To Secure A Private Credit Role

Table of Contents

Do's to Secure Your Private Credit Role

Develop Specialized Knowledge

The private credit market is complex, demanding a deep understanding beyond general finance principles. To excel, you must demonstrate specialized knowledge in several key areas:

- Master the Intricacies of Private Credit Markets: Gain a thorough understanding of various private credit strategies, including leveraged buyouts (LBOs), direct lending, mezzanine financing, and distressed debt investing. Familiarize yourself with different deal structures, covenants, and risk mitigation techniques.

- Stay Updated on Market Trends and Regulations: The private credit landscape is constantly evolving. Stay informed about regulatory changes, market cycles, and emerging trends through industry publications, conferences, and networking events. Understanding current economic conditions and their impact on private credit is crucial.

- Proficiency in Financial Modeling and Valuation: Develop strong skills in financial modeling, specifically tailored to private credit transactions. This includes discounted cash flow (DCF) analysis, leveraged buyout modeling, and other valuation techniques used to assess the creditworthiness of borrowers and the potential return on investment.

- Credit Analysis, Risk Assessment, and Portfolio Management: Demonstrate a deep understanding of credit analysis, encompassing qualitative and quantitative aspects. Master the art of risk assessment, including identifying and mitigating potential credit risks within a private credit portfolio. Understanding portfolio construction and management principles is also essential.

- Network Strategically: Networking is paramount in the private credit world. Attend industry conferences such as the Private Equity International (PEI) events, actively participate in relevant online forums, and connect with professionals on LinkedIn. These interactions can lead to invaluable insights and hidden opportunities.

Showcase Relevant Experience

Your resume and cover letter are your first impression. To make a lasting impact, highlight your qualifications effectively:

- Highlight Relevant Experience: Emphasize experience in credit underwriting, portfolio management, or financial analysis, particularly within private credit, investment banking, or a related finance setting. Quantify your achievements whenever possible, showing the impact of your work. For example, instead of simply stating "managed a portfolio," quantify your success by mentioning the portfolio's size and return on investment.

- Tailor Your Application Materials: Each private credit role is unique. Customize your resume and cover letter to match the specific requirements and keywords of each job description. Generic applications rarely stand out in a competitive field.

- Emphasize Key Skills: Focus on skills crucial to private credit, including financial modeling, credit risk assessment, deal structuring, due diligence, and negotiation. Use relevant keywords such as "private debt," "leveraged finance," "distressed debt investing," and "credit underwriting."

- Showcase accomplishments: Instead of simply listing your responsibilities, use the STAR method (Situation, Task, Action, Result) to showcase your accomplishments and quantify your impact.

Build a Strong Network

Networking is not just about collecting business cards; it's about building genuine relationships.

- Attend Industry Events: Private credit conferences and networking events are invaluable for meeting professionals and learning about new opportunities.

- Engage Online: Participate in online forums and groups related to private credit to stay updated and connect with peers.

- Leverage LinkedIn: Use LinkedIn to connect with professionals in private credit roles and research potential employers.

- Informational Interviews: Schedule informational interviews with professionals in the field to gain valuable insights and expand your network.

- Work with Recruiters: Partner with recruiters who specialize in private credit placements. They can provide valuable guidance and access to unadvertised opportunities.

Don'ts to Avoid When Pursuing a Private Credit Role

Neglect Networking

The private credit world is relationship-driven. Avoid these common mistakes:

- Relying Solely on Online Applications: Don't underestimate the power of networking. Directly reaching out to professionals in the field significantly increases your chances of landing an interview.

- Underestimating Personal Connections: Hidden opportunities often arise through personal referrals and networking.

- Failing to Follow Up: After networking events or interviews, promptly follow up to express your continued interest and gratitude.

Lack of Specialized Knowledge

A superficial understanding of private credit will hurt your chances.

- Applying Without Sufficient Knowledge: Thoroughly research the industry and demonstrate a deep understanding of the specific products and market dynamics.

- Underestimating Technical Skills: Private credit roles demand strong analytical and technical skills; ensure your abilities align with the role's requirements.

- Ignoring the Nuances: Understand the differences between private and public credit markets and the unique challenges of each.

Generic Application Materials

Your application materials must be tailored and polished.

- Submitting Generic Applications: Generic resumes and cover letters show a lack of effort and fail to highlight your relevant qualifications for the specific role.

- Overlooking Customization: Tailor your materials to each position, focusing on the skills and experiences most relevant to the job description.

- Poor Proofreading: Typos and grammatical errors create a negative first impression and demonstrate a lack of attention to detail.

Conclusion

Securing a private credit role is a challenging but achievable goal. By following these do's and don'ts—mastering specialized knowledge, showcasing relevant experience, and building a strong network—you can significantly increase your chances of success. Remember to tailor your approach, highlight your unique qualifications, and consistently network within the private credit community. Don't delay—start implementing these strategies today to crack the code and secure your dream private credit role, or even a private equity role, if that is your aim.

Featured Posts

-

Trumps Trade War Imf Warns Of Systemic Financial Risk

Apr 23, 2025

Trumps Trade War Imf Warns Of Systemic Financial Risk

Apr 23, 2025 -

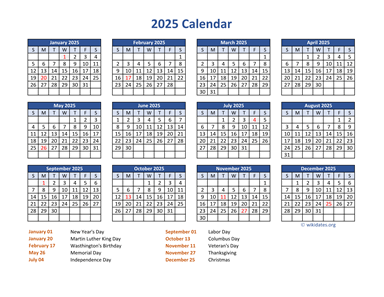

2025 Your Guide To Us Federal And Non Federal Holidays

Apr 23, 2025

2025 Your Guide To Us Federal And Non Federal Holidays

Apr 23, 2025 -

Analyse Du 18h Eco Lundi 14 Avril

Apr 23, 2025

Analyse Du 18h Eco Lundi 14 Avril

Apr 23, 2025 -

Aaron Judges Historic Night Yankees Set New Home Run Record In 2025

Apr 23, 2025

Aaron Judges Historic Night Yankees Set New Home Run Record In 2025

Apr 23, 2025 -

State Treasurers Express Concerns To Tesla Board About Musks Leadership

Apr 23, 2025

State Treasurers Express Concerns To Tesla Board About Musks Leadership

Apr 23, 2025