Credit Suisse Whistleblower Reward: Up To $150 Million To Be Shared

Table of Contents

The Magnitude of the Credit Suisse Whistleblower Reward Program

Unprecedented Financial Incentive

The $150 million whistleblower reward offered by Credit Suisse represents a significant leap in financial incentives for reporting wrongdoing. This dwarfs many previous rewards offered by other financial institutions and signifies a substantial commitment to transparency and accountability.

- Comparison: While specific figures for other institutions' whistleblower programs aren't always publicly available due to confidentiality concerns, the Credit Suisse reward likely surpasses most, if not all, previously offered incentives in the financial sector. This scale alone is designed to attract informants with crucial information.

- Impact on Reporting: The sheer size of the reward has the potential to dramatically increase the number of reports of financial wrongdoing received by Credit Suisse. The potential for a substantial payout acts as a powerful motivator for individuals with knowledge of illegal activities to come forward.

- Multiple Informants: The reward program likely includes provisions for distributing the $150 million amongst multiple informants whose information contributes to a successful investigation. This collaborative approach encourages individuals with partial knowledge to share their information, potentially piecing together a complete picture of the wrongdoing.

The Types of Information Eligible for Reward

Credit Suisse is actively seeking information on a range of serious financial crimes. The reward program aims to incentivize reporting on a wide spectrum of illegal activities, ensuring a comprehensive approach to uncovering and preventing financial misconduct.

- Examples of Eligible Information: The types of financial wrongdoing targeted by the reward program include, but are not limited to, securities fraud, market manipulation, insider trading, money laundering, sanctions violations, and other regulatory violations.

- Criteria for Reward Consideration: To be eligible for the reward, information must be original, credible, and lead to a successful investigation resulting in substantial monetary sanctions or other significant enforcement actions against Credit Suisse or related parties. The quality and significance of the information provided will be key factors in determining the reward amount.

The Process of Submitting a Whistleblower Tip to Credit Suisse

Confidentiality and Protection

Credit Suisse prioritizes the confidentiality and protection of whistleblowers who come forward. The bank understands the risks associated with reporting financial wrongdoing, and has implemented robust measures to safeguard informants' identities and protect them from retaliation.

- SEC Whistleblower Protection Laws: The SEC's whistleblower protection laws provide significant legal protection to individuals who report potential violations. These laws shield whistleblowers from retaliation, including job loss or other forms of discrimination.

- Anonymous Reporting Options: Credit Suisse likely offers various anonymous reporting channels, allowing individuals to submit tips without revealing their identities. This allows whistleblowers to share information without fear of repercussions.

- Identity Protection Measures: Credit Suisse likely employs advanced security measures to protect the identities of informants, ensuring their anonymity throughout the investigation process.

How to Report Information

Submitting a tip to Credit Suisse about financial wrongdoing should be a straightforward process. The bank likely provides multiple channels for reporting, ensuring accessibility and ease of use.

- Contact Information and Online Portals: Credit Suisse will likely provide dedicated email addresses, phone numbers, and a secure online portal for submitting whistleblower tips. These channels are designed to allow for confidential and secure submission of information.

- Supporting Documentation: Individuals submitting tips should provide all relevant documentation and information to support their claims. The more detailed and comprehensive the information, the more valuable it is likely to be to the investigation.

- Investigation Process: After submitting a tip, Credit Suisse will initiate an investigation process, which may involve further communication with the whistleblower to gather additional information. The outcome of the investigation will determine if a reward is applicable and the amount awarded.

Implications and Future Outlook for Financial Compliance

Impact on Corporate Governance

The Credit Suisse whistleblower reward program is expected to significantly impact corporate governance practices, not only within Credit Suisse but potentially across the wider financial industry.

- Improved Internal Controls: The program serves as a powerful incentive for Credit Suisse to strengthen its internal controls and compliance programs. A robust compliance framework reduces the risk of financial misconduct and strengthens the company's reputation.

- Reporting Structure Changes: The program may lead to changes in Credit Suisse's reporting structures to facilitate more efficient and confidential reporting of potential wrongdoing. Clear and accessible reporting channels are essential for effective compliance.

- Long-Term Impact on Financial Crime Prevention: By incentivizing reporting, the program contributes to a long-term reduction in financial crime by making it more difficult for wrongdoers to operate undetected. This contributes to a more ethical and transparent financial system.

Increased Whistleblower Reporting

The announcement of such a substantial reward is expected to lead to a significant increase in the number of whistleblower reports received by Credit Suisse.

- Benefits for Credit Suisse and Society: This increase in reporting will help Credit Suisse identify and address potential issues promptly, mitigating reputational and financial risks. For society, it means a more transparent financial system, better protection for investors, and a more equitable distribution of resources.

- Challenges in Processing Reports: The increased volume of reports might present challenges in terms of processing and investigating each claim efficiently. Credit Suisse will need to ensure it has the resources and processes in place to manage the increased workload effectively.

- Impact on Investigation Efficiency: While an increase in reports can present challenges, it can also lead to a more comprehensive and efficient investigation process, as more perspectives and evidence become available. This helps uncover more complex and potentially widespread financial crimes.

Conclusion

The Credit Suisse whistleblower reward program, with its unprecedented $150 million incentive, represents a significant shift in the fight against financial crime. The program's magnitude underscores the seriousness with which Credit Suisse is addressing misconduct and highlights the crucial role whistleblowers play in maintaining the integrity of the financial system. The potential for increased reporting and improved corporate governance makes this program a landmark initiative.

Call to Action: If you possess credible information about financial wrongdoing at Credit Suisse, take advantage of this unparalleled opportunity. Contact the designated channels to submit your tip and potentially claim a share of the Credit Suisse whistleblower reward of up to $150 million. Help protect the integrity of the financial system and contribute to a more ethical and transparent industry by reporting what you know. Don't hesitate; act now to make a difference.

Featured Posts

-

Experiences Of Transgender People Under Trump Administration Executive Orders

May 10, 2025

Experiences Of Transgender People Under Trump Administration Executive Orders

May 10, 2025 -

Lac Kir Dijon Violente Agression De Trois Hommes

May 10, 2025

Lac Kir Dijon Violente Agression De Trois Hommes

May 10, 2025 -

The Maha Movement And Trumps Surgeon General Nominee A Deeper Look

May 10, 2025

The Maha Movement And Trumps Surgeon General Nominee A Deeper Look

May 10, 2025 -

Canadian Sports Fans Flock To Seattle Businesses Offer Competitive Exchange Rates

May 10, 2025

Canadian Sports Fans Flock To Seattle Businesses Offer Competitive Exchange Rates

May 10, 2025 -

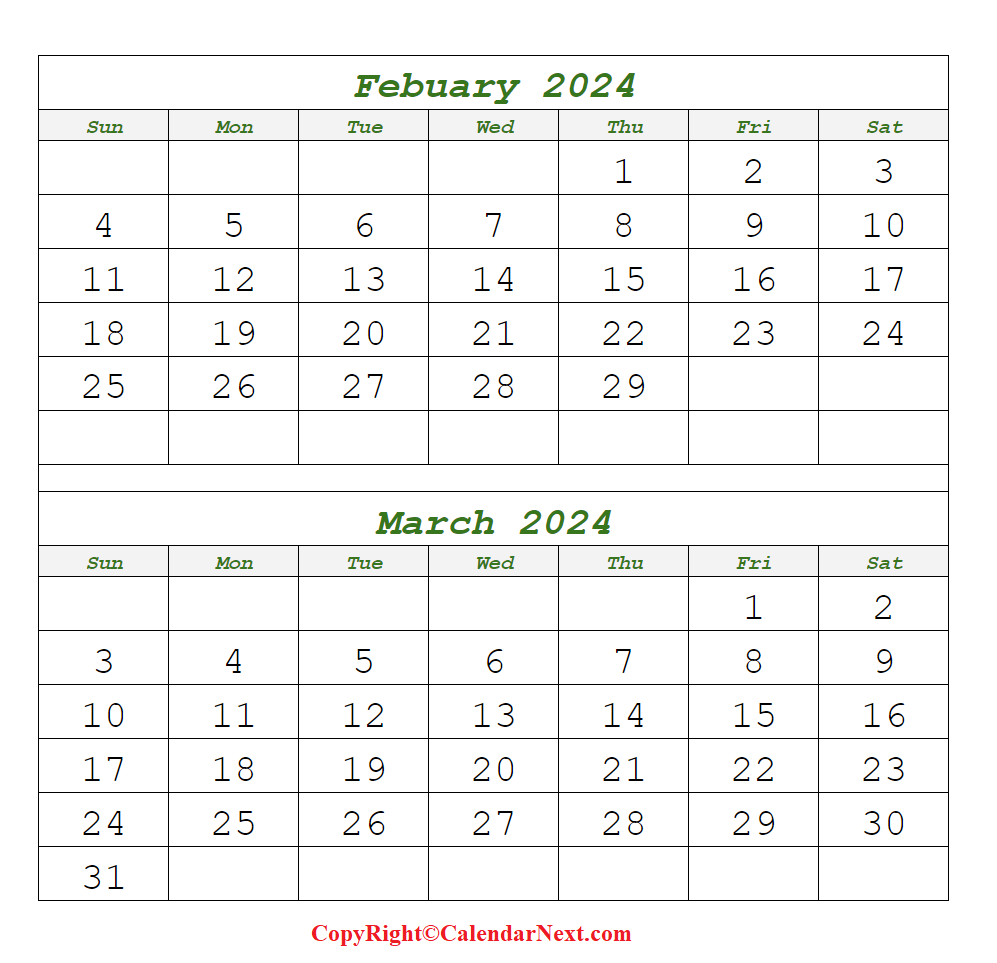

Elizabeth Line Strike Dates Routes Affected In February And March 2024

May 10, 2025

Elizabeth Line Strike Dates Routes Affected In February And March 2024

May 10, 2025