Crude Oil Market Update: Key Developments On April 24th

Table of Contents

Geopolitical Influences on Crude Oil Prices

Geopolitical events significantly impact the crude oil market, often causing dramatic price swings. April 24th was no exception, with several key factors playing a role.

Impact of the Russia-Ukraine Conflict

The ongoing Russia-Ukraine conflict continues to exert a powerful influence on global oil supply and prices.

- Disruptions to Oil Exports: The conflict directly impacts oil exports from the Black Sea region, a major source of crude oil for global markets. Any disruption to these exports immediately affects global supply and puts upward pressure on prices. Concerns about further disruptions remain a key driver of volatility in the crude oil market.

- Sanctions Against Russia: International sanctions imposed on Russia have significantly impacted its ability to export crude oil and refined petroleum products. These sanctions limit access to international markets and financial systems, affecting trading volumes and pushing prices higher. The effectiveness and enforcement of these sanctions remain a critical factor influencing future crude oil market trends.

- Alternative Supply Routes: The search for alternative supply routes to replace Russian oil is ongoing. However, finding sufficient alternative sources and establishing reliable transportation infrastructure takes time and effort. The success (or failure) of these initiatives will heavily influence future crude oil price stability.

OPEC+ Decisions and Their Market Impact

Decisions made by the Organization of the Petroleum Exporting Countries and its allies (OPEC+) have a profound effect on the crude oil market.

- Production Quotas: Any announcements regarding production quotas from OPEC+ directly influence the global supply of crude oil. Increases in production can lead to lower prices, while decreases can push prices upwards. The April 24th situation needs specific referencing here, to contextualize the market reaction on that day.

- Market Sentiment: OPEC+ decisions significantly shape market sentiment. Announcements indicating a commitment to stable supply can soothe market anxieties and stabilize prices, whereas unexpected changes can trigger volatility. Market analysis on April 24th is key here to accurately reflect the situation.

- Internal Disagreements: Disagreements among OPEC+ members regarding production targets and strategies can create uncertainty and volatility in the crude oil market. Such discord can make it difficult to predict future price movements, adding to market uncertainty.

Economic Indicators and Crude Oil Demand

Economic factors play a crucial role in determining the demand for crude oil. Changes in global economic growth, inflation, and interest rates can significantly influence oil consumption and prices.

Global Economic Growth Projections

Global economic forecasts have a direct impact on crude oil demand.

- Implications for Oil Demand: Strong economic growth generally leads to increased industrial activity and transportation, boosting crude oil demand. Conversely, weaker economic growth can reduce oil consumption. Economic forecasts for April 24th should be analyzed here.

- Inflation and Interest Rates: High inflation and rising interest rates can curb economic activity and reduce consumer spending, including on transportation fuel, thus impacting crude oil demand. The interplay between these factors needs to be carefully examined in the context of April 24th.

- Significant Economic Events: Any major economic events occurring on April 24th, such as the release of important economic data or announcements from central banks, will have impacted the crude oil market. These events need to be specifically mentioned and analyzed.

Changes in Fuel Demand and Consumption

Fluctuations in gasoline and diesel demand influence the crude oil market.

- Seasonal Changes: Seasonal changes in driving habits and industrial activity can cause fluctuations in fuel demand. Analyzing seasonal factors specific to April 24th is crucial.

- Energy Policies: New government policies promoting renewable energy or imposing stricter emission standards can reduce demand for fossil fuels, including crude oil. Any relevant policy changes affecting fuel demand on April 24th should be detailed here.

- Economic Activity and Crude Oil Demand: A strong correlation exists between economic activity and crude oil demand. Higher economic activity usually translates to higher fuel consumption.

Supply Chain Disruptions and Their Effects

Disruptions to the crude oil supply chain can significantly impact prices and availability.

Impact of Logistics Bottlenecks

Bottlenecks in oil transportation, refining, or distribution can create shortages and price increases.

- Transportation Disruptions: Problems with pipelines, shipping, or other transportation methods can limit the flow of crude oil to refineries and consumers, driving up prices. Consider specific examples relevant to April 24th.

- Price and Availability Impacts: Logistics bottlenecks cause shortages, leading to increased prices due to supply constraints. The magnitude of price increases is directly related to the severity and duration of the disruptions.

- Mitigation Efforts: Various strategies are implemented to mitigate supply chain disruptions, such as increasing refinery capacity or improving transportation efficiency.

Inventory Levels and Their Significance

Crude oil inventory levels in key regions play a crucial role in shaping market dynamics.

- Changes in Inventories: Increases in crude oil inventories generally suggest ample supply and can put downward pressure on prices. Conversely, decreasing inventories signal tightening supply and may drive prices upward. Data from April 24th is essential here.

- Impact on Market Prices: Inventory levels significantly influence market expectations regarding future supply and demand. This, in turn, impacts price movements.

- Strategic Petroleum Reserves: Governments use strategic petroleum reserves to stabilize the market during periods of supply disruptions. The potential use or release of these reserves can have a profound impact on prices.

Conclusion

April 24th saw notable fluctuations in the crude oil market, driven by a complex interplay of geopolitical tensions, economic indicators, and supply chain dynamics. Understanding the impact of the Russia-Ukraine conflict, OPEC+ decisions, economic growth projections, and supply chain disruptions is critical for navigating this volatile market. Staying informed about daily developments in the crude oil market is essential for investors and industry professionals. For continuous updates and deeper analysis of the crude oil market, be sure to check back regularly for more insightful crude oil market updates.

Featured Posts

-

Gold Investment Soars Following Trumps More Moderate Approach

Apr 25, 2025

Gold Investment Soars Following Trumps More Moderate Approach

Apr 25, 2025 -

Chinas Resilience Xis Strategy For A Lengthy Trade War With The Us

Apr 25, 2025

Chinas Resilience Xis Strategy For A Lengthy Trade War With The Us

Apr 25, 2025 -

Financial Times China Signals End To Sanctions Against European Parliamentarians

Apr 25, 2025

Financial Times China Signals End To Sanctions Against European Parliamentarians

Apr 25, 2025 -

E Bay Faces Legal Action Over Banned Chemicals Section 230 At Stake

Apr 25, 2025

E Bay Faces Legal Action Over Banned Chemicals Section 230 At Stake

Apr 25, 2025 -

The Los Angeles Wildfires A Case Study In Disaster Speculation

Apr 25, 2025

The Los Angeles Wildfires A Case Study In Disaster Speculation

Apr 25, 2025

Latest Posts

-

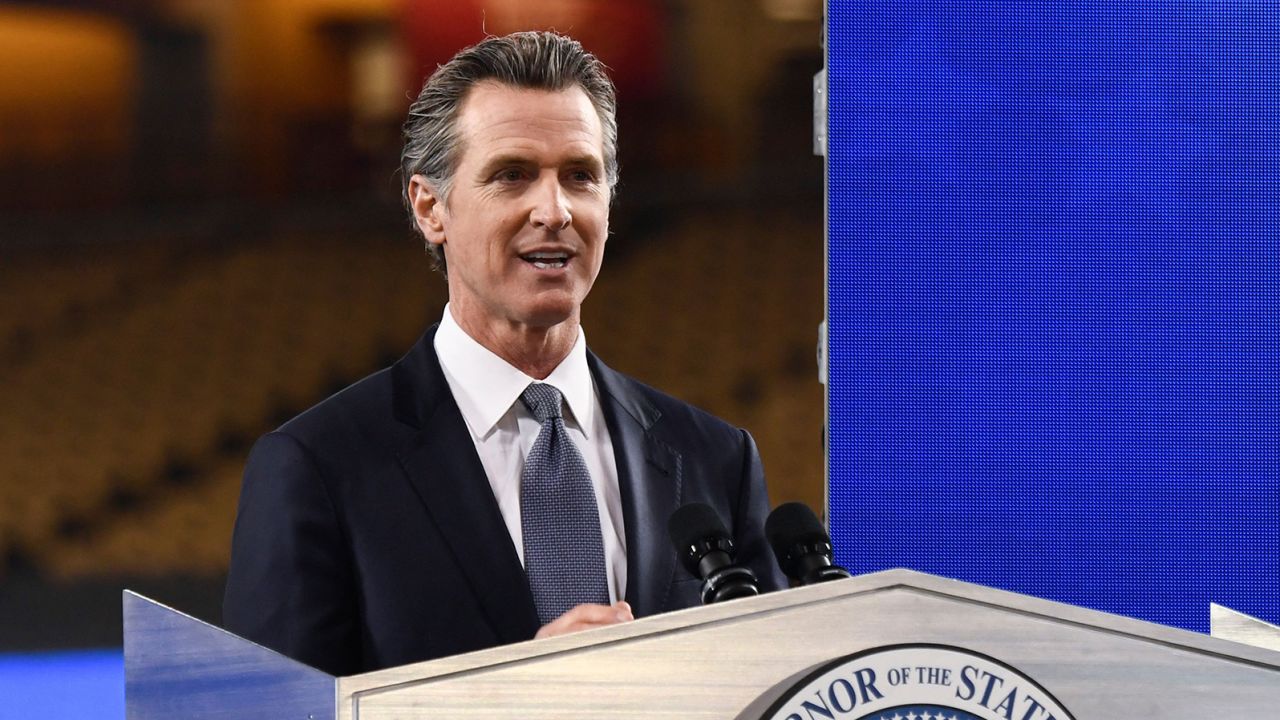

Newsoms Policies A Balanced Perspective

Apr 26, 2025

Newsoms Policies A Balanced Perspective

Apr 26, 2025 -

The Deeply Unfair Debate Newsoms Policy On Transgender Participation In Sports

Apr 26, 2025

The Deeply Unfair Debate Newsoms Policy On Transgender Participation In Sports

Apr 26, 2025 -

Examining The Truthfulness Of Claims Against Gavin Newsom

Apr 26, 2025

Examining The Truthfulness Of Claims Against Gavin Newsom

Apr 26, 2025 -

Is Gavin Newsoms New Trans Athlete Rule Deeply Unfair A Critical Analysis

Apr 26, 2025

Is Gavin Newsoms New Trans Athlete Rule Deeply Unfair A Critical Analysis

Apr 26, 2025 -

A Critical Look At Governor Gavin Newsoms Recent Decisions

Apr 26, 2025

A Critical Look At Governor Gavin Newsoms Recent Decisions

Apr 26, 2025