Cryptocurrency's Resilience Amidst Trade Wars

Table of Contents

Crypto's Decentralized Nature as a Protective Shield

Cryptocurrencies operate outside the traditional financial system, offering a unique level of protection against the turmoil often associated with trade wars. This inherent decentralization acts as a significant buffer against geopolitical instability.

Bypassing Geopolitical Barriers

Decentralized networks, powered by blockchain technology, reduce reliance on centralized institutions – banks and governments – which are often heavily impacted by trade restrictions and sanctions. This peer-to-peer transaction capability allows for the transfer of value without intermediaries susceptible to governmental control.

- Reduced reliance on centralized institutions: The decentralized nature of crypto means transactions aren't subject to the same level of control as traditional financial systems. This is particularly beneficial in countries with strict capital controls.

- Circumventing sanctions: In situations where traditional financial channels are blocked due to sanctions, cryptocurrencies can provide an alternative means of transferring funds. Several examples exist where crypto has facilitated cross-border payments despite geopolitical tensions.

- Examples: The use of cryptocurrencies in countries like Venezuela, where hyperinflation and capital controls have limited access to traditional banking, highlights the potential for decentralized finance (DeFi) to provide financial freedom.

Keywords: Decentralized finance (DeFi), blockchain technology, peer-to-peer transactions, capital controls, sanctions, crypto resilience.

Hedge Against Currency Volatility

Trade wars often lead to significant currency fluctuations, creating uncertainty for businesses and investors alike. Cryptocurrencies, while volatile themselves, can potentially act as a hedge against these fluctuations, offering portfolio diversification and mitigating losses from volatile fiat currencies.

- Diversification strategy: Including cryptocurrencies in a diversified investment portfolio can reduce overall risk exposure. While crypto prices can be volatile, their correlation with traditional markets isn't always strong, offering a potential buffer during market downturns caused by trade conflicts.

- Safe haven potential: During times of economic uncertainty, investors may shift towards assets perceived as safer. While not a perfect safe haven, cryptocurrency can serve as an alternative for some investors seeking refuge from fluctuating fiat currencies.

- Risk management tool: Cryptocurrency can be a component of a broader risk management strategy, helping investors to manage and mitigate potential losses stemming from trade war-related market volatility.

Keywords: Portfolio diversification, risk management, volatile markets, fiat currency, hedging strategies, cryptocurrency investment.

Increased Adoption During Economic Uncertainty

The inherent uncertainty associated with trade wars can drive investors towards alternative assets perceived as less risky. While cryptocurrencies have their own volatility, they often see increased adoption during periods of economic uncertainty.

Flight to Safety

When geopolitical instability rises, investors frequently seek what they perceive as "safe haven" assets, such as gold or government bonds. While cryptocurrency's inherent volatility challenges its classification as a truly safe haven, its adoption often increases during these periods, as investors seek diversification away from traditional markets.

- Historical examples: Data suggests increased cryptocurrency trading volume and adoption during past periods of economic turmoil and heightened geopolitical uncertainty.

- Investor sentiment analysis: Market research indicates a shift in investor sentiment towards cryptocurrencies as a potential hedge or diversification tool during times of trade disputes.

- Gold vs. Crypto: Comparisons between gold and crypto as safe haven assets are frequently made. While gold historically has been considered the primary safe haven, crypto is increasingly seen as a competing alternative.

Keywords: Safe haven assets, investor sentiment, market volatility, risk aversion, gold vs. crypto, cryptocurrency adoption.

Growth of the DeFi Ecosystem

The decentralized finance (DeFi) ecosystem is rapidly expanding, providing alternative financial services that are less susceptible to the traditional regulatory pressures often intensified by trade conflicts.

- Cross-border transactions: DeFi platforms allow for cross-border payments without relying on traditional banking systems, potentially mitigating the impact of trade barriers.

- Reduced reliance on traditional banking: DeFi offers a range of financial services such as lending, borrowing, and yield farming, reducing reliance on banks and financial institutions often impacted by trade wars.

- Innovation in finance: The DeFi space continues to innovate, offering new ways to manage and transfer assets in a more decentralized and potentially less susceptible manner to geopolitical pressures.

Keywords: Decentralized finance (DeFi), stablecoins, yield farming, lending platforms, cross-border payments, cryptocurrency trends.

Challenges and Limitations

While cryptocurrencies offer some resilience to trade war impacts, they are not without significant challenges.

Regulatory Uncertainty

Regulatory uncertainty remains a significant hurdle for widespread cryptocurrency adoption and stability. Different jurisdictions have vastly different regulatory approaches, creating a fragmented and unpredictable landscape.

- Varying regulatory landscapes: The lack of a globally unified regulatory framework creates uncertainty for investors and businesses operating in the cryptocurrency space.

- Impact on markets: Regulatory actions or announcements in any major jurisdiction can significantly influence cryptocurrency prices and overall market sentiment.

- Ongoing regulatory debates: The debate surrounding the regulation of cryptocurrencies continues, creating an environment of uncertainty.

Keywords: Crypto regulation, regulatory uncertainty, compliance, taxation, legal frameworks, cryptocurrency risks.

Volatility and Market Manipulation

The inherent volatility of cryptocurrencies remains a significant concern. Market manipulation also poses a considerable risk, regardless of global trade dynamics.

- Factors influencing volatility: Numerous factors contribute to crypto's price fluctuations, including speculation, market sentiment, and technological developments.

- Risks of market manipulation: The decentralized nature of cryptocurrencies, while offering advantages, also makes them potentially vulnerable to manipulation by large holders or coordinated efforts.

- Need for robust security measures: Strong security protocols and risk management strategies are crucial for mitigating the risks of volatility and manipulation within the cryptocurrency market.

Keywords: Market volatility, price manipulation, security risks, scams, cryptocurrency exchanges, bitcoin volatility.

Conclusion

While not immune to market fluctuations, cryptocurrencies are demonstrating a notable degree of resilience amidst global trade wars. Their decentralized nature, the burgeoning DeFi ecosystem, and their potential as a hedge against currency volatility contribute to this resilience. However, regulatory uncertainty and inherent volatility remain significant challenges.

Understanding cryptocurrency's resilience amidst trade wars is crucial for navigating the evolving global economic landscape. Learn more about the benefits and risks of investing in cryptocurrency and explore the potential of decentralized finance (DeFi) to manage your assets in an increasingly uncertain world. Further research into cryptocurrency and its potential as a hedge against global instability is highly recommended.

Featured Posts

-

How Saturday Night Live Launched Counting Crows To Mainstream Success

May 08, 2025

How Saturday Night Live Launched Counting Crows To Mainstream Success

May 08, 2025 -

Brookfields Strategic Investments Navigating Market Volatility

May 08, 2025

Brookfields Strategic Investments Navigating Market Volatility

May 08, 2025 -

Filipe Luis Conquista Otro Titulo

May 08, 2025

Filipe Luis Conquista Otro Titulo

May 08, 2025 -

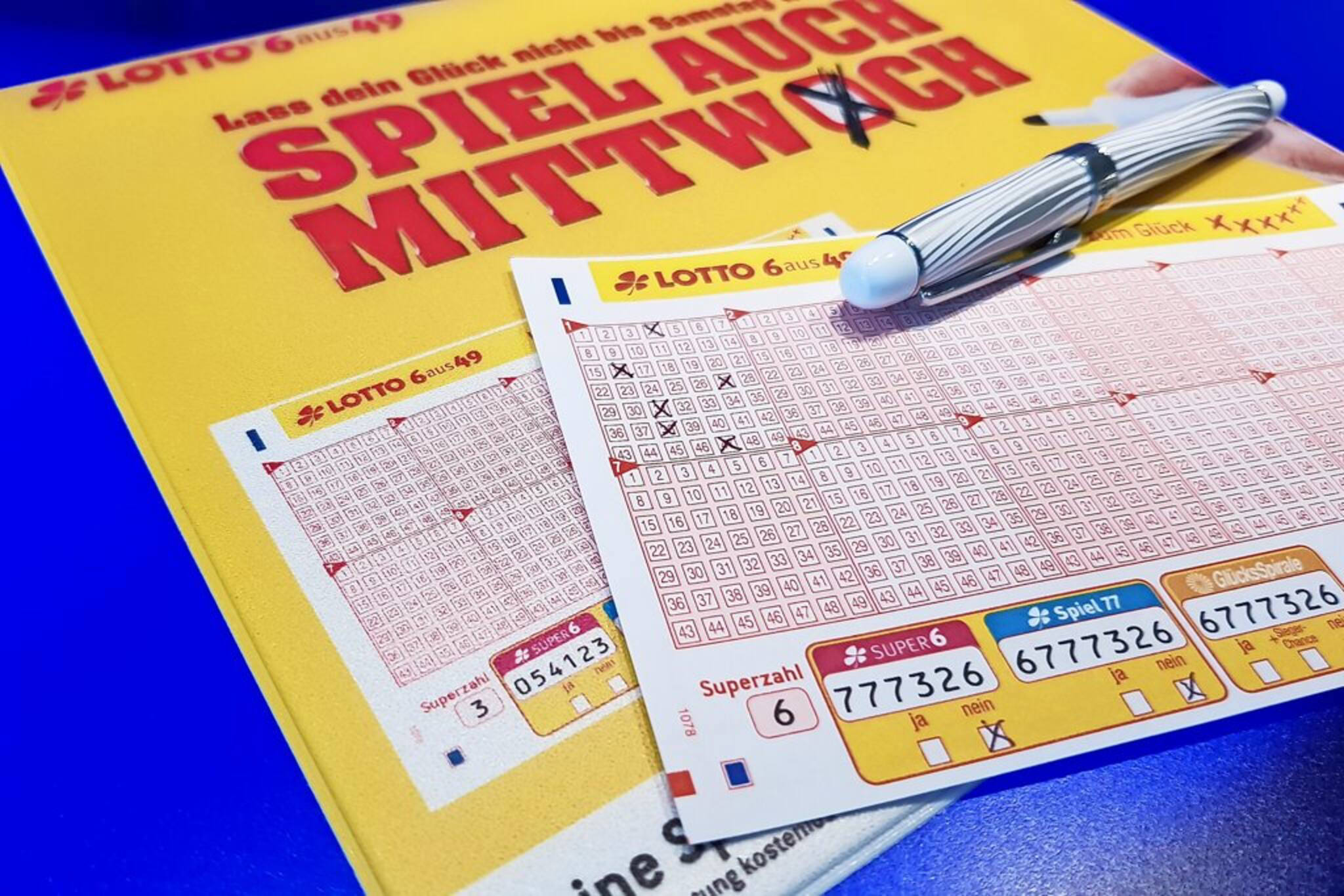

Mittwoch Lotto 6aus49 9 4 2025 Die Aktuellen Gewinnzahlen

May 08, 2025

Mittwoch Lotto 6aus49 9 4 2025 Die Aktuellen Gewinnzahlen

May 08, 2025 -

Dijital Miras Kripto Para Varliklarinin Korunmasi Ve Devri

May 08, 2025

Dijital Miras Kripto Para Varliklarinin Korunmasi Ve Devri

May 08, 2025