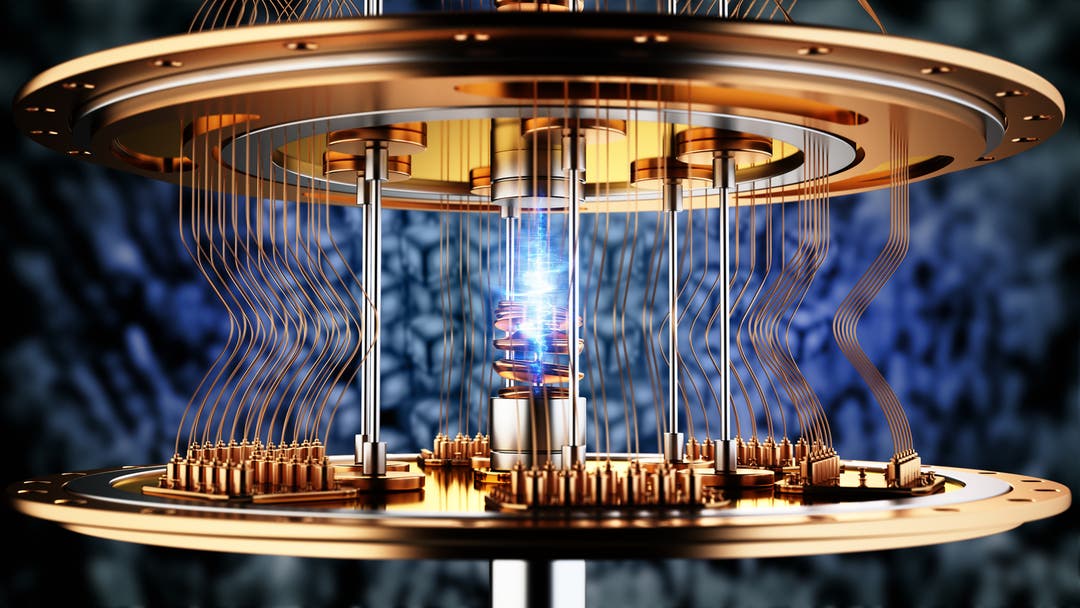

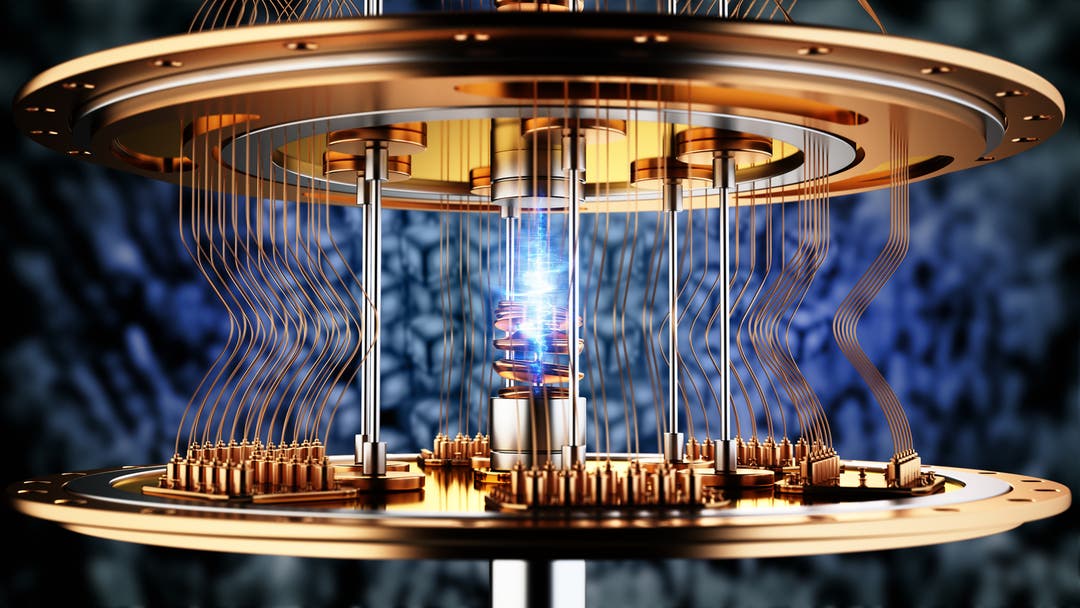

D-Wave Quantum Inc. (QBTS) Stock Drop On Monday: Reasons And Analysis

Table of Contents

Main Points: Deciphering the QBTS Stock Plunge

2.1 Market Sentiment and Overall Market Downturn

Monday's market presented a challenging environment for many stocks, including QBTS. The overall market downturn contributed significantly to the decline in D-Wave Quantum Inc.'s stock price. A general negative investor sentiment, affecting the technology sector as a whole, exacerbated the situation. The [Name of relevant stock index, e.g., Nasdaq Composite] experienced a [Percentage] drop, reflecting a broader sell-off. This broader market volatility created a ripple effect impacting even promising companies in emerging sectors like quantum computing.

- Negative investor sentiment: A prevailing feeling of uncertainty and risk aversion in the market led to widespread selling.

- Technology sector weakness: The technology sector, often more susceptible to market fluctuations, experienced a significant downturn, dragging down QBTS with it.

- Increased volatility: High market volatility amplified the impact of negative news, both real and perceived, contributing to the QBTS stock drop.

The confluence of these factors created a perfect storm, pushing down even relatively stable technology stocks and significantly impacting the more volatile quantum computing sector.

2.2 Company-Specific News and Announcements (or Lack Thereof)

A crucial aspect of understanding the QBTS stock drop is analyzing whether any company-specific news preceded or coincided with the decline. [State whether there was any relevant news. If yes, describe the news and its potential impact. If not, explain the absence of positive catalysts].

- Absence of positive catalysts: The lack of positive news or announcements, such as a major contract win or breakthrough in technology, left QBTS vulnerable to the broader market downturn.

- No significant press releases: An absence of positive press releases or significant announcements might have contributed to the lack of investor confidence.

- Delayed earnings reports (if applicable): Delays in releasing crucial financial reports can create uncertainty, fueling speculation and potentially triggering a sell-off.

The absence of any positive counterbalance to the negative market sentiment likely amplified the impact of the broader market downturn on QBTS stock.

2.3 Analysis of D-Wave Quantum Inc.'s Financial Performance

Analyzing D-Wave Quantum Inc.'s recent financial performance is crucial for understanding the stock drop. [Insert details of financial performance. Include data points like revenue growth, profitability, debt levels, and cash flow, comparing to competitors if possible]. Any underlying weaknesses in the company’s financials might have contributed to investor concern and the subsequent sell-off.

- Revenue growth: Compare D-Wave's revenue growth to its competitors and industry benchmarks. A slower-than-expected growth rate could cause investor unease.

- Profitability: Analyze profitability metrics to determine if the company is generating sufficient profits to sustain its operations and future growth.

- Debt levels: High debt levels can indicate financial vulnerability, making the company more susceptible to market downturns.

- Cash flow: Strong positive cash flow suggests a healthy financial position, while negative cash flow raises concerns.

A thorough analysis of D-Wave's financial health, particularly in comparison to its competitors in the quantum computing space, is essential for a comprehensive understanding of the stock's recent performance.

2.4 Speculation and Trading Activity

Speculation and trading activity often play a significant role in short-term stock price fluctuations. High trading volume on Monday might indicate substantial sell-offs, driven by speculation and potentially short-selling. [Insert data on trading volume if available]. Social media sentiment also needs consideration; any negative narratives circulating online could have influenced trader decisions.

- High trading volume: Unusual spikes in trading volume often suggest large-scale buying or selling pressure.

- Short-selling activity: Increased short-selling activity can exacerbate downward price movements.

- Social media sentiment: Negative sentiment expressed on social media platforms can impact investor confidence and drive further selling.

Understanding the interplay between speculation, short-selling, and social media sentiment is crucial for a complete picture of the QBTS stock drop.

Conclusion: Assessing the Future of QBTS Stock and Investing in Quantum Computing

The D-Wave Quantum Inc. (QBTS) stock drop on Monday resulted from a combination of factors: a general market downturn, negative investor sentiment towards technology stocks, the absence of positive company-specific news, and potentially, speculative trading activity. While the short-term outlook may seem uncertain, the long-term potential of quantum computing remains significant. Investors should conduct thorough due diligence before investing in QBTS or other quantum computing stocks, considering both the significant risks and the potentially high rewards. Monitor QBTS stock closely, analyze future QBTS performance reports, and understand the risks of investing in this volatile but potentially transformative technology. Further research into the company's financial health and the broader quantum computing landscape is advised before making any investment decisions. Stay informed to navigate the complexities of investing in QBTS and the future of quantum computing.

Featured Posts

-

Critics Honest Reviews Jennifer Lawrences New Film

May 20, 2025

Critics Honest Reviews Jennifer Lawrences New Film

May 20, 2025 -

Maltraitance Et Abus Sexuels Presumes A La Fieldview Care Home Informations Et Reactions

May 20, 2025

Maltraitance Et Abus Sexuels Presumes A La Fieldview Care Home Informations Et Reactions

May 20, 2025 -

Microsoft Activision Merger Ftc Files Appeal Against Court Ruling

May 20, 2025

Microsoft Activision Merger Ftc Files Appeal Against Court Ruling

May 20, 2025 -

El Viaje En Helicoptero De Michael Schumacher De Mallorca A Suiza

May 20, 2025

El Viaje En Helicoptero De Michael Schumacher De Mallorca A Suiza

May 20, 2025 -

Saisonende Bundesliga Abstieg Fuer Bochum Und Kiel Leipzig Entgeht Champions League

May 20, 2025

Saisonende Bundesliga Abstieg Fuer Bochum Und Kiel Leipzig Entgeht Champions League

May 20, 2025