D-Wave Quantum (QBTS): Investigating The 2025 Stock Market Performance

Table of Contents

Technological Advancements and Market Adoption of D-Wave's Quantum Annealers

D-Wave's success in 2025 hinges significantly on its technological progress and the adoption of its quantum annealing technology. Recent breakthroughs, like the D-Wave Advantage system, have pushed the boundaries of what's possible with quantum annealing. However, widespread adoption is crucial for significant stock appreciation.

- New algorithm developments and performance improvements: Continued progress in algorithm design specifically tailored for D-Wave's architecture is vital. Improvements in qubit connectivity and reduced noise levels will directly impact the system's performance and attract more users.

- Expansion of partnerships and collaborations with major corporations: Strategic alliances with industry leaders in finance, logistics, and materials science will accelerate the deployment of quantum annealing solutions, fueling market adoption and demonstrating real-world applications.

- Progress in user-friendly software and accessibility of D-Wave's systems: Ease of use is critical. Simplified software development kits (SDKs) and cloud-based access will significantly lower the barrier to entry for potential users, expanding the market reach of D-Wave's technology.

- Market research and analysis of industry growth projections for quantum annealing: Independent market research confirming robust growth projections for quantum annealing technology will bolster investor confidence and positively impact QBTS stock valuation. This includes tracking the number of users and the scale of their applications.

Competitive Landscape and Market Share of D-Wave Quantum

The quantum computing landscape is fiercely competitive. While D-Wave has established itself as a leader in quantum annealing, it faces competition from companies like IBM, Google, and IonQ, which are pursuing different quantum computing approaches (gate-based quantum computers).

- Comparison of D-Wave's technology with competing technologies (gate-based quantum computers, etc.): D-Wave's quantum annealing approach differs from gate-based systems. Understanding the strengths and weaknesses of each technology against specific use cases is essential to predicting D-Wave's market share.

- Analysis of market share and future growth potential: Tracking D-Wave's market share within the broader quantum computing market is crucial. Analyzing its potential for future growth, given the expected expansion of the quantum computing industry as a whole, is a key factor.

- Assessment of intellectual property protection and patent landscape: A strong intellectual property portfolio is essential for maintaining a competitive edge and safeguarding future revenue streams. Analyzing D-Wave's patent holdings and their strength is important.

- Discussion of potential mergers, acquisitions, or partnerships: Strategic partnerships or acquisitions could significantly alter D-Wave's market position and impact its stock price. Monitoring the industry for such developments is crucial.

Macroeconomic Factors Influencing QBTS Stock Performance in 2025

Macroeconomic conditions significantly influence the performance of technology stocks, including QBTS. Economic uncertainty, inflation, and interest rate changes can all impact investor sentiment and valuations.

- Impact of government regulations and funding on the quantum computing industry: Government policies and funding initiatives can accelerate or hinder the growth of the quantum computing sector, significantly affecting QBTS stock.

- Analysis of investor sentiment towards technology stocks in 2025: Overall investor sentiment toward tech stocks will influence QBTS's performance. A positive outlook will likely boost the stock price, while negative sentiment could suppress it.

- Potential for increased investment in quantum computing due to geopolitical factors: Geopolitical events can create a surge in investment in strategically important technologies like quantum computing. This could benefit QBTS.

- Economic forecasts and their impact on QBTS stock valuation: Economic forecasts predicting growth or recession will directly impact the valuation of technology stocks, including QBTS.

Financial Performance and Valuation of D-Wave Quantum (QBTS)

Analyzing D-Wave's financial statements, revenue growth, profitability, and cash flow is essential for assessing the company's financial health and future potential.

- Revenue projections and anticipated growth rates for 2025: Forecasting D-Wave's revenue growth in 2025 is critical for determining its stock valuation. This requires analyzing its current sales and projections for future contracts.

- Analysis of operating expenses and profit margins: Understanding D-Wave's operating expenses and profit margins will reveal its efficiency and profitability. Higher profit margins indicate a healthier financial position.

- Assessment of debt levels and financial stability: High debt levels can be risky. Analyzing D-Wave's debt burden and overall financial stability is important.

- Comparison of QBTS valuation with those of similar companies in the tech sector: Comparing QBTS's valuation metrics (price-to-earnings ratio, price-to-sales ratio, etc.) with those of similar companies in the technology sector provides context for its valuation.

Conclusion: Investing in the Future with D-Wave Quantum (QBTS) in 2025

Predicting QBTS stock performance in 2025 requires considering a complex interplay of technological advancements, competitive dynamics, and macroeconomic factors. While D-Wave's innovative technology holds immense potential, the inherent risks associated with investing in a relatively young company in a rapidly evolving field must be acknowledged. Thorough due diligence is essential before investing in D-Wave Quantum (QBTS) in 2025. Consider the long-term potential of D-Wave Quantum (QBTS) and its role in the future of quantum computing. Further research into D-Wave Quantum (QBTS) and its place within the 2025 stock market is highly recommended. Investing in D-Wave Quantum (QBTS) should be considered as part of a well-diversified investment portfolio, carefully balancing potential rewards with inherent risks.

Featured Posts

-

La Regresa Fallida De Schumacher Conversacion Sincera Antes Del Gran Premio De 2010

May 20, 2025

La Regresa Fallida De Schumacher Conversacion Sincera Antes Del Gran Premio De 2010

May 20, 2025 -

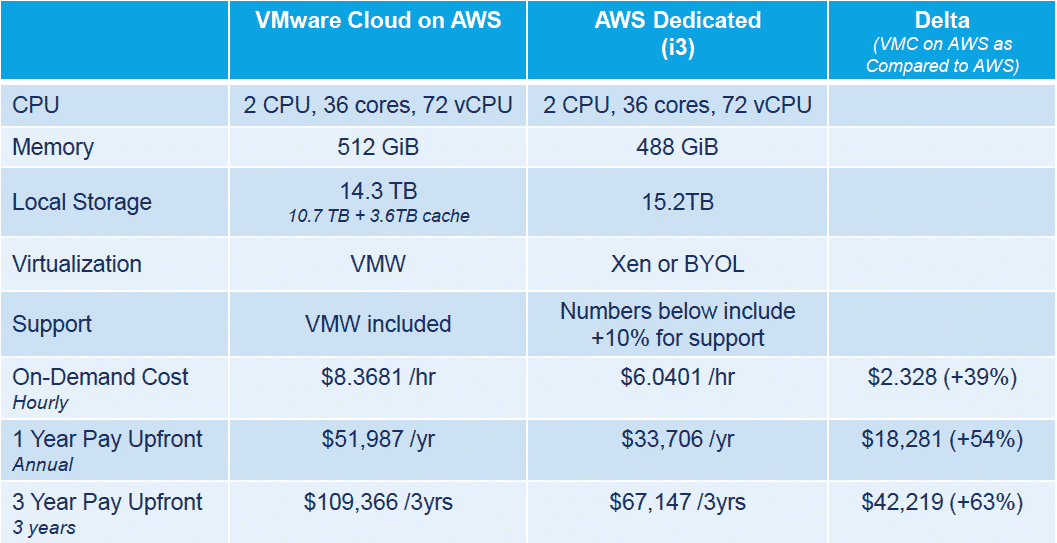

Broadcoms Extreme V Mware Price Increase At And T Sounds The Alarm

May 20, 2025

Broadcoms Extreme V Mware Price Increase At And T Sounds The Alarm

May 20, 2025 -

Rio De Janeiro Incendio Em Escola Na Tijuca Causa Tristeza E Indignacao

May 20, 2025

Rio De Janeiro Incendio Em Escola Na Tijuca Causa Tristeza E Indignacao

May 20, 2025 -

How To Plan Activities For Breezy And Mild Weather

May 20, 2025

How To Plan Activities For Breezy And Mild Weather

May 20, 2025 -

Andelka Milivojevic Tadic U Suzama Ispracena Na Vecni Pocinak

May 20, 2025

Andelka Milivojevic Tadic U Suzama Ispracena Na Vecni Pocinak

May 20, 2025