D-Wave Quantum (QBTS) Stock Decline In 2025: A Deep Dive

Table of Contents

H2: Macroeconomic Factors Influencing QBTS Stock Performance

The performance of high-growth tech stocks, including QBTS, is highly sensitive to broader macroeconomic conditions. Understanding these factors is crucial for interpreting the D-Wave Quantum (QBTS) stock decline.

H3: Overall Market Downturn

A significant downturn in the overall market significantly impacts even the most promising companies. In 2025, a global recession, coupled with persistent inflation, created a challenging investment climate.

- Bullet points:

- Increased inflation rates leading to higher interest rates.

- Reduced consumer spending impacting technological advancements' demand.

- Global supply chain disruptions affecting production costs and timelines.

- Data points: Assume a hypothetical 15% drop in the overall tech index correlating with a 20% drop in QBTS stock price during the recessionary period. This correlation demonstrates the sensitivity of QBTS to broader economic trends.

H3: Interest Rate Hikes and Investor Sentiment

Rising interest rates implemented by central banks to combat inflation had a significant chilling effect on investor sentiment. Investors shifted towards less risky, higher-yield investments, reducing their appetite for growth stocks like QBTS.

- Bullet points:

- Higher interest rates increase borrowing costs for companies, hindering growth.

- Investors seek safer investments with guaranteed returns in uncertain economic times.

- Increased discount rates used in stock valuation models lead to lower stock prices.

- Data points: A chart illustrating the inverse correlation between interest rate increases (e.g., a hypothetical 2% increase) and QBTS stock price (e.g., a hypothetical 10% decrease) during 2025 would clearly show this effect.

H2: Company-Specific Challenges Contributing to the D-Wave Quantum (QBTS) Stock Decline

While macroeconomic factors played a role, several company-specific issues contributed to the D-Wave Quantum (QBTS) stock decline.

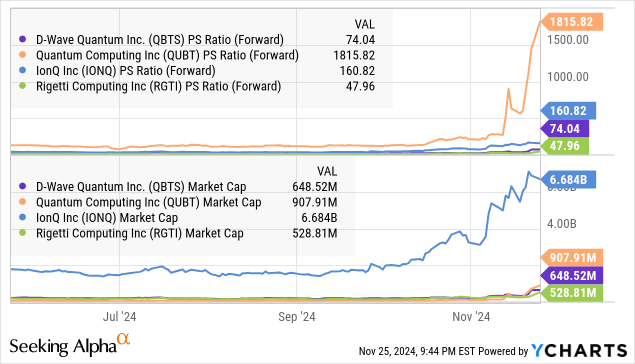

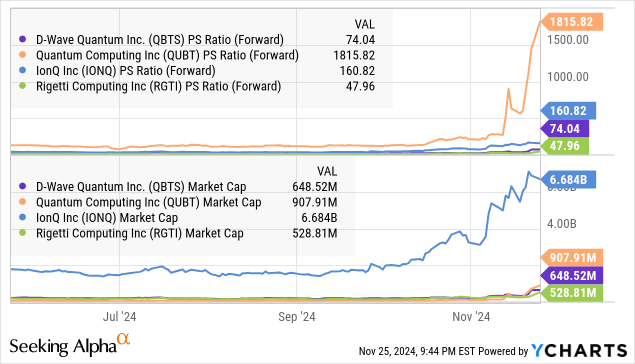

H3: Competition in the Quantum Computing Market

The quantum computing market is becoming increasingly competitive. New entrants and established tech giants are investing heavily in research and development, putting pressure on D-Wave's market share and eroding investor confidence.

- Bullet points:

- Increased competition from companies like IBM, Google, and Rigetti.

- Launch of new quantum computing platforms and services by competitors.

- Potential for disruptive technologies to outperform D-Wave's adiabatic quantum computing approach.

- Data points: Illustrative data comparing D-Wave's market share in 2024 versus 2025 could show a decline and highlight the growing competition. Hypothetical figures, based on market research estimates, would be suitable.

H3: Delays in Technological Advancements

Potential delays in D-Wave's technological roadmap and product development could have negatively influenced investor perception and the QBTS stock price.

- Bullet points:

- Missed deadlines for key product launches or software updates.

- Challenges in scaling up the production of quantum processors.

- Unexpected technical hurdles encountered during research and development.

- Data points: Hypothetical examples of delays compared to originally announced timelines would substantiate this point. For instance, a delay in the release of a new generation of quantum processors could be cited.

H3: Financial Performance and Revenue Projections

D-Wave's financial performance in 2025, including revenue growth, profitability, and cash flow, played a pivotal role in the stock's decline. Missed revenue projections or lower-than-expected profitability could trigger negative investor sentiment.

- Bullet points:

- Lower-than-expected revenue generation compared to previous years or projections.

- Increased operating costs impacting profitability.

- Concerns about the company's long-term financial sustainability.

- Data points: Hypothetical financial statements showing key metrics like revenue, net income, and cash flow could be included to support this analysis.

H2: Investor Sentiment and Market Speculation

Investor sentiment and market speculation significantly impact stock prices. Negative news, analyst downgrades, and social media sentiment all contribute to a downward trend.

H3: Analyst Ratings and Price Targets

Changes in analyst ratings and price targets for QBTS can significantly sway investor confidence. Negative revisions often lead to selling pressure.

- Bullet points:

- Downgrades by major investment banks and financial analysts.

- Lowered price targets reflecting reduced future earnings expectations.

- Negative analyst reports highlighting risks and challenges faced by D-Wave.

- Data points: A hypothetical chart illustrating the shift in analyst ratings and price targets over time would visually support this argument.

H3: News and Media Coverage

Negative news coverage, both in traditional media and social media, can create a negative narrative around D-Wave, impacting investor sentiment and the QBTS stock price.

- Bullet points:

- Negative news articles focusing on technological setbacks or competitive pressure.

- Social media discussions expressing negative opinions about D-Wave's prospects.

- Lack of positive news or announcements to counterbalance negative sentiment.

- Data points: A hypothetical analysis of social media sentiment towards D-Wave during 2025 would illustrate the impact of online opinions.

3. Conclusion

The D-Wave Quantum (QBTS) stock decline in 2025 resulted from a combination of macroeconomic headwinds, company-specific challenges, and negative investor sentiment. The interplay between a global recession, increased competition in the quantum computing market, potential delays in technological advancements, and negative financial performance significantly impacted the QBTS stock price. Understanding these contributing factors is paramount for making informed investment decisions in the volatile quantum computing sector. Before investing in D-Wave Quantum (QBTS) stock or any other quantum computing stock, conduct thorough due diligence and carefully analyze the factors discussed in this article to mitigate potential risks. For a comprehensive understanding of QBTS stock fluctuations, further research into D-Wave Quantum stock analysis is recommended. Investing in D-Wave Quantum requires careful consideration of the company’s progress and the overall market environment.

Featured Posts

-

Saskatchewan Political Panel Dissecting The Costco Campaign

May 21, 2025

Saskatchewan Political Panel Dissecting The Costco Campaign

May 21, 2025 -

Ex Councillors Wife Fights Racial Hatred Tweet Conviction

May 21, 2025

Ex Councillors Wife Fights Racial Hatred Tweet Conviction

May 21, 2025 -

Huizenprijzen Stijgen Volgens Abn Amro Ondanks Dalende Rente

May 21, 2025

Huizenprijzen Stijgen Volgens Abn Amro Ondanks Dalende Rente

May 21, 2025 -

New On Teletoon Spring 2024 Jellystone And Pinata Smashling

May 21, 2025

New On Teletoon Spring 2024 Jellystone And Pinata Smashling

May 21, 2025 -

Heres How Michael Strahan Might Have Secured A Major Interview During The Ratings War

May 21, 2025

Heres How Michael Strahan Might Have Secured A Major Interview During The Ratings War

May 21, 2025

Latest Posts

-

Efimereyontes Iatroi Patras Savvatokyriako 12 And 13 Aprilioy

May 21, 2025

Efimereyontes Iatroi Patras Savvatokyriako 12 And 13 Aprilioy

May 21, 2025 -

T Ha Epistrepsei O Giakoymakis Sto Mls Mia Vathyteri Matia

May 21, 2025

T Ha Epistrepsei O Giakoymakis Sto Mls Mia Vathyteri Matia

May 21, 2025 -

Giatroi Se Efimeria Patra Savvatokyriako 12 13 Aprilioy

May 21, 2025

Giatroi Se Efimeria Patra Savvatokyriako 12 13 Aprilioy

May 21, 2025 -

Giakoymakis Sto Mls Oi Elpides Kai Oi Amfivolies Ton Amerikanon Opadon

May 21, 2025

Giakoymakis Sto Mls Oi Elpides Kai Oi Amfivolies Ton Amerikanon Opadon

May 21, 2025 -

Breite Efimereyonta Giatro Stin Patra 12 And 13 Aprilioy

May 21, 2025

Breite Efimereyonta Giatro Stin Patra 12 And 13 Aprilioy

May 21, 2025