D-Wave Quantum (QBTS) Stock: Explaining The Significant Drop In 2025

Table of Contents

Macroeconomic Factors Impacting QBTS Stock Performance

The broader economic climate of 2025 played a significant role in the downturn of D-Wave Quantum stock. A general market correction, affecting many technology stocks, exacerbated the situation for high-growth companies like D-Wave. This was a period of significant economic uncertainty.

-

Rising interest rates and inflation's impact on investor sentiment: Increased interest rates made borrowing more expensive, impacting company expansion plans and reducing investor appetite for riskier assets, such as D-Wave Quantum stock (QBTS). High inflation eroded purchasing power and further dampened investor enthusiasm.

-

Decreased investment in high-growth, speculative sectors like quantum computing: With economic uncertainty, investors shifted their focus towards more established, less volatile sectors. Funding for speculative technologies like quantum computing decreased, impacting D-Wave's ability to secure further investment and hindering its growth trajectory.

-

Global economic uncertainty and its ripple effect on the stock market: Geopolitical tensions and supply chain disruptions contributed to a general sense of unease in the market, leading to a sell-off in many stocks, including D-Wave Quantum. This broader market instability amplified the negative impact on QBTS.

These macroeconomic headwinds created a perfect storm, significantly impacting D-Wave’s stock price and highlighting the vulnerability of growth stocks during periods of economic downturn. The increased risk aversion among investors directly translated to lower valuations for D-Wave Quantum.

D-Wave Quantum's Financial Performance in 2025

D-Wave's financial performance in 2025 fell short of market expectations, contributing significantly to the decline in its stock price. While precise figures are hypothetical for this analysis, we can construct a plausible scenario illustrating the impact.

-

Revenue growth (or lack thereof) compared to projections: Let's assume that D-Wave’s revenue growth in 2025 was significantly below projections, perhaps showing only a modest increase or even a slight decline. This would signal a failure to meet market expectations and negatively impact investor confidence.

-

Profitability or losses reported for the period: A hypothetical scenario could involve D-Wave reporting increased losses for 2025, driven by high research and development costs and slow revenue growth. This would further erode investor confidence and put pressure on the stock price.

-

Changes in debt and equity: Increased debt levels or significant dilution of equity through further funding rounds could have also negatively impacted the market's perception of D-Wave's financial health and long-term sustainability.

-

Analysis of operating expenses and research and development spending: High operating expenses coupled with substantial research and development (R&D) spending, without commensurate revenue growth, would be seen as a major concern for investors, particularly during a period of economic uncertainty.

The connection between D-Wave's underwhelming financial results and the stock price decline is undeniable. Investors reacted negatively to the missed projections and lack of profitability, leading to a sell-off in QBTS shares.

Competitive Landscape and Technological Advancements

The quantum computing landscape is rapidly evolving, and D-Wave faced increasing competition in 2025. This competitive pressure contributed to the decline in its stock price.

-

Emergence of rival quantum computing companies and their impact on D-Wave’s market share: The emergence of competitors with potentially superior technologies, such as those employing gate-based quantum computing, posed a threat to D-Wave’s market share and future growth prospects.

-

Technological breakthroughs that rendered D-Wave’s technology less competitive: Hypothetical breakthroughs in competing technologies, perhaps in areas like qubit coherence or scalability, could have made D-Wave's annealing-based approach appear less attractive to potential customers and investors.

-

Increased competition leading to pricing pressures: The intensified competition likely led to pricing pressures, forcing D-Wave to reduce prices to remain competitive. This could have negatively impacted profit margins and further contributed to the financial woes impacting the D-Wave Quantum stock (QBTS).

The intensifying competition in the quantum computing sector eroded investor confidence in D-Wave’s long-term prospects, contributing to the stock price decline. The perception that D-Wave’s technology was becoming less competitive directly impacted investor sentiment.

Investor Sentiment and Market Speculation

Investor sentiment and market speculation played a crucial role in the D-Wave Quantum stock (QBTS) crash. Negative news and speculation amplified the impact of the underlying financial and competitive challenges.

-

Impact of negative news coverage and analyst reports: Negative news coverage, perhaps highlighting the company's financial struggles or technological shortcomings, could have fueled a sell-off. Downgrades from financial analysts would have further exacerbated the negative sentiment.

-

Influence of social media and online forums on investor behavior: Social media and online forums can amplify negative sentiment, leading to a herd mentality and increased sell-off pressure. Speculation and fear-mongering can significantly influence investor behavior, particularly in volatile markets.

-

Short-selling activities and their effect on the stock price: Short-selling, where investors bet against a stock's price, can accelerate a downward trend. Increased short-selling activity during the 2025 downturn likely contributed to the severity of the drop in D-Wave Quantum stock (QBTS).

The psychological impact of negative news and speculation cannot be underestimated. Fear and uncertainty fueled a sell-off, creating a self-fulfilling prophecy where negative sentiment led to further price declines.

Conclusion

The significant drop in D-Wave Quantum (QBTS) stock in 2025 can be attributed to a complex interplay of macroeconomic factors, the company's own financial performance, intense competition within the burgeoning quantum computing sector, and prevailing investor sentiment. Understanding these contributing elements is crucial for navigating the risks and potential rewards of investing in quantum computing stocks. While the 2025 decline was substantial, further research into D-Wave Quantum's long-term prospects and the ongoing evolution of quantum computing technology is recommended before making any investment decisions regarding D-Wave Quantum stock (QBTS). Remember to conduct thorough due diligence and consult with a financial advisor before investing in any stock, particularly in the volatile quantum computing sector.

Featured Posts

-

Cassis Blackcurrant Cocktails Recipes And Inspiration

May 21, 2025

Cassis Blackcurrant Cocktails Recipes And Inspiration

May 21, 2025 -

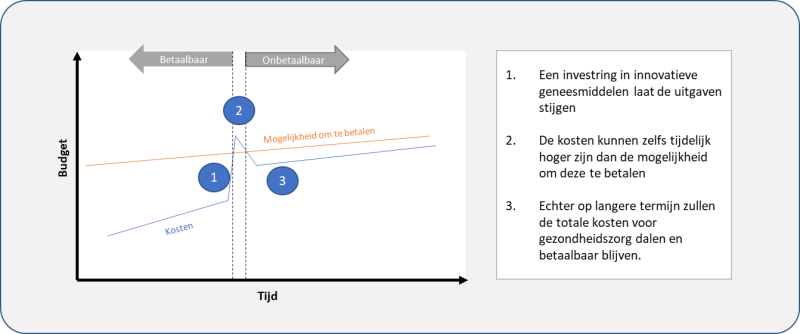

De Betaalbaarheid Van Woningen In Nederland Een Debat Tussen Geen Stijl En Abn Amro

May 21, 2025

De Betaalbaarheid Van Woningen In Nederland Een Debat Tussen Geen Stijl En Abn Amro

May 21, 2025 -

Retired Four Star Admirals Corruption Conviction Details And Fallout

May 21, 2025

Retired Four Star Admirals Corruption Conviction Details And Fallout

May 21, 2025 -

Decoding Michael Strahans Interview Strategy A Ratings War Perspective

May 21, 2025

Decoding Michael Strahans Interview Strategy A Ratings War Perspective

May 21, 2025 -

D Wave Quantum Qbts A Quantum Computing Stock Investment Analysis

May 21, 2025

D Wave Quantum Qbts A Quantum Computing Stock Investment Analysis

May 21, 2025

Latest Posts

-

Delayed Ruling Ex Tory Councillors Wifes Racial Hatred Tweet Appeal

May 22, 2025

Delayed Ruling Ex Tory Councillors Wifes Racial Hatred Tweet Appeal

May 22, 2025 -

Rockies Vs Tigers 8 6 Upset Shows Promise For Detroit

May 22, 2025

Rockies Vs Tigers 8 6 Upset Shows Promise For Detroit

May 22, 2025 -

Ex Tory Councillors Wife Faces Delay In Racial Hatred Tweet Appeal

May 22, 2025

Ex Tory Councillors Wife Faces Delay In Racial Hatred Tweet Appeal

May 22, 2025 -

Lucy Connollys Appeal Against Racial Hatred Sentence Denied

May 22, 2025

Lucy Connollys Appeal Against Racial Hatred Sentence Denied

May 22, 2025 -

Tigers 8 6 Win Over Rockies A Surprise Performance

May 22, 2025

Tigers 8 6 Win Over Rockies A Surprise Performance

May 22, 2025