D-Wave Quantum (QBTS) Stock Market Performance: A Week Of Growth

Table of Contents

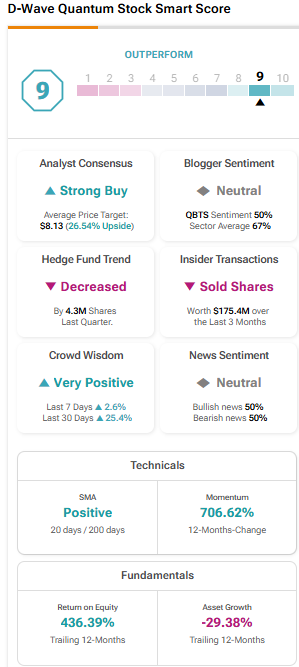

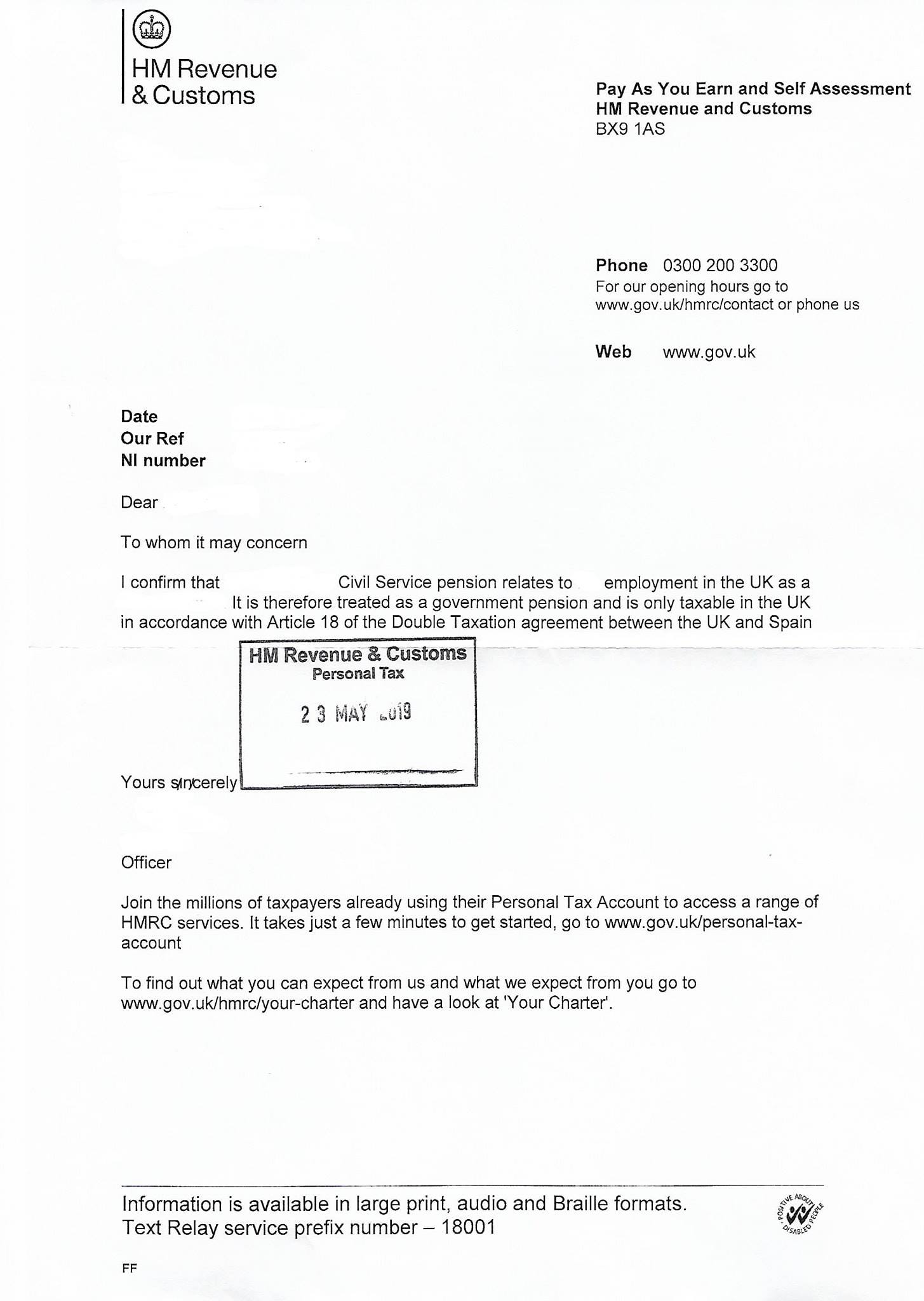

Analyzing the QBTS Stock Price Surge

From Monday, October 23rd, to Friday, October 27th, QBTS experienced a 15% increase, a noteworthy jump that caught the attention of many investors. This substantial growth warrants a closer look at the underlying factors.

Key Factors Influencing the Growth

Several factors likely contributed to this positive QBTS stock performance:

-

Positive news releases or announcements: A recent partnership with a major cloud computing provider (hypothetical example: "Amazon Web Services") to integrate D-Wave's quantum annealing technology into their cloud platform was announced on October 24th. [Insert hypothetical link to press release here]. This significantly boosted investor confidence. Another factor could be the successful completion of a major milestone in their roadmap, like reaching a specific qubit count or achieving a breakthrough in algorithm performance.

-

Increased investor interest in the quantum computing market overall: The quantum computing market is experiencing a period of significant growth, with increased investment from both private and public sectors. This overall market optimism spills over into individual quantum computing stocks, positively impacting QBTS. Growing government investment in quantum technology research and development further fuels this trend.

-

Speculation regarding future technological advancements from D-Wave: Market anticipation of D-Wave's upcoming advancements in quantum annealing and potential breakthroughs in solving complex optimization problems is driving investor interest. Rumors of a new generation of processors with improved qubit coherence times also contributed to the surge.

-

Comparison to competitor stock performance in the quantum computing space: While other quantum computing companies like IonQ and Rigetti also experienced growth, D-Wave's increase was proportionally more significant this week. This relative outperformance attracted further investment.

Trading Volume and Volatility

The trading volume for QBTS increased considerably during the week, suggesting heightened investor activity. This higher volume coupled with the price increase indicates strong buying pressure. The price movement was relatively stable throughout the week, with only minor daily fluctuations, suggesting a controlled and sustained upward trend rather than a speculative bubble.

Understanding the Long-Term Implications for D-Wave Quantum

The recent QBTS stock performance offers insights into the company's long-term potential and the broader quantum computing landscape.

Future Growth Potential

The long-term growth potential for D-Wave hinges on several factors:

-

Continued technological advancements: D-Wave's ongoing research and development efforts are critical. Further improvements in qubit coherence, connectivity, and control systems will enhance the capabilities of their quantum annealers, leading to wider adoption.

-

Expansion into new markets: Applications of quantum annealing in areas like logistics optimization, materials science, and financial modeling could unlock substantial growth opportunities. Integration with cloud platforms will broaden accessibility and accelerate adoption.

Risk Factors and Considerations

Despite the positive momentum, investing in QBTS involves risks:

-

Market volatility: The quantum computing sector, like any emerging technology market, is subject to volatility. Economic downturns or shifts in investor sentiment could negatively impact QBTS's stock price.

-

Competition: Intense competition from other quantum computing companies developing different quantum technologies (e.g., gate-based quantum computers) presents a challenge. Maintaining a technological edge is crucial for long-term success.

-

Technological hurdles: Overcoming technological challenges and scaling up quantum processors remain significant hurdles. Unforeseen technical difficulties could delay progress and impact investor confidence.

Investment Strategies for D-Wave Quantum (QBTS)

Making informed investment decisions regarding QBTS requires careful consideration of various strategies.

Short-Term vs. Long-Term Investments

-

Short-term investments: While short-term gains are possible, the volatility of QBTS stock makes this approach riskier. Profiting from short-term fluctuations requires precise market timing and a higher risk tolerance.

-

Long-term investments: A long-term perspective aligns better with the potential for growth in the quantum computing sector. This approach mitigates short-term volatility and focuses on the company's long-term prospects.

Diversification and Risk Management

Diversification is paramount. Don't invest a significant portion of your portfolio in a single stock, especially in a high-growth, high-risk sector like quantum computing. Proper risk management involves thorough research, understanding your risk tolerance, and having a well-defined exit strategy.

Conclusion

This week's substantial growth in D-Wave Quantum (QBTS) stock presents a compelling case study in the dynamic quantum computing market. While analyzing the factors driving this growth, understanding the potential future implications, and considering the inherent risks are crucial for investors, the overall trend indicates a promising outlook. Whether you're considering short-term gains or long-term investments, thorough research and a well-defined investment strategy are paramount before engaging with D-Wave Quantum (QBTS) stock. Stay informed about the latest developments in the quantum computing sector and keep a close eye on D-Wave Quantum (QBTS) stock market performance. Consider your risk tolerance and investment goals carefully before investing in QBTS or any other quantum computing stock.

Featured Posts

-

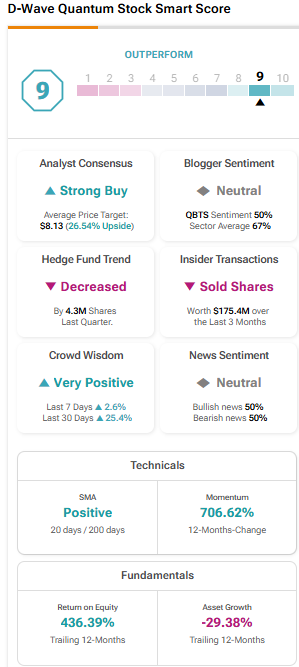

Is Canada Post Facing Bankruptcy The Case For Ending Door To Door Mail Service

May 20, 2025

Is Canada Post Facing Bankruptcy The Case For Ending Door To Door Mail Service

May 20, 2025 -

Bucharest Open Flavio Cobolli Secures Historic Victory

May 20, 2025

Bucharest Open Flavio Cobolli Secures Historic Victory

May 20, 2025 -

Eurovision 2025 Meet The Contestants

May 20, 2025

Eurovision 2025 Meet The Contestants

May 20, 2025 -

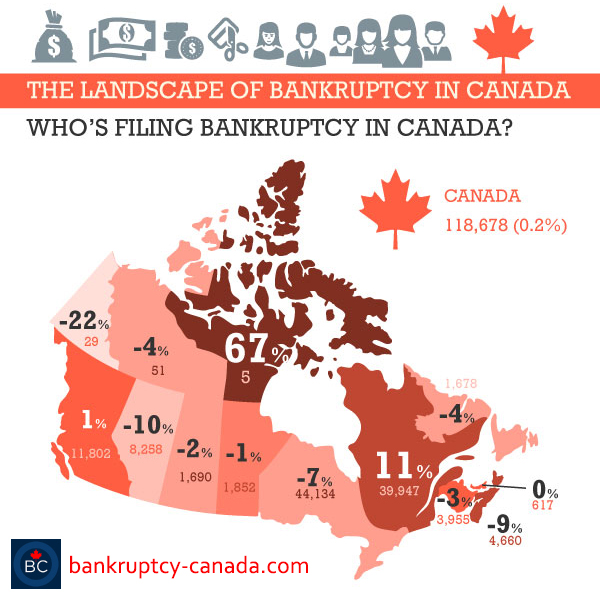

Understanding Your Hmrc Post A Guide For Uk Citizens

May 20, 2025

Understanding Your Hmrc Post A Guide For Uk Citizens

May 20, 2025 -

Diner Exclusif Rooftop Galeries Lafayette Biarritz Imanol Harinordoquy Et Jean Michel Suhubiette

May 20, 2025

Diner Exclusif Rooftop Galeries Lafayette Biarritz Imanol Harinordoquy Et Jean Michel Suhubiette

May 20, 2025