D-Wave Quantum (QBTS) Stock Performance: Explaining Monday's Dip

Table of Contents

Market-Wide Factors Influencing QBTS Stock Price

Monday's downturn in QBTS wasn't an isolated event; broader market forces played a significant role. The overall market sentiment was negative, with a prevailing sense of uncertainty impacting various technology stocks, including those in the burgeoning quantum computing field. This general negativity likely contributed to the downward pressure on QBTS.

- Broader Market Downturn: A general sell-off in the technology sector, potentially fueled by concerns over interest rate hikes or inflation reports, could have negatively impacted QBTS. Many tech stocks are highly sensitive to macroeconomic conditions.

- Economic News and Events: Negative economic news, such as unexpectedly high inflation figures or announcements of further interest rate increases by central banks, often leads to risk aversion among investors, causing them to sell off shares in even promising companies like D-Wave Quantum.

- Correlation with NASDAQ: The NASDAQ Composite, a benchmark for technology stocks, often influences the performance of individual tech companies. A significant drop in the NASDAQ would likely correlate with a decrease in QBTS stock price. Analyzing the correlation between QBTS and the NASDAQ on Monday is key to understanding the extent of this influence.

Company-Specific News and Developments

While market sentiment contributed to the dip, it's crucial to examine any company-specific factors that may have influenced investor confidence. Analyzing press releases, financial reports, and overall company news is essential.

- Press Releases and Announcements: Did D-Wave Quantum release any news on or around Monday that might have spooked investors? A disappointing product announcement, a delay in project timelines, or even negative press coverage could have contributed to the stock decline.

- Financial Reports and Earnings Calls: Recent financial reports and earnings calls are vital for understanding a company's financial health. If D-Wave Quantum missed earnings expectations or provided a less-than-optimistic outlook, it could have led to a sell-off.

- Internal Challenges: Internal challenges, such as unexpected setbacks in research and development, management changes, or internal restructuring, can also affect investor confidence and lead to a decline in stock price.

Analysis of Investor Sentiment and Trading Volume

Understanding investor sentiment and trading volume provides further insights into Monday's QBTS stock dip.

- Trading Volume: Was the trading volume for QBTS unusually high on Monday? High volume often indicates significant selling pressure, suggesting many investors were simultaneously selling their shares.

- Analyst Ratings and Price Targets: Changes in analyst ratings or price targets for QBTS could significantly influence investor behavior. A downgrade from a major analyst firm could trigger a sell-off.

- Social Media Sentiment: Monitoring social media sentiment towards D-Wave Quantum can provide a real-time gauge of investor opinion. Negative sentiment expressed on platforms like Twitter or Reddit could contribute to selling pressure.

Comparison to Competitor Stock Performance

To gain a clearer perspective on Monday's QBTS dip, comparing its performance to competitors in the quantum computing sector is crucial.

- Competitor Analysis: Did D-Wave Quantum's competitors experience similar stock price declines on Monday? If so, it suggests that the dip might be largely attributable to broader market factors. If not, company-specific factors are more likely to be at play.

- Relative Strength: Analyzing the relative strength or weakness of QBTS compared to its peers helps to determine whether the decline was disproportionate or in line with the sector's overall performance.

Conclusion: Assessing the Future of D-Wave Quantum (QBTS) Stock

Monday's dip in D-Wave Quantum (QBTS) stock price was likely influenced by a combination of market-wide factors, such as broader market downturns and general economic uncertainty, and potentially company-specific news or investor sentiment. While these negative factors are concerning, it's essential to maintain a balanced perspective. D-Wave Quantum operates in a rapidly evolving and potentially highly lucrative sector, and long-term opportunities in quantum computing remain significant. Before making any investment decisions regarding D-Wave Quantum (QBTS) stock, thorough independent research is essential. Stay updated on the company's progress and future developments in the quantum computing field to make informed decisions about your investment strategy. Remember to carefully consider your risk tolerance before investing in QBTS or any other quantum computing stock.

Featured Posts

-

Talisca Ve Fenerbahce Saha Tartismasi Ve Tadic Transferi

May 20, 2025

Talisca Ve Fenerbahce Saha Tartismasi Ve Tadic Transferi

May 20, 2025 -

The Unexpected Link Between Agatha Christie And M Night Shyamalans The Village

May 20, 2025

The Unexpected Link Between Agatha Christie And M Night Shyamalans The Village

May 20, 2025 -

Familia Schumacher Se Mareste Gina Maria A Nascut O Fetita

May 20, 2025

Familia Schumacher Se Mareste Gina Maria A Nascut O Fetita

May 20, 2025 -

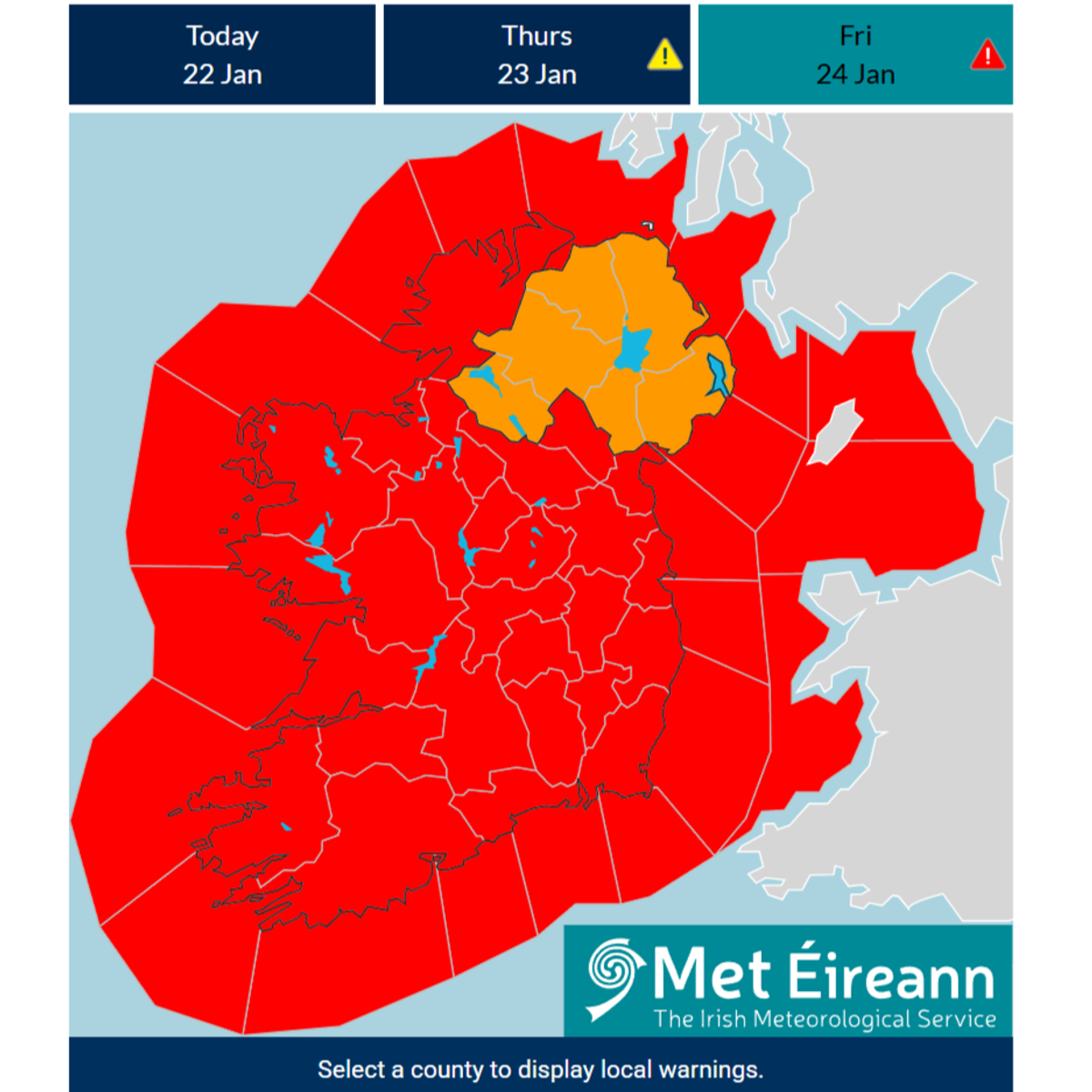

Severe Weather Alert Strong Winds And Impending Storms

May 20, 2025

Severe Weather Alert Strong Winds And Impending Storms

May 20, 2025 -

Patra Efimereyontes Giatroi Savvatokyriako 12 And 13 Aprilioy

May 20, 2025

Patra Efimereyontes Giatroi Savvatokyriako 12 And 13 Aprilioy

May 20, 2025