Dalton's Alliance With Murakami-Linked Fund Targets Fuji Media Restructuring

Table of Contents

Dalton Investment's Strategy and Objectives

Dalton Investments is renowned for its activist investing approach, often targeting undervalued companies with the potential for significant turnaround. Their strategy typically involves identifying operational inefficiencies, restructuring management, and implementing cost-cutting measures to boost profitability and shareholder value. In the case of Fuji Media, Dalton likely seeks to unlock significant hidden value. Their objectives likely include:

- Increased Profitability: Improving Fuji Media's operating margins through streamlined operations and cost optimization.

- Enhanced Market Share: Strengthening Fuji Media's competitive position through strategic initiatives and innovative content development.

- Improved Corporate Governance: Implementing best practices in corporate governance to enhance transparency and accountability.

Bullet Points:

- Expected ROI: While specific projections are unavailable publicly, Dalton likely anticipates a substantial return based on their historical performance in similar restructuring projects.

- Management Changes: Significant changes in Fuji Media's senior management and board composition are highly anticipated as part of the restructuring.

- Timeline: The restructuring process is expected to unfold over several quarters, involving several phases of analysis, strategic planning, and implementation.

The Role of the Murakami-Linked Fund

The involvement of a Murakami-linked fund adds another layer of complexity and intrigue to this restructuring. Yoshiaki Murakami, a prominent figure in Japanese finance known for his activist investing and occasionally controversial tactics, has a history of significant influence in corporate restructurings. While the specifics of this particular fund's involvement remain undisclosed, its connection to Murakami suggests a deep understanding of the Japanese media landscape and a willingness to engage in bold strategic moves.

Bullet Points:

- Investment Size: The exact financial contribution of the Murakami-linked fund is yet to be publicly disclosed.

- Expertise: The fund likely brings invaluable expertise in media content creation, distribution, and audience engagement.

- Potential Conflicts: The fund's involvement may attract regulatory scrutiny due to Murakami's past activities and the potential for conflicts of interest.

Fuji Media's Current Situation and Restructuring Needs

Fuji Media currently faces a challenging environment characterized by declining viewership, fierce competition from streaming services, and a heavy debt burden. These factors have significantly impacted its financial performance, necessitating a comprehensive restructuring to ensure long-term viability.

Bullet Points:

- KPIs: Declining advertising revenue, shrinking profit margins, and a decrease in viewer ratings are key indicators of Fuji Media's current struggles.

- Impact on Stakeholders: The restructuring may lead to job losses and changes in shareholder composition.

- Regulatory Hurdles: Securing regulatory approvals for significant restructuring initiatives will be a crucial step in the process. Antitrust issues and broadcasting regulations will need careful consideration.

Market Reactions and Potential Implications

The announcement of Dalton's alliance with the Murakami-linked fund has sent ripples through the Japanese financial markets. Fuji Media's stock price has experienced significant volatility since the news broke, reflecting investors' uncertainty about the outcome of the restructuring.

Bullet Points:

- Stock Price Fluctuations: Initial reactions have been mixed, with some investors expressing optimism while others remain cautious.

- Analyst Predictions: Analysts' opinions are divided, with some predicting a successful turnaround while others express concerns about the potential risks.

- Long-Term Effects: The restructuring's success could reshape the Japanese media landscape, potentially influencing content creation, distribution, and media consumption habits.

Conclusion

Dalton's Alliance with Murakami-Linked Fund Targets Fuji Media Restructuring represents a significant event in the Japanese media industry. The alliance combines Dalton's expertise in corporate restructuring with the Murakami-linked fund's deep understanding of the media sector. While the restructuring presents both opportunities and risks, the potential for a revitalized Fuji Media is undeniable. The success of this endeavor will depend on the effective implementation of a comprehensive strategy, navigating regulatory hurdles, and addressing the concerns of stakeholders. To stay updated on the progress of this significant restructuring and its impact on the Japanese media landscape, continue to follow reliable news sources and financial reports. Follow the developments of Dalton's Alliance with Murakami-Linked Fund's efforts to restructure Fuji Media.

Featured Posts

-

Eisaggeleas Oyasingkton I Tzanin Piro I Epilogi Toy Tramp

May 29, 2025

Eisaggeleas Oyasingkton I Tzanin Piro I Epilogi Toy Tramp

May 29, 2025 -

Gravenberch On Liverpool A Changed Approach For Improved Performance

May 29, 2025

Gravenberch On Liverpool A Changed Approach For Improved Performance

May 29, 2025 -

Police Respond To Double Shooting Incident In Downtown Seattle

May 29, 2025

Police Respond To Double Shooting Incident In Downtown Seattle

May 29, 2025 -

Bayern Munich Steps Up Pursuit Of Defender Jonathan Tah

May 29, 2025

Bayern Munich Steps Up Pursuit Of Defender Jonathan Tah

May 29, 2025 -

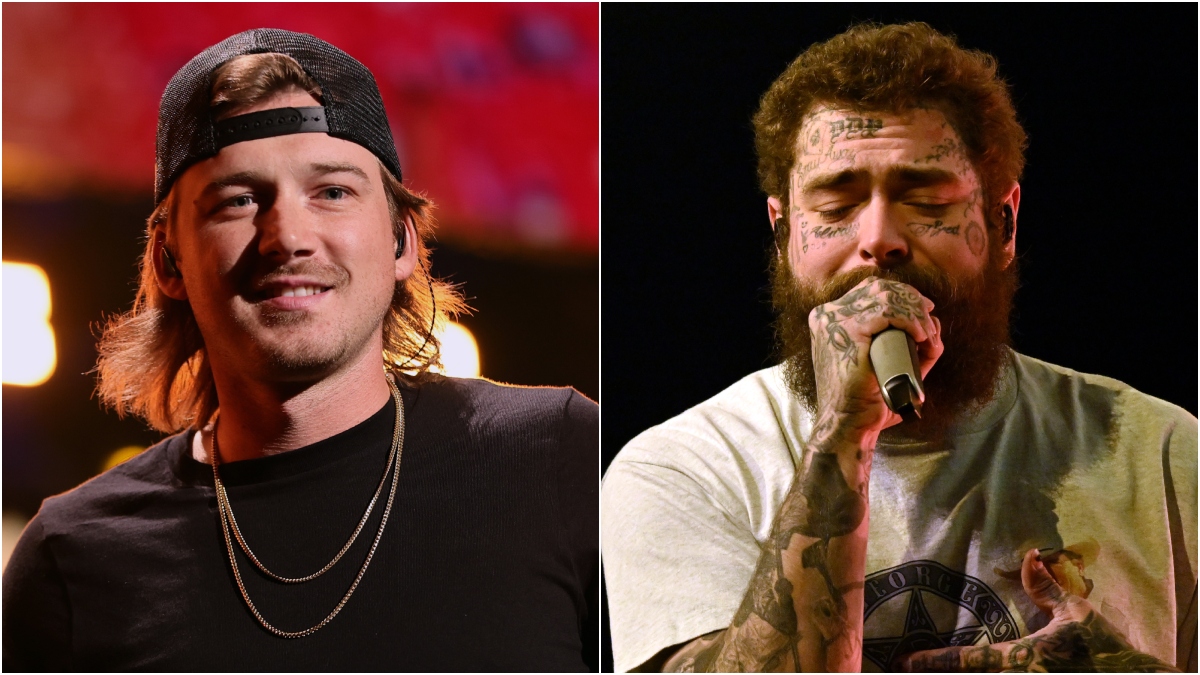

Morgan Wallen And Post Malone Hello Kitty Plushies Now Available

May 29, 2025

Morgan Wallen And Post Malone Hello Kitty Plushies Now Available

May 29, 2025