David Dodge On Canada's Economy: Slow Growth Predicted For Next Year

Table of Contents

Dodge's Concerns Regarding Inflation and Interest Rates

Keywords: Inflation Canada, Interest Rates Canada

David Dodge's concerns center on the persistent nature of inflation in Canada and the Bank of Canada's response through interest rate hikes. He highlights the interconnectedness of these two factors in shaping the overall economic trajectory.

-

Persistent Inflation: Dodge's assessment likely points to inflation remaining stubbornly high, exceeding the Bank of Canada's target rate. This persistent inflation erodes purchasing power and impacts consumer confidence. Factors contributing to this might include supply chain disruptions, global energy prices, and strong consumer demand.

-

Bank of Canada's Interest Rate Policies: The Bank of Canada has implemented a series of interest rate increases to combat inflation. Dodge likely analyzes the effectiveness of these policies, weighing their impact on cooling inflation against their potential to stifle economic growth. The higher interest rates aim to curb borrowing and spending, thereby reducing demand-pull inflation.

-

Impact on Consumer Spending and Business Investment: Higher interest rates directly affect borrowing costs for consumers and businesses. This leads to reduced consumer spending on big-ticket items like houses and cars, and decreased business investment in expansion and new projects. This slowdown in spending and investment contributes to the predicted slow growth.

-

Canadian Housing Market Impact: The housing market is particularly sensitive to interest rate changes. Higher borrowing costs make mortgages more expensive, potentially leading to a slowdown in housing sales and a decrease in house prices. This could have ripple effects throughout the economy, impacting related industries like construction and real estate.

-

Comparison to Previous Slowdowns: Dodge likely draws parallels between the current economic climate and previous periods of economic slowdown in Canada, offering historical context to his prediction. Analyzing past responses to similar economic situations can provide valuable insights into potential future outcomes.

Impact on Key Economic Sectors

Keywords: Canadian Economy Sectors, Economic Growth Canada

The predicted slow growth will differentially impact various sectors of the Canadian economy. Dodge's analysis likely highlights the vulnerabilities and resilience of different industries.

-

Housing Market: As previously discussed, the housing market is expected to experience a significant slowdown due to higher interest rates. This will impact construction, real estate, and related industries.

-

Manufacturing and Resource Sectors: These sectors are often sensitive to global economic conditions. A global slowdown could reduce demand for Canadian exports, leading to reduced production and potential job losses in these sectors. Commodity prices also play a significant role, influencing the profitability of these industries.

-

Service Industry (Retail and Tourism): The service industry, particularly retail and tourism, is likely to feel the pinch from reduced consumer spending power. Lower disposable income due to higher interest rates and inflation could lead to decreased consumer confidence and spending in these sectors.

-

Employment Rates: The overall impact on employment rates is a crucial element of Dodge's prediction. Slow economic growth often translates to lower job creation and potentially even job losses in some sectors. This will depend on the severity and duration of the slowdown.

-

Vulnerable Sectors: Dodge may highlight specific sectors within the Canadian economy that he considers particularly vulnerable to the predicted slow growth, offering a more nuanced understanding of the risks involved.

Dodge's Recommendations for Navigating Slow Growth

Keywords: Economic Forecast Canada, Canada Economic Outlook

Dodge's analysis likely extends beyond simply predicting slow growth; it probably includes recommendations for mitigating its negative impacts.

-

Policy Recommendations for Government: Dodge might suggest specific fiscal or monetary policies the government could implement to stimulate the economy and support vulnerable sectors. This could include targeted spending programs, tax incentives, or adjustments to social safety nets.

-

Strategies for Businesses: Businesses will need to adapt to the predicted slow growth. Dodge may advise strategies like cost-cutting measures, diversification of revenue streams, and focusing on efficiency improvements.

-

Advice for Consumers: Consumers can play a role in navigating the economic slowdown. Dodge may recommend strategies like budgeting, debt management, and saving more to weather potential economic hardship.

-

Opportunities During Slow Growth: Even during periods of slow growth, opportunities exist. Dodge might highlight areas where businesses can innovate, develop new technologies, or expand into new markets. Consolidation and restructuring may also create opportunities.

-

Importance of Responsible Fiscal Policy: The role of responsible government spending and prudent fiscal management is critical during economic uncertainty. Dodge would likely stress the importance of avoiding excessive debt accumulation and focusing on sustainable economic growth strategies.

Conclusion

David Dodge's forecast paints a picture of relatively slow growth for Canada's economy next year, driven primarily by persistent inflation and high interest rates. His analysis highlights potential challenges across various sectors, emphasizing the need for both government and individuals to adapt to this predicted economic climate. Understanding these challenges is crucial for navigating the coming year successfully. His insights into the interplay between inflation Canada, interest rates Canada, and the overall health of the Canadian economy sectors provide a valuable framework for understanding the potential economic landscape.

Call to Action: Stay informed about the latest developments in Canada's economy by regularly checking back for updates and analysis on this crucial topic. Understanding David Dodge's insights into Canada's economy is essential for making informed decisions in the coming year.

Featured Posts

-

Conservative Party Rift Deepens Lee Anderson On Dysfunction With Rupert Lowe

May 03, 2025

Conservative Party Rift Deepens Lee Anderson On Dysfunction With Rupert Lowe

May 03, 2025 -

Tributes Paid At Funeral For Poppy Atkinson Devoted Manchester United Fan

May 03, 2025

Tributes Paid At Funeral For Poppy Atkinson Devoted Manchester United Fan

May 03, 2025 -

Nouvelle Loi Sur Les Partis Politiques En Algerie Analyse Des Reactions Du Pt Ffs Rcd Et Jil Jadid

May 03, 2025

Nouvelle Loi Sur Les Partis Politiques En Algerie Analyse Des Reactions Du Pt Ffs Rcd Et Jil Jadid

May 03, 2025 -

Wrqt Syasat Aqtsadyt Jdydt Mn Amant Alastthmar Baljbht Alwtnyt

May 03, 2025

Wrqt Syasat Aqtsadyt Jdydt Mn Amant Alastthmar Baljbht Alwtnyt

May 03, 2025 -

Reform Party The Debate Over Farages Continued Leadership

May 03, 2025

Reform Party The Debate Over Farages Continued Leadership

May 03, 2025

Latest Posts

-

Makron Ubedil S Sh A Usilit Davlenie Na Rossiyu Po Ukraine

May 04, 2025

Makron Ubedil S Sh A Usilit Davlenie Na Rossiyu Po Ukraine

May 04, 2025 -

Pm Modis France Visit Ai Summit Co Chairmanship And Ceo Forum Address

May 04, 2025

Pm Modis France Visit Ai Summit Co Chairmanship And Ceo Forum Address

May 04, 2025 -

Image Rare Emmanuel Macron Profondement Touche Par Le Recit Des Victimes Israeliennes

May 04, 2025

Image Rare Emmanuel Macron Profondement Touche Par Le Recit Des Victimes Israeliennes

May 04, 2025 -

La Rencontre Emouvante D Emmanuel Macron Avec Des Victimes De L Armee Israelienne

May 04, 2025

La Rencontre Emouvante D Emmanuel Macron Avec Des Victimes De L Armee Israelienne

May 04, 2025 -

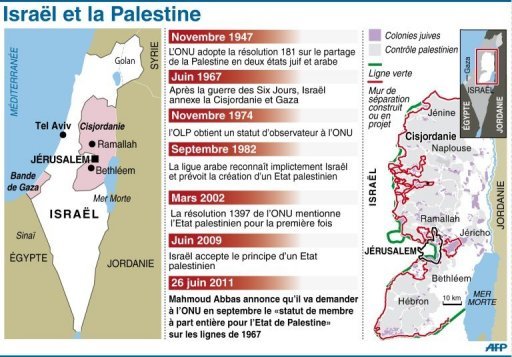

Positions Divergentes Sur L Etat Palestinien Macron Et Netanyahu S Opposent

May 04, 2025

Positions Divergentes Sur L Etat Palestinien Macron Et Netanyahu S Opposent

May 04, 2025